The DoJ killed Visa & Plaid's $5.3B merger deal.

What went wrong?

A brief 🧵for those out of the loop... 👇

What went wrong?

A brief 🧵for those out of the loop... 👇

Quick context:

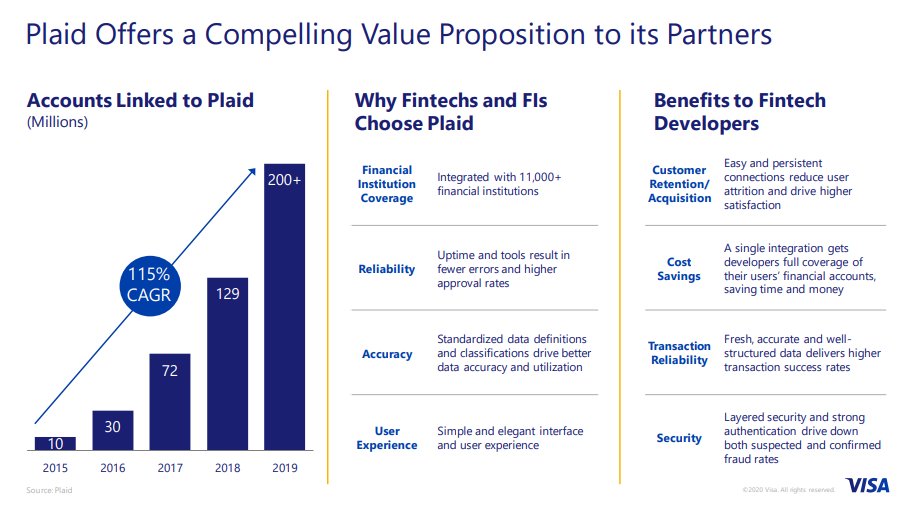

1 year ago (to the day), Visa announced plans to acquire Plaid, a fintech co. helping connect bank accs. and services much more effectively than the traditional methods.

The primary goal for the move was (supposedly) to deepen Visa's integration in fin. services

1 year ago (to the day), Visa announced plans to acquire Plaid, a fintech co. helping connect bank accs. and services much more effectively than the traditional methods.

The primary goal for the move was (supposedly) to deepen Visa's integration in fin. services

What quickly became apparent, though, was that the move was less about improving Visa's offering, as it was avoiding being threatened by new financial service routes which would threaten Visa's business.

To give a (very) rough explanation:

- Visa earns a majority of revenue through interchange and card network fees.

- They *don't* earn money on direct pay-by-bank transfers.

- Direct bank payments are pretty rare for consumers, as they take ages (3-4+ days) to set up & verify

- Visa earns a majority of revenue through interchange and card network fees.

- They *don't* earn money on direct pay-by-bank transfers.

- Direct bank payments are pretty rare for consumers, as they take ages (3-4+ days) to set up & verify

- Plaid's technology makes this days-long process almost instantaneous, and circumvents the fees taken on every transaction using a card.

- Businesses will be eager to adopt Plaid where possible, to avoid paying these fees. For consumers, it'd be even faster to pay online.

- Businesses will be eager to adopt Plaid where possible, to avoid paying these fees. For consumers, it'd be even faster to pay online.

Therefore, Visa was eager to take control of the growing threat, and buying Plaid was the optimal solution to do it.

From the DOJ lawsuit:

Senior leadership at Visa estimated a "potential downside risk of $300M-$500M in [their] US debit business by 2024" if Plaid continued to pose a risk

justice.gov/atr/case-docum…

Senior leadership at Visa estimated a "potential downside risk of $300M-$500M in [their] US debit business by 2024" if Plaid continued to pose a risk

justice.gov/atr/case-docum…

After the Jan. announcement, the US DoJ announced their formal complaint against the merger by early November, citing obvious antitrust concerns.

A key statement they quote, from Visa's CEO:

"[Plaid] would be an insurance policy to protect our debit biz in the US"

A key statement they quote, from Visa's CEO:

"[Plaid] would be an insurance policy to protect our debit biz in the US"

More interestingly, from an internal document:

"It is in our collective interest to manage the evolution of these payment forms in a way that protects the commercial results we mutually realize through card-based payments."

The DOJ believe Visa way buying Plaid to kill it.

"It is in our collective interest to manage the evolution of these payment forms in a way that protects the commercial results we mutually realize through card-based payments."

The DOJ believe Visa way buying Plaid to kill it.

The DOJ's lawsuit repeatedly states that Visa's position is one of a blatant monopolist.

The deal "would have enabled Visa to eliminate this competitive threat to its online debit business before Plaid had a chance to succeed, thereby enhancing or maintaining its monopoly."

The deal "would have enabled Visa to eliminate this competitive threat to its online debit business before Plaid had a chance to succeed, thereby enhancing or maintaining its monopoly."

And that brings us to today's news that the deal is being dropped.

When the lawsuit was filed, Visa (of course) initially pushed to defend the deal.

But just 2 months later, the companies announced a termination of the deal, rather than continuing fighting.

When the lawsuit was filed, Visa (of course) initially pushed to defend the deal.

But just 2 months later, the companies announced a termination of the deal, rather than continuing fighting.

Of all the players involved, Plaid is almost certainly the one that best made out of the situation, and is believed to have pushed an end to the lawsuit, dropping the acquisition deal.

Many were surprised by the initial announcement last January, given the massive deal value (justified as being "strategic, not financial" by Visa leadership), and the perceived massive future opportunities for Plaid.

Some are saying this is grounds to expect Plaid to opt for the IPO route in the coming years, as the last year has done nothing but bring more attention to their innovative fintech offering.

Given this outcome, Plaid will be a hugely interesting company to keep an eye on in coming years. On the other side, this does mark a significant line in the sand for Visa, which has long been seen as a staple of a strong stock portfolio, as online sales growth is only rising.

Things are unlikely to change overnight for that Visa thesis, but the future opportunities for Plaid are undeniably a sign of changing times to come.

Change happens very slowly, and then all at once.

Change happens very slowly, and then all at once.

If you learned anything from this thread, be sure to drop a follow for more business & brand strategy content! @rhyswallaceco

Thanks so much for reading! 🙏

Thanks so much for reading! 🙏

Ooh and a shout-out to FinTechToday/@iankar_, their newsletter has massively helped me understand Plaid better over the last year. Heavy recommend for anything fintech!

• • •

Missing some Tweet in this thread? You can try to

force a refresh