Building trust in blockchains among people, businesses, and governments. Our crypto compliance and investigation software powers hundreds of top institutions.

How to get URL link on X (Twitter) App

2/ Using the methodology described in our blog, we calculate the weakly realized gains and losses of all personal wallets over the course of 2022. bit.ly/3j5Dc3Z

2/ Using the methodology described in our blog, we calculate the weakly realized gains and losses of all personal wallets over the course of 2022. bit.ly/3j5Dc3Z

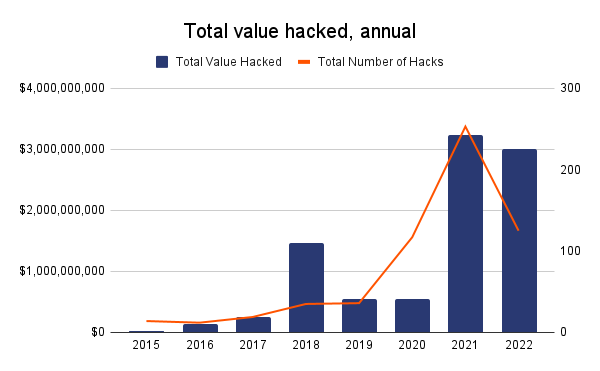

2/ At this rate, 2022 will likely surpass 2021 as the biggest year for hacking on record. So far, hackers have grossed over $3 billion dollars across 125 hacks.

2/ At this rate, 2022 will likely surpass 2021 as the biggest year for hacking on record. So far, hackers have grossed over $3 billion dollars across 125 hacks.

2/ Don't miss out on our events where #WomenInTech from Chainalysis will be answering questions like:

2/ Don't miss out on our events where #WomenInTech from Chainalysis will be answering questions like:

2/ Mixers are designed to provide more privacy in #crypto transactions and can be used to obfuscate the source of funds. They create a disconnect between the #crypto funds that users deposit and what they withdraw, making it more difficult to trace the flow of funds.

2/ Mixers are designed to provide more privacy in #crypto transactions and can be used to obfuscate the source of funds. They create a disconnect between the #crypto funds that users deposit and what they withdraw, making it more difficult to trace the flow of funds.

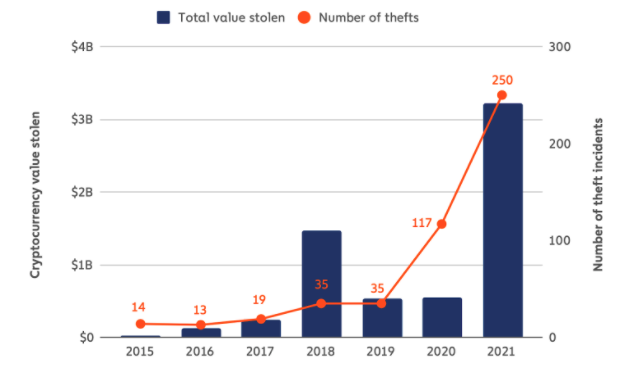

https://twitter.com/Ronin_Network/status/1508828719711879168Unfortunately, the hack of @Ronin_Network is the latest in a series of DeFi thefts. In 2021, $3.2B in crypto was stolen from individuals and services — 6x the amount stolen in 2020. ow.ly/ZCRG50IvnEa

https://twitter.com/chainalysis/status/1454142695874695170Blockchain analysis firms erroneously identified DarkSide’s movement of funds as a simple peel chain, without identifying the mixer involved. They incorrectly traced the funds to exchanges & other services based on that conclusion. bit.ly/3pSSDxU