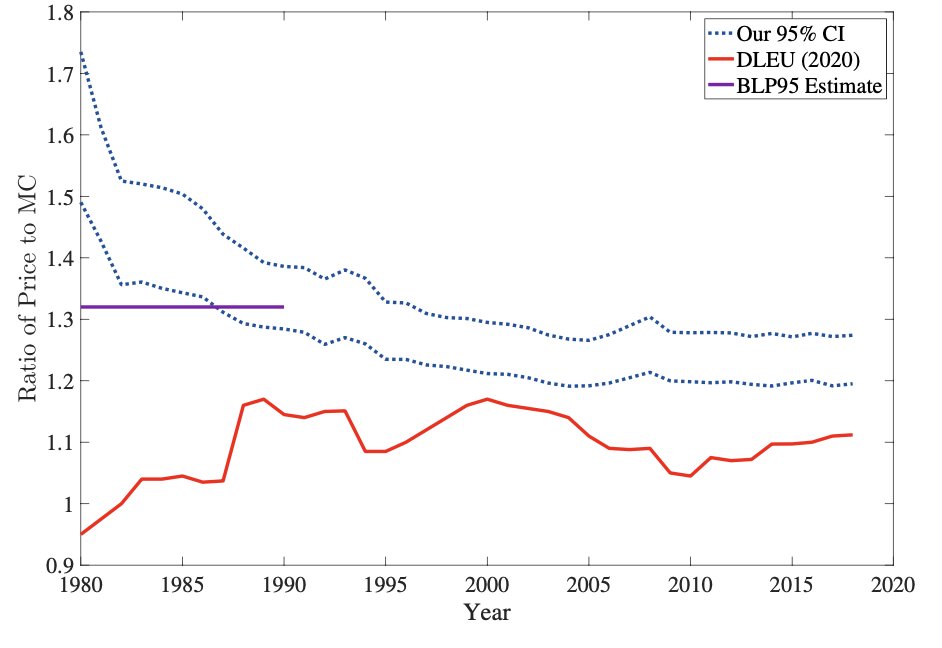

A quick thread about current issues around markups. Many people have seen this figure, but there is still a lot of discussion around what it "means". Estimated markups appear to be rising but we aren't really sure why. 1/

More innocuous explanations include accounting and measurement issues: transforming variable costs into fixed costs (either for tax or technology purposes), selection effects (low margin manufacturers move overseas leaving higher margin firms in US), etc 2/

Also striking is that while markups appear to have risen, in most manufactured goods (particularly "high technology" goods) prices have declined in quality adjusted terms. This story implies that costs are falling more rapidly than prices, again but why? 3/

The most popular explanation is that market power has gone up over the past 30-40 years (maybe due to lack of antitrust enforcement, maybe due to technological changes). 4/

IO Economists have several ways to measure market power. The DLEU approach above starts with cost minimization, but has the limitation that it recovers aggregate markups for a firm or a plant rather than product by product, so it is hard to see what is going on (sometimes). 5/

The other method is to use profit maximization, and recover markups from elasticity. This requires estimating demand for many products and has much more substantial requirements on data (and instruments !) that means getting an answer for one market might take months. 6/

A nice recent example of the demand-side approach is work by @charliemurry and coauthors revisiting autos where they find the opposite story (rising costs and falling markups) while demand becomes more elastic over time (in part due to rising foreign competition) 7/

What we'd really like to do is run the demand-side approach to markups at scale (for many markets) and see how it compares to the supply-side approach. This is something we talk about at conferences, often with laughter and "... sure with $1m of funding for six pre-docs..." 8/

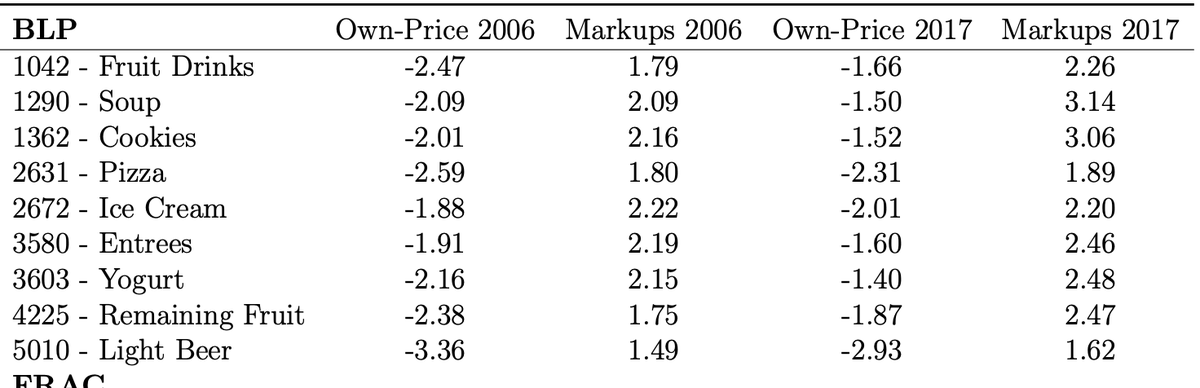

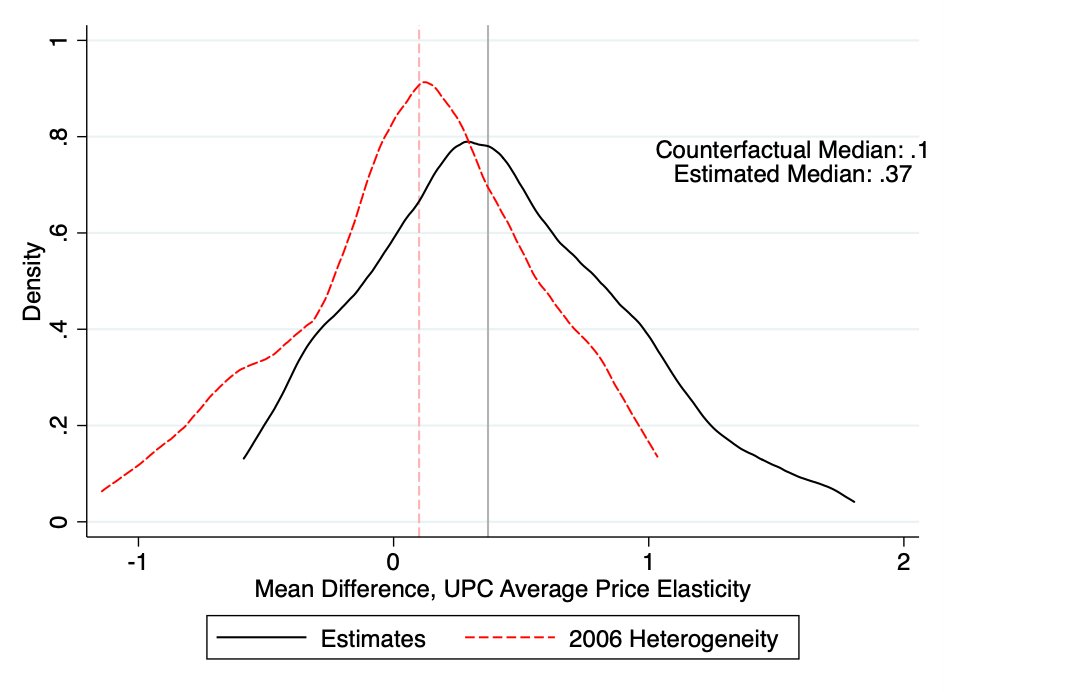

So @jamesbrandecon actually did this in his JMP. He went to Nielsen data and said "let's estimate the elasticity for lots of product categories" and found that from 2006 to 2017, consumers appear to become more inelastic in their demand across a broad range of categories. 9/

Getting BLP-type demand once is hard (despite my best efforts). Salanie and Wolak show a neat way to linearize things and Brand's results suggest the simplified version gives pretty similar results which is hopeful for doing things at mega-scale 10/

So what happened in supermarkets? Sales rose (a little), and prices remained flat (or fell), and yet markups rose because consumers became less elastic. Why? improved product assortment/quality (eg. fruit in the winter) and more "niche" consumption/tastes got more different. 11/

Where are we now? Variety is the "good" explanation for rising markups (my favorite is @mrequalsmc and Tom Quan's paper). The anticompetive explanation is large firms are acquiring more brands, both of which can push us into less elastic demand. 12/

Anyway -- I thought the paper was cool -- Stern is not on the 2021 market-- so consider this my "2021 IIOC rising star " discussion... I'm glad I didn't try to estimate demand 6 different ways for a dozen categories myself! 13/13 bit.ly/3neqihA

• • •

Missing some Tweet in this thread? You can try to

force a refresh