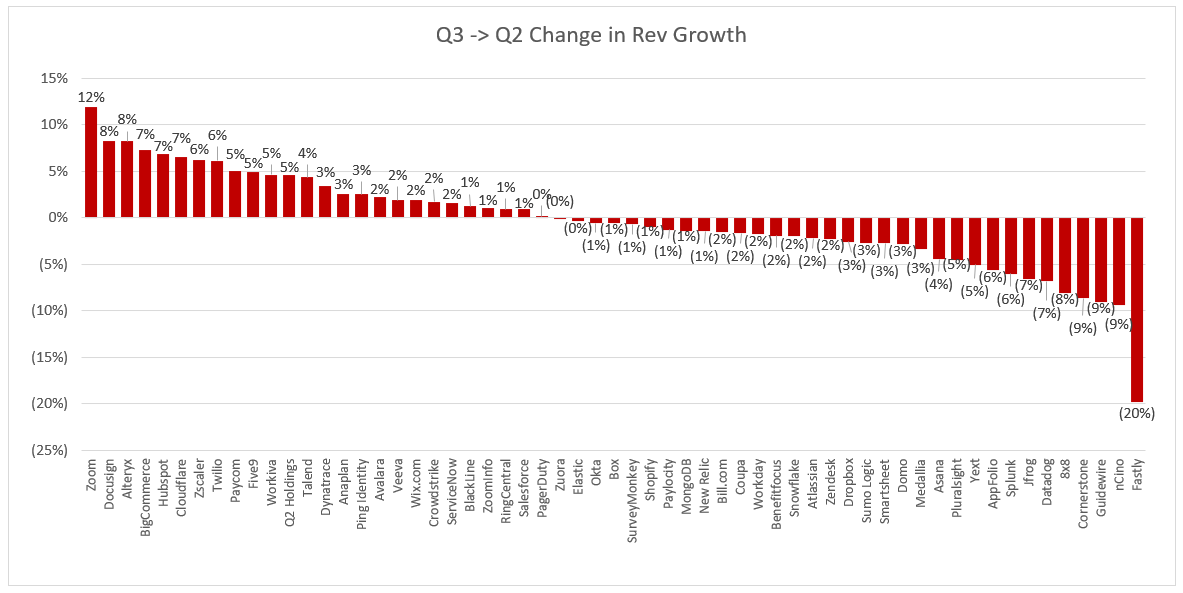

My biggest takeaway from Q3 cloud earnings? We REALLY saw cloud businesses ACCELEERATE. Since Covid began we heard anecdotal data of "digital transformations accelerating." But the data was never there. It is now. Data below shows the absolute change in rev growth % from Q3 to Q2

For further clarification - the graph shows the delta between Q3 YoY growth rate and Q2 YoY growth rate (I tried to normalize for acquisitions where I could, sure I missed some). As an example - Zoom grew 367% in Q3 and 355% in Q2, so the delta, 12%, is graphed.

I'm defining "accelerating" as YoY rev growth that is increasing on an absolute basis. And as you can see, there are plenty of businesses who accelerated this quarter

It is VERY interesting to compare this quarters data from last quarter. As you can see in my thread below, in Q2 we really only saw 2 businesses accelerate meaningfully, and 7 in total. This Q 26 companies accelerated

https://twitter.com/jaminball/status/1293677298382548992

It's easy to see the distribution of both graphs from Q3 and Q2 to imply the difference. There is just such a heavier volume of companies that fall above the line in Q2

So what's happening? I think what I predicted after Q2 played out. Namely, procurement was pushed in Q2, and those deals closed in spades in Q3. Buyers knew they needed more cloud tech in Q2, but didn't start more normal buying patterns until Q3

https://twitter.com/jaminball/status/1293677305139585025

My cloud Covid timeline this year

Q1: Little effect. The obvious Covid beneficiaries (Zoom, Shopify, etc) got slight boosts at tail end of quarter

Q2: Buyers buttoned up. All spend was cut. Only obvious winners benefited

Q3: budgets reopened, digital transformations played out

Q1: Little effect. The obvious Covid beneficiaries (Zoom, Shopify, etc) got slight boosts at tail end of quarter

Q2: Buyers buttoned up. All spend was cut. Only obvious winners benefited

Q3: budgets reopened, digital transformations played out

And here's the other interesting aspect of this graph. I'd argue a number of the high growth names who didn't technically accelerate, but maintained their high growth are also winners. Without Covid I bet their growth would have fallen off more

Here's who I include in that list. All have negative changes in my initial graph, but all very impressive quarters (this Q YoY growth / last Q YoY growth)

Snowflake: 119% / 121%

Shopify: 96% / 97%

Elastic: 43% / 44%

Okta: 42% / 43%

Mongo: 38% / 39%

Asana: 55% / 59%

Snowflake: 119% / 121%

Shopify: 96% / 97%

Elastic: 43% / 44%

Okta: 42% / 43%

Mongo: 38% / 39%

Asana: 55% / 59%

Since the graph just shows the absolute change it's harder to make relative comparisons. Certain companies performances are masked when I present the data like I have. Crowdstrike only shows a 2% change. They grew 86% this Q, and 84% last Q. That is PHENOMINAL

The biggest winners of this quarter, in my opinion, were the companies that grew >50% YoY AND also accelerated. This list includes:

Zoom

Docusign

Cloudflare

Zscaler

Twilio

Crowdstrike

Including the "impressive maintainers" I'd add:

Shopify

Snowflake

Zoom

Docusign

Cloudflare

Zscaler

Twilio

Crowdstrike

Including the "impressive maintainers" I'd add:

Shopify

Snowflake

I think everyone knows I love Datadog, but I just couldn't include them. They grew 61% YoY this Q, and 68% YoY last Q. Still very impressive. I'd have wanted to see >65% YoY growth this Q to put them in that "impressive maintainer" bucket. Next Q important for them. Want >60%

For Q4 I'll be keeping an eye on who can maintain their high growth. Any company that stacks multiple quarters of YoY acceleration, while growing >50% is 🤯🤯

I thought about making the bar >40% YoY growth while accelerating, but >50% is truly elite

I thought about making the bar >40% YoY growth while accelerating, but >50% is truly elite

One final note - this is NOT meant to be a commentary on valuations or stock prices. This is simply an analysis that I hope sheds light on which businesses are operating the best.

Valuation is an entirely separate discussion :)

Valuation is an entirely separate discussion :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh