Looking to survive. Authenticity wins. Sharing mistakes is more important than sharing wins. @packers part owner.

How to get URL link on X (Twitter) App

$ZI Customers contributing over $100k in revenue were 1,623 up from 950 YoY, +71% YoY.

$ZI Customers contributing over $100k in revenue were 1,623 up from 950 YoY, +71% YoY.

Monthly average visitors +30% to 46 million.

Monthly average visitors +30% to 46 million.

https://twitter.com/skillz/status/1387394630652555265$SKLZ also sent a message to developer accounts today.

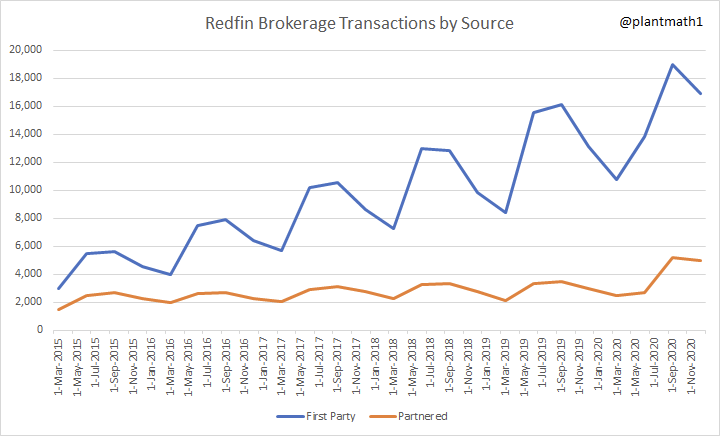

Second: $RDFN's brokerage transaction over time, by source.

Second: $RDFN's brokerage transaction over time, by source.

Am I reading this wrong or does $RBLX have 6.6% Gross Margins for first 9 months 2020 (excluding R&D, G&A, S&M)?

Am I reading this wrong or does $RBLX have 6.6% Gross Margins for first 9 months 2020 (excluding R&D, G&A, S&M)?

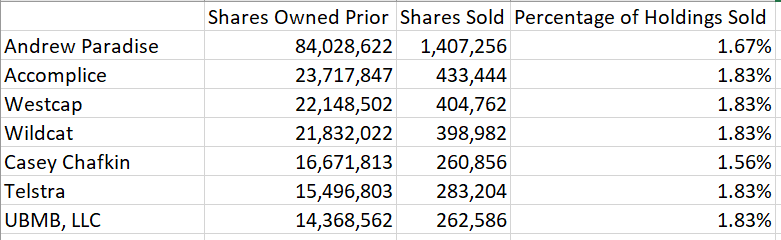

https://twitter.com/WolfpackReports/status/1368997459897237511$SKLZ - Wolfpack, do you know people can look this stuff up? The largest existing shareholders sold less than 2% of their holdings in the offering. If I own 100 shares of $AAPL and sell 2 shares, that doesn't make me bearish on the company.

https://twitter.com/WolfpackReports/status/1368999635738521600?s=20