2021: It's All About Central Banks And Liquidity

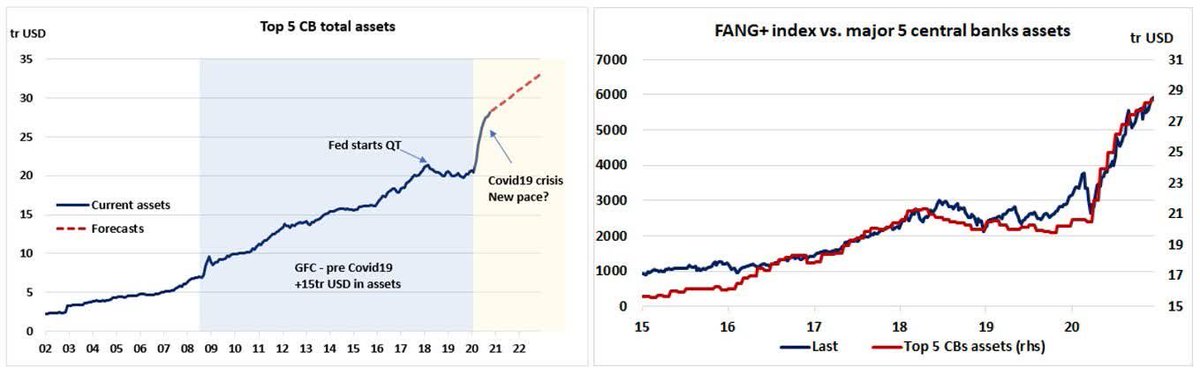

Despite valuations looking "stretched" and sentiment indicators trading at extreme levels, liquidity injections from major central banks could be enough to generate new highs in markets..

Despite valuations looking "stretched" and sentiment indicators trading at extreme levels, liquidity injections from major central banks could be enough to generate new highs in markets..

@GoldmanSachs expects another 2 to 3 trillion USD of liquidity to reach markets in 2021, and sees an S&P 500 at 4,300 by December 2021

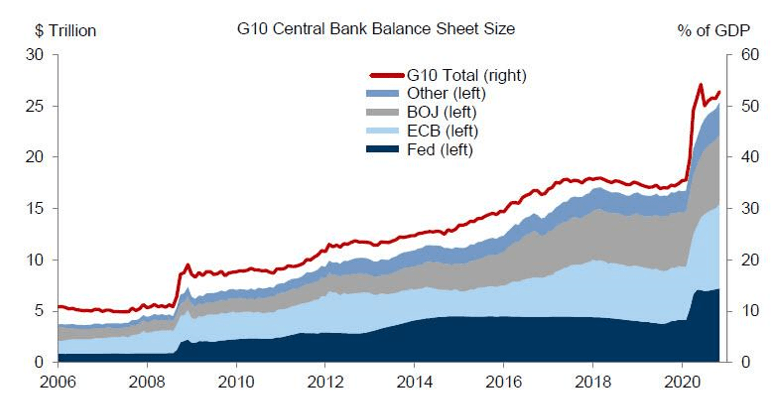

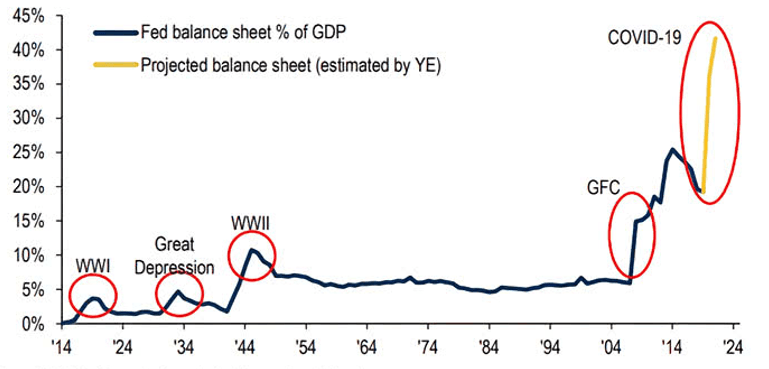

@BankofAmerica estimated that the World world generated a 22 trillion USD stimulus (combined fiscal and monetary) in 2020, nearly a quarter of global GDP. Fed's balance sheet reached 40% of US GDP, its highest level since Fed inception in December 1913

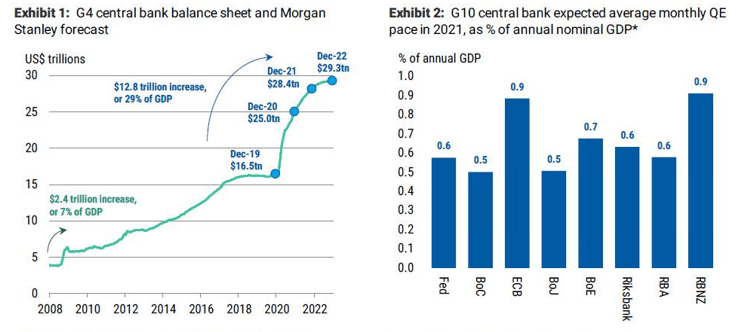

@MorganStanley expects another 3.4 trillion USD to reach markets in 2021 and therefore projects another 10% increase in US equities, which would levitate the S&P 500 up to 4,070 by year-end 2021.

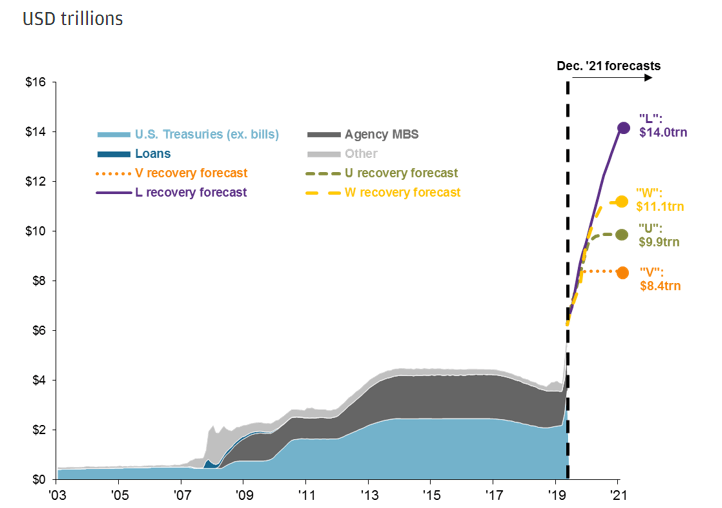

@jpmorgan estimated that the worst outcome - L-shape 'recovery' - could raise the Fed assets up to 14tr USD by the end of 2021

Most likely scenario sits between a U and V-shape recovery, implying another 1 to 2tr USD of liquidity this year

Base case S&P 500 price target of 4,400

Most likely scenario sits between a U and V-shape recovery, implying another 1 to 2tr USD of liquidity this year

Base case S&P 500 price target of 4,400

Despite their 'overbought' status, we still think that US equities have another year ahead of them and that the S&P 500 is likely to break through its psychological resistance of 4,000 within the next three to six months with a peak probably priced for early 2022

• • •

Missing some Tweet in this thread? You can try to

force a refresh