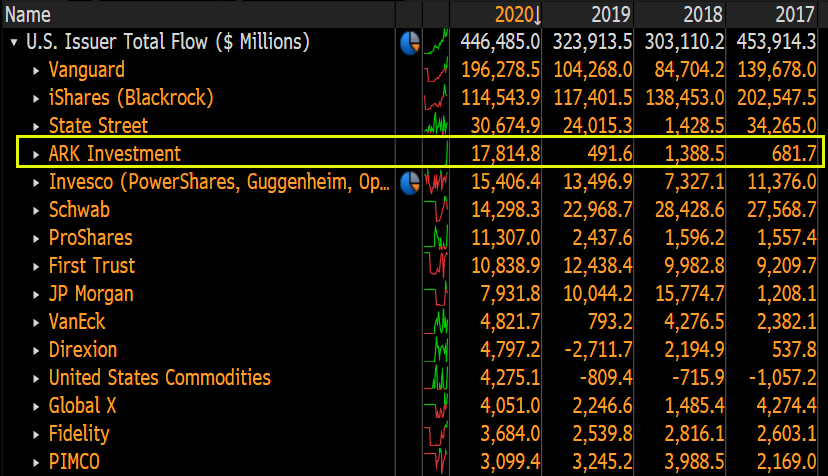

Most of the ARK ETFs saw record flows last night. All told the ARK Fam took in about $1b based on Monday's $2b in volume, which means 50% of its volume was creates, wow. So lookout for another $1b+ in flows tonight based off Tue's $2.3b in volume (ARK reports shares T+1).

The 50% volume to flow ratio is even higher than I predicted but I will still take some credit for getting VERY close to nailing the flow amount.

https://twitter.com/EricBalchunas/status/1341518377114865666?s=20

$ARKK and $ARKG are 5th and 6th in overall in creations in past week with about $1b each. Big boy flows.

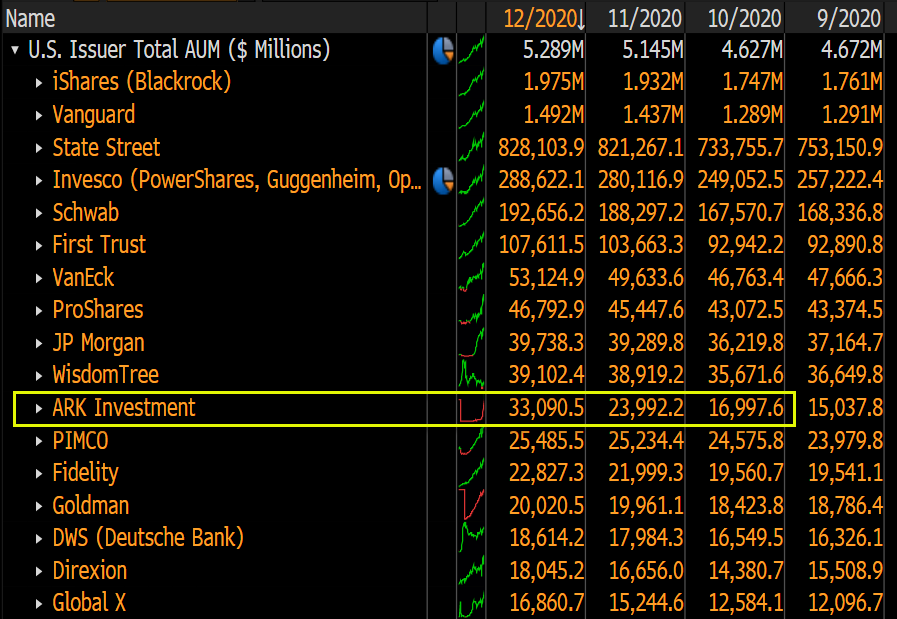

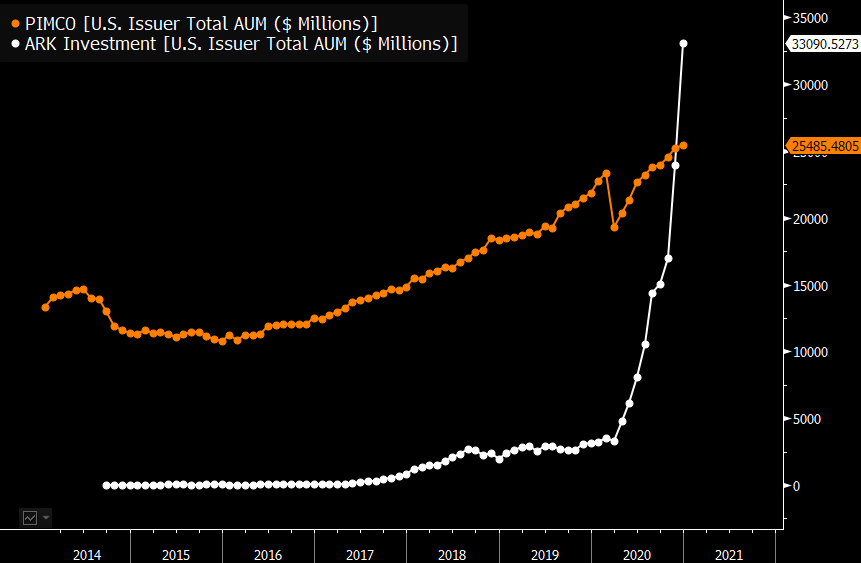

Also, the inflows last night boosted $ARKK aum to $18.7b which surpasses $DXJ's peak asset level amid the currency hedging craze.

One point on $DXJ is that it was #1 in inflows in 2013. That is one thing ARKK will not be able to touch. It does have real shot to crack Top 10 (curr #14 and $2.5b behind #10 spot) but it's not getting anywhere near VTI's $32b.

• • •

Missing some Tweet in this thread? You can try to

force a refresh