1/ The state of the Zim Economy. Looking ahead.

In August 2017, supermarkets were breaming with product,albeit an ominous cloud hung over the state. The black market for forex reached 40% premium from 1:1 gedye.

Inflation was only 4.83%. But even the Herald had no good news

In August 2017, supermarkets were breaming with product,albeit an ominous cloud hung over the state. The black market for forex reached 40% premium from 1:1 gedye.

Inflation was only 4.83%. But even the Herald had no good news

2/ Fast forward to Dec 2020, two years of negative growth makes Zim an economic depression. Technically Zim is in an ECONOMIC DEPRESSION. Coupled with high inflation, it’s the worst kind. STAGFLATION.

Yet, pundits & GOZ maintain a happy festive is to be had.

Yet, pundits & GOZ maintain a happy festive is to be had.

3/ I have noticed the new regime does not take kindly to debate. Let alone robust debate. This is seen by how much gusto in spin is spent by GOZ in ridiculous propositions such as Budget surplus & now $1bn in FX reserves.

There is a dangerous flirtation with the futile

There is a dangerous flirtation with the futile

4/

It is futile to tax an economy in a depression. Even the most arden communist understands this. The common man to cabinet know this. So why is MOF strident in this furlong end? Can we ask the Professor what he taught must happen in an economic depression?

It is futile to tax an economy in a depression. Even the most arden communist understands this. The common man to cabinet know this. So why is MOF strident in this furlong end? Can we ask the Professor what he taught must happen in an economic depression?

5/

The introduction of the 2% transaction tax inhibits production and trade. It’s ostensibly used to capture the informal sector. But how were informal sector participants avoiding VAT? The 2% was never debated & now the penalty is worse. Charged to consumers in retrospect

The introduction of the 2% transaction tax inhibits production and trade. It’s ostensibly used to capture the informal sector. But how were informal sector participants avoiding VAT? The 2% was never debated & now the penalty is worse. Charged to consumers in retrospect

6/

MOF actually imagine they will collect USD$4.8bn in taxes. A staggering number, never achieved in Zim. In 2020, we shall be lucky to collect US$2bn. Almost half what it used to be in 2013. As a nation, as Parliament should we just fold our arms & pretend all is well?

MOF actually imagine they will collect USD$4.8bn in taxes. A staggering number, never achieved in Zim. In 2020, we shall be lucky to collect US$2bn. Almost half what it used to be in 2013. As a nation, as Parliament should we just fold our arms & pretend all is well?

7/Perhaps some good news first

Unlike the rest of the world that suffered greatly from covid, in Zim it helped matters somewhat. At zero growth economy, Zim imports close to USD$2bn in Petrol, Diesel, Electricity. The lockdown & slow economy meant Zim saved potentially US$1bn.

Unlike the rest of the world that suffered greatly from covid, in Zim it helped matters somewhat. At zero growth economy, Zim imports close to USD$2bn in Petrol, Diesel, Electricity. The lockdown & slow economy meant Zim saved potentially US$1bn.

8/

This is easily explained by FCA accounts with US$1.1bn. Lockdown curtailed expenditure. It’s also a saving from the corruption and 100% taxes in the sector. Money stayed with the customers. & not middlemen.

Without fuel import taxes, GOZ went after the consumer!

This is easily explained by FCA accounts with US$1.1bn. Lockdown curtailed expenditure. It’s also a saving from the corruption and 100% taxes in the sector. Money stayed with the customers. & not middlemen.

Without fuel import taxes, GOZ went after the consumer!

9/

This cascades to transport, food, spares & many imports that we simply did not consume. It’s good news because what we saved on fuel imports we made up for it in food imports without pressure on the exchange rate.

This cascades to transport, food, spares & many imports that we simply did not consume. It’s good news because what we saved on fuel imports we made up for it in food imports without pressure on the exchange rate.

** brimming

10/

The second most important positive is that oil prices slumped while other global commodities went up. Gold is up by 35% this year. As a major commodity exporter, this was an enviable position to be in.

The second most important positive is that oil prices slumped while other global commodities went up. Gold is up by 35% this year. As a major commodity exporter, this was an enviable position to be in.

11/

Unfortunately GOZ did not take advantage of this situation. It was a lost opportunity to press restart. Instead, it went & borrowed USD debt against commodities. $2.6bn in a year.

With a global $100trillion dollar shortage & EM risk this was the worst action.

Unfortunately GOZ did not take advantage of this situation. It was a lost opportunity to press restart. Instead, it went & borrowed USD debt against commodities. $2.6bn in a year.

With a global $100trillion dollar shortage & EM risk this was the worst action.

12/

Then it went and fixed the exchange rate, at an overvalued rate for that matter. The black market rate has a 40% premium off the auction fixed rate. GOZ is punishing the Exporter and subsidizing the importer by 40%. Mind you, this absurdity in an Economic depression.

Then it went and fixed the exchange rate, at an overvalued rate for that matter. The black market rate has a 40% premium off the auction fixed rate. GOZ is punishing the Exporter and subsidizing the importer by 40%. Mind you, this absurdity in an Economic depression.

13/

By its actions GOZ is encouraging imports & punishing exports. Why would a functional rational government do this?

In the 1980’s corruption was firmly etched in imports & rations/import tokens. GOZ decided who could import. With imports of over $7bn, rent seeking is rife.

By its actions GOZ is encouraging imports & punishing exports. Why would a functional rational government do this?

In the 1980’s corruption was firmly etched in imports & rations/import tokens. GOZ decided who could import. With imports of over $7bn, rent seeking is rife.

14/

An importer makes 40% on their stock on the dollar. Why would an importer stop importing? Never mind demand. It bodes well for the importer NOT to record sales but stock up. Check inventory of listed firms. Arbitrage is the game in town. Sponsored & encouraged by GOZ!

An importer makes 40% on their stock on the dollar. Why would an importer stop importing? Never mind demand. It bodes well for the importer NOT to record sales but stock up. Check inventory of listed firms. Arbitrage is the game in town. Sponsored & encouraged by GOZ!

15.

Is it not curious. That GOZ policy since the 80’s has always favored importers? Whereas Rhodesian chose import substitution, GOZ favors importers.Remember the time Cottco was forced to export at a fixed rate of 824, yet the chemicals importers was given FX basically for free.

Is it not curious. That GOZ policy since the 80’s has always favored importers? Whereas Rhodesian chose import substitution, GOZ favors importers.Remember the time Cottco was forced to export at a fixed rate of 824, yet the chemicals importers was given FX basically for free.

16/ Eddie Cross an Economist who sits on RBZ board writes lyrically of a promising 2021. Under his watch :

1. Negative real interest rates of 350%.

2. Private sector credit shrunk to US$400m from US$4bn

3. RBZ with US$5bn debt

Will Ed address his complicity in such absurdity?

1. Negative real interest rates of 350%.

2. Private sector credit shrunk to US$400m from US$4bn

3. RBZ with US$5bn debt

Will Ed address his complicity in such absurdity?

17.

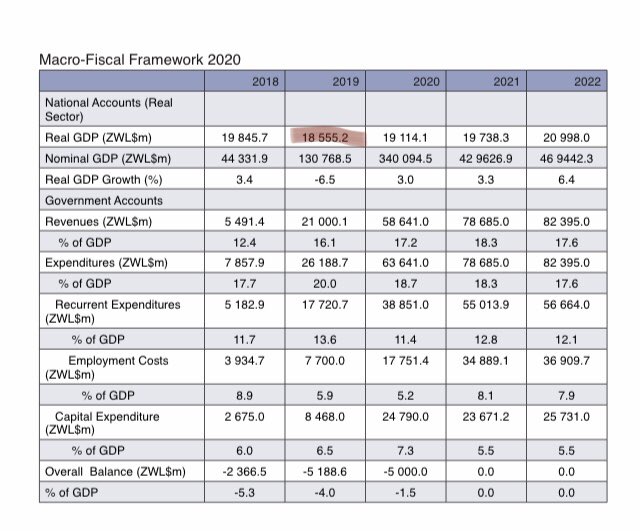

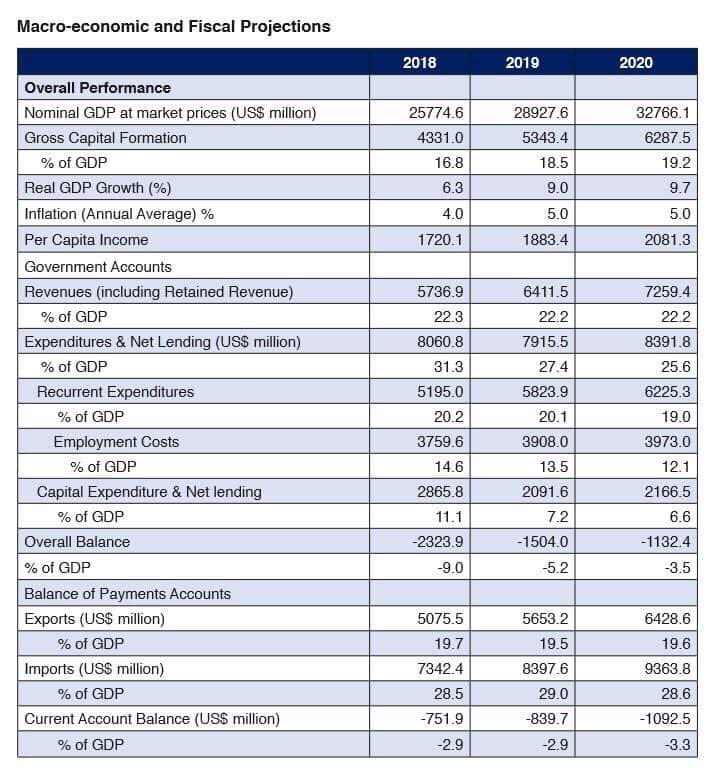

This is what Mthuli presented in 2018 budget. He increased without cause Zim gdp by 40% to US$25bn. Before revising it down to US$18bn. Just for fun check out the ambitious projections without any basis in reality .All I wish to show is that GOZ policy docs are best discarded

This is what Mthuli presented in 2018 budget. He increased without cause Zim gdp by 40% to US$25bn. Before revising it down to US$18bn. Just for fun check out the ambitious projections without any basis in reality .All I wish to show is that GOZ policy docs are best discarded

18/

GOZ destroyed the savings pool & capital formation 3X in the last 20yrs

1- Land reform

2- Hyperinflation

3- 1:1 gedye

In all 3 cases GOZ has buried its head in the sand & continues the wanton destruction of capital.

Remember :

Savings = Investment

GOZ destroyed the savings pool & capital formation 3X in the last 20yrs

1- Land reform

2- Hyperinflation

3- 1:1 gedye

In all 3 cases GOZ has buried its head in the sand & continues the wanton destruction of capital.

Remember :

Savings = Investment

19/

In all 3 cases the result is accumulation of more public debt. US$3.5bn to compensate white farmers is not addressing the capital formation problem. Only title deeds can finally bury the land issue.

In all 3 cases the result is accumulation of more public debt. US$3.5bn to compensate white farmers is not addressing the capital formation problem. Only title deeds can finally bury the land issue.

20/

An average civil servant used to earn US$500 now takes home US$150. Yet their production has not depleted. A teacher & a nurse must still produce. This is how GOZ has stolen income & benefitted from Inflation tax. Incomes have been severely destroyed.

An average civil servant used to earn US$500 now takes home US$150. Yet their production has not depleted. A teacher & a nurse must still produce. This is how GOZ has stolen income & benefitted from Inflation tax. Incomes have been severely destroyed.

21/

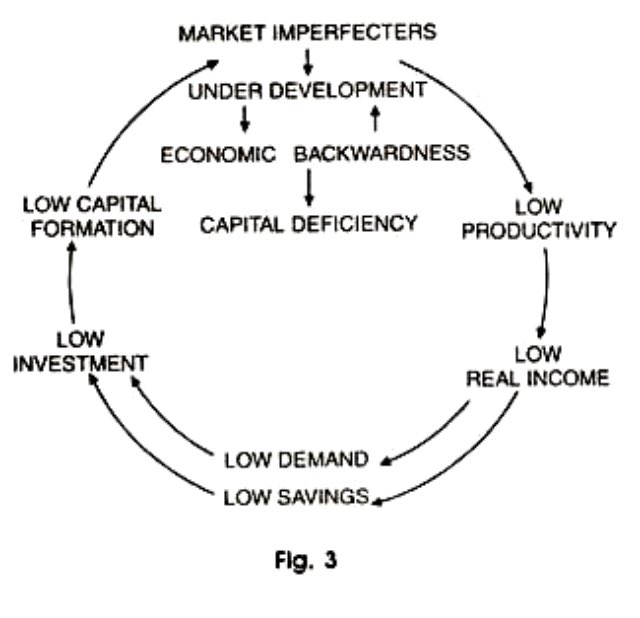

Zim is in an Economic Depression. 8m of its citizens are in abject poverty, 60% informal traders. Those employed earn low incomes. Savings have been replaced by a debt trap. Low incomes mean low demand

In Economic theory. Zim is in a vicious cycle of poverty.

Zim is in an Economic Depression. 8m of its citizens are in abject poverty, 60% informal traders. Those employed earn low incomes. Savings have been replaced by a debt trap. Low incomes mean low demand

In Economic theory. Zim is in a vicious cycle of poverty.

22/

While in 2021 the global recovery is 4%, for Zim it’s not as straight forward. Zim has structural impediments to growth. Eg it requires US$1.6bn for a good farming season, but the total private sector credit is only US$400m.

FDI was US$250m in 2019. Growth requires capital.

While in 2021 the global recovery is 4%, for Zim it’s not as straight forward. Zim has structural impediments to growth. Eg it requires US$1.6bn for a good farming season, but the total private sector credit is only US$400m.

FDI was US$250m in 2019. Growth requires capital.

23/

While Covid period was low economic activity in the 8 months since March, Reserve money has increased by 53%. One of the world’s fastest.

In context, in Europe( where pundits are gravely concerned) M1 grew by 13.8% in a year.

What does 53% increase in Zim mean come 2021?

While Covid period was low economic activity in the 8 months since March, Reserve money has increased by 53%. One of the world’s fastest.

In context, in Europe( where pundits are gravely concerned) M1 grew by 13.8% in a year.

What does 53% increase in Zim mean come 2021?

• • •

Missing some Tweet in this thread? You can try to

force a refresh