How to get URL link on X (Twitter) App

Every on-chain metric signals a bear market. With fresh liquidity drying up, new whales are selling Bitcoin at lower prices.

Every on-chain metric signals a bear market. With fresh liquidity drying up, new whales are selling Bitcoin at lower prices.

1/ I’ve been talking about on-chain whale accumulation for months.

1/ I’ve been talking about on-chain whale accumulation for months. https://x.com/ki_young_ju/status/1796409304108737003

On-chain realized price reveals wallet profitability.

On-chain realized price reveals wallet profitability.

These whale wallets are supersets of custodial wallets.

These whale wallets are supersets of custodial wallets. https://twitter.com/ki_young_ju/status/1688998757143019520

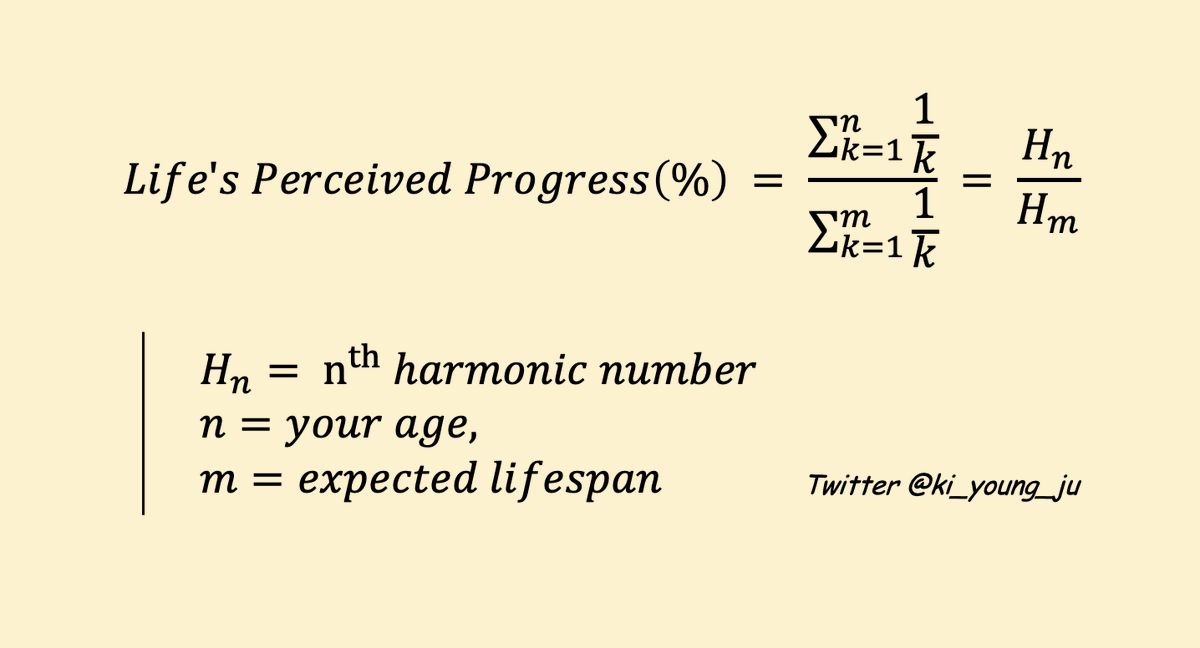

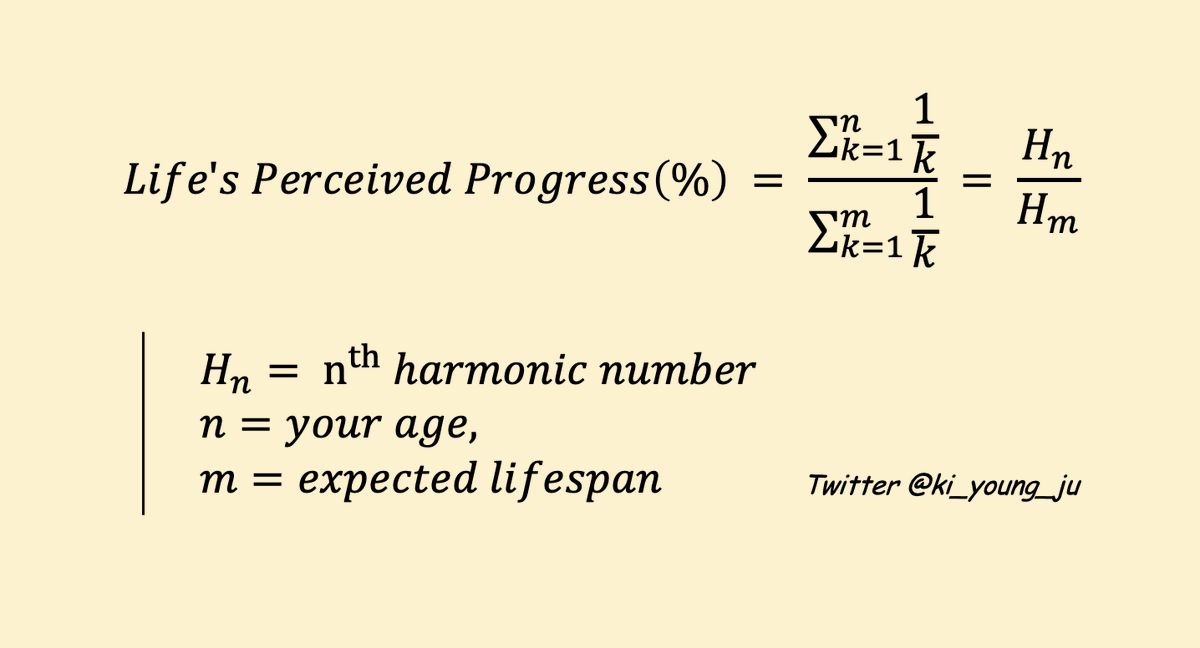

For example, at 1 year old, a year is 100% of your life. At 2 years old, it's 50%. At 3 years old, it's 33.3%.

For example, at 1 year old, a year is 100% of your life. At 2 years old, it's 50%. At 3 years old, it's 33.3%.

Most investors are still underwater if you see on-chain PnL-related indicators like MVRV.

Most investors are still underwater if you see on-chain PnL-related indicators like MVRV.

@cz_binance FTX hourly withdrawals for $ETH just hit an all-time high.

@cz_binance FTX hourly withdrawals for $ETH just hit an all-time high.

PlusToken-related MFers who used the same mixer are still sending $BTC to exchanges, for example, 50 BTC a week ago.

PlusToken-related MFers who used the same mixer are still sending $BTC to exchanges, for example, 50 BTC a week ago.

https://twitter.com/SEC_Investor_Ed/status/14487107499210874881/ 1.6B-worth $BTC buying in 5 mins.

https://twitter.com/ki_young_ju/status/1445746666401792013

https://twitter.com/ki_young_ju/status/1394235754776121347

About this indicator 👉dataguide.cryptoquant.com/quick-start/wh…

About this indicator 👉dataguide.cryptoquant.com/quick-start/wh…

About this indicator:

About this indicator: