🎤 “Men lie women lie, numbers don't.” – Jay-Z

Home ownership may be the single most misunderstood topic in personal finance.

👉Fact: Owning your home is the single best investment you can make. Nothing else comes close. Let’s follow J’s advice and look at the numbers.👇

Home ownership may be the single most misunderstood topic in personal finance.

👉Fact: Owning your home is the single best investment you can make. Nothing else comes close. Let’s follow J’s advice and look at the numbers.👇

I’ve seen many articles and posts suggesting that renting is better than owning, that an index fund or 401k is a better investment, or even that mortgages are a “toxic product”. All dead wrong.

By the numbers, home ownership is the single largest source of wealth in America...

By the numbers, home ownership is the single largest source of wealth in America...

Americans have nearly $20 trillion in home equity and for millions of Americans the home is the sole source of wealth, because – often without knowing it - they made a smart levered investment and sat on it for a long time instead of paying someone else's mortgage (a.k.a. rent).

To understand home ownership, you need to understand leverage, a concept that many (including smart fintech people) don’t understand.

In simple terms, leverage means borrowing money to multiply the size of your investment (and the returns).

In simple terms, leverage means borrowing money to multiply the size of your investment (and the returns).

Simple example: If you have $10k in cash to invest and you borrow another $10k, now you can make a $20k investment. If that investment goes up by 20% and is now worth $24k you could sell it, pay off the $10k loan, and realize a gain of $4k on the $10k you invested, a gain of 40%.

In this example, you used 2:1 leverage to double your investment return. That’s great, but there’s also a ☠️dangerous dark side☠️ to leverage. It can multiply your gains, but it can also multiply your losses.

In our example, if your $20k investment lost value and was suddenly worth $5k, then not only have you lost all of your original $10k, but your investment is only worth enough to cover half of the $10k that you borrowed so you’re another $5k in the hole. A disaster!

For this reason, *amateur investors should only use leverage to invest in hard assets that are almost certain to appreciate*. You see where I’m headed? 🏠

Home ownership is unique because it comes with the best aspects of leverage and almost none of the downside.

Home ownership is unique because it comes with the best aspects of leverage and almost none of the downside.

When you, a regular American, buy a home using a mortgage, you have access to the very best form of leverage available on planet Earth:

1) A mortgage is the lowest cost form of debt. Billionaire RE investors pay higher rates for their debt! Also, most people can borrow 95% of the price of their home, which is 20-to-1 leverage. So if the value of your home goes up 1% the return on your investment is 20%.

2) You're making a house payment whether or not you own. In fact, if you rent you’ll pay *more* for the same home because the owner has to cover all their expenses plus profit. Why not rent from yourself?

3) *Over the long term* homes appreciate slowly & steadily even through economic downturns. This is the key to protecting your downside in levered investment. Let’s dive into this one a bit because this fact is surprisingly misunderstood...

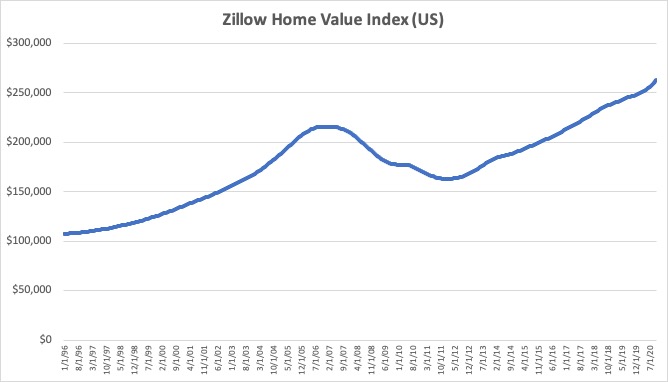

This chart shows the Zillow Home Value Index from 1996 to today (including the worst housing crisis in history). For this period home appreciation averaged 3.7% annually. Even if you bought at the pre-crisis peak in 2007 the average home regained its value 10 years later.

Of course some areas fared worse and some better. In Texas home values barely dipped at all through the crisis. This highlights the importance of living in a “city on the rise”, which I believe is a critical first step toward prosperity and will address in a future post.

Same story over the longer term. This chart shows median home prices since the early 60’s. What you see is steady long term growth in housing prices through 7 recessions (the grey shaded areas).

Let’s bring it all together. Assume you buy a $200k house. You put $10k down (5%) and get a mortgage to cover the remaining $190k. Let’s assume just 2% annual appreciation.

What sort of return will you get on the $10k you invested? To answer that let’s fast-forward 10 years...

What sort of return will you get on the $10k you invested? To answer that let’s fast-forward 10 years...

Welcome to the year 2030. We still don’t have flying cars, but the good news is due to appreciation your home is now worth $244k. And because you’ve made 120 mortgage payments (instead of paying rent) your loan balance has dropped to $147k so you’ve built $97k in equity.

In other words your $10k investment has grown to $97k in 10 years, which is a 23% IRR (Google IRR for more).

Just for fun, let’s assume your home appreciates at 3.7% annually instead of 2%. Now the IRR is an eye-popping 30% and you’re an investing legend in the making.

Just for fun, let’s assume your home appreciates at 3.7% annually instead of 2%. Now the IRR is an eye-popping 30% and you’re an investing legend in the making.

But wait, here’s the best part:

Even if your home *doesn’t* appreciate and its value stays the same or even goes down a bit over those 10 years you can still earn a double-digit return due to equity earned through mortgage payments.

Even if your home *doesn’t* appreciate and its value stays the same or even goes down a bit over those 10 years you can still earn a double-digit return due to equity earned through mortgage payments.

Remember, you’re making a house payment either way so that expense is a wash and doesn’t factor into the investment math. That, my friends, is what you call downside protection!

No other investment vehicle available to regular folks can produce that kind of risk-adjusted return. And I haven't even mentioned the tax benefits of home ownership, which are big.

Here’s the bottom line: If you’re a renter the single smartest financial move you can make is to buy a home. Before putting money into the market and even before putting money into a 401k, even with company matching. The entire housing system is set up to help you win!

DISCLAIMER: Yes there are nuances and there are exceptions to every rule but for the *vast* majority everything above applies. Please don’t @ me with corner cases. Realtor commissions, taxes, maintenance and other costs don't change the math.

This topic is near & dear to my heart so if you enjoyed this post please RT and help me get the word out!

Geeky side note: Housing prices are strongly correlated with inflation, so one way think about home ownership is as an investment that earns a multiple of inflation (through leverage). Inflation is an inexorable economic force and the Fed makes sure that it remains steady.

• • •

Missing some Tweet in this thread? You can try to

force a refresh