How even after knowing everything about your work, a series of emotional judgments can place you in a difficult situation.

A thread on how loss Aversion causes us to take irrational decisions-

A thread on how loss Aversion causes us to take irrational decisions-

An experiment by professor Bazerman of Harvard.

On the first day of class, Professor Bazerman announces a game that seems innocuous enough. Waving a twenty-dollar bill in the air, he offers it up for auction.

On the first day of class, Professor Bazerman announces a game that seems innocuous enough. Waving a twenty-dollar bill in the air, he offers it up for auction.

Everybody is free to bid; there are only two rules. The first is that bids are to be made in $1 increments. The second rule 30 The Swamp of Commitment is a little trickier.

The winner of the auction, of course, wins the bill. But the runner-up must still honor his or her bid,

The winner of the auction, of course, wins the bill. But the runner-up must still honor his or her bid,

while receiving nothing in return.

In other words,this is a situation where second best finishes last. Indeed, at the beginning of the auction, as people sniff out an opportunity to get a $20 bill for a bargain, the hands quickly shoot up, and the auction is officially under way

In other words,this is a situation where second best finishes last. Indeed, at the beginning of the auction, as people sniff out an opportunity to get a $20 bill for a bargain, the hands quickly shoot up, and the auction is officially under way

A flurry of bids follows. As Bazerman described it, "The pattern is always the same. The bidding starts out fast and furious until it reaches the $12 to $16 range." At this point,

it becomes clear to each of the participants that he or she isn't the only one with the brilliant idea of winning the twenty bucks for cheap.

There is a collective hard swallow. As if sensing the floodwaters rising, the students get jittery.

There is a collective hard swallow. As if sensing the floodwaters rising, the students get jittery.

"Everyone except the two highest bidders drops out of the auction," Bazerman explained.

Without realizing it, the two students with the highest bids get locked in. "One bidder has bid $16 and the other has bid $ 17," Bazerman said.

Without realizing it, the two students with the highest bids get locked in. "One bidder has bid $16 and the other has bid $ 17," Bazerman said.

"The $ 16 bidder must either bid $18 or suffer a $16 loss."

Up to this point the students were looking to make a quick dollar; now neither one wants to be the sucker who paid good money for nothing.

Up to this point the students were looking to make a quick dollar; now neither one wants to be the sucker who paid good money for nothing.

This is when the students adopt the equivalent of football's war-of attrition model. They become committed to the strategy of playing not to lose.

Like a runaway train, the auction continues, with the bidding going up past $ 18, $19, and $20.

Like a runaway train, the auction continues, with the bidding going up past $ 18, $19, and $20.

As the price climbs 31 higher, the other students don't know whether to watch or cover their eyes.

"Of course," reflected Bazerman, "the rest of the group roars with laughter when the bidding goes over $20."

"Of course," reflected Bazerman, "the rest of the group roars with laughter when the bidding goes over $20."

From a rational perspective, the obvious decision would be for the bidders to accept their losses and stop the auction before it spins even further out of control.

But that's easier said than done. Students are pulled by both the momentum of the auction and the looming loss

But that's easier said than done. Students are pulled by both the momentum of the auction and the looming loss

if they back down-a loss that is growing greater by the bid.

The two forces, in turn, feed off each other: commitment to a chosen path inspires additional bids, driving the price up, making the potential loss loom even larger.

The two forces, in turn, feed off each other: commitment to a chosen path inspires additional bids, driving the price up, making the potential loss loom even larger.

And so students continue bidding: $21, $22, $23, $50, $100, up to a record $204.

Over the years that Bazerman has conducted the experiment, he has never lost a penny (he donates all proceeds to charity).

Over the years that Bazerman has conducted the experiment, he has never lost a penny (he donates all proceeds to charity).

Regardless of who the bidders have been-college students or business executives attending a seminar-they are always swayed. The deeper the hole they dig themselves into, the more they continue to dig.

This example was from the book, Sway.

This example was from the book, Sway.

This all happened because of Loss aversion bias which even you can relate to as a trader,

When you Buy something at 100 , it goes to 110 and you didn’t sell, when it comes back to 105 you cant sell,and then you sell it way lower. because you felt again it will go up.

When you Buy something at 100 , it goes to 110 and you didn’t sell, when it comes back to 105 you cant sell,and then you sell it way lower. because you felt again it will go up.

Instead of closing the trade and cutting his losses, the trader continues to wait it out, afraid of losing the money he has already invested. He tells himself he will get out once he loses a certain amount of money,

but instead of that happening, he holds the trade and let the loss grow.

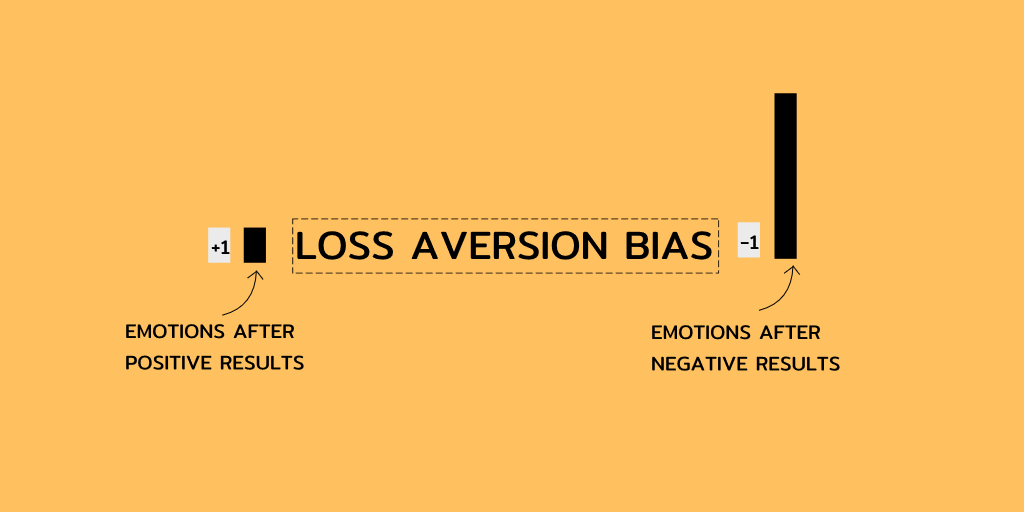

Traders feel loss 2X the emotions we feel when we are in profits.

How to avoid loss aversion bias-

1. Think of long term instead of short term results.

Traders feel loss 2X the emotions we feel when we are in profits.

How to avoid loss aversion bias-

1. Think of long term instead of short term results.

2. A simple way to tackle loss averse is to remind ourselves to ask what the worst outcome would be if the course action was taken.

Usually, this helps individuals put loss, and the strong associated feelings of loss into perspective and better rationalize if it’s worth making

Usually, this helps individuals put loss, and the strong associated feelings of loss into perspective and better rationalize if it’s worth making

a decision or not.

Trading is not only about the conditions those who win from their emotions and biases win in trading.

Thanks for reading till here.

Trading is not only about the conditions those who win from their emotions and biases win in trading.

Thanks for reading till here.

• • •

Missing some Tweet in this thread? You can try to

force a refresh