There is a perception that Buffett spends his days at the desk, eating candy, reading annual reports at a pace of 500 pages per minute. Sometimes he gets a call for a great deal. Maybe that's the case today. But to get here, Buffett was proactive, networked, traveled a ton.

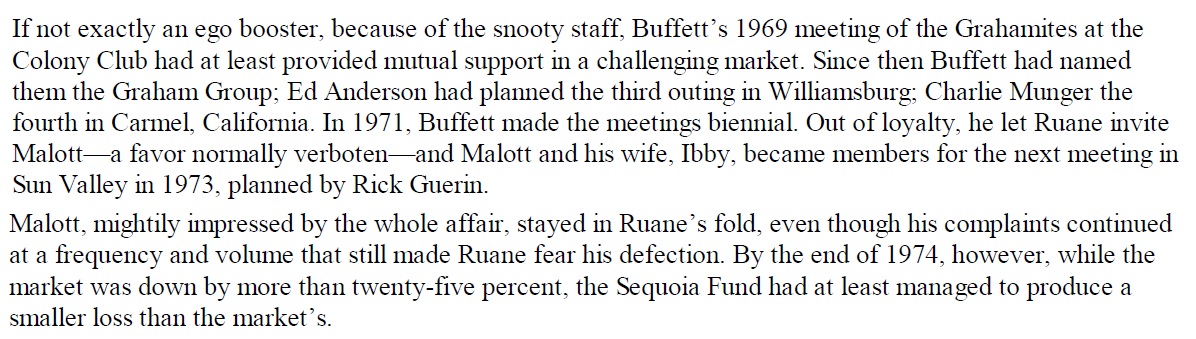

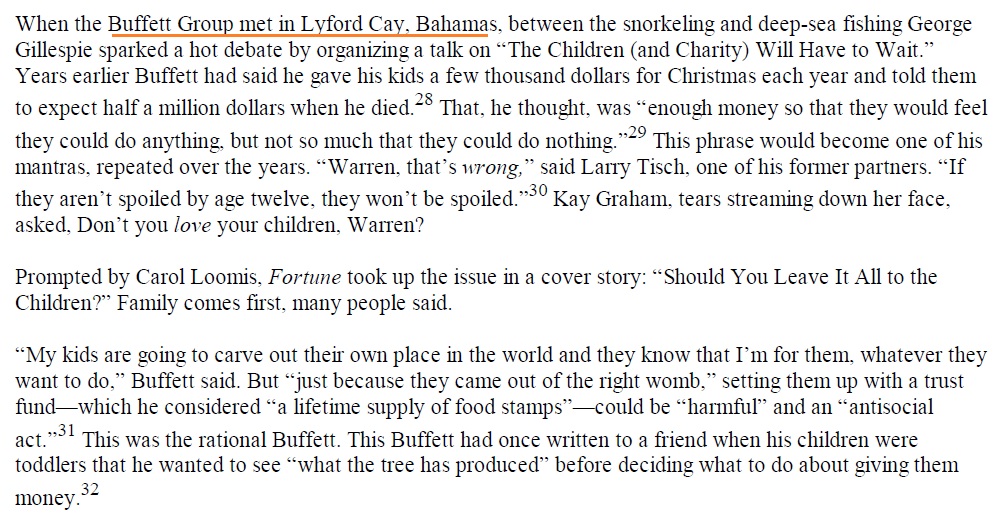

For example, the biennial meeting that started as the Graham Group and became the Buffett Group. They met all over the country, sometimes in Europe. Today he might be at events like Sun Valley. But early on he cultivated and maintained his tribe.

He found ways that work for him: small group setting vs. formal dinners. Playing bridge. Intellectually stimulating talks. But he traveled.

What about GEICO? You think he got all the answers from a 10-K?

He went to DC. He persisted until he could talk to someone. He charmed that person. Then he learned the "secret" of GEICO.

"He didn't go to lunch that day. He just sat there and talked to me for hours." (Snowball)

He went to DC. He persisted until he could talk to someone. He charmed that person. Then he learned the "secret" of GEICO.

"He didn't go to lunch that day. He just sat there and talked to me for hours." (Snowball)

He used third parties for diligence, for scuttlebutt research. Like Henry Brandt.

"The two men shared an interest in knowing the minutest details about a company"

Blue Chip Stamps owned Pinkerton's, the detective agency. Buffett was on the board. I wonder if he ever used them?

"The two men shared an interest in knowing the minutest details about a company"

Blue Chip Stamps owned Pinkerton's, the detective agency. Buffett was on the board. I wonder if he ever used them?

I think I read once that Buffett sent people to attend annual meetings on his behalf. Has anyone read/heard about that and has a source? Might be wrong on this one.

Anyway, feel free to point out other specific practices of his that go against the "read many annual reports and don't use a computer" cliche.

• • •

Missing some Tweet in this thread? You can try to

force a refresh