1/ In yesterday's note, I covered the DeFi <> NFT symbiosis and explored how the two are mutually beneficial.

The 2020 DeFi summer drove gas fees to intolerable levels for many NFT activities. Whilst it seemed like a curse, it may have been a blessing...

delphidigital.io/reports/the-de…

The 2020 DeFi summer drove gas fees to intolerable levels for many NFT activities. Whilst it seemed like a curse, it may have been a blessing...

delphidigital.io/reports/the-de…

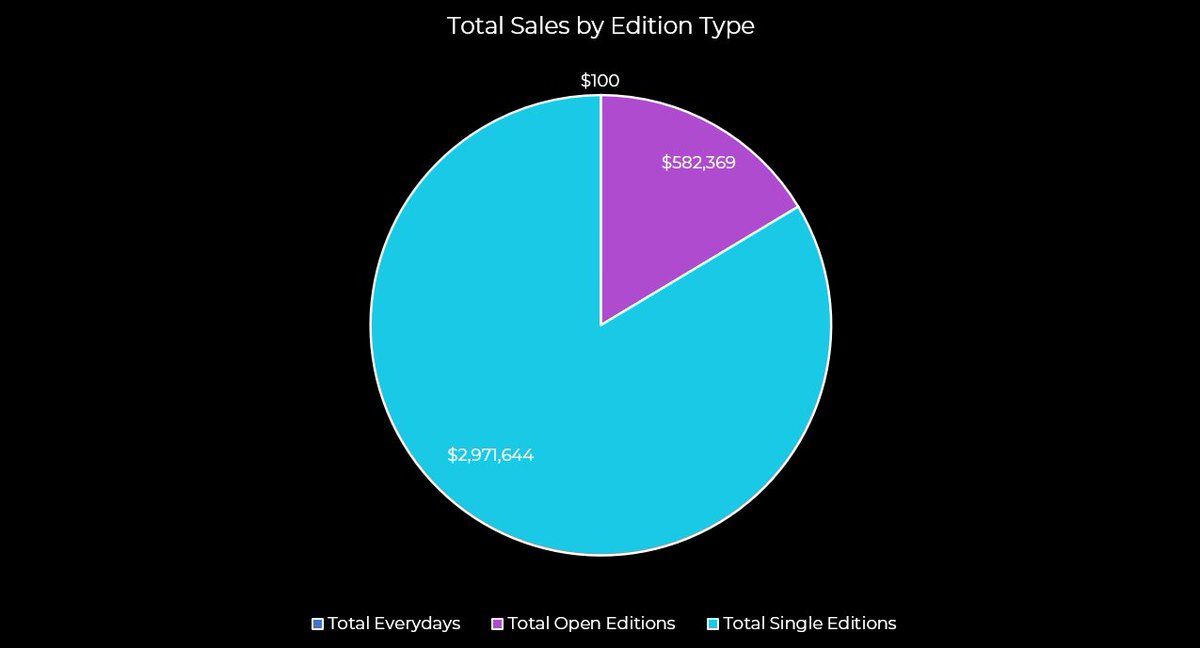

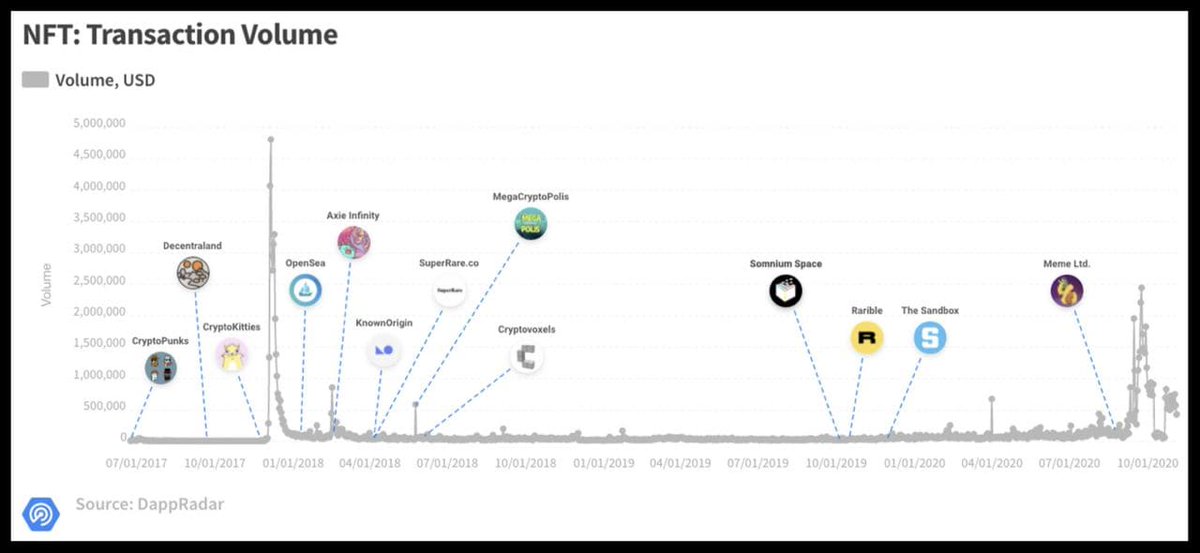

2/ Some may argue that residual liquidity from a frothy market is what affored NFTs their moment in the sun.

The end of the DeFi boomed coincided with the highest volumes the NFT space had seen since 2017, before ending the year explosively with historic crypto art sales.

The end of the DeFi boomed coincided with the highest volumes the NFT space had seen since 2017, before ending the year explosively with historic crypto art sales.

3/ Early experiments showed a clear synergy between the two.

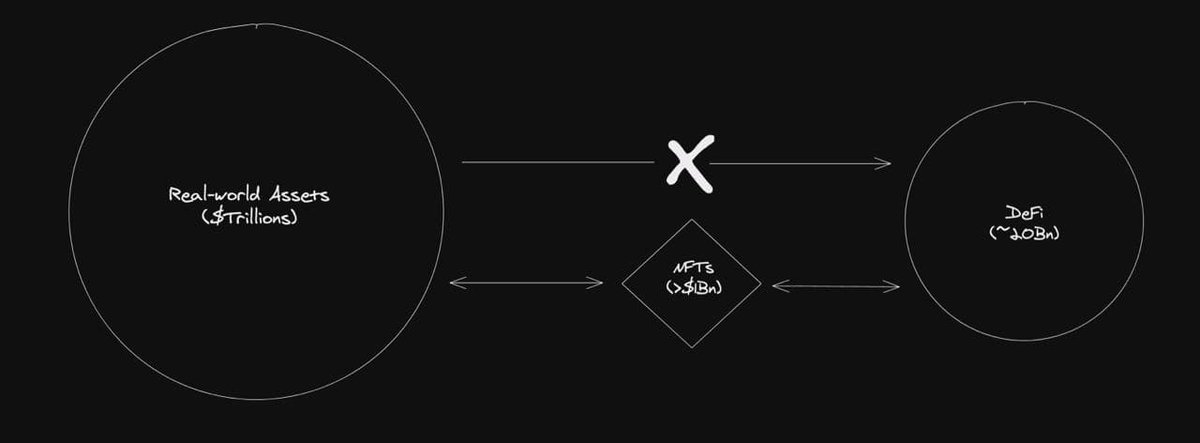

On the one hand, DeFi can provide a dramatic expansion of utility, functionality, and access to more complex financial infrastructure through fractionalization for the NFT ecosystem.

On the one hand, DeFi can provide a dramatic expansion of utility, functionality, and access to more complex financial infrastructure through fractionalization for the NFT ecosystem.

4/ And on the other, NFTs provide DeFi with an expansion of the universe of collateral, and may ultimately prove to be the primary mechanism through which real-world assets can enter this new land.

Successful implementations will undoubtedly serve as additional DeFi propellant.

Successful implementations will undoubtedly serve as additional DeFi propellant.

5/ Aside from that exciting prospect, NFTs can also be used to represent financial products in an intuitive way. We have already seen this with yInsure, but it’s my view that this will extend well beyond insurance into options, bonds, and other more complex financial products.

6/ One of the major frictions for integrating NFTs with traditional lending protocols is the lack of reliable pricing data. Whereas in DeFi oracles can be used, no such thing exists for NFTs.

As a result, most NFT-collateralized loan activity happens in a P2P fashion.

As a result, most NFT-collateralized loan activity happens in a P2P fashion.

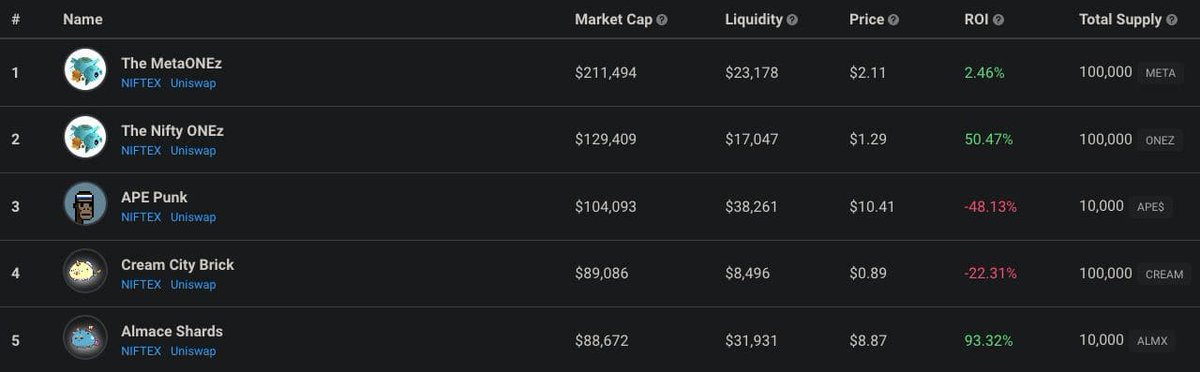

7/ With the rise of individual NFT fractionalization @NIFTEXdotcom as well as indexing through projects like @NFTX_, this is changing.

8/ As we see NFTs make their way into DeFi, concepts native to the latter are beginning to seep back into the NFT space too.

Governance tokens like $RARI, to “NFT mining” @DontBuyMeme, to the emergence of “voting NFTs” @mintable_app.

Governance tokens like $RARI, to “NFT mining” @DontBuyMeme, to the emergence of “voting NFTs” @mintable_app.

9/ I covered @aavegotchi's interesting approach in another Daily last summer, but other projects like @DefiNft (actually predates Aavegotchi!) are evolving nicely.

delphidigital.io/reports/ghst-c…

delphidigital.io/reports/ghst-c…

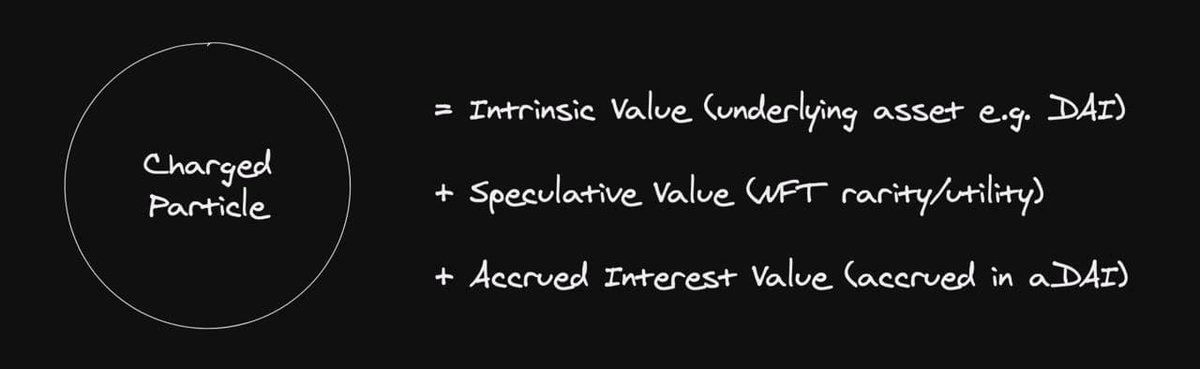

10/ Charged Particles allows you to bind interest-bearing assets such as aDAI with any NFT.

As that NFT earns yield, its “charge” increases. That charge can be compounded, programmed so that some heads elsewhere, or “discharged” by a future owner who can claim accrued interest.

As that NFT earns yield, its “charge” increases. That charge can be compounded, programmed so that some heads elsewhere, or “discharged” by a future owner who can claim accrued interest.

11/ Their documents allude to a hypothetical gaming use case in which we can imagine that an NFT represents a sword, whose power is dependent on its charge.

Not only might the original sword NFT be costly to acquire, but so is the time that was sunk into gaining that charge.

Not only might the original sword NFT be costly to acquire, but so is the time that was sunk into gaining that charge.

12/ Interestingly, these elements could actually be used to combat “pay to win” environments.

By having to charge (even cheap) items over time, early adopters could actually wield greater power than latecomers no matter how deep their pockets.

By having to charge (even cheap) items over time, early adopters could actually wield greater power than latecomers no matter how deep their pockets.

13/ As we head into 2021, I am confident we are going to see significantly more experimentation at the intersection of these two sectors.

Obviously the relative sizes of both sectors are far from alignment, NFTs are fighting the uphill battle in terms of both users and size.

Obviously the relative sizes of both sectors are far from alignment, NFTs are fighting the uphill battle in terms of both users and size.

14/ That being said, NFTs potentially have a broader retail appeal that could draw new entrants into the space through actual products and experiences faster than DeFi.

Content is much more intuitively understood by most whether it’s a video game, art, music, or writing

Content is much more intuitively understood by most whether it’s a video game, art, music, or writing

15/ Crypto Art has already demonstrated just how infectious this can be across creative spaces.

delphidigital.io/reports/crypto…

In time, as models are tested, both DeFi and NFTs should eventually harmonize and become mutually beneficial.

delphidigital.io/reports/crypto…

In time, as models are tested, both DeFi and NFTs should eventually harmonize and become mutually beneficial.

16/ Regardless of the manner and order in which growth happens, both DeFi and NFTs especially (due to lower transaction values) are going to require scaling solutions to meet demand.

Check out @Alex_Ged's excellent report covering this below.

delphidigital.io/reports/layer-…

Check out @Alex_Ged's excellent report covering this below.

delphidigital.io/reports/layer-…

Stay tuned for an @Delphi_Digital NFT Ecosystem Update soon 👀

My apologies, I forgot to tag @ShardMarketCap and @DappRadar who continue to provide awesome analysis tools for us to sink our teeth into.

Thank you!

Thank you!

• • •

Missing some Tweet in this thread? You can try to

force a refresh