How to get URL link on X (Twitter) App

https://twitter.com/arindube/status/1847758144547803571In product markets concentration can rise if a large firm innovates, reduces cost, and increases market share.

https://twitter.com/mattyglesias/status/1780192881233305652But think about how things work:

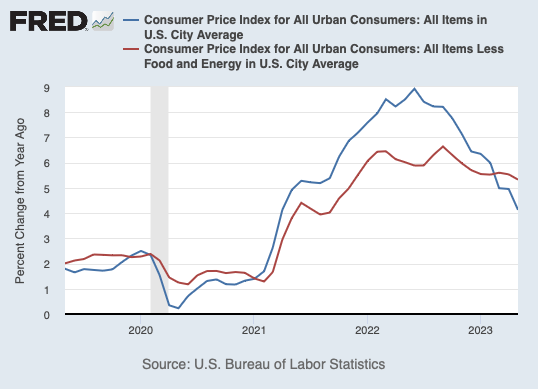

https://twitter.com/conlon_chris/status/1750146997984661928The truth -- in the past 4 quarters (Q3 2022- Q3 2023) corporate profits are DOWN and real wages are UP.

https://twitter.com/DarianWoods/status/1668794097459494912When we think about what CAUSES increasing prices we have four options: (1) demand: more consumers willing to pay more (2) higher costs/ constrained supply (3) expectations/beliefs about the future: what matters is how much something costs to replace, not what you paid ... 2/

https://twitter.com/straiberman/status/1408427456101498881#1: increases the fee firms pay when they file a merger pre-notification and expands funding at the agencies. [This is desperately needed, they are understaffed. If it were up to me, I'd also shift pay off the GS scale like SEC and Fed do.]

More innocuous explanations include accounting and measurement issues: transforming variable costs into fixed costs (either for tax or technology purposes), selection effects (low margin manufacturers move overseas leaving higher margin firms in US), etc 2/

More innocuous explanations include accounting and measurement issues: transforming variable costs into fixed costs (either for tax or technology purposes), selection effects (low margin manufacturers move overseas leaving higher margin firms in US), etc 2/

https://twitter.com/AEAjournals/status/1322157853914861569But when we ran the usual 2WFE regression we got PT >1 and for some products closer to 3 [oops!].The typical explanation for overshifting in the literature is "something something market power", but it turns out you need some very strange demand curves to get PTR=3 2/9