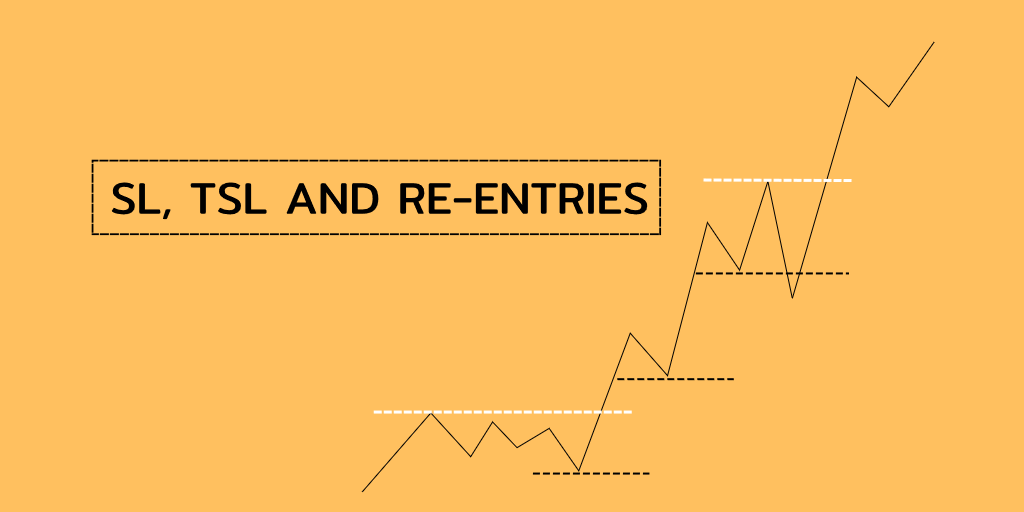

WHERE TO PUT THE SL-

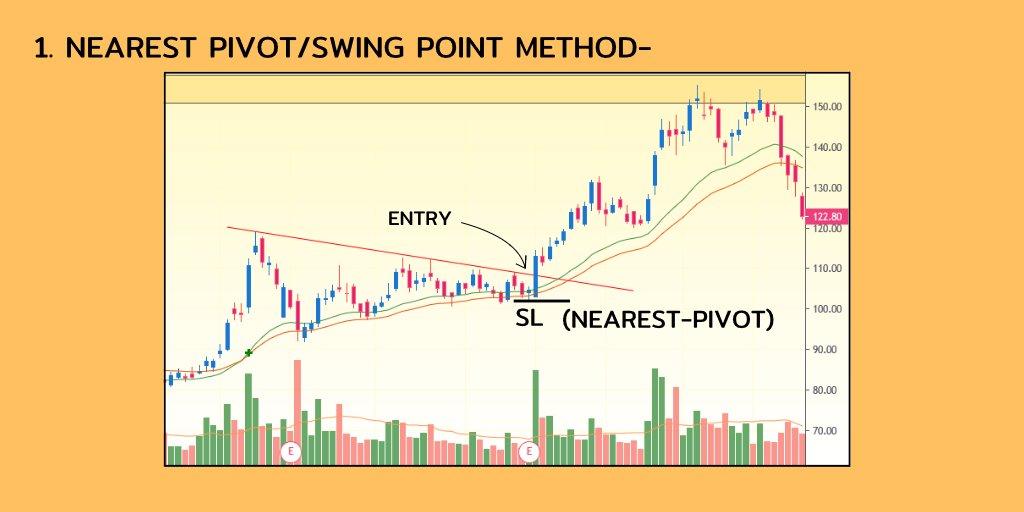

1. NEAREST PIVOT/SWING POINTS-

Normally I use this method for placing sl, In this method we use swing point for placing the SL.

As normally the stock would not try to go below previous swing point if it is to go in our direction.

1. NEAREST PIVOT/SWING POINTS-

Normally I use this method for placing sl, In this method we use swing point for placing the SL.

As normally the stock would not try to go below previous swing point if it is to go in our direction.

2. ATR method-

Sometimes the Stock do not have any nearest pivot at time of buy, So we use this method as it gives us a level on basis of current volatility of the stock.

I use 1.5 ATR away sl , say the ATR at point of entry is 30, so I place sl

1.5 X, or 45 rs away from entry

Sometimes the Stock do not have any nearest pivot at time of buy, So we use this method as it gives us a level on basis of current volatility of the stock.

I use 1.5 ATR away sl , say the ATR at point of entry is 30, so I place sl

1.5 X, or 45 rs away from entry

In below example the entry is 120, ATR=5, SL= 1.5X ATR= 7.5 OR 113.

Nearest pivot was too far away, that’s why this method is used in these cases.

Nearest pivot was too far away, that’s why this method is used in these cases.

4. Anchor candles-

Anchor bars are those which have extreme Volume, gaps or wide Ranges.

Here, we place our sl below those candles which has the above characteristics.

Anchor bars are those which have extreme Volume, gaps or wide Ranges.

Here, we place our sl below those candles which has the above characteristics.

In below example first we have a gap with high volume, and also a wide range candle both places can be used for placing sl.

In case of gap up , its better to wait for 2-3 candles for confirming.

In case of gap up , its better to wait for 2-3 candles for confirming.

2. TRAILING METHODS-

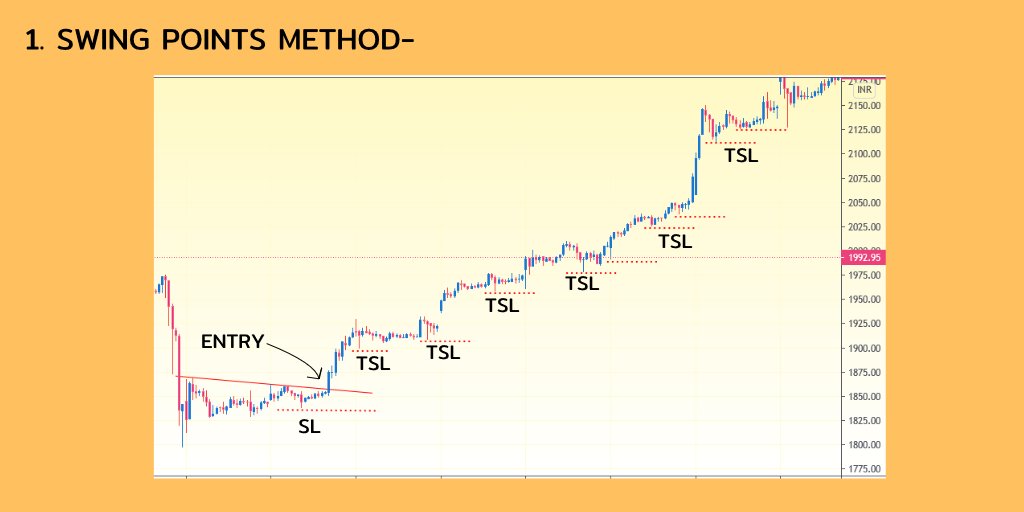

1. SWING POINT METHOD-

In this method we use the swing points or the HH- HL OR LH-LL points for placing sl,

In this method we trail our sl when the stock make a Higher low after our entry and keep Trailing the sl till it hits.

1. SWING POINT METHOD-

In this method we use the swing points or the HH- HL OR LH-LL points for placing sl,

In this method we trail our sl when the stock make a Higher low after our entry and keep Trailing the sl till it hits.

2. ATR TRAILING STOPS-

In this method we use the ATR trailing stop indicator, This method is good as it uses volatility to decide the stop levels.

In this method we use the ATR trailing stop indicator, This method is good as it uses volatility to decide the stop levels.

3. R-Based Trail sl-

In this method we increases sl when the instrument increases in our direction the equal amount as our sl.

Say we enter a stock at 500 with sl 490, if the stock moves to 510 we will Trail sl to 500, and so on, till our sl hit.

In this method we increases sl when the instrument increases in our direction the equal amount as our sl.

Say we enter a stock at 500 with sl 490, if the stock moves to 510 we will Trail sl to 500, and so on, till our sl hit.

In below chart entry was 120, sl 113.5 (check prev example), And we trail the sl when stock move 7.5 rs in our direction, and keep doing it till the TSL hit.

4. MOVING AVERAGES TRAIL METHOD-

In this method we Trail with help of moving averages,

Either we can exit when the 2 consecutive candles closes below the Moving average or we can exit when the moving averages gives crossover.

Ema used in this example are 21,33.

In this method we Trail with help of moving averages,

Either we can exit when the 2 consecutive candles closes below the Moving average or we can exit when the moving averages gives crossover.

Ema used in this example are 21,33.

* RE-ENTRIES-

What are re-entries?

When we are Trailing our sl in a stock , sometimes due to high volatility our stop-loss gets hit , but the trend is still intact even after that if the stock make a new high again.

So We again enter the stock if it make a New high .

What are re-entries?

When we are Trailing our sl in a stock , sometimes due to high volatility our stop-loss gets hit , but the trend is still intact even after that if the stock make a new high again.

So We again enter the stock if it make a New high .

In below example Our tsl got hit , but the stock didn’t make a lower low and break above the swing high.

For Re- entry sl can be decided according to either the swing point or use ATR or deciding sl.

I use the 1.5 ATR away sl for re-entry.

For Re- entry sl can be decided according to either the swing point or use ATR or deciding sl.

I use the 1.5 ATR away sl for re-entry.

Say ATR at point of re-entry is 6, SL will be 9 points away.

Some points to consider before re-entry which I prefer-

1. I don’t re-enter if I don’t have enough R on my side, atleast 2R should be in my pocket before the re-entry situation occurs.

Some points to consider before re-entry which I prefer-

1. I don’t re-enter if I don’t have enough R on my side, atleast 2R should be in my pocket before the re-entry situation occurs.

2. I only Re-enters with the initial qty and not the pyramidid qty.

Say at entry I have 1000 qty and at time of TSL hit I had 5000 qty because of pyramiding, and I get a signal for re-entry I only enter with 1000qty and build the qty again.

Say at entry I have 1000 qty and at time of TSL hit I had 5000 qty because of pyramiding, and I get a signal for re-entry I only enter with 1000qty and build the qty again.

These are only my opinions and not necessarily be yours.

Thanks for reading till here

Cheers,

TRADER KNIGHT

Thanks for reading till here

Cheers,

TRADER KNIGHT

• • •

Missing some Tweet in this thread? You can try to

force a refresh