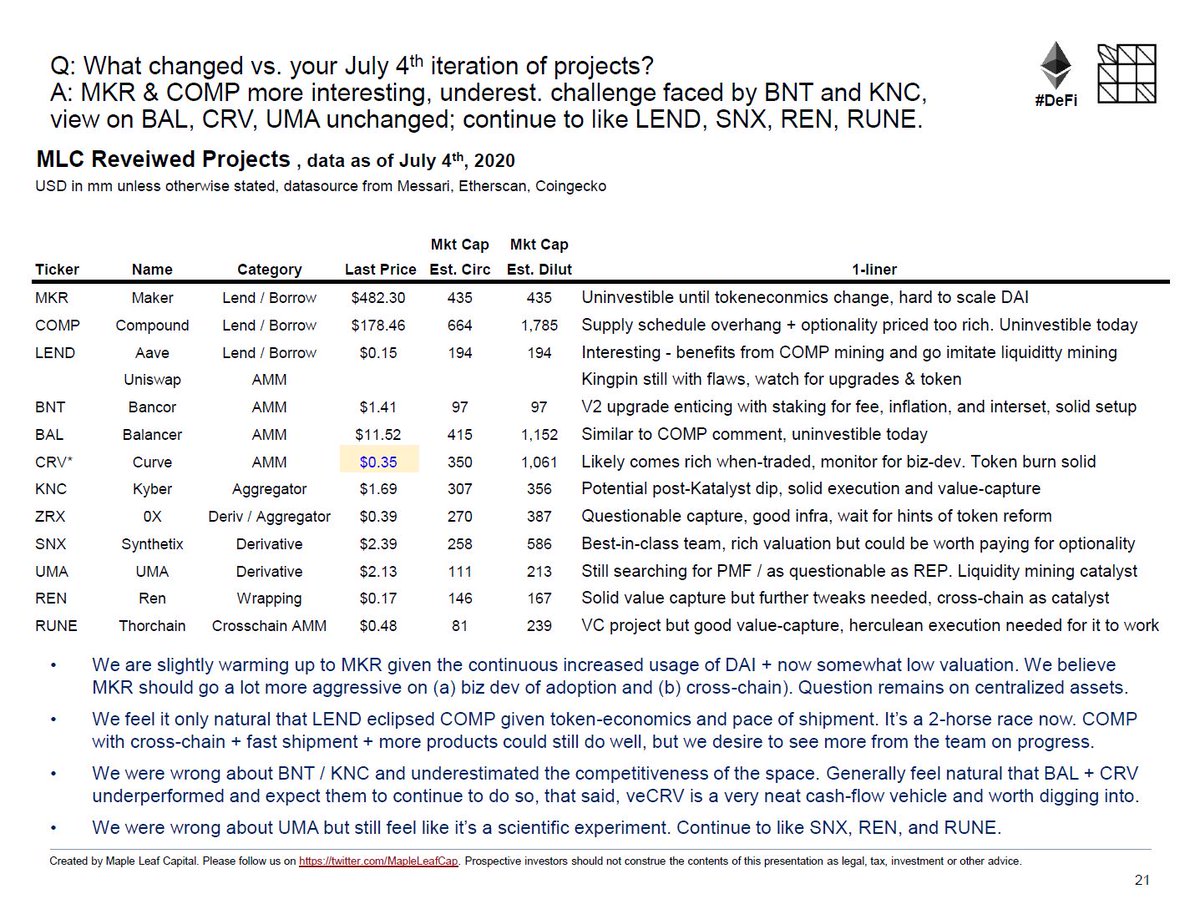

(0) Since our last report on July 4th, 2020, The #DeFi space and our mental framework had evolved enough to prompt another iteration – a deck about the broader #valuenet and ETH-based #DeFi / #WallstreetAPI. As usual, would appreciate any feedback!

Link: drive.google.com/file/d/1eTuhqn…

Link: drive.google.com/file/d/1eTuhqn…

(0.5) As #Bitcoin soars to uncharted heights today and hitting sweetest part of adoption S-curve at 3rd to 4th inning, we feel like broader #valuenet + #DeFi concept is barely at top half of first inning. If one is so adventurous, this is likely where the next 100-10,000x is born

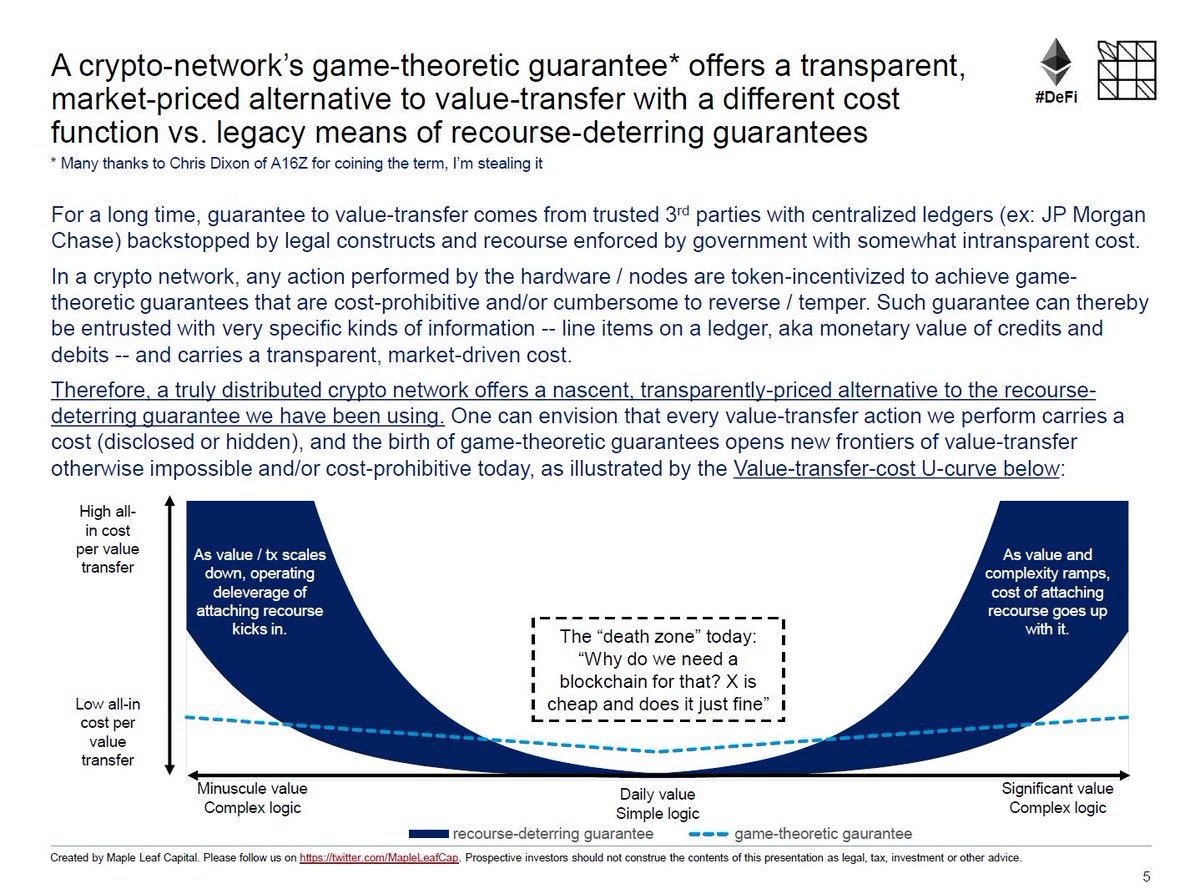

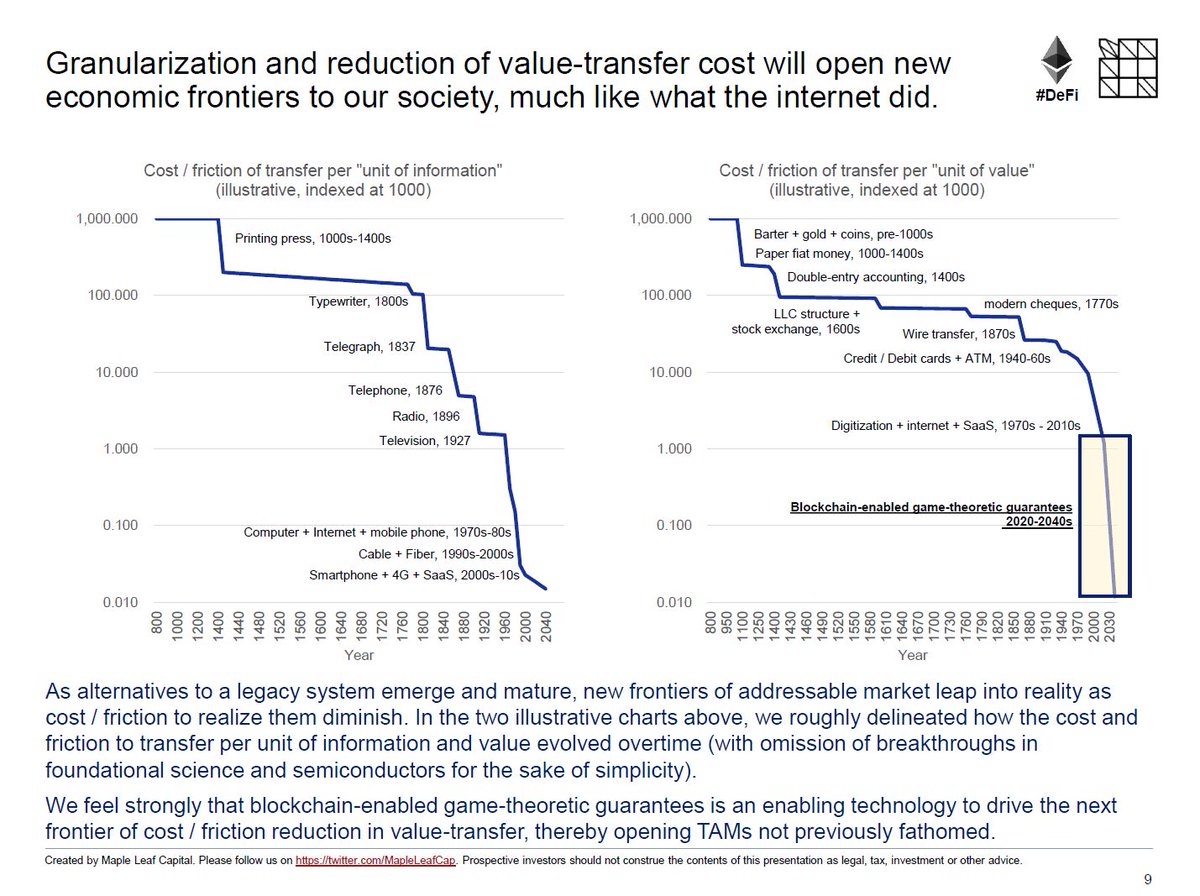

(1) @cdixon coined the term “game-theoretic guarantee” for tx offered by L0/L1s (too cogent not to steal) -- this nascent, transparent, market-driven alternative harbors a different cost function vs. the legacy recourse-deterring ones, as seen by the Value-transfer-cost U-curve.

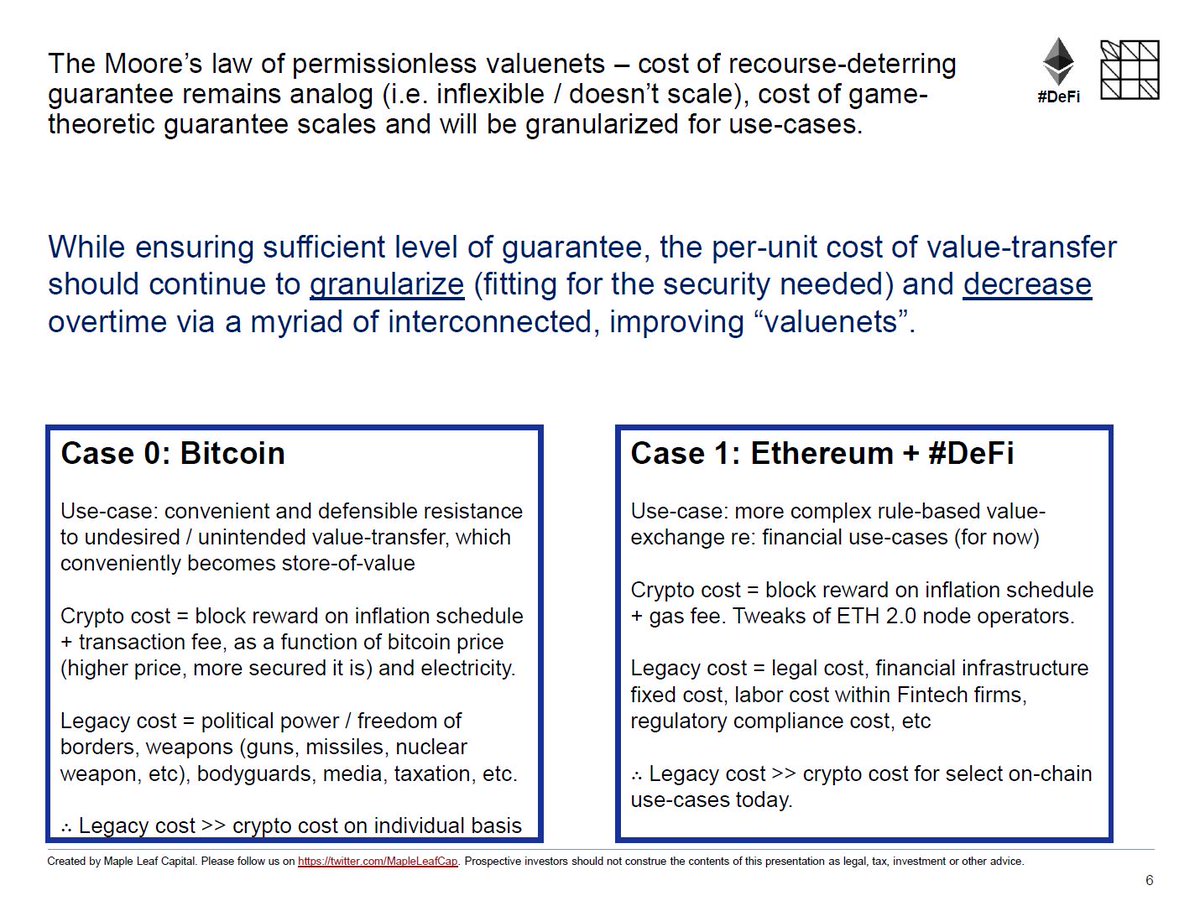

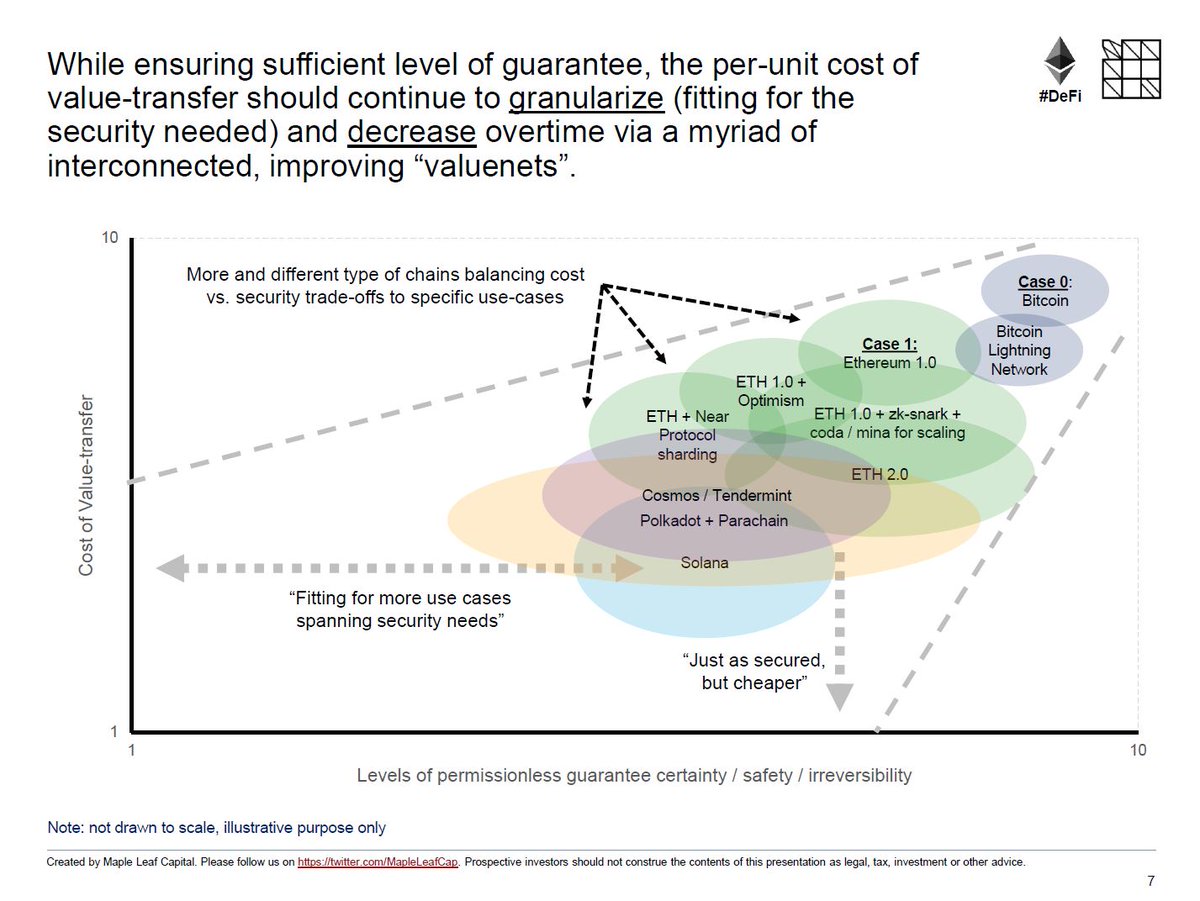

(2) In the same spirit as Moore’s law, I suspect that while ensuring sufficiently similar level of guarantee, per unit cost of value transfer should continue to granularize (fitting for security needed) and decrease overtime via a myriad of interconnected, improving “valuenets”

(3) As alternatives emerge and mature, new frontiers of TAM leap into reality as cost / friction to realize them diminish. Crypto game theoretic guarantees drives the next frontier of cost / friction reduction in value transfer, thereby opening TAMs not previously fathomed.

(4) Dream bigger on what low cost, game-theoretic guaranteed “value transfer” can do to the world. Don’t repeat the mistake of that guy who presumed the impact of the internet would be “no greater than the fax machine’s”.

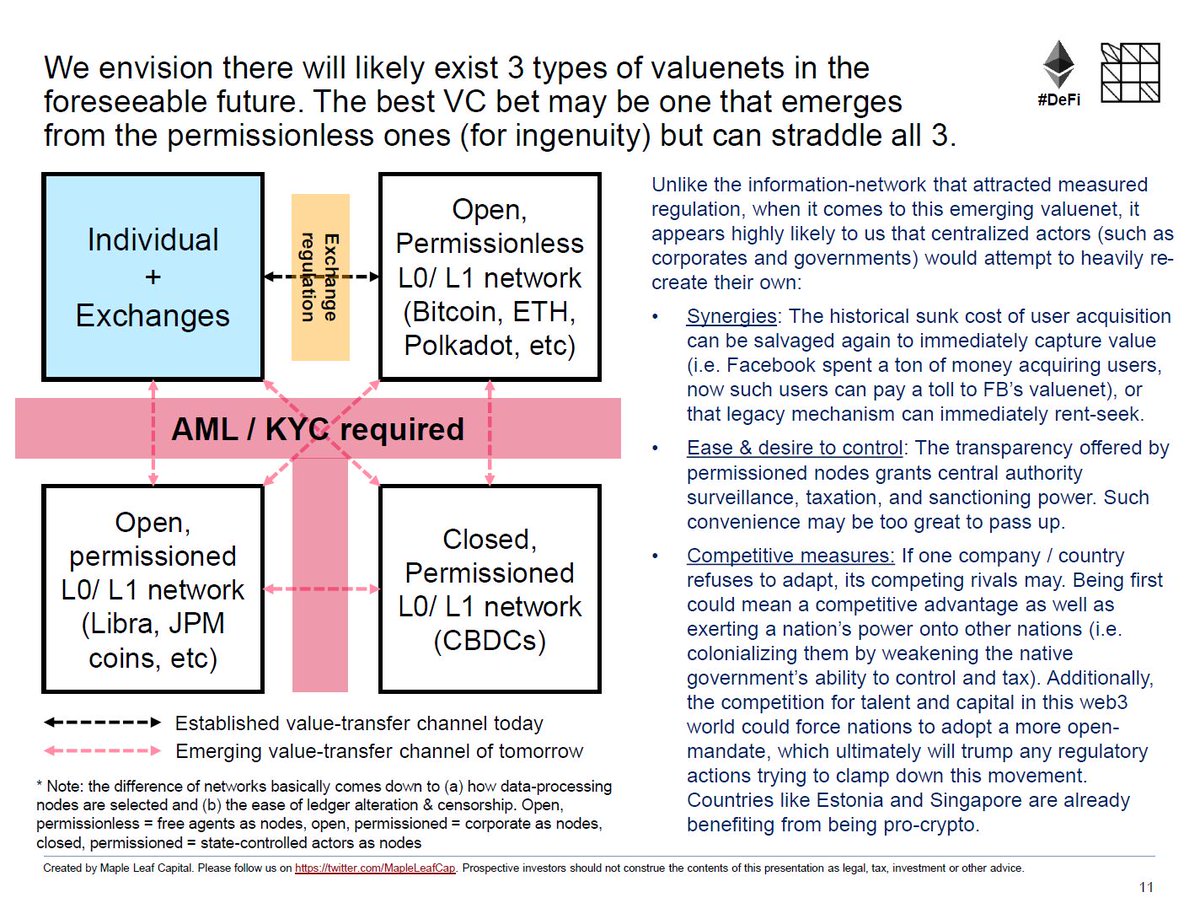

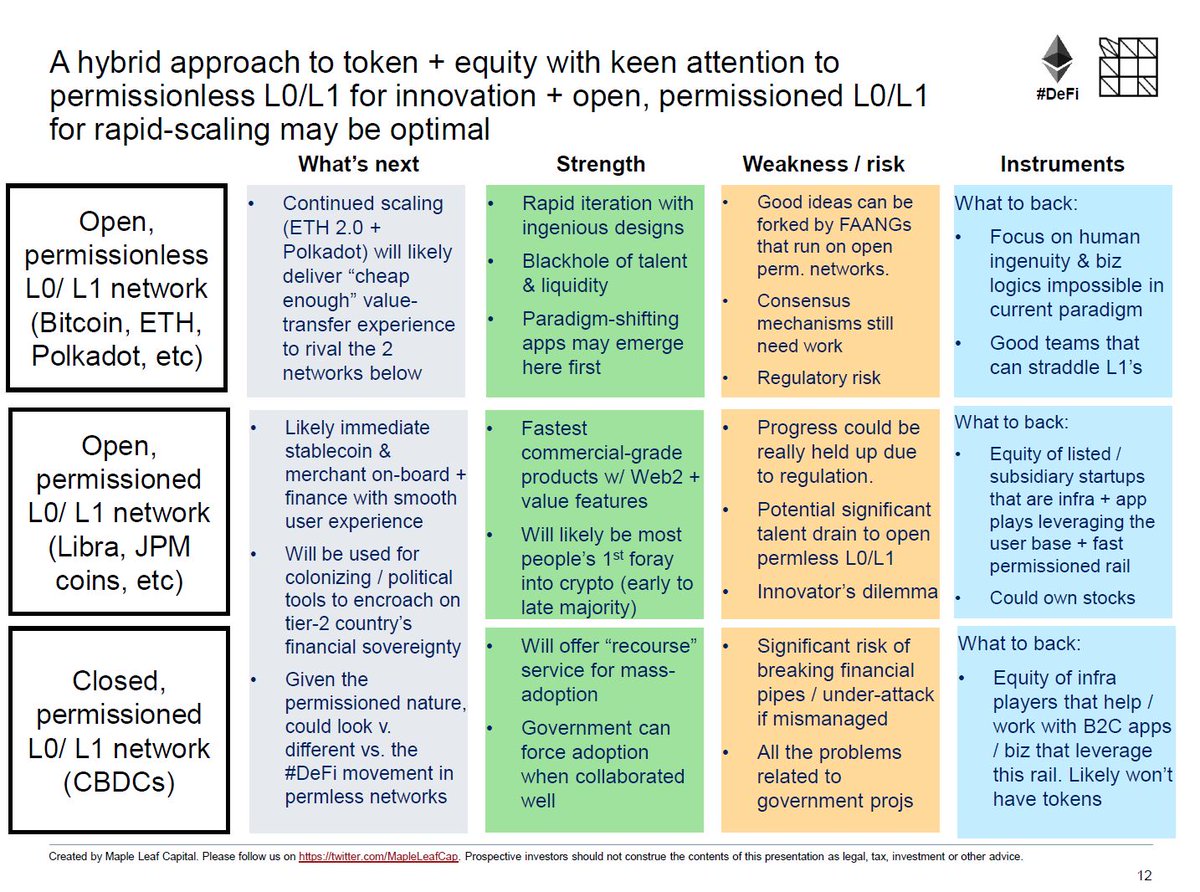

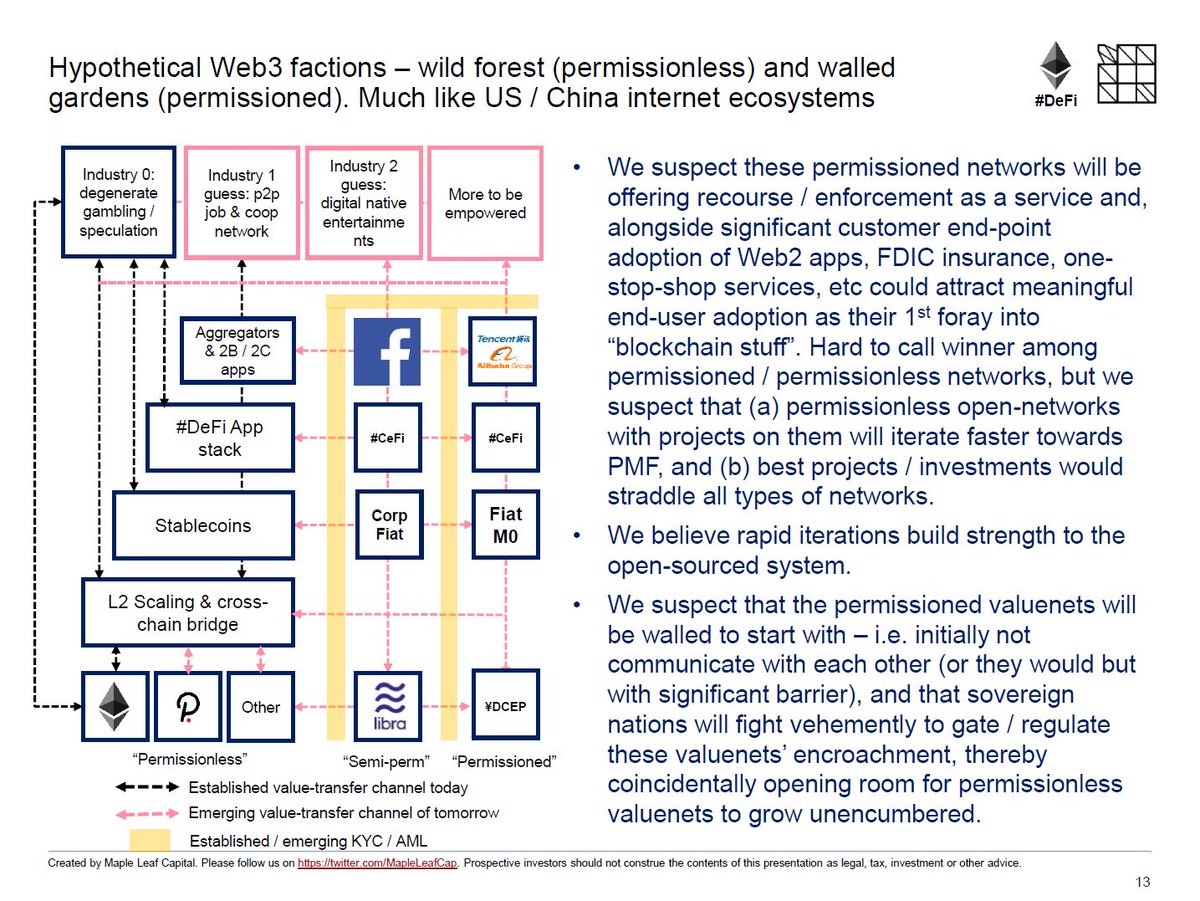

(5) 3 types of valuenets could emerge – open, permissionless (ETH), open, permissioned (Libra), and closed, permissioned (CBDC). We suspect 1st group would be a talent & capital black hole with constant sparks of ingenuity, countered by latter 2 s’ scale, reach, & network effects

(6) …whereby there could still be meaningful barriers between wild forest (permissionless) and walled gardens (permissioned), much similar to US / China internet divide. We think this fragmentation calls for a equity + token hybrid approach still with focus on perm-less projects

(7) We are certain of 1 thing – that how value is transferred in 10-20 years would look similar to how information is transferred today. The path of realizing it can be filled with landmines, whereby we feel like more than anything a strong founding team is paramount…

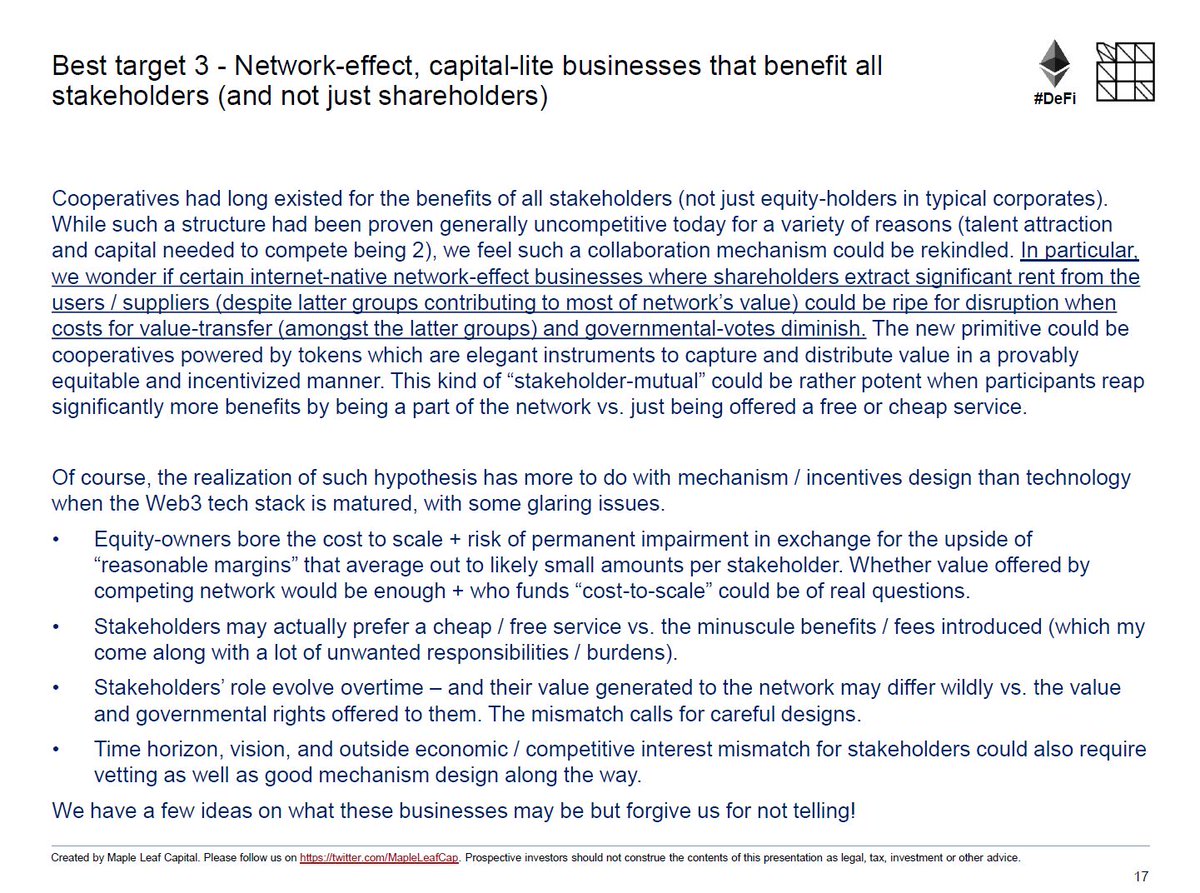

(8) …with 3 types of businesses we really like – “picks and shovels”, Web2.0 network-effect businesses with valuenet enabled, and Web3 native network-effect businesses that elegantly benefit all stakeholders. Again, we feel like this calls for a hybrid token + equity structure.

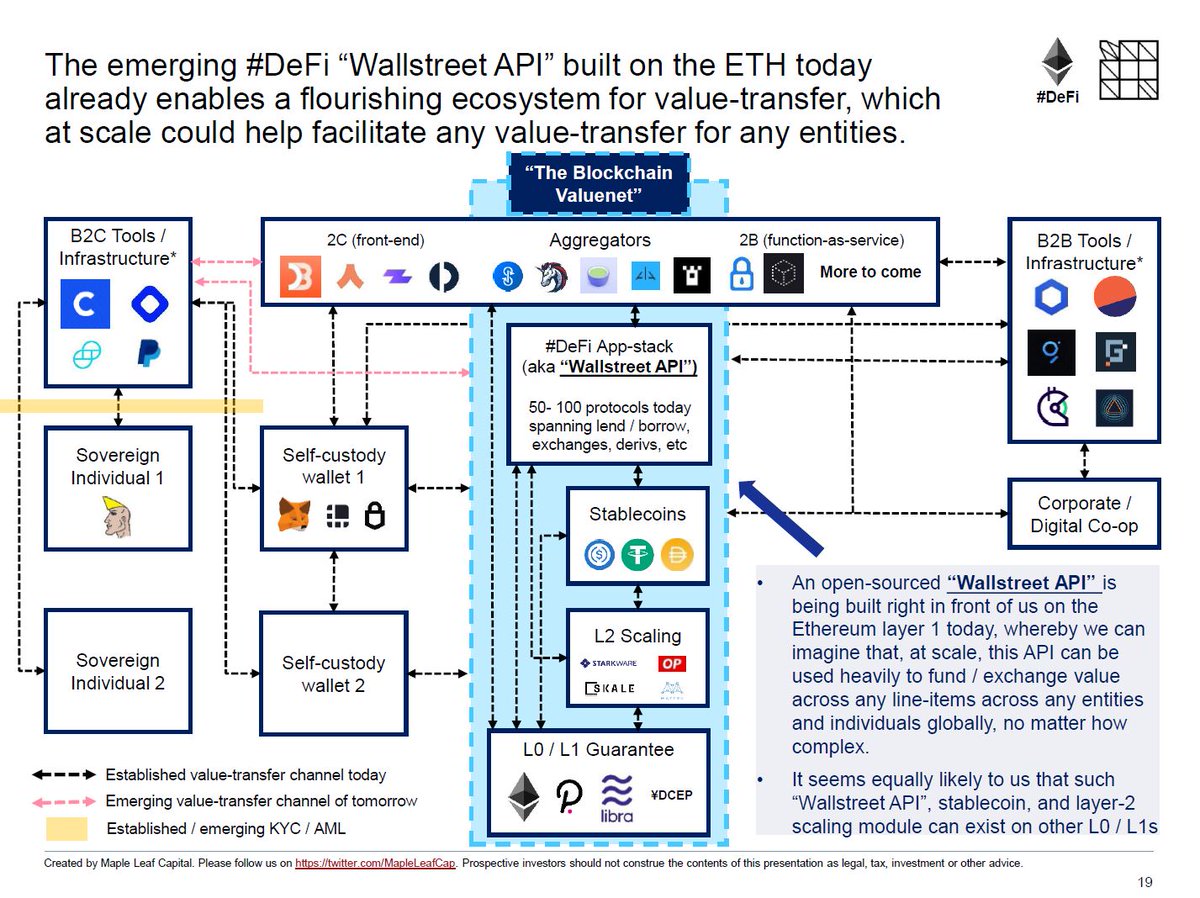

(9) The “picks and shovels” play not only solves the platform-risk rather elegantly, but their XaaS business model with a blockchain tilt offer good exits via takeout by strategic late-comers or IPO. In exchange for the lower beta, we do suspect they may not offer as much upside.

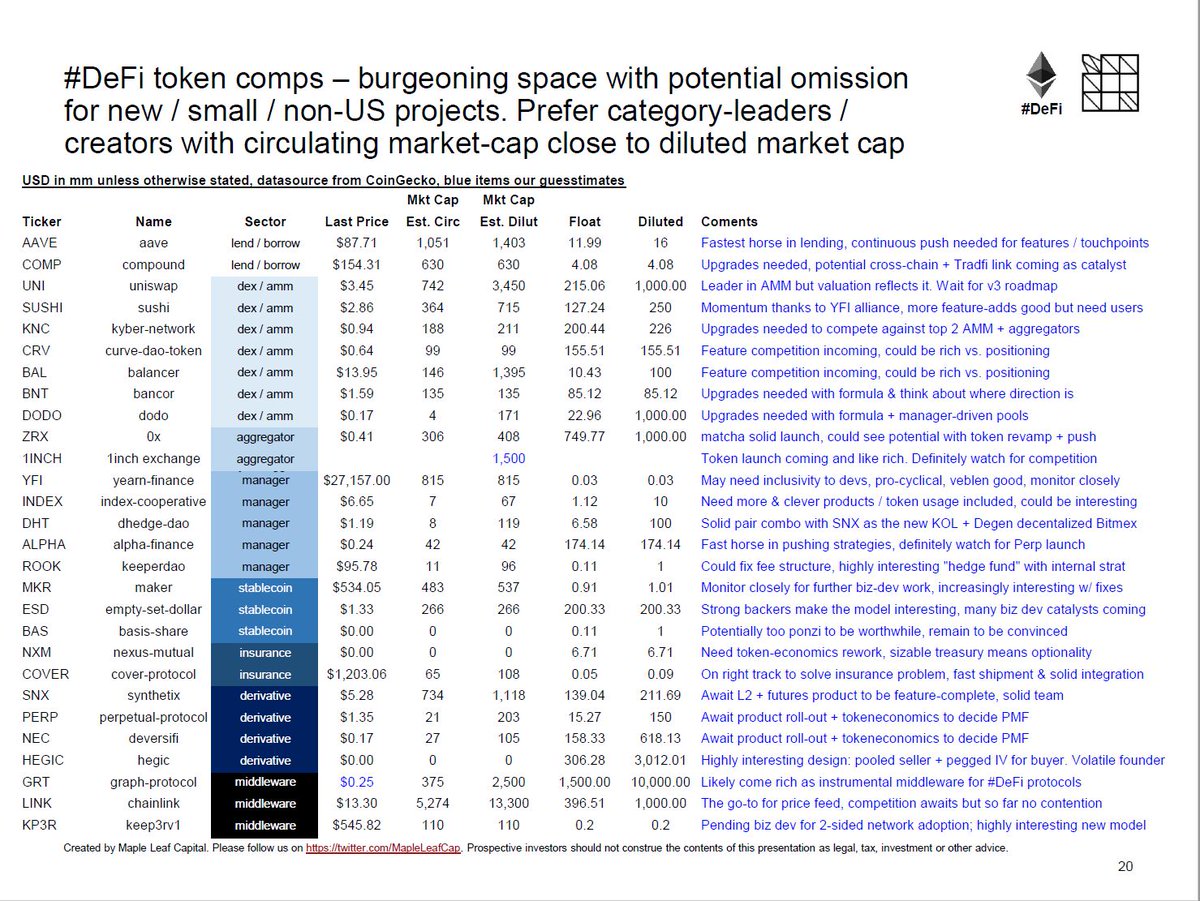

(10) The “Web2.0+” bucket is interesting because for any internet businesses that built 2-sided network-effects, exponentially monetizing their users via the new “valuenet module” seems to be 1-step away (and also make them stickier). There should be massive stock-market winners

(11) We do wonder, however, if certain biz where shareholders extract significant rent from the users / suppliers (despite latter groups contributing to most of network’s value) could be ripe for disruption. Significant mechanism work still ahead, but the 0-to-1 here smells juicy

(12) Re: #DeFi, an open sourced “Wallstreet API” is being built right in front of us on the Ethereum layer 1 today, whereby we can imagine that, at scale, this API can be used heavily to fund / exchange value across any line items for any entities globally.

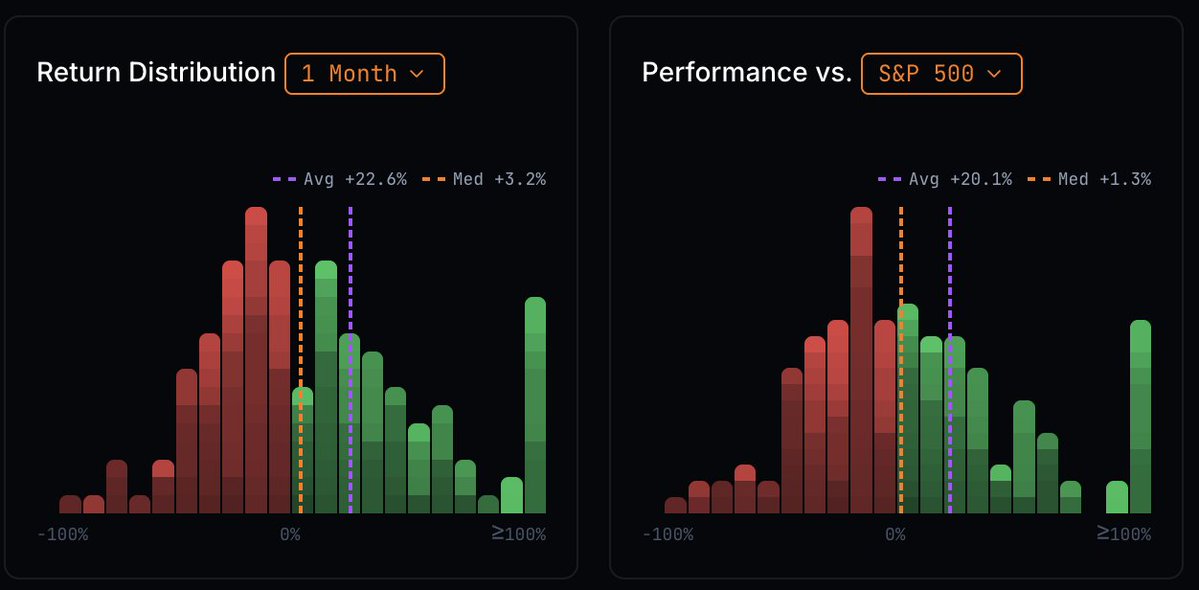

(13) The #DeFi sector today is forming specific “finance subsectors”, with fundamental properties similar to that of small / micro-cap stock investing. We generally prefer category leaders / creators and those that with circulating mkt cap close to FDV. Happy to debate names!

(14) It seems equally likely to us that such “Wallstreet API”, stablecoins, and layer 2 scaling module can exist on other L0 / L1s, so advantages like cost advantage + temper-resistance seem transitory, whereby defensible moats go to team quality, community, and network effects.

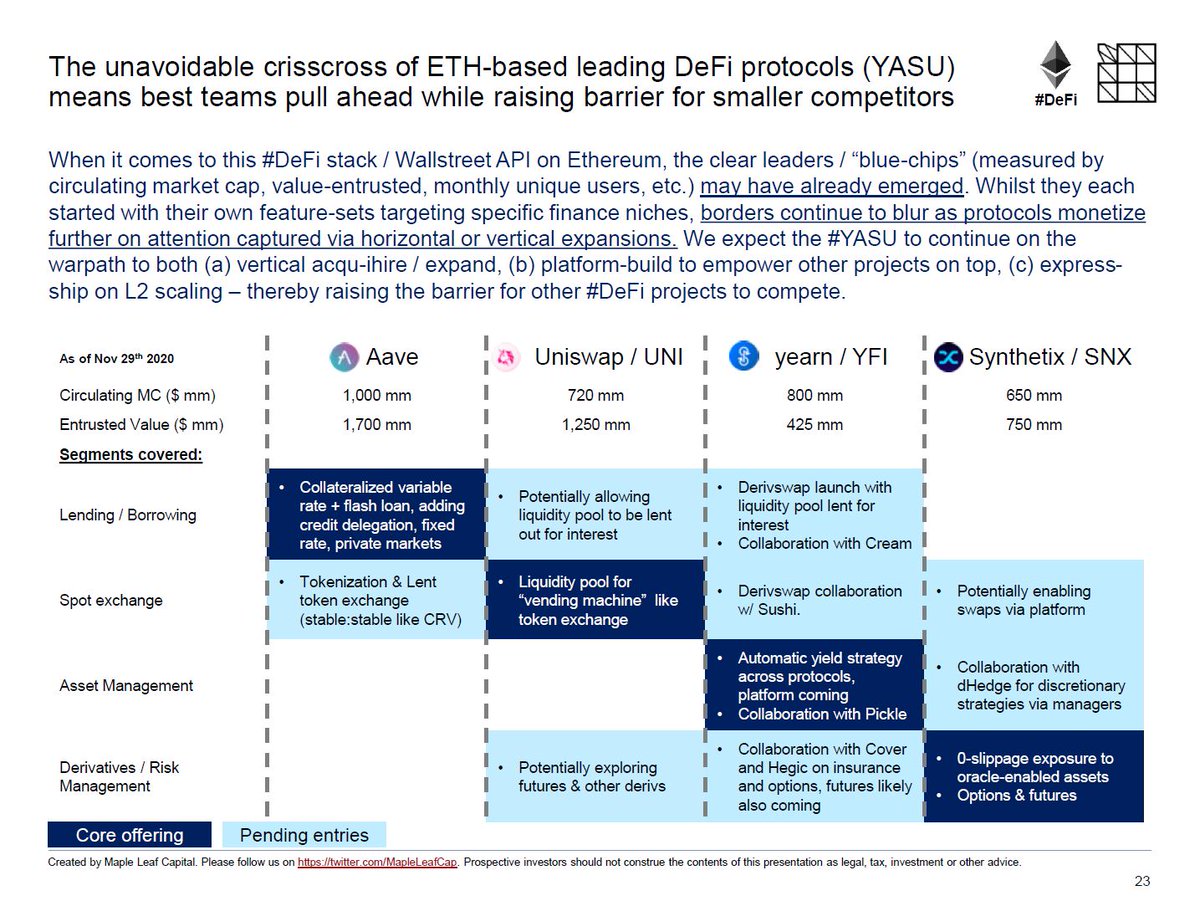

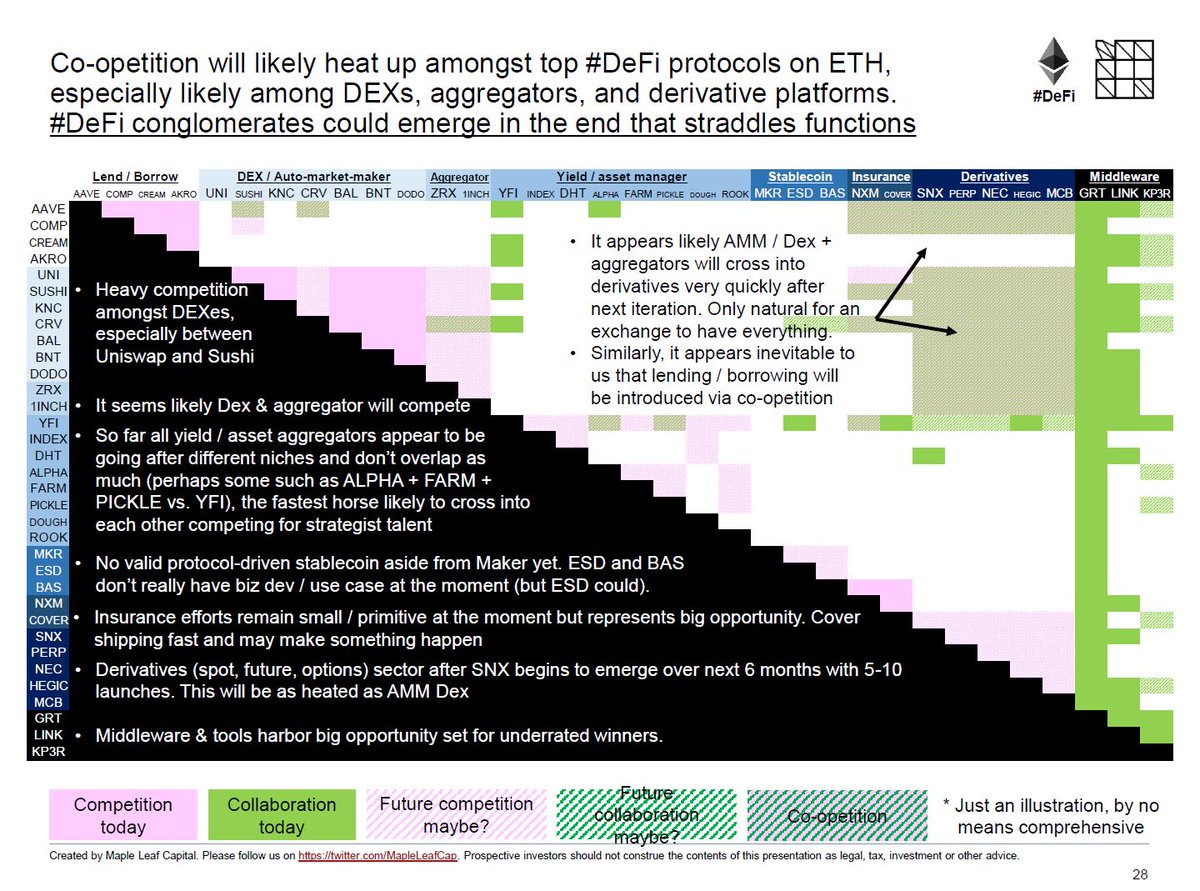

(15) The ETH-based #DeFi winners may have already emerged. Whilst they each started with their own feature sets targeting specific finance niches, borders continue to blur as protocols monetize further on attention captured via horizontal or vertical expansions.

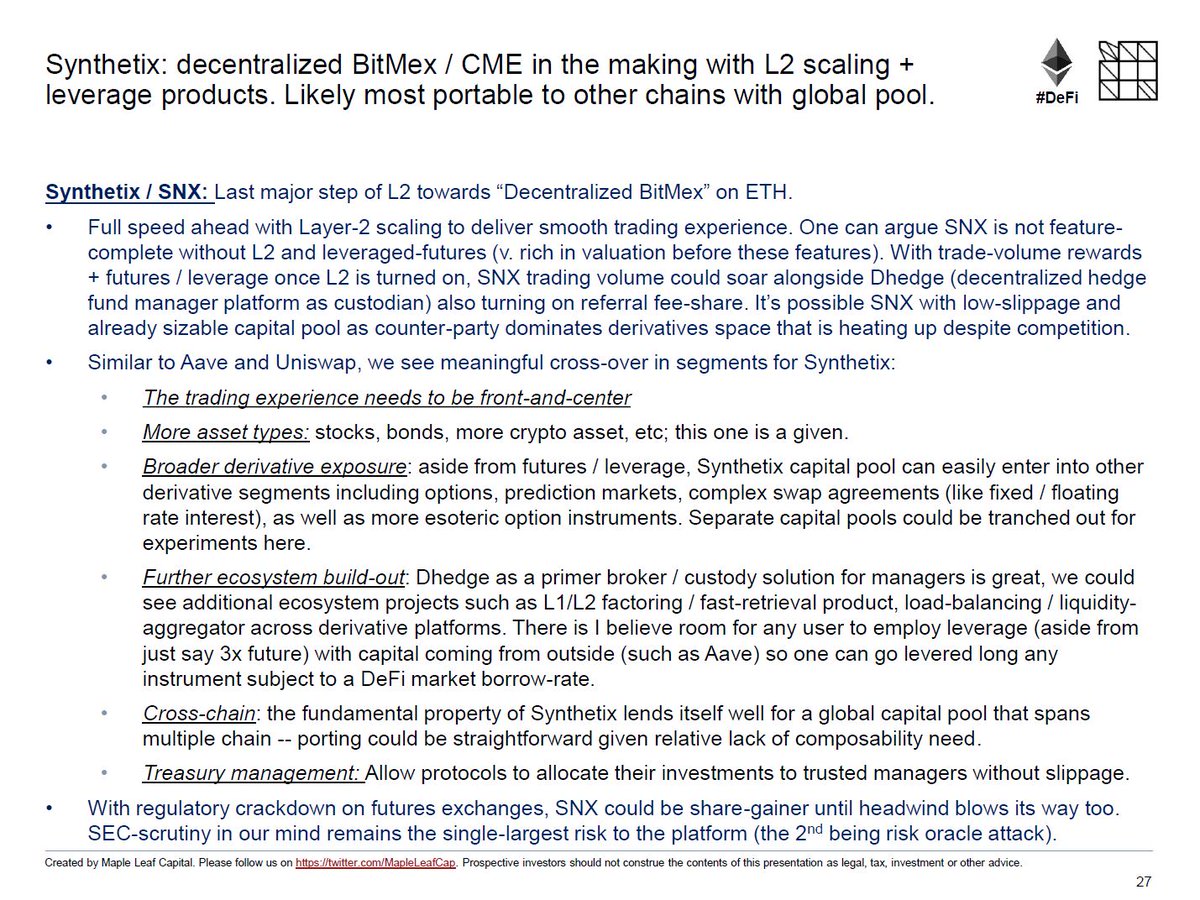

(16) $AAVE will continue to go hard on touch-points / products while thinking about TradFi + cross-chain; $UNI needs v3 and should watch out for disaggregation risk + failure to attract new projects. $SNX is only feature-complete now with L2, Futures, and $DHT…

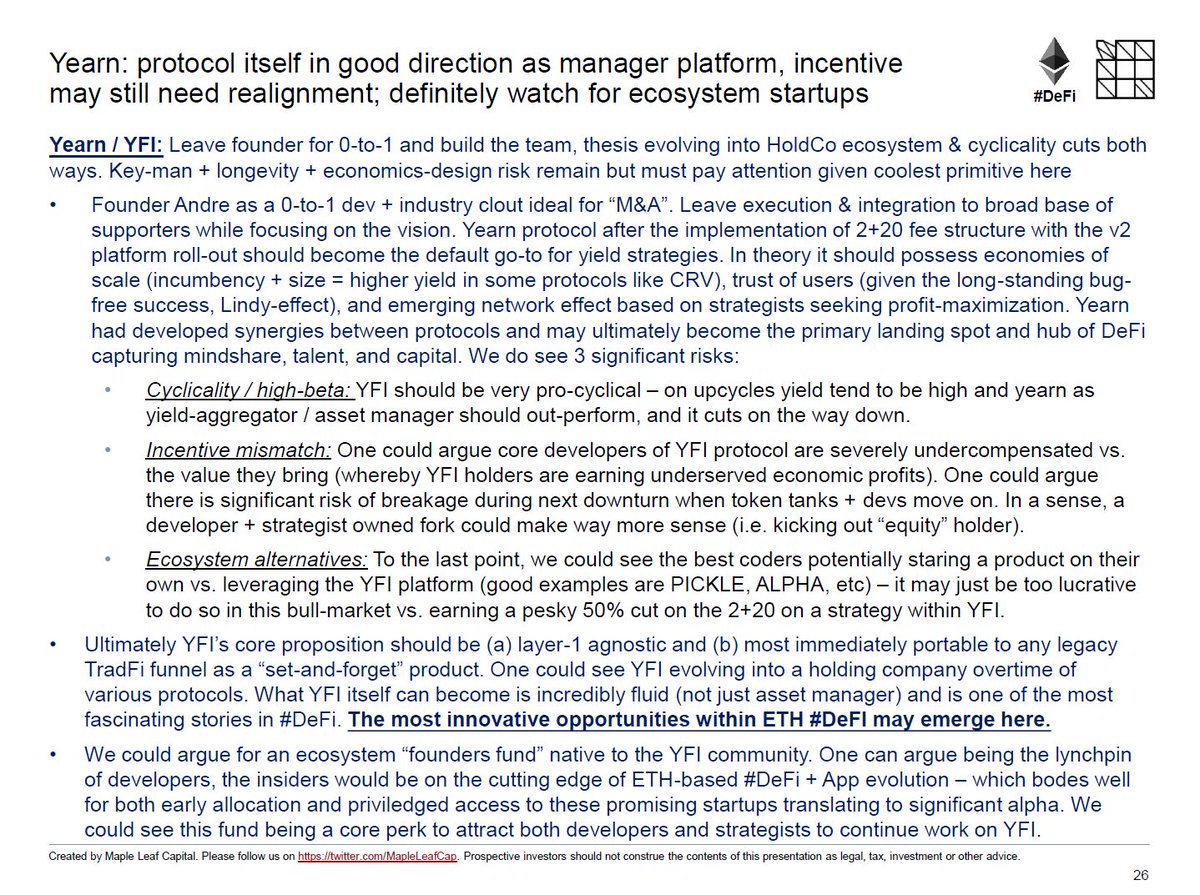

(17)…and we see $YFI as potentially the hotbed for some of the coolest products / designs emerging out of the alliance Andre is building, despite the token / project itself potentially facing cyclicality and incentive mis-match risks. We could argue for a founder fund.

(18) To the broader co-opetition point, we believe conglomerates amongst #DeFi protocols would start to form that turn into “all-in-one” offerings. Meanwhile, the fiercest battleground would likely to be the combo of capital efficient AMM-DEX / lending / derivatives.

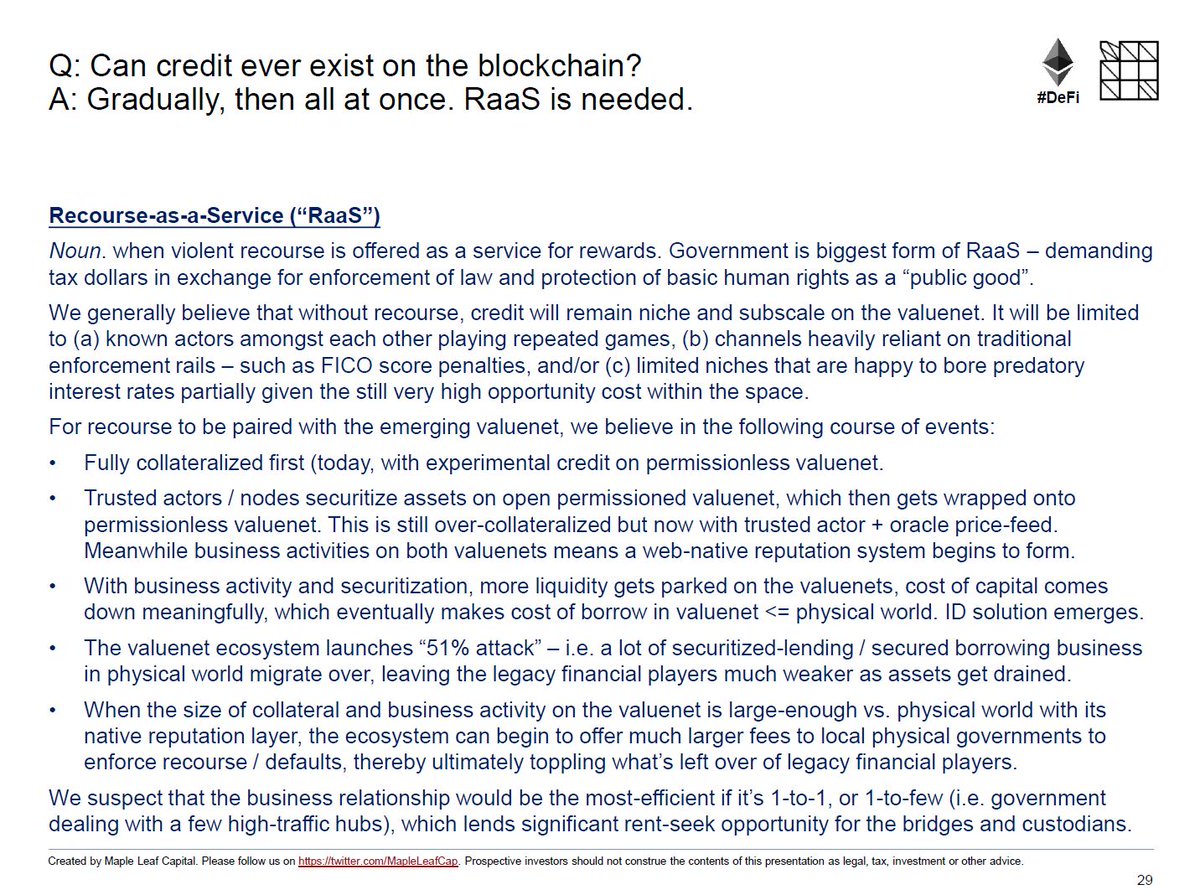

(19) We generally feel that unsecured / credit-driven lending could be slow; but if #DeFi does collateralized lending so well, once collateral on L0/L1 exceeds TradFi, we wonder if unsecured lending in TradFi could just shift over suddenly / i.e. get 51% attacked.

(20) We remain more bullish on “centralized” stablecoins given the alternatives’ weaker business use case and the stability being influenced by market-cycles (i.e. likely not stable when bear market). That said, we see really neat experiments like $ESD and can be swayed.

(21) We think smart-contract insurance remains a neat unsolved segment, whereby partial reserve (for higher yield to entice capital), market-based pricing of premium, highly flexible maturity, strong biz dev for point-of-sale, and good token incentive design are needed.

(22) We generally find middlewares like $GRT and $KP3R fascinating – they can be layer-1 agnostic and can harbor network effect properties. $GRT could come out to be rather sizable to be alpha-generating, and $KP3R seems primed for further token design w/ PMF already.

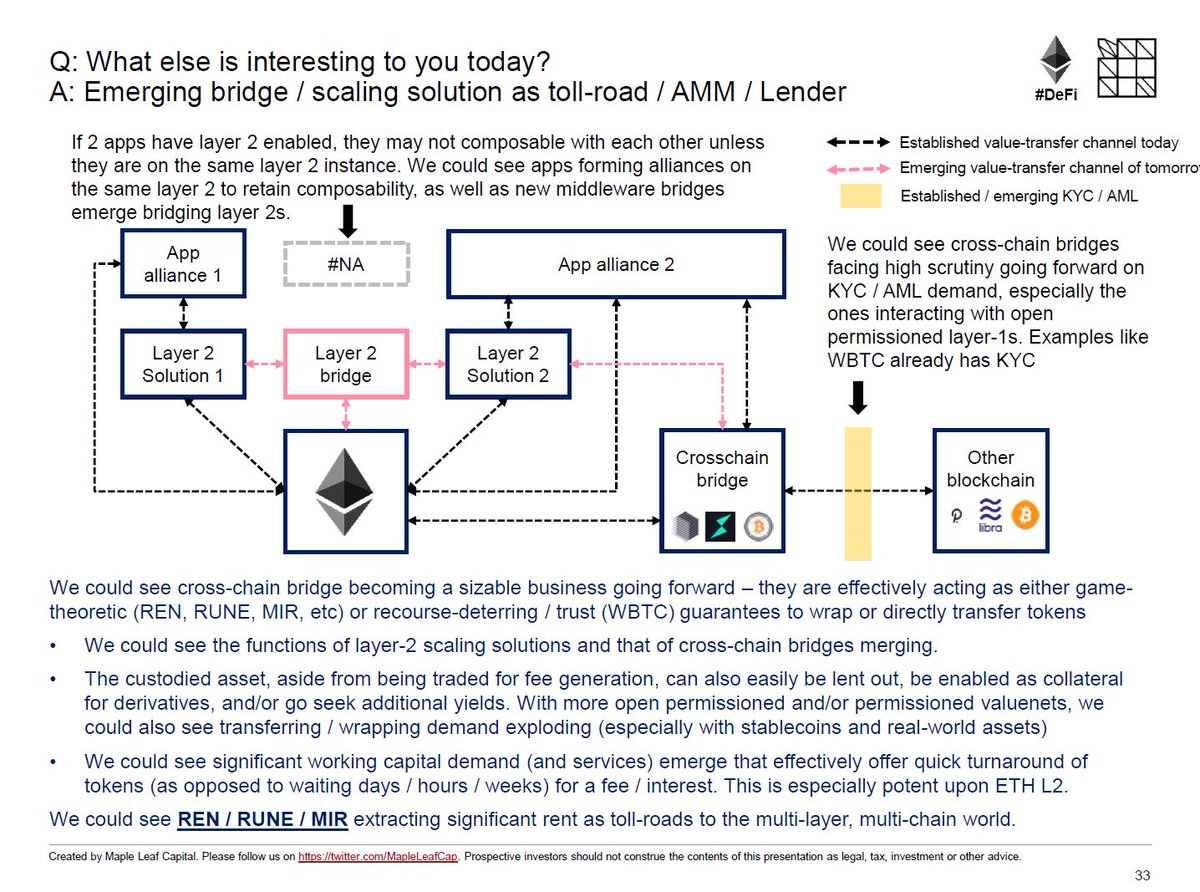

(23) We think cross-chain bridges as toll-roads can be sizable businesses going forward – in particular, whether its L1-L1, or L2-L2, there could be significant lending / borrowing needs (for immediate access). They seem primed for multi-layer, multi-chain world.

(24) We suspect that as the #DeFI stack matures, the equivalent of B2B all-in-one “Wallstreet aggregator” API suite may emerge similar to Twillio that serves real businesses on-top. I don’t think it’s obvious whom that may be yet, maybe firms like Plaid and Stripe could win here.

(25) On ETH specifically, we are lukewarm to “another” upstart trying to tackle AMM / futures / derivative problems with minor improvements. Same with projs that are more features than product. We’d also happily farm anon fruit coins and learn but unlikely to really dive in.

(26) This is a mouthful. If we were any smarter, we’d make it shorter. Special thanks to the people generous with their time and insights! @AriDavidPaul @calchulus @DegenSpartan @GTJOKER_ @mcasto_ @santiagoroel @Fiskantes @simiao_li @tbr90

• • •

Missing some Tweet in this thread? You can try to

force a refresh