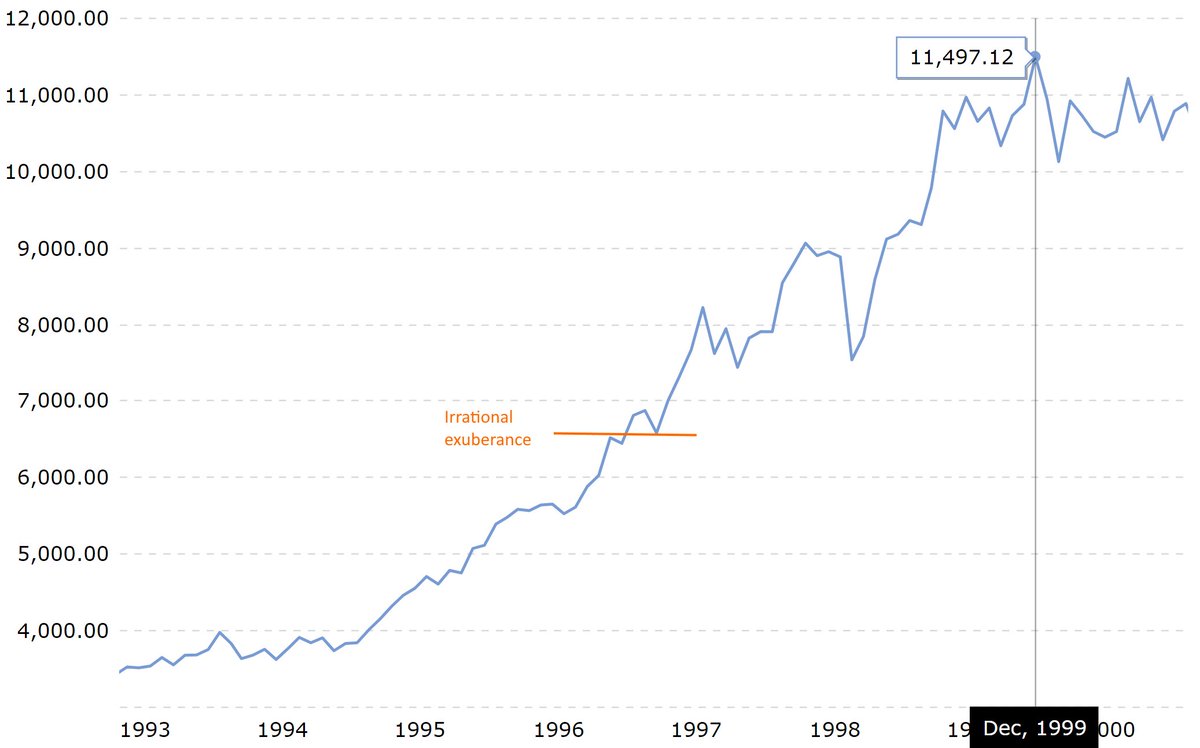

The market did correct a whopping 20%....more than a year later. The bottom point of that 20% correction was...uhm, no, let's see it:

Which then corrected massively, I tell you. Massively. That dot com bust was a slap on the face of everyone that thought we were not irrationally exuberant.

The original statement in this thread was made by Alan Greenspan, Then Governor of the US Federal Reserve.

There is absolutely no point in predicting an end date to madness.

There is absolutely no point in predicting an end date to madness.

• • •

Missing some Tweet in this thread? You can try to

force a refresh