7 Investments I'm Making This Year (Part Two)

The second day in a week long series where I show you places I am personally focusing my time, energy, and money in 2021.

Feel free to repurpose any ideas and use them for yourself.

The second day in a week long series where I show you places I am personally focusing my time, energy, and money in 2021.

Feel free to repurpose any ideas and use them for yourself.

Investment Two: Internationally Diversified Stocks

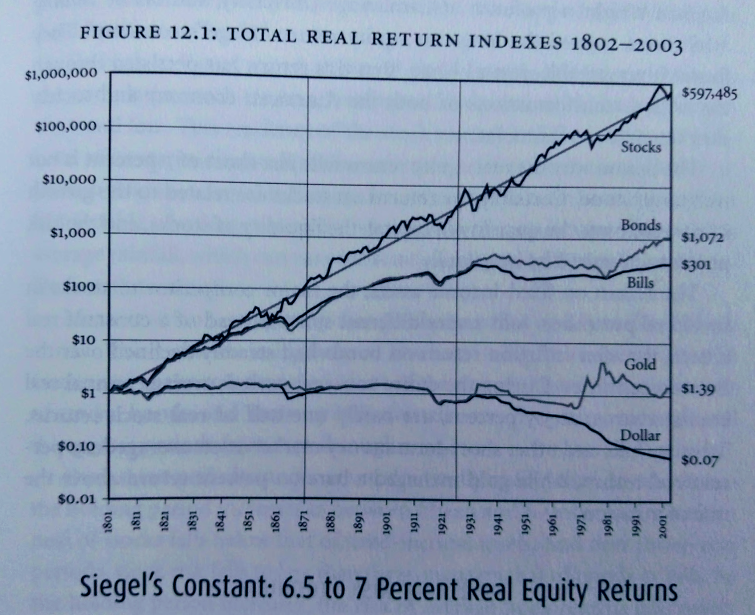

Buying and holding quality assets is one of the easiest ways to build wealth long-term. Stocks gain value while the dollar loses it.

Here's a graph from Jeremy Siegel's "The Future For Investors."

Buying and holding quality assets is one of the easiest ways to build wealth long-term. Stocks gain value while the dollar loses it.

Here's a graph from Jeremy Siegel's "The Future For Investors."

This is why people who never invest in anything are eventually priced out of life, while people who make one or two MODERATELY INTELLIGENT investments can create generational wealth.

There are families who built their generational wealth off Grandpa buying rental properties in 1960's California, or throwing his extra income into Colgate stock.

Think about that.

Think about that.

Since there is a lot of talk about the US Dollar declining further, I'm trying to pick out international investments that benefit from a weak dollar and strong foreign currency.

Some companies on my radar are pretty well known (Nestle) but I also wanted to mention a few businesses that many people might not have heard of.

Obviously this is not investment advice.

Obviously this is not investment advice.

One business is Industrias Bachoco.

This is a Mexican poultry producer, and you'll see their pink or green cartons in every supermarket across the country.

This is a Mexican poultry producer, and you'll see their pink or green cartons in every supermarket across the country.

Mexico was already in a recession before Coronavirus hit, and the country isn't popular with international investors like China or India are.

As such, you've got an established business in an unpopular country, with a local currency that's already beaten down.

It's like the reverse Luckin Coffee.

It's like the reverse Luckin Coffee.

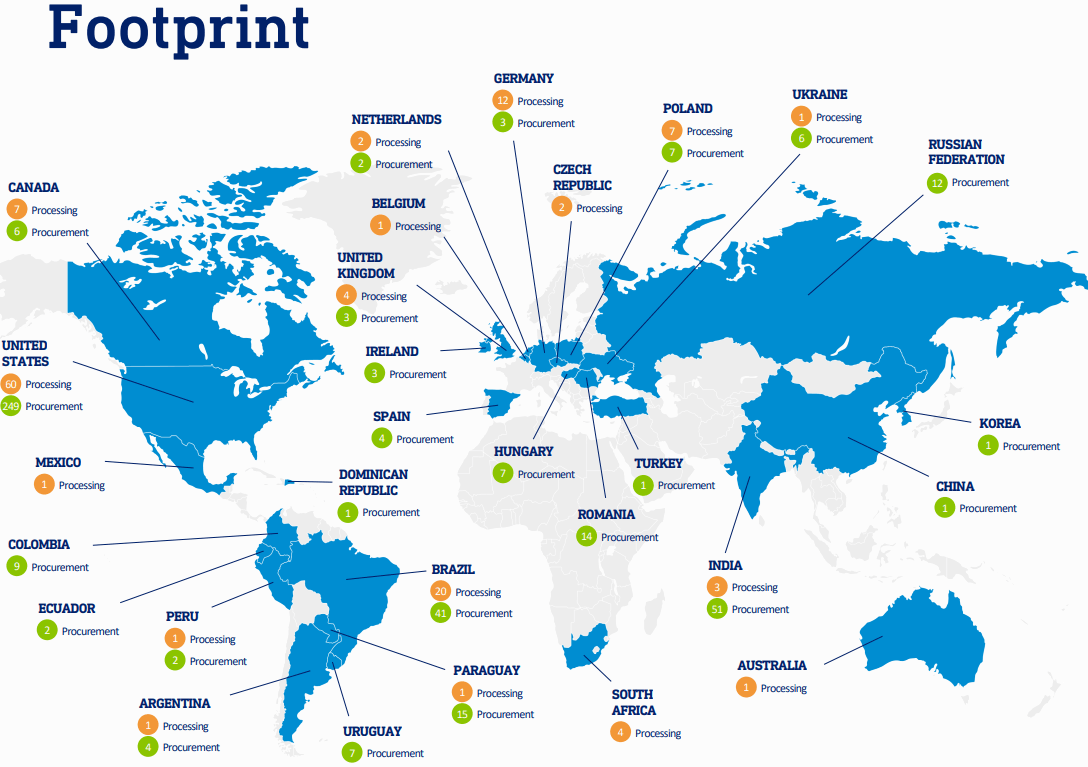

Another stock that benefits from global exposure is Archer-Daniels-Midland.

This is a huge, international agricultural commodity business that processes grains like corn and wheat.

This is a huge, international agricultural commodity business that processes grains like corn and wheat.

One interesting aspect of the grain industry is how little the general public knows about it.

Unlike other commodities (such as oil or mining), there's no widespread backlash against agriculture.

Unlike other commodities (such as oil or mining), there's no widespread backlash against agriculture.

On top of this, ADM stock is never popular with Wall Street, allowing you to buy-in at a low P/E ratio.

In fact, the current forward P/E is under 15, while other big global conglomerate stalwarts (3M and Coca-Cola) hover between 20 - 30.

In fact, the current forward P/E is under 15, while other big global conglomerate stalwarts (3M and Coca-Cola) hover between 20 - 30.

So, you've got a boring, dependable business that's essential for society. And you're able to invest at a reasonable valuation.

Lastly, if you want to make some money off overvalued stocks, try selling puts.

I have a whole thread on this already:

But in 2021 I'll also be selling cash secured puts against broad market ETFs.

I have a whole thread on this already:

https://twitter.com/XDays/status/1337759232922411008

But in 2021 I'll also be selling cash secured puts against broad market ETFs.

As this thread indicates, I'm not particularly interested in buying growth companies or speculating on penny stocks.

It's great to see people tripling their money on SPACs (literal shell companies that are hoping to aquire a business), but I don't know how long this can last.

It's great to see people tripling their money on SPACs (literal shell companies that are hoping to aquire a business), but I don't know how long this can last.

Personally, I'm happy buying and holding reasonably priced and functional companies that people depend on.

It's unclear if people will still use Pinterest or Zoom in 10 years. But wagering that they'll eat food is a pretty safe bet.

It's unclear if people will still use Pinterest or Zoom in 10 years. But wagering that they'll eat food is a pretty safe bet.

• • •

Missing some Tweet in this thread? You can try to

force a refresh