1/ With the current market sentiment surrounding Bitcoin and digital assets, 2021 will be one of the most important years to date to follow in terms of investment and M&A/Corp Development. In our EOY report, we summarized the trends of 2020 going into the new year.

2/ Roughly $3.1 billion in venture funding was allocated to crypto/blockchain projects in 2020. Year-over-year, venture funding stayed relatively consistent despite a 61% drop off in total funding from Q1 to Q2 due to the COVID-19 pandemic.

3/ The distribution of funding deals by their size stayed relatively consistent compared to 2019. The grouping with the largest shift this year was from $0-<$1 M to $1-<$5M. This suggests that the larger median deal sizes grew.

4/ Q4'20 was the first time in at least 2 years that the industry reported three or more deals greater than or equal to $50 million. All the deals are valuable sub-sectors primed for growth: Brokerage/Custody firms, Data & Analytics providers, and Exchanges in developing regions.

5/ This year had 3 venture funding deals that were some of the largest-ever in the Crypto/Blockchain vertical: Bakkt's $300 million Series B, Ripple’s $200 million Series C, and a $142 million Series C by Paxos.

6/ The raise by Chainalysis valued the company at $1 billion, making it the first Data & Analytics provider within the crypto/blockchain industry to achieve unicorn status.

7/ One of the dominant investment trends in 2020 was the influx of capital to decentralized finance (DeFi) applications. In Q3, the DeFi segment was the most popular category and accounted for roughly 20% of all venture deals. Deal flow took off in June and peaked in September.

8/ Roughly 17% of the total venture funding was invested in Crypto-like Brokerages & Custody providers. We spoke to more than 40 firms that operate across the digital asset infrastructure segment & a common theme expressed was the need for a "full prime services" offering.

9/ The state of digital asset infrastructure has never been more fragmented, with more than 115 firms offering services. Liquidity and services are split unevenly across various offerings around the globe, akin to the market structure for equities in the late 1990s & early 2000s

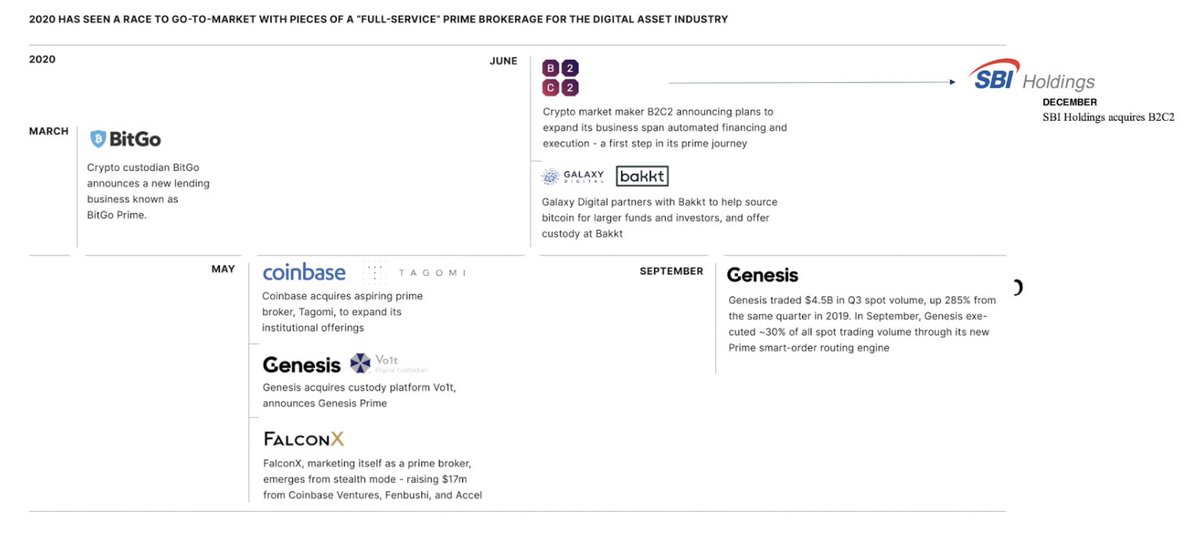

10/ Recognizing this fragmentation, In 2020, a handful of companies made strategic acquisitions or launched new business lines to build towards full prime offerings. Some of the larger events are highlighted below :

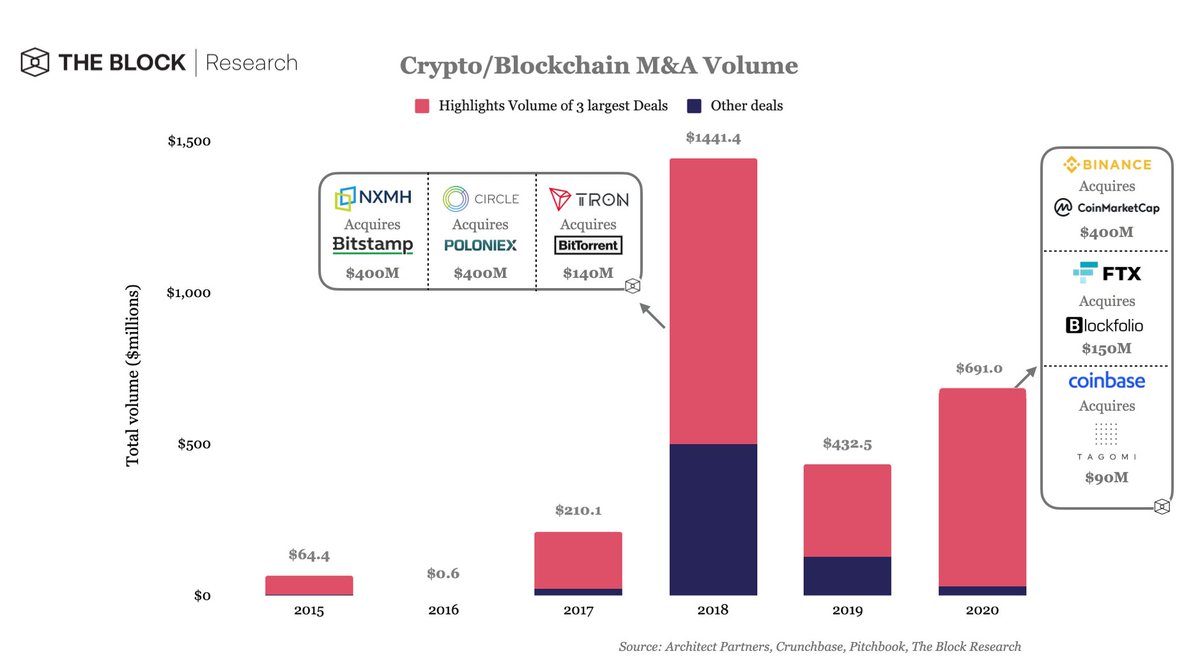

11/ M&A activity & corporate development are still in their infancy compared to traditional markets. However, 2020 recorded the most M&A transactions in the sector’s history. The 83 acquisitions that occurred topped the previous high set in 2018

12/ M&A activity this year had three top-ticket purchases that qualify as some of the largest ever within the sector. These transactions include Binance's acquisition of CoinMarketCap for $400m, FTX's acquisition of Blockfolio for $150m, & Coinbase's purchase of Tagomi for $90m.

13/ Historically, Crypto Trading Firms & Exchanges have seen the most consolidation and represent one-third of the 15 largest M&A deals. Other sub-sectors that have more than one appearance include Brokerage/Custody, Mining, and Software.

14/ We expect more involvement by traditional financial institutions and fintech companies like Paypal. Naturally, Brokerages & Custody firms that provide the infrastructure needed for mainstream companies to offer crypto services will be an area of interest.

15/ Firms such as PayPal will be tasked with either producing its crypto services and offerings in-house and through partnerships, or if it is better served acquiring a company in the space.

16/ An expected increase in regulatory and compliance mandates for the industry will make Data & Analytics companies more attractive. More consolidation within the sub-sector should be expected as firms compete to become the premier data provider.

17/ Branching from data & analytics, crypto tax software companies like TokenTax or Lukka, which analyze users' trading data & determine taxes owed, will be potential targets for exchanges, external players like Turbotax, or even brokerages that want to add to their product suite

18/ For consecutive years (since The Block began its active fund commentary), six of the 10 most active funds in 2019 were once again among the most active funds in 2020. These firms include Coinbase Ventures, DCG, Dragonfly Capital, NGC Ventures, Pantera Capital, and Polychain.

19/ In aggregate, of the 121 companies, the most active investors allocated toward, roughly 31% were DeFi-related.

20/ If you enjoyed this commentary, check out the full report below. Special thanks to @_RJTodd for not sleeping or showering these past couple of weeks to make sure all the sections were pieced together. theblockcrypto.com/post/88463/202…

• • •

Missing some Tweet in this thread? You can try to

force a refresh