1/ Every year there are so many of year-end crypto reports. But trust me when I say that you will want to at least skim this one and send it to your non-crypto friends. You can download it for free here: theblockcrypto.com/post/88463/202…

2/ First of all, a massive shout out to the research team. We now have 8 full-time analysts and have produced 550 unique pieces of research and market commentary in 2020. Go follow the team:

@_RJTodd

@Dogetoshi

@mhonkasalo

@FrankResearcher

@lars_hl

@dantwany

@MillennialMike7

@_RJTodd

@Dogetoshi

@mhonkasalo

@FrankResearcher

@lars_hl

@dantwany

@MillennialMike7

3/ In the report we look at:

• State of the market

• Crypto investment trends

• DeFi themes and outlook

• Payments and banking trends (CBDCs, stablecoins...)

• Macro perspectives

Some highlights:

• State of the market

• Crypto investment trends

• DeFi themes and outlook

• Payments and banking trends (CBDCs, stablecoins...)

• Macro perspectives

Some highlights:

4/ Market structure has matured massively this year. Liquid options market, futures market is no longer as concentrated but more spread out, and volumes as well as interest reaching all-time highs.

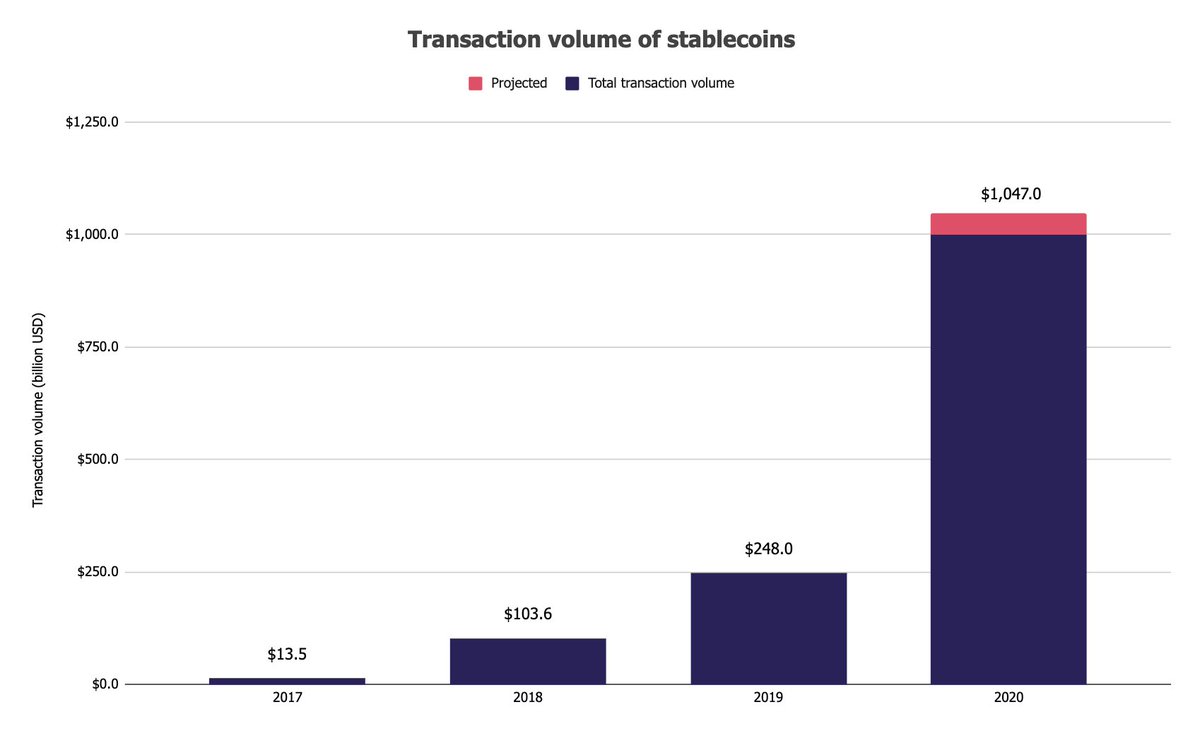

5/ Stablecoins found a product-market fit in 2020. Since the beginning of the year, the aggregate stablecoin supply has grown from $5.9B to over $26B. Annual stablecoin adjusted transaction volume will has crossed $1 trillion in 2020.

6/ Venture funding allocated into crypto and blockchain companies ticks higher in 2020. Roughly $3.1 billion in venture funding was allocated to crypto/blockchain projects in 2020.

7/ 2020 recorded the most M&A transactions in the sector’s history. Although M&A activity & corporate development within digital assets is still in its infancy, more than $691 million in M&A volume was conducted across 83 transactions in 2020.

8/ Successful DeFi protocols are now measured in the billions. DEXs passed $100 billion in annual trade volume in 2020, while the total value locked in DeFi is $16.6 billion.

9/ A look at the biggest DeFi hacks of 2020. In total, The Block Research estimates more than $120 million worth of value has been exploited from DeFi contracts.

10/ 2020 also marked itself as the banner year for legacy fintech, and financial services’ interest in crypto, as some of the world's largest financial companies accelerated the strategic desire to expand crypto capabilities

11/ Now go download the full report and give it a quick read. It’s very visual with tons of charts and graphics to make it easily sharable and lighter. theblockcrypto.com/post/88463/202…

12/ Some of my predictions for next year?

• Options have another great year and Binance finally launches a Deribit competitor

• PayPal launches a stablecoin on Ethereun and stablecoins start finding a product-market fit outside of trading

• Options have another great year and Binance finally launches a Deribit competitor

• PayPal launches a stablecoin on Ethereun and stablecoins start finding a product-market fit outside of trading

• Non-custodial derivatives take off due to Optimism and capture 10% of CEX's open interest by year-end

• Coinbase market cap is above $80 billion at one point, which leads to the repricing of other pure crypto play companies

• Coinbase market cap is above $80 billion at one point, which leads to the repricing of other pure crypto play companies

• M&A starts heating up with traditional companies targeting profit-generating crypto companies

• FATF crypto guidance starts getting implemented, which will put pressure on jurisdiction-less crypto-to-crypto exchanges

• FATF crypto guidance starts getting implemented, which will put pressure on jurisdiction-less crypto-to-crypto exchanges

• • •

Missing some Tweet in this thread? You can try to

force a refresh