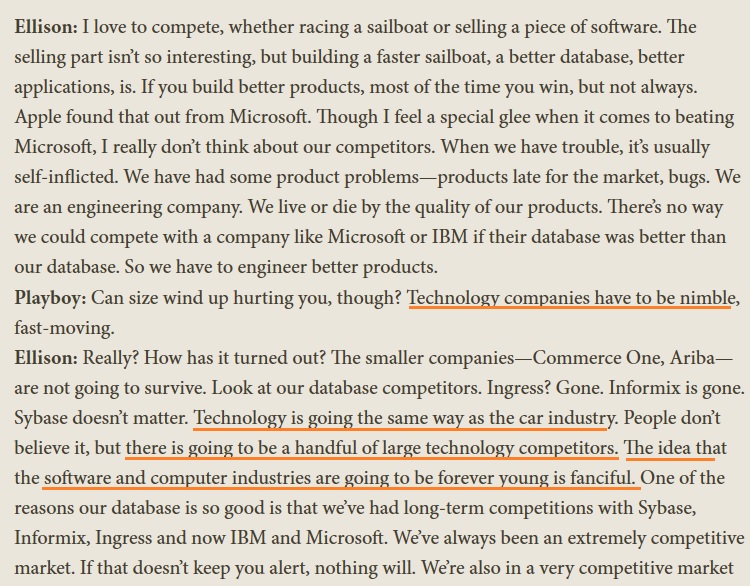

Quote from this podcast reminded me of a Soros story:

"When stuff gets completely crazy, it's very important to simplify everything as much as possible. The more complexity you have, the more anchoring risk you have. The harder it's going to be to pivot."

"When stuff gets completely crazy, it's very important to simplify everything as much as possible. The more complexity you have, the more anchoring risk you have. The harder it's going to be to pivot."

https://twitter.com/NeckarValue/status/1332672327839068163

Soros headed into the 1987 crash long US stocks and short the Japanese bubble.

"It is difficult to see how the Japanese land and stock market boom can continue. A bust is looming."

Yet in the week of the crash, both his longs and shorts went against him.

"It is difficult to see how the Japanese land and stock market boom can continue. A bust is looming."

Yet in the week of the crash, both his longs and shorts went against him.

Wednesday after Black Monday, Soros added to his longs. But that night, the Nikkei jumped (Druckenmiller later said "authorities intervened")

Thursday morning, US futures weakened. Soros was leveraged and in a bad spot. What if US stocks renewed their decline while Japan held up?

Thursday morning, US futures weakened. Soros was leveraged and in a bad spot. What if US stocks renewed their decline while Japan held up?

I think one of the key quotes to understand Soros is: "I learned the art of survival from a grand master."

(His father; surviving both a Siberian POW camp and Nazi occupation)

(His father; surviving both a Siberian POW camp and Nazi occupation)

Soros dumped his position. He told the trader: "I'm going to walk out of here, they're not going to carry me out."

His massive trade drove the price down: "The offer went from 230 down to 220 to 215 to 205 to 200. The Soros block sold from 195 to 210."

His massive trade drove the price down: "The offer went from 230 down to 220 to 215 to 205 to 200. The Soros block sold from 195 to 210."

Markets rebounded, Soros looked foolish for blowing out of his position, and there was much schadenfreude.

Barron's called it: "A Bad Two Weeks: A Wall Street Star Loses $840 million"

Barron's called it: "A Bad Two Weeks: A Wall Street Star Loses $840 million"

Soros was ok looking foolish to survive.

And he was able to move on without being shell-shocked.

Druckenmiller: "He knows all he has to do is stay in the game and his talents will come back. For the threat of looking silly, he's not going to jeopardize the fund."

And he was able to move on without being shell-shocked.

Druckenmiller: "He knows all he has to do is stay in the game and his talents will come back. For the threat of looking silly, he's not going to jeopardize the fund."

Druckenmiller: "Just about every manager I knew who was caught in the crash became almost comatose afterwards. George took a bigger hit than any of them. Within 2 weeks, he put on a massive leveraged dollar position."

Soros ended '87 up 13% despite being in the red in October.

Soros ended '87 up 13% despite being in the red in October.

• • •

Missing some Tweet in this thread? You can try to

force a refresh