I have started a position in $SSPK.

-

SPAC - $SSPK Silver Spike Acquisition Comp

They are merging with WM Holdings, Inc who owns Weedmaps. Founded in 2008. Lead by CEO Chris Beals. Former life-sciences attorney (important - will come in later).

-

SPAC - $SSPK Silver Spike Acquisition Comp

They are merging with WM Holdings, Inc who owns Weedmaps. Founded in 2008. Lead by CEO Chris Beals. Former life-sciences attorney (important - will come in later).

https://twitter.com/plantmath1/status/1339219905556717568

Basic Description:

The business is a two-sided marketplace which serves customers and sellers of marijuana products.

Who are they?

The business is a two-sided marketplace which serves customers and sellers of marijuana products.

Who are they?

On the consumer side, weedmaps.com which is a marketplace for standardized marijuana products.

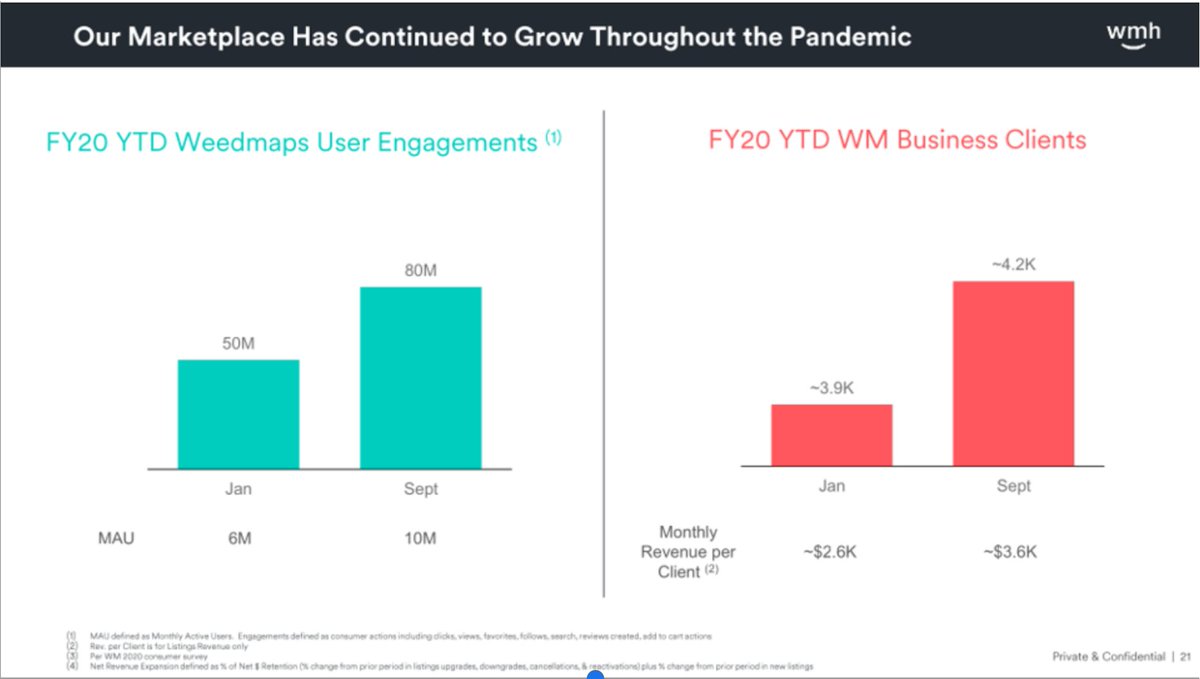

Weed Maps is the world’s largest base of cannabis users with over 10M MAUs, 90% of which are cannabis users, and a stunning 70% are DAILY users.

Weed Maps is the world’s largest base of cannabis users with over 10M MAUs, 90% of which are cannabis users, and a stunning 70% are DAILY users.

A key part of the marketplace is the differentiation between alcohol/tobacco and cannabis. Cannabis is *not* a standardized product so Weedmaps compiles millions of data points from strain traits, user feedback, effects, etc., to suggest the best products for the user.

Weedmaps is operating at a 1.5B GMV run rate. With cannabis illegal on the Federal level, they do not currently take a percentage of this GMW but stated that they plan to with Federal legalization.

Currently 18k business listings on the marketplace. Average order value (AOV) ~$100, compared with average cannabis retailers $50-60, showing how they are more than standard retail.

On the business side, they provide a “Business-in-a-Box” (BiaB) SaaS solution for retailers, most importantly compiling all regulation requirements (state, county, city) in real-time to ensure compliance.

They claim there are no direct competitors who can support cannabis businesses in this space. Most of their clients were doing all record keeping on pen and paper because other ecomm platforms and record software cannot meet regulatory requirements.

They have ~4k clients on the monthly subscription service ($500/mo). They plan to build out their platform to include CRM, loyalty programs, and premium analytics. With new features they will increase the price.

I would expect average business revenue to steadily increase over time as the product suite is extremely compelling.

Weedmap’s BiaB includes a suite of products:

-Weedmaps: Access to the Weedmaps marketplace

-wm ads: Providing sponsored listings in the marketplace (common in marketplaces)

-wm deals: Promotions to attract new buyers

-wm orders: Software to manage POs

-Weedmaps: Access to the Weedmaps marketplace

-wm ads: Providing sponsored listings in the marketplace (common in marketplaces)

-wm deals: Promotions to attract new buyers

-wm orders: Software to manage POs

-wm dispatch: Regulatory compliant software to manage deliveries

-Some states require real-time GPS tracking of orders, some require delivery drivers to wear body cameras – weedmaps BiaB manages these requirements depending on their location

-Some states require real-time GPS tracking of orders, some require delivery drivers to wear body cameras – weedmaps BiaB manages these requirements depending on their location

-wm store: Off marketplace e-comm for cannabis shops (Shopify clone)

-wm retail: On-site regulatory compliant POS systems and software (Square clone)

-wm exchange: Background marketplace for wholesale sellers and retail buyers

-wm dashboard: Analytics

-wm retail: On-site regulatory compliant POS systems and software (Square clone)

-wm exchange: Background marketplace for wholesale sellers and retail buyers

-wm dashboard: Analytics

On compliance, they have developed methods to quickly convert changes to regulation from their government relations team into the software. It can't be stressed enough that regulation is an important moat for Weedmaps.

Financials:

Weedmaps has grown revenue at a 40% CAGR from 2015 to 2019 while maintaining gross margins 93-95% and being EBITDA positive every year.

Weedmaps has grown revenue at a 40% CAGR from 2015 to 2019 while maintaining gross margins 93-95% and being EBITDA positive every year.

At FY19 year end, Weedmaps had to cut off many accounts that did not meet California’s marijuana compliance requirements which accounted for nearly 30M in revenue. Adjusting out these accounts would reduce FY19 revenue from 144 to 115M.

Therefore, in FY20, the anticipated 39% growth in 2020 to 160M is among the adjusted cohort, and only 11% if you use FY19 actuals. It is impressive they returned ~40% growth while exiling a large percentage of their customers.

This is a situation where a company is using data to actually improve sales (not just talk about AI). On the left chart below, you can see how customers have been spending more, faster. Important to watch 2019 over time post cut-off.

wm ads has a long runway for price adjustments. Average CPC is only $0.5 compared to $2.5 in other industries.

On projections, they anticipate 40% CAGR through 2023 *with no new states legalizing*. I definitely anticipate new states legalizing by 2023 and expect more upside. Similar thesis to $DKNG. Projecting constant 92-95% gross margins. Reminder: They are profitable!

Valuation:

$SSPK is trading at roughly a $386M cap and will own 17% of the entity yielding a full 2.2B market cap. The SPAC math is odd but I am taking the most conservative figure. There is a 6 month lock-up.

$SSPK is trading at roughly a $386M cap and will own 17% of the entity yielding a full 2.2B market cap. The SPAC math is odd but I am taking the most conservative figure. There is a 6 month lock-up.

At 2.2B, they are trading at 11x 2021 revenue. As a SaaS/Ecomm product, I consider this to be a very fair valuation growing at roughly 40%.

Risks:

There are many. I'll categorize into:

1) Regulatory

2) Glassdoor

3) Recent reviews

There are many. I'll categorize into:

1) Regulatory

2) Glassdoor

3) Recent reviews

1) Regulatory - I am not sure if Federal legalization is a benefit or risk. If legalized, business opens up nationwide, but competitors will come into the space. That said, local laws will still remain and be an important moat.

2) In 2019, when they had to remove a chunk of California vendors, they had layoffs. You can see the impact on their Glassdoor reviews if you sort by chronological. I hope it doesn't have long lasting impact. Also some reviews about poor behavior. Watching this like a hawk.

3) Recent reviews - They apparently removed delivery in Canada. This has caused a spike in bad reviews on their site. Watching this closely but Canada is an important market.

I like the play into MJ through a SaaS/E-Comm/Marketplace lense. I am not comfortable investing in the growers because I don't have experience to know the brands. Until we have full financials and more data, I am starting with a smallish 2% position.

The valuation is very reasonable and I see a lot of upside from here, on valuation alone. Could easily trade to 20x sales, a double from here. With a 40% CAGR and I think this could be a 10-15B company in a few years.

I haven't seen any discussion on this name, so I hope it was helpful. This is my first long thread so feedback would be appreciated. @JonahLupton @TheMarkCooke @jablamsky @StockMarketNerd

• • •

Missing some Tweet in this thread? You can try to

force a refresh