Indigo Paints IPO

indigopaints.com

Should we apply for this IPO AT:

129X at 1360/share with 10.49 EPS(FY20)

114X at 1360/share annualized EPS(FY21)

OR:

177X at 1860/share(GMP-500)

Face Value: 10

Let's deep dive a bit into the company & Indian Paint Industry

indigopaints.com

Should we apply for this IPO AT:

129X at 1360/share with 10.49 EPS(FY20)

114X at 1360/share annualized EPS(FY21)

OR:

177X at 1860/share(GMP-500)

Face Value: 10

Let's deep dive a bit into the company & Indian Paint Industry

6/n

Value chain of a paint industry

The industry has a three-stage setup comprising raw material suppliers, manufacturers and sellers. Most of the raw materials in the paint industry are petroleum based, supplied by petrochemical companies.

Value chain of a paint industry

The industry has a three-stage setup comprising raw material suppliers, manufacturers and sellers. Most of the raw materials in the paint industry are petroleum based, supplied by petrochemical companies.

7/n

Raw Material Analysis

Raw material sourcing: 60%+ of the input costs of paint manufacturing.

Around 300 to 400 ingredients are used in the manufacturing of decorative paints, of which, Titanium Dioxide (TiO2), a white pigment, constitutes around 20% to 25%.

Raw Material Analysis

Raw material sourcing: 60%+ of the input costs of paint manufacturing.

Around 300 to 400 ingredients are used in the manufacturing of decorative paints, of which, Titanium Dioxide (TiO2), a white pigment, constitutes around 20% to 25%.

8/n

The paint industry has historically been successful in passing on any significant price increases in inputs to the customers.

TiO2 is derived from ilmenite. Kerala Metals and Minerals is one of the leading manufacturers of TiO2 in India.

The paint industry has historically been successful in passing on any significant price increases in inputs to the customers.

TiO2 is derived from ilmenite. Kerala Metals and Minerals is one of the leading manufacturers of TiO2 in India.

9/n

For water-based paints, the principal raw materials are acrylic emulsions and compounds such as TiO2, china clay and certain minerals.

Asian Paints, Berger & Nerolac- Inhouse emulsion production by importing raw materials such as monomers from China.

For water-based paints, the principal raw materials are acrylic emulsions and compounds such as TiO2, china clay and certain minerals.

Asian Paints, Berger & Nerolac- Inhouse emulsion production by importing raw materials such as monomers from China.

10/n

Indigo Paints procures it locally as purchasing emulsion instead of producing it has a cost benefit & higher margins.

Apart from TiO2, the other raw materials being used for water based paints and putty: white cement, minerals including lime, dolomite, calcite and talcum.

Indigo Paints procures it locally as purchasing emulsion instead of producing it has a cost benefit & higher margins.

Apart from TiO2, the other raw materials being used for water based paints and putty: white cement, minerals including lime, dolomite, calcite and talcum.

12/n

India: Paint industry market size

The decorative paint segment: 74% of the total paint sales.

The Indian paint industry is valued at approx. ₹ 545 billion and is expected to grow to amount to ₹ 971 billion by 2024.

Historically almost doubled India's GDP growth rate.

India: Paint industry market size

The decorative paint segment: 74% of the total paint sales.

The Indian paint industry is valued at approx. ₹ 545 billion and is expected to grow to amount to ₹ 971 billion by 2024.

Historically almost doubled India's GDP growth rate.

14/n

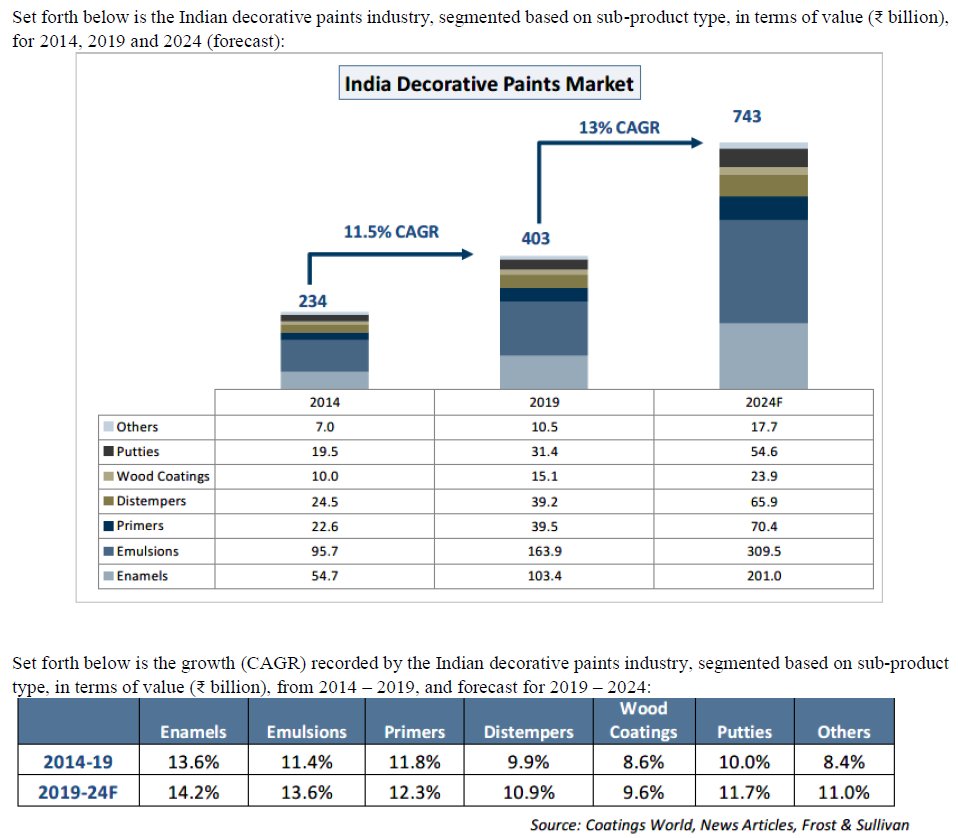

Indian Decorative Paints

Emulsions & Enamels are clear leaders in the decorative paints segment.

Indian Decorative Paints

Emulsions & Enamels are clear leaders in the decorative paints segment.

15/n

Competitive Landscape: Decorative Paints

Asian Paints is the clear leader at 42% while Indigo Paints is at 2%

Competitive Landscape: Decorative Paints

Asian Paints is the clear leader at 42% while Indigo Paints is at 2%

24/n

As observed from above, Indigo Paints is growth at a fast pace YoY basis since FY18 and is planning capex of it's water based plant along with existing businesses.

Company will remain richly valued in line with it's peers and will trade at higher multiples post listing.

As observed from above, Indigo Paints is growth at a fast pace YoY basis since FY18 and is planning capex of it's water based plant along with existing businesses.

Company will remain richly valued in line with it's peers and will trade at higher multiples post listing.

Above is not a recommendation nor advise to subscribe/buy to the IPO pre/post listing.

All data is from Company DRHP.

I am not a SEBI registered investment advisor.

Kindly do your due diligence and consult a licensed expert before taking any action.

All data is from Company DRHP.

I am not a SEBI registered investment advisor.

Kindly do your due diligence and consult a licensed expert before taking any action.

• • •

Missing some Tweet in this thread? You can try to

force a refresh