"Start your Trading day with a fresh and empty mind."

Ever faced stress and strong emotions after having loss day and under-performance for a long time after that?

Thread on Emotion and how to control them with help of trading journal

Ever faced stress and strong emotions after having loss day and under-performance for a long time after that?

Thread on Emotion and how to control them with help of trading journal

Poker players calls it TILT.

Tilt is pretty much any reason for you to trade sub-optimally.

Greed and fear are tilts in trading.

When normally you have a stressful day (not in trading) and you go to bed with a bad mood, the next day you wake up fine without much stress .

Tilt is pretty much any reason for you to trade sub-optimally.

Greed and fear are tilts in trading.

When normally you have a stressful day (not in trading) and you go to bed with a bad mood, the next day you wake up fine without much stress .

So where did the emotion go?

The brain absorbs and digests all the emotions.

But, when you have a big emotional and loss day , and then a sleepless night, the brain cant digest those emotions as easily.

The brain absorbs and digests all the emotions.

But, when you have a big emotional and loss day , and then a sleepless night, the brain cant digest those emotions as easily.

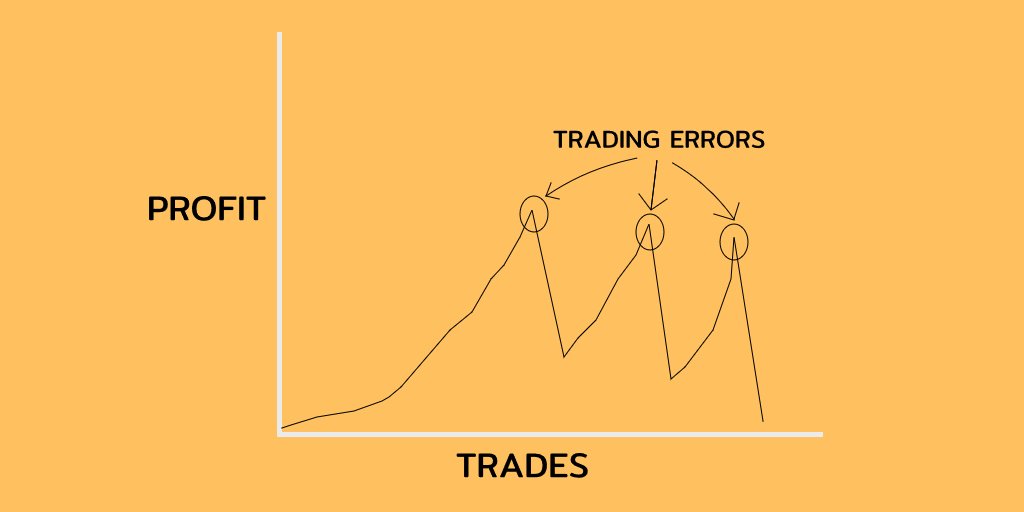

The next day you wake up to trade , you don’t feel quite right, you feel fear.

So, now you are not starting with an empty cup.

Now your tilt threshold level ( the level where your decision making ability reduces and you take bad decisions ) decreases.

So, now you are not starting with an empty cup.

Now your tilt threshold level ( the level where your decision making ability reduces and you take bad decisions ) decreases.

Now, you will be angry a little faster then normally and feel fear more then you do.

So,how to empty your mind after having a bad or even a good day?

By using a Trading journal.

So,how to empty your mind after having a bad or even a good day?

By using a Trading journal.

I use one note as my trading journal, I write all my trade results , emotions experience during a trade, trading setups in my trading journal.

So the purpose of writing about how your trading day went, is to get those emotions out of your head.

My journal.

So the purpose of writing about how your trading day went, is to get those emotions out of your head.

My journal.

Keeping things inside is not a great thing, particularly in trading.

The writing become helpful when you look back after 2-3 days later, and you should ask yourself why I am getting so pissed of, why I am getting angry.

The writing become helpful when you look back after 2-3 days later, and you should ask yourself why I am getting so pissed of, why I am getting angry.

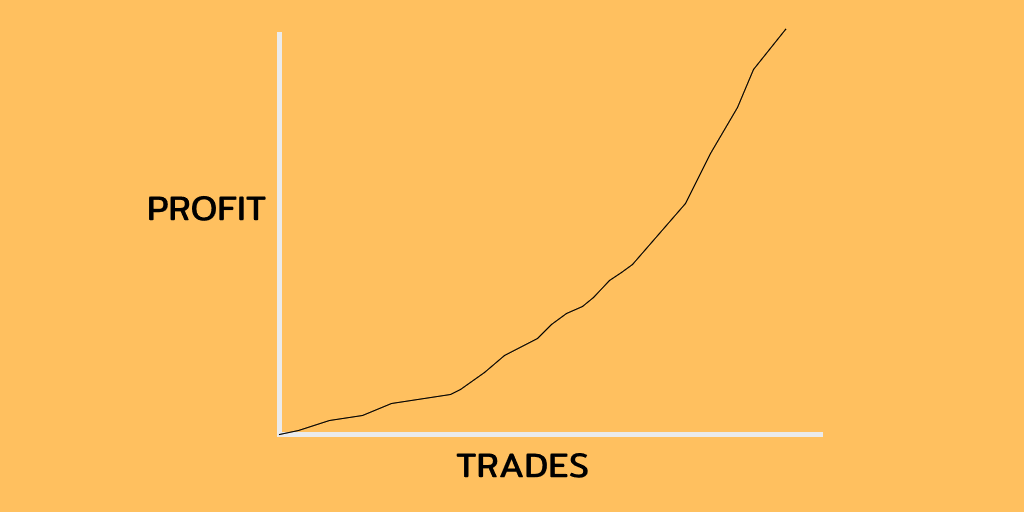

So by doing this you will reduce the accumulation of the emotions in your mind, and you will give yourself a reset.

Thanks for reading till here.

Thanks for reading till here.

• • •

Missing some Tweet in this thread? You can try to

force a refresh