One of my favorite stocks for 2021 is Exact Sciences $EXAS.

1) Here's a quick look under the hood:

👇👇👇

#Investing #StockMarket #stockpicks2021

1) Here's a quick look under the hood:

👇👇👇

#Investing #StockMarket #stockpicks2021

2) ➡️Listing: NASDAQ

➡️Segment: Cancer diagnostics, Colon Cancer focus

➡️Mkt Cap: $20B

➡️Segment: Cancer diagnostics, Colon Cancer focus

➡️Mkt Cap: $20B

3) Elevator pitch: ‘Colon cancer no.2 cause of death in USA – 53,200 in 2020. ‘Cologuard’ allows early screening (noninvasive) to identify & treat before cancer becomes a problem for those 45+ (94% detection rate). Cheaper/easier to administer than the alternative (colonoscopy)'.

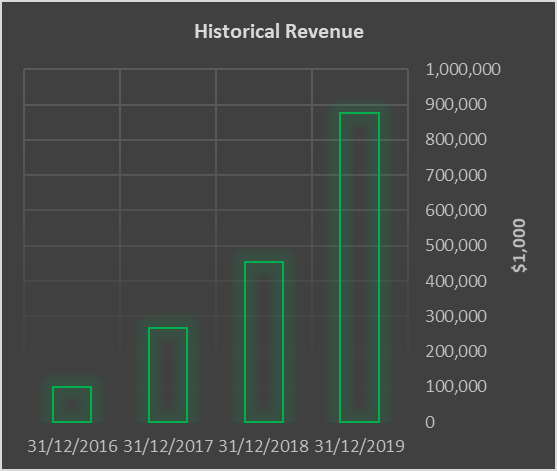

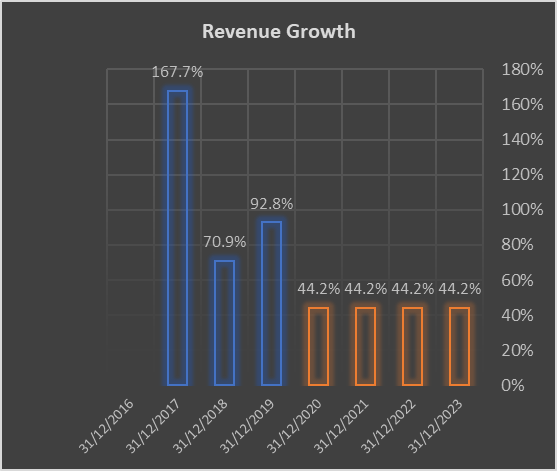

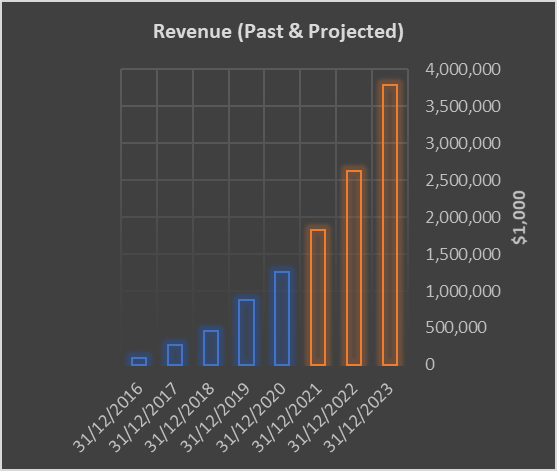

4) Revenues: EXAS Revenue grew at 110% average per annum from 2016 - 2019.

Taking a conservative future growth rate (44% year on year, immature market), it’s reasonable to expect EXAS to reach $3.8B in revenue by 2023 end 📈:

Taking a conservative future growth rate (44% year on year, immature market), it’s reasonable to expect EXAS to reach $3.8B in revenue by 2023 end 📈:

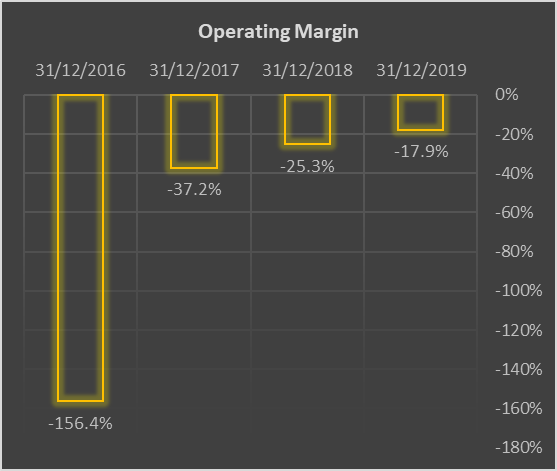

5) Margins & Profitability: EXAS offers an impressive (and improving) Gross Margin of 75.4%✅.

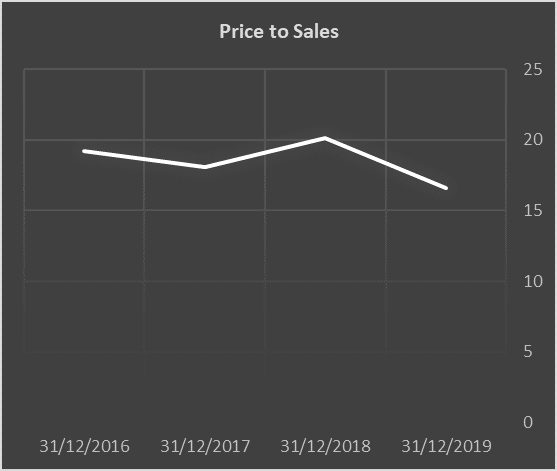

Per all good growth companies, Operating Margin is showing significant improvement suggesting profitability is not too far away, while P/S is very reasonable 👇👇👇

Per all good growth companies, Operating Margin is showing significant improvement suggesting profitability is not too far away, while P/S is very reasonable 👇👇👇

6) Share Price: EXAS SP action has a volatile history. High valuations were the norm during the past 5 years (P/S of 550 in 2014!).

In 2020, SP was +50% YOY and +126% from the March low. Continued ‘higher lows’ observed in Q4, supported by blowout earnings reported in Q3 🔥:

In 2020, SP was +50% YOY and +126% from the March low. Continued ‘higher lows’ observed in Q4, supported by blowout earnings reported in Q3 🔥:

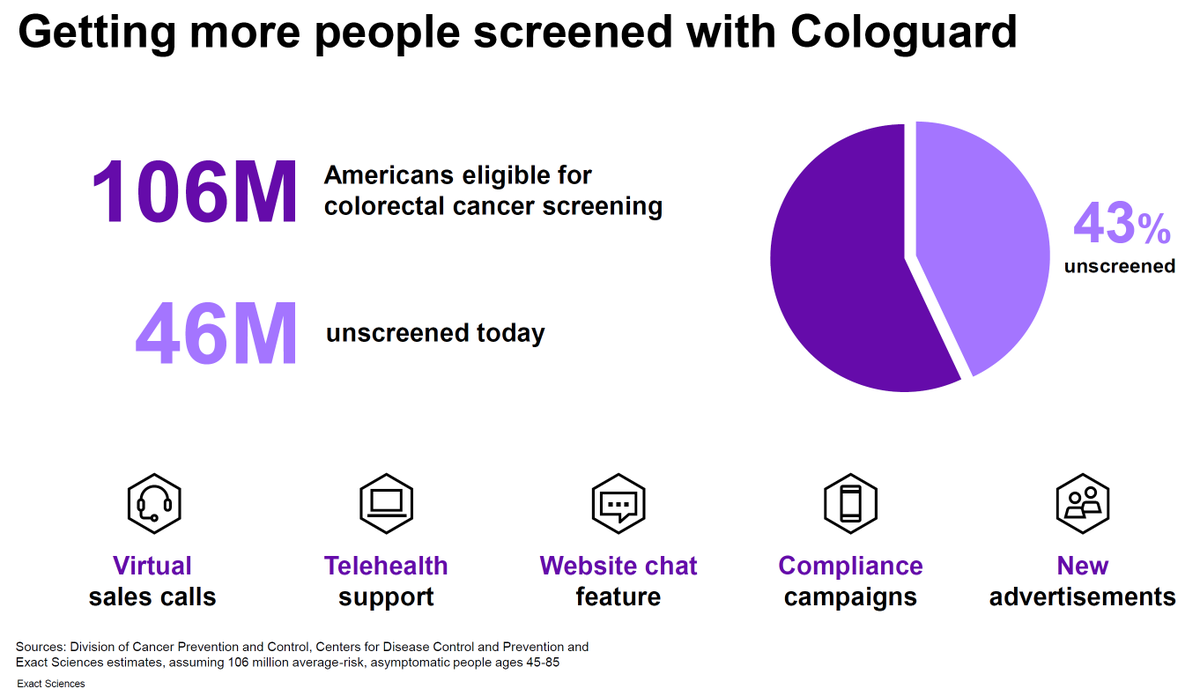

7) Runway 🛫: Potential addressable market is big, giving the company a long runway.

Adoption of non-invasive screening is early and the company continues to diversify into other screening areas to include blood-based assessment for prostate and breast cancers.

Adoption of non-invasive screening is early and the company continues to diversify into other screening areas to include blood-based assessment for prostate and breast cancers.

8) Runway Cont'd: Obvious synergies with Telehealth exist given this is a ‘from home’ service.

For the core product, there are 46M Americans unscreened today, giving plenty of scope for top line growth and market share gain:

For the core product, there are 46M Americans unscreened today, giving plenty of scope for top line growth and market share gain:

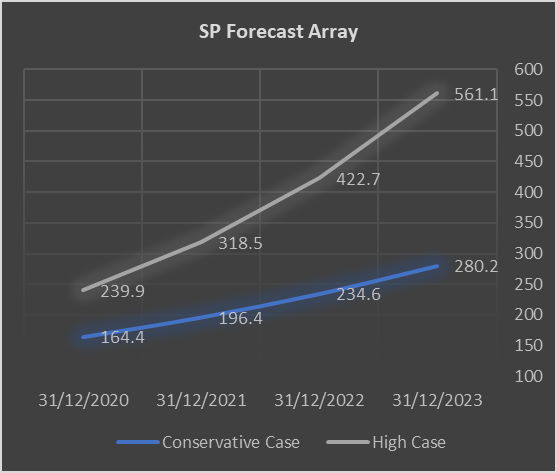

9) Prediction: With a reasonable margin of safety (50% of historical Revenue growth rate, share dilution and P/S values):

⭐️Target of $280 per share at 2023 end is reasonable

(+111% on today’s price of $132.5)

⭐️Target of $280 per share at 2023 end is reasonable

(+111% on today’s price of $132.5)

10) Prediction cont'd: Should revenues match actual historical performance (high case):

⭐️Target of $561 per share at 2023 end is reasonable. (+324% on today’s price of $132.5)

⬇️⬇️⬇️

⭐️Target of $561 per share at 2023 end is reasonable. (+324% on today’s price of $132.5)

⬇️⬇️⬇️

11) Conclusion: Net buyer of EXAS at current price levels.

Current cost basis $120 per share, 4.9% of my portfolio.

EXAS should flourish/continue to disrupt traditional cancer screening market, particularly if/when the Covid 19 pandemic eases.

Current cost basis $120 per share, 4.9% of my portfolio.

EXAS should flourish/continue to disrupt traditional cancer screening market, particularly if/when the Covid 19 pandemic eases.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh