THREAD: We published a response to Treasury's proposed rule re: unhosted wallets, analyzing data behind their use, what the industry would have to do to comply & offering thoughts on how the rule could better achieve its purpose to curtail illicit activity bit.ly/3mHLYS2

First, three clear trends from our blockchain data suggest unhosted wallets are primarily used by individuals and organizations to either store their cryptocurrency for investment purposes, or move it between regulated trading venues.

Our first chart shows the vast majority of bitcoin sent between unhosted wallets is sourced from Virtual Asset Service Providers (VASPs), primarily exchanges:

79% of bitcoin sent from 1 unhosted wallet to another originally came from a regulated exchange. So gov can usually trace suspicious unhosted wallet activity back to regulated exchanges. Only 5% came from risky or illicit services.

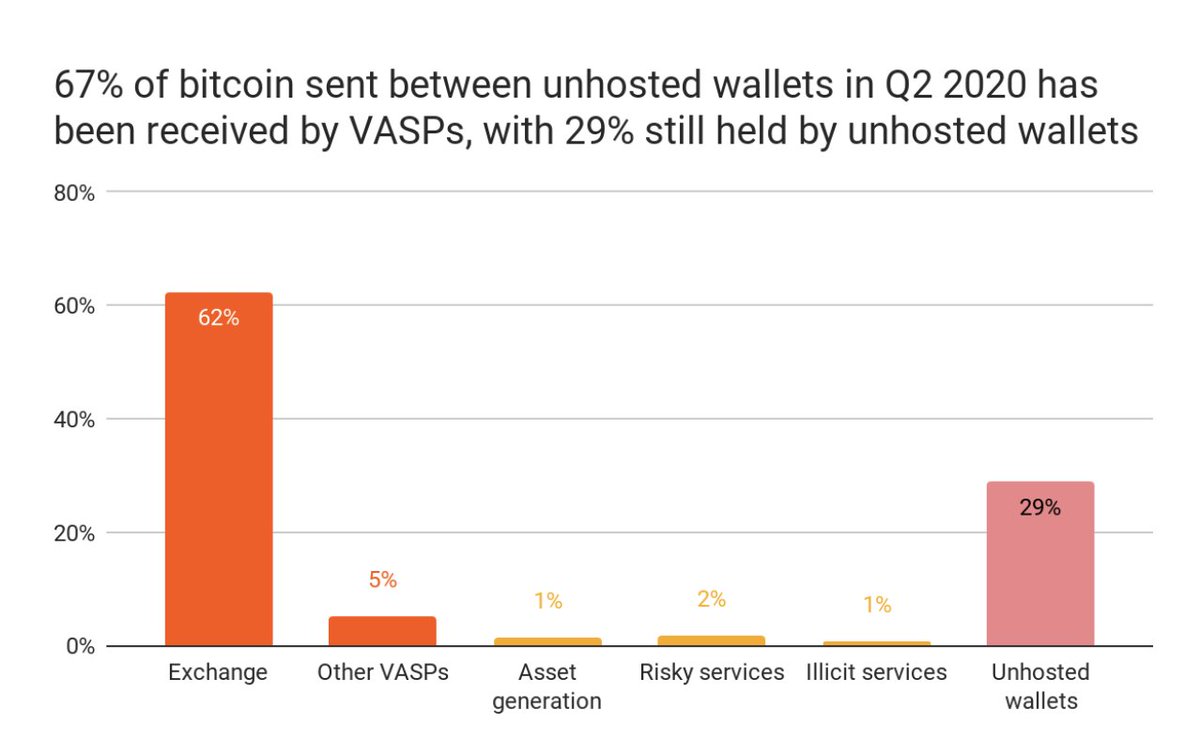

Our second chart shows the vast majority of bitcoin sent between non-VASPs is later sent on to VASPs:

While 29% of bitcoin sent between unhosted wallets was not sent to a service – possibly to hold as an investment, as discussed below – 62% was sent to regulated exchanges and only 3% was sent to risky or illicit services

Taken together, these charts show that the vast majority of bitcoin both sent and received by unhosted wallets has an exchange in a regulated environment as the counterparty, with the resources to help law enforcement

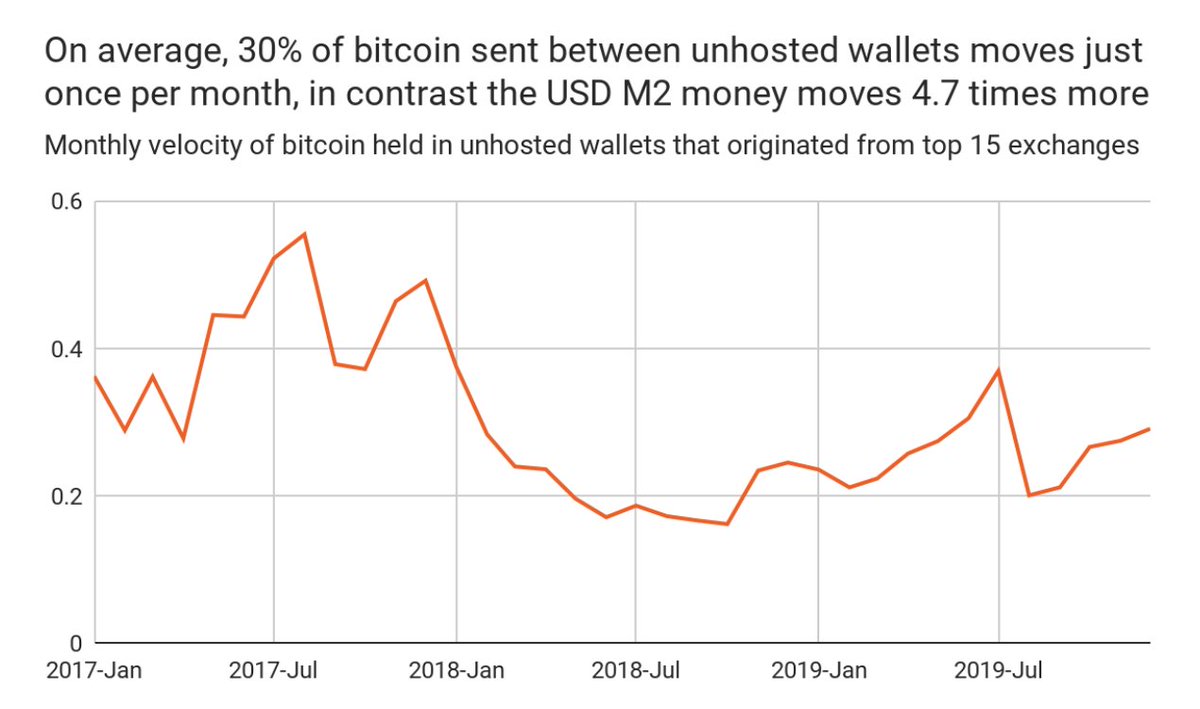

Our third chart strongly suggests unhosted wallets are primarily used as an investment. By plotting bitcoin’s velocity against the M2 money supply, we can see whether bitcoin use is trending towards payments or towards savings and/or investment:

On average, only 30% of bitcoin withdrawn from top exchanges to unhosted wallets moves to another unhosted wallet in any given month. The other 70% remains in the original withdrawal wallet, suggesting it is held for saving and investment purposes.

The M2 USD money stock moves 4.7 times more than this, indicating that bitcoin is used more like an investment and less like cash.

This indicates that these reporting requirements to detect illicit activity will likely not deliver the intended results, but rather will cost VASPs millions of dollars in unnecessary compliance costs to report on the savings and investment activity of their customers.

Next we looked at trends in the flows of illicit funds. 62% are cashed out at exchanges w/ AML programs & 23% are sent to risky services like mixers, gambling services & services in high-risk jurisdictions. Interventions are needed on these vulnerabilities, not unhosted wallets

There are not 2 separate cryptocurrency ecosystems, 1 made up of legitimate transactions btwn exchanges and the other illicit transactions among unhosted wallets. There is 1 interconnected ecosystem, and most exchanges have controls to support govs in their investigations

Law enforcement used Chainalysis in successful prosecutions, seizures & forfeitures totaling $1.5B+ USD in 2020 alone. The current system is working & efforts to improve enforcement should help the effectiveness of the system, not add box-checking compliance requirements

These requirements will come with a high cost for exchanges. They go beyond the level of reporting and verification that exists in traditional financial services, placing an undue burden on the industry to collect and manage this data.

So how could these requirements more effectively improve the AML regime? First, the transparency of the blockchain enables gov to investigate the vast majority of the obligated transactions under the rule, without the reporting requirement, & we think record keeping is sufficient

Second, we applaud FinCEN’s recent efforts to broaden the information sharing protocols & strongly believe that strengthening these types of public/private partnerships, domestically and internationally, will more effectively address govs’ vulnerabilities & protect their citizens

What’s next? We are continuing to engage with industry bodies on responses to these proposed requirements. As always, we will advocate for policies that fight illicit activity and keep people safe, while building trust in the cryptocurrency industry.

Our blog goes into more detail about the requirements, what exchanges will have to do to comply, and has a nifty tool for KYT customers to estimate the quantity of records and reports the proposed rule will require: bit.ly/3mHLYS2

• • •

Missing some Tweet in this thread? You can try to

force a refresh