A small thread on the power of compounding.

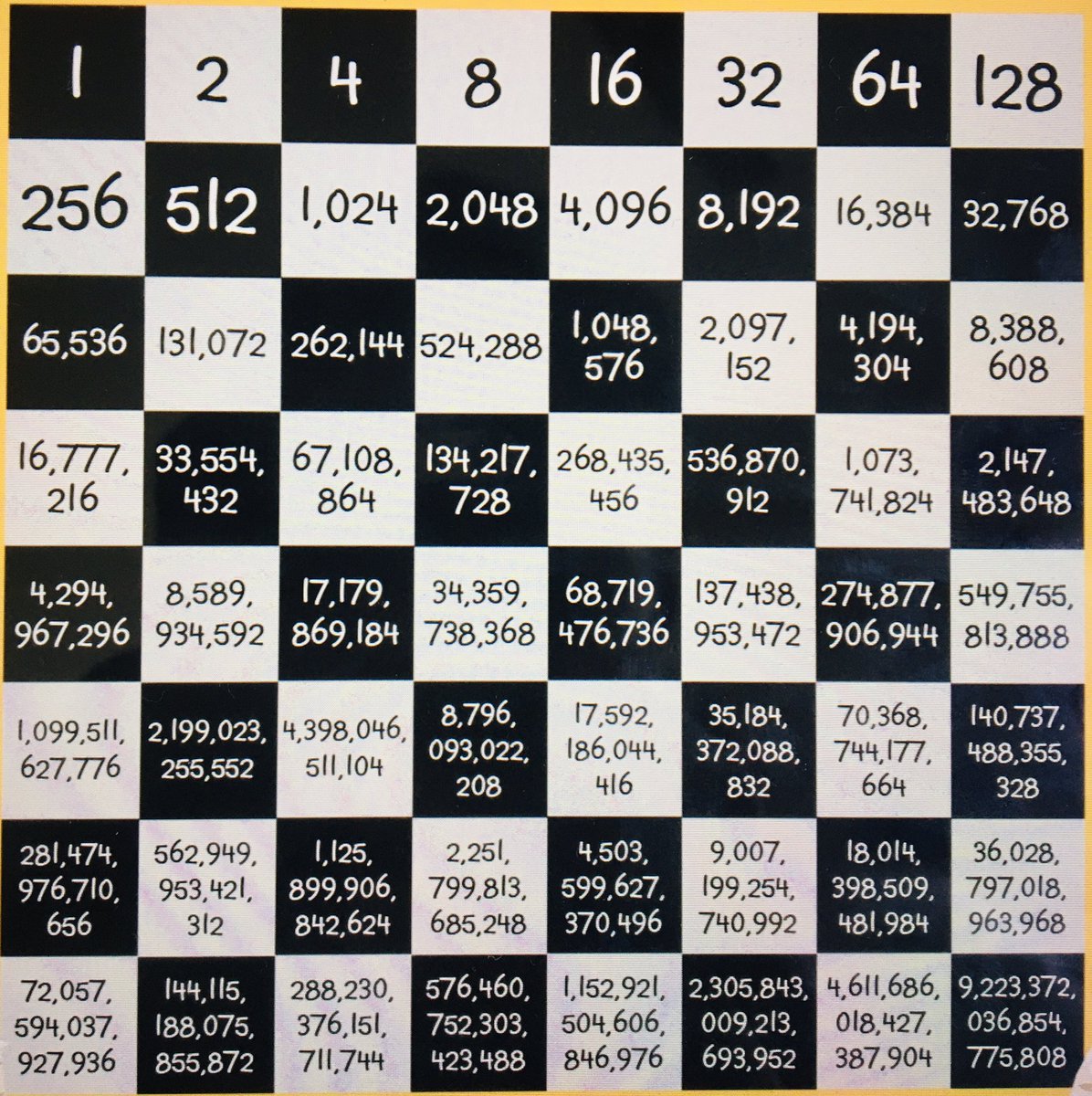

1. If you invested 1 ₹ in the 1st box and allowed it to compound let’s say in a simple bank account, by the time it’s in the 8th box you would have made 128 x your original 1₹ now apply this to sensex or Berkshire Hathaway.

1. If you invested 1 ₹ in the 1st box and allowed it to compound let’s say in a simple bank account, by the time it’s in the 8th box you would have made 128 x your original 1₹ now apply this to sensex or Berkshire Hathaway.

2. The time it takes to reach the boxes depends on the time taken to compound. If you put that 1₹ in bank account it takes 8-10 years to move to second box, but the same will take just 3 years if invested in Berkshire and around 6 years if if you invested in sensex.

3. Compounding applies to everything in life, I had 5 good friends in school and as we grew up those 5 knew 5 more and they knew 5 more and over a period of time there’s this big group of people I came to know just by the first 5 persons. So compounding happens in everyday life.

4. There’s this negative compounding like debt, bad relationships, bad habits etc which once not identified and stopped keeps compounding negatively. So the first thing to do is stop negative compounding and look for positive compounders.

5. The biggest mystery in compounding is the maximum part of the gains comes at the last compounding period ex : Assume you’re compounding at 15 % CAGR, which means every 5 years your money moves to second box or doubles. If you have 15 years to do this than in the first

Compounding period

1 = 2 in 5 years

2 = 4 in 10th year

4= 8 in 15 th year

Now from the above 50 % of your gains have come in the 15th year and if you would’ve stopped it in 10th year you would have lost 50 % of your net-worth. So the trick is time and patience.

1 = 2 in 5 years

2 = 4 in 10th year

4= 8 in 15 th year

Now from the above 50 % of your gains have come in the 15th year and if you would’ve stopped it in 10th year you would have lost 50 % of your net-worth. So the trick is time and patience.

6.I owned a piece of land bought in 2012 and now sold it at 3 x gains realizing a gain of 15 % CAGR. So compounding happens in all sorts of monetary investments like gold, land, equity and also intangibles like human relationships and karma

Happy compounding #caprichinvestments

Happy compounding #caprichinvestments

7. Time is the friend of a good business and the enemy of a bad one - Warren Buffett

This is so true, to realize your compounding effect always focus on good businesses which keeps growing, investing in bad compounders will jeopardize the compounding effect and kill returns.

This is so true, to realize your compounding effect always focus on good businesses which keeps growing, investing in bad compounders will jeopardize the compounding effect and kill returns.

8. The right kind of knowledge compounds ex : Before investing I got thorough understanding of the basics which gave a strong foundation. Know the basics very well will compounds over time.

Munger says -More basic knowledge you have less new knowledge you require

Munger says -More basic knowledge you have less new knowledge you require

Happy compounding and wish you all a happy and a prosperous new year

#caprichinvestments #2021 #compunding

#caprichinvestments #2021 #compunding

• • •

Missing some Tweet in this thread? You can try to

force a refresh