We never know the OTC transaction volume under the hood by institutional investors, but there are on-chain indicators to estimate OTC deals.

And based on these indicators, large OTC deals are still going on. Potentially that institutions are continuing to buy BTC.

Thread 👇

And based on these indicators, large OTC deals are still going on. Potentially that institutions are continuing to buy BTC.

Thread 👇

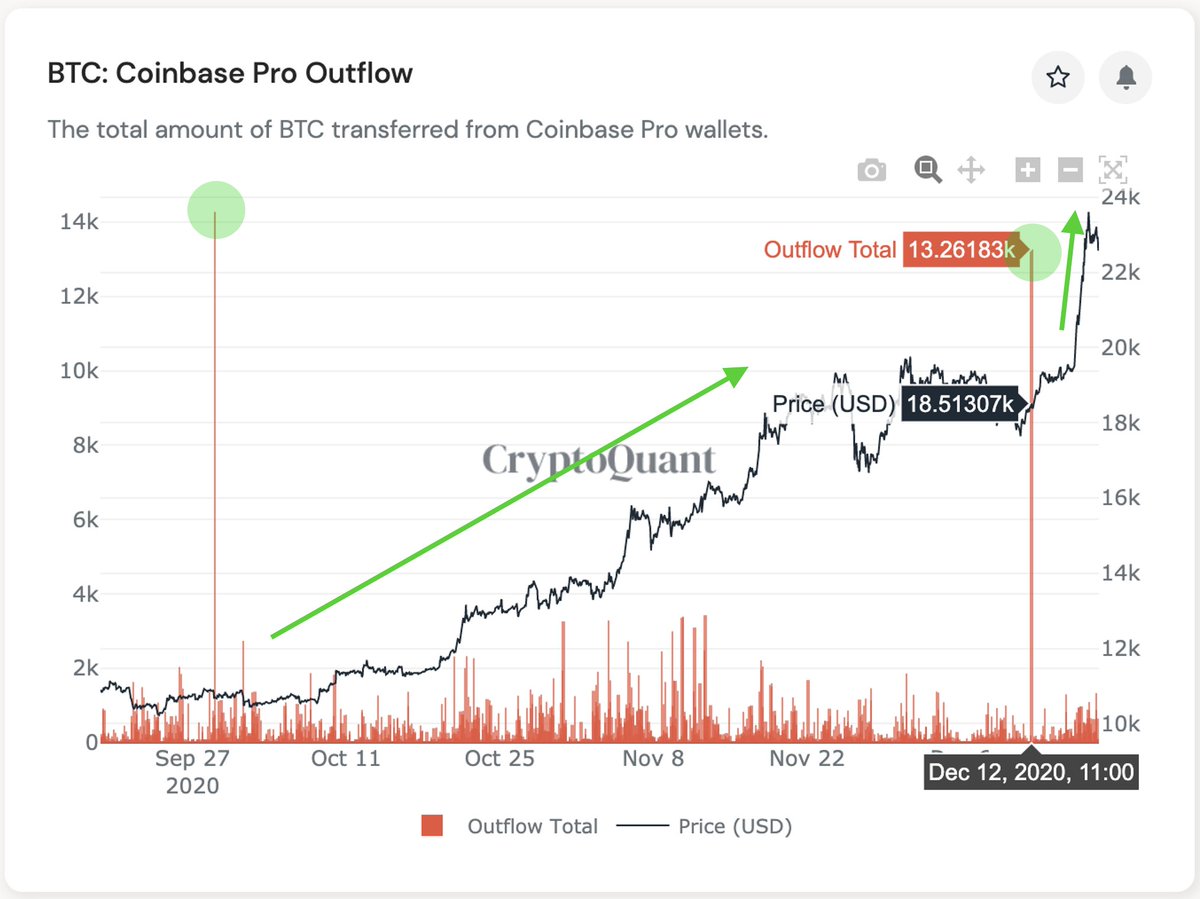

1/ Coinbase BTC outflows

It seems massive Coinbase BTC outflow usually goes to their new cold wallet for custody that held 6000-8000 BTC. If Coinbase moves a significant amount of Bitcoins to other cold wallets, it would indicate OTC deals.

Chart: bit.ly/3mqQJze

It seems massive Coinbase BTC outflow usually goes to their new cold wallet for custody that held 6000-8000 BTC. If Coinbase moves a significant amount of Bitcoins to other cold wallets, it would indicate OTC deals.

Chart: bit.ly/3mqQJze

Grayscale uses Genesis Trading for buying Bitcoins, and Genesis Trading uses Coinbase OTC desk. And Ruffer just confirmed they purchased BTC via Coinbase.

And Coinbase Custody is directly integrated with Coinbase's OTC desk.

blog.coinbase.com/coinbase-custo….

And Coinbase Custody is directly integrated with Coinbase's OTC desk.

blog.coinbase.com/coinbase-custo….

2/ Fund Flow Ratio for all exchanges

Fund Flow Ratio for all exchanges is the ratio of network transaction volume of exchanges among the entire tokens transferred on the network.

If this value goes up, it implies most of the network TXs are exchange deposits/withdrawals.

Fund Flow Ratio for all exchanges is the ratio of network transaction volume of exchanges among the entire tokens transferred on the network.

If this value goes up, it implies most of the network TXs are exchange deposits/withdrawals.

Otherwise, TX volumes are coming from non-exchange wallets. Since the price is eventually determined on exchanges, massive non-exchange transaction volume is considered as a bullish signal. These transactions include OTC deals.

Chart: bit.ly/3h6VtsL

Chart: bit.ly/3h6VtsL

For now, only 5% of the network transactions are used for exchange deposits/withdrawals. This happened in Feb 2019 as well when major exchanges launched OTC desks.

cointelegraph.com/news/major-cry…

cointelegraph.com/news/major-cry…

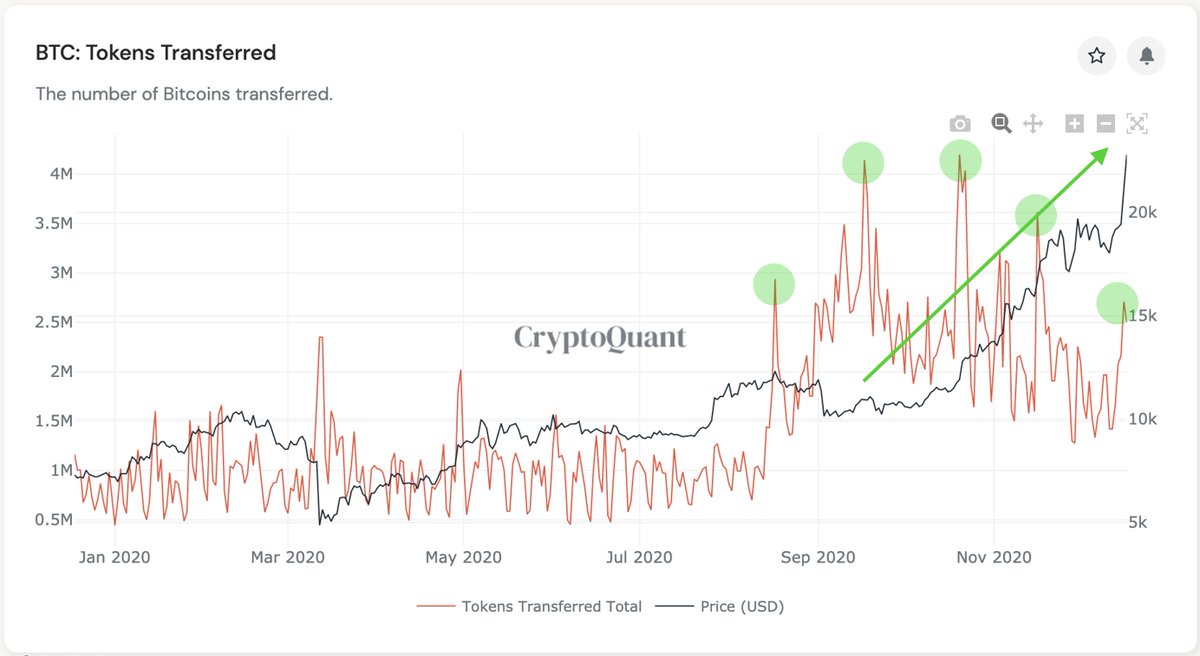

3/ Tokens Transferred

Tokens Transferred is the number of Bitcoins transferred on the network. If this value goes up and the fund flow ratio for all exchanges goes down, it implies that huge OTC deals are on-going.

Chart: bit.ly/2KaFMVA

Tokens Transferred is the number of Bitcoins transferred on the network. If this value goes up and the fund flow ratio for all exchanges goes down, it implies that huge OTC deals are on-going.

Chart: bit.ly/2KaFMVA

Bitcoin transactions are mostly used for P2P TXs(including OTC deals) and mixers/tumblers for money-laundering. That's why we need to see transactions btw non-exchange wallets.

CryptoQuant predicted the series of OTC deals with these three indicators.

https://twitter.com/ki_young_ju/status/1306648466790051840

Conclusion:

This $BTC bull-run never stops as long as these OTC indicators keep saying institutional-buying.

This $BTC bull-run never stops as long as these OTC indicators keep saying institutional-buying.

• • •

Missing some Tweet in this thread? You can try to

force a refresh