SEBI RA INH200005832|Eq advisory & research|Specialize in identifying Franchisee biz | Cash Flows | Risk Management | DM for Subscriptions

How to get URL link on X (Twitter) App

Once the ranges are in green we start to buy without second thoughts until I feel comfortable and as long as it’s available within that range. It’s a very disciplined process.

Once the ranges are in green we start to buy without second thoughts until I feel comfortable and as long as it’s available within that range. It’s a very disciplined process.

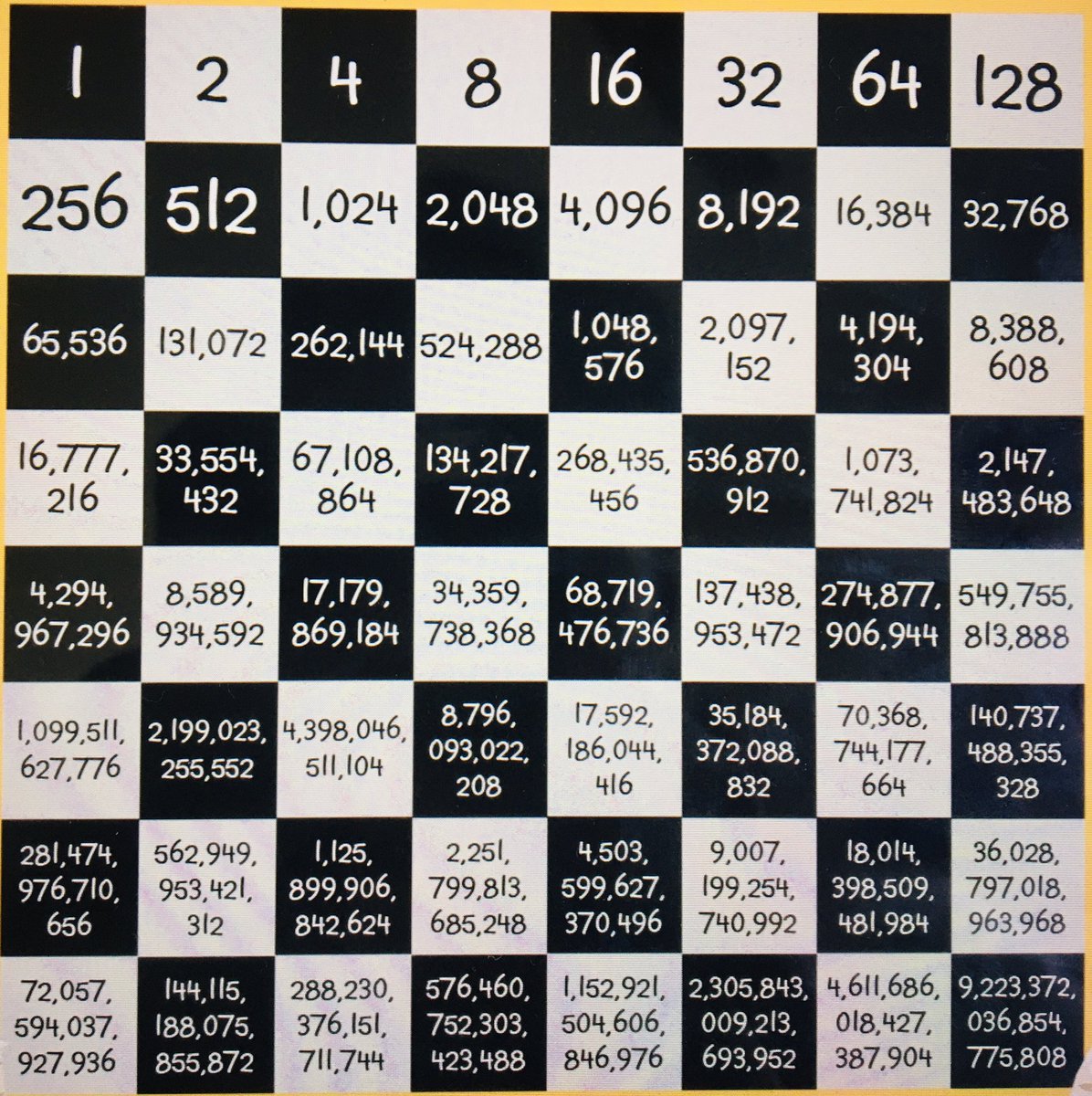

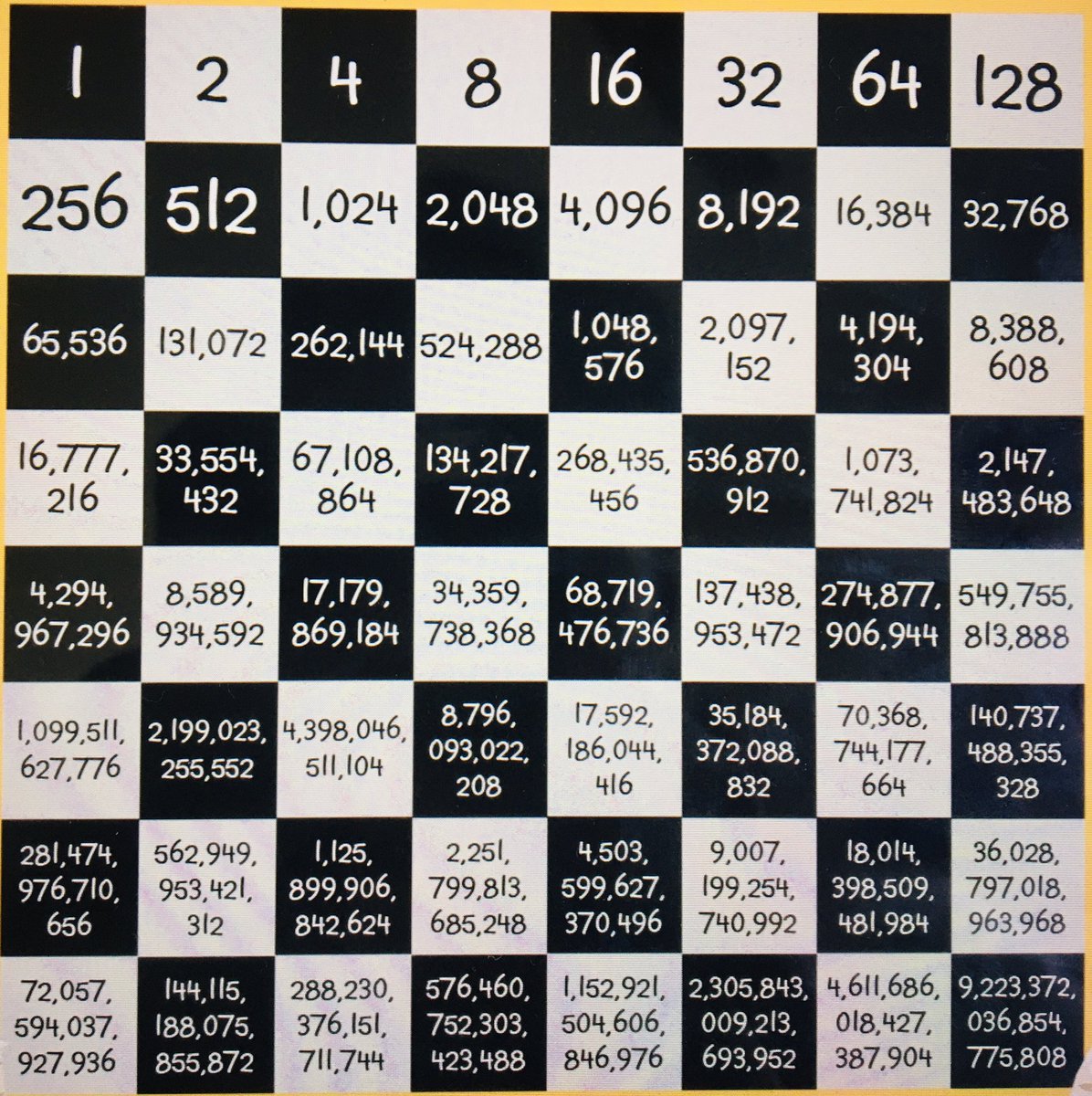

2. The time it takes to reach the boxes depends on the time taken to compound. If you put that 1₹ in bank account it takes 8-10 years to move to second box, but the same will take just 3 years if invested in Berkshire and around 6 years if if you invested in sensex.

2. The time it takes to reach the boxes depends on the time taken to compound. If you put that 1₹ in bank account it takes 8-10 years to move to second box, but the same will take just 3 years if invested in Berkshire and around 6 years if if you invested in sensex.