Good morning! Another sunny & cool day in Hong Kong 🌞to make the end of the 1st 2 weeks of January.

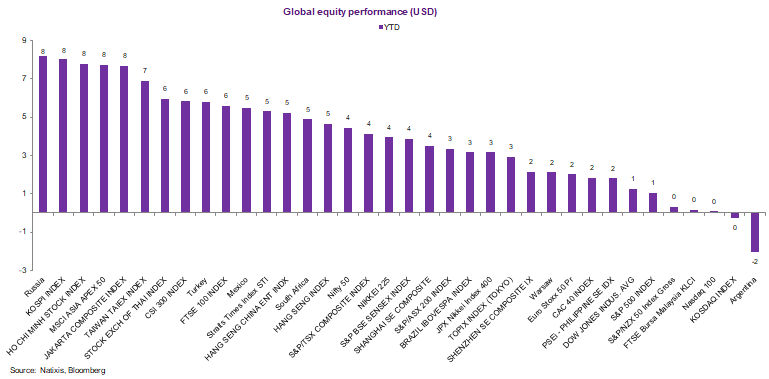

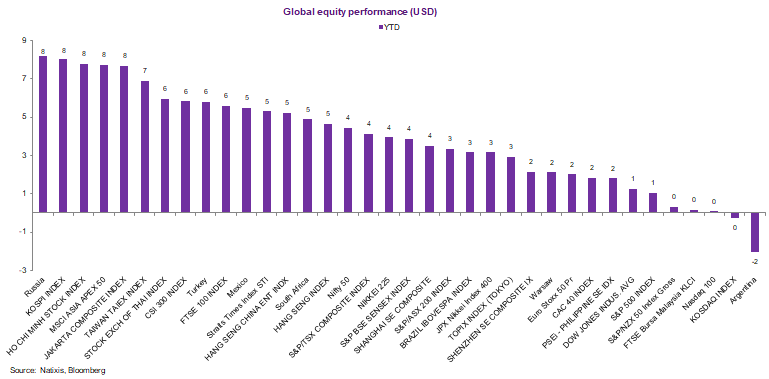

Shall we look at where we stand? Let's looksie! Here is global equity return in USD. Guess who is best?

Russia, Kospi (Korea), Vietnam, Indonesia, Taiwan, & Thailand. So Asia!

Shall we look at where we stand? Let's looksie! Here is global equity return in USD. Guess who is best?

Russia, Kospi (Korea), Vietnam, Indonesia, Taiwan, & Thailand. So Asia!

Remember that this is the GREAT ROTATION TRADE (oil, commodity & real economy, meaning EM up) & so the losers so far are Kosdaq (Korea tech) & Nasdaq (US tech) as well as Argentina.

The question then is, is this warranted given the raging pandemic outside!

The question then is, is this warranted given the raging pandemic outside!

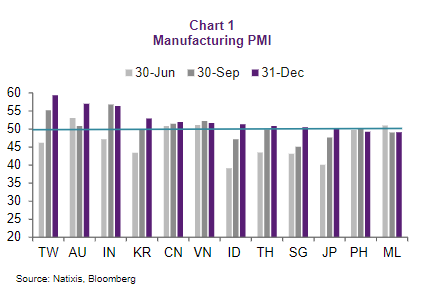

Let's look at Asia (skipping US, EU PMIs & we'll talk later), which has done BEST in asset price movement so far in 2021, real economic activity to see if this euphoric 2-week start is matched by data.

Manufacturing PMI for Asia shows improvement (purple line > grey) esp for ID.

Manufacturing PMI for Asia shows improvement (purple line > grey) esp for ID.

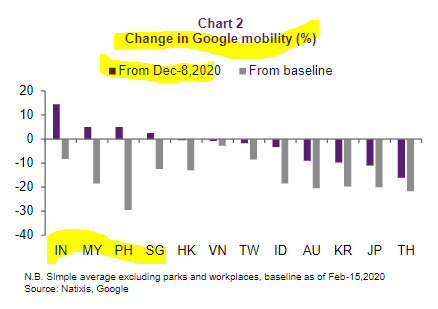

Let's look at Google Mobility & show here in 2 ways: change from baseline (preCovid) in grey & change from 8 December 2020. Guess who's having the best change? Well, INDIA! The Philippines improved too🇮🇳🇵🇭. Malaysia also before the lockdown (been in targeted lockdown for a while.

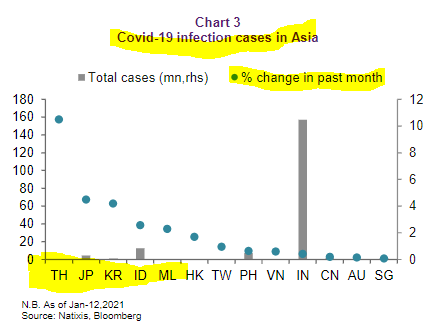

Of course people talk about the pandemic raging but is it getting worse in Asia? As u saw, some got better like India & the Philippines even before we talk about the vaccines.

But sadly, cases are up for some too, esp Thailand, Japan, South Korea, Indonesia, Malaysia & HK!!!

But sadly, cases are up for some too, esp Thailand, Japan, South Korea, Indonesia, Malaysia & HK!!!

What does this mean? It means that u either fight the virus w/ suppression/lockdown or hopefully vaccinate the population so u don't have to worry about it (US & UK approach as raging pandemic = hope of improvement w/ higher vaccination).

So let's talk about Asia vaccination!

So let's talk about Asia vaccination!

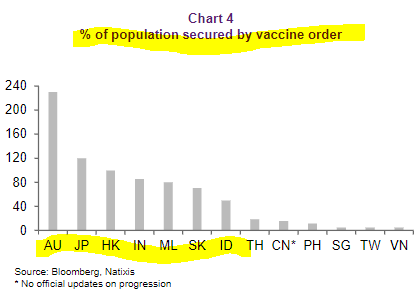

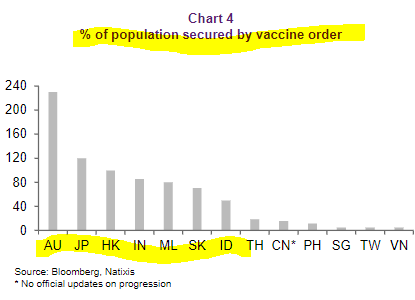

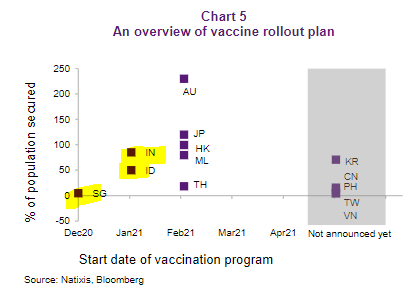

In the West, people talk about vaccine rollout disappointing but frankly the US (4%) & UK (5%) vaccinated people already & here in Asia we're still talking about acquisition. But that's no surprise as we have to buy to distribute. Who got enough? Developed Asia. In EM, India best

Yes, India despite being so populous managed to acquire almost the total population. Malaysia, South Korea and Indonesia not too bad. But Thailand the rest are surprising, esp Thailand which has higher cases as of late & highest exposure to international mobility via tourism.

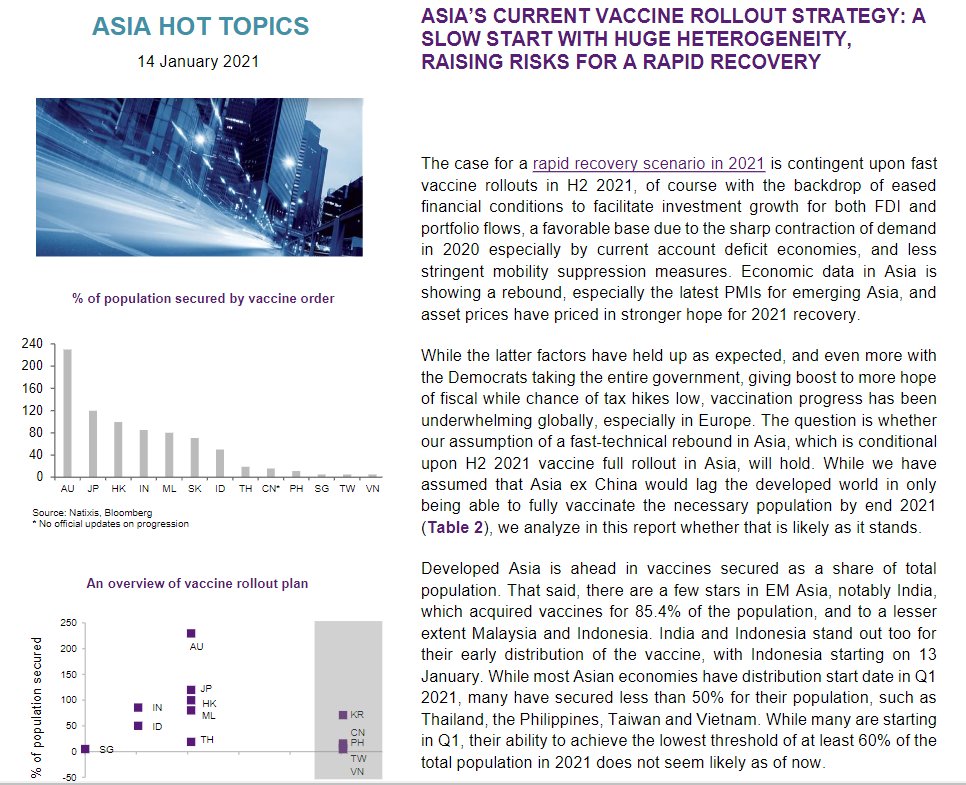

a) India acquired the most in EM Asia as a share of population & b) it is also starting its vaccination program pretty early!

This is an Asian star of vaccine so it may turn around its bad performance of 2020 (already doing much better w/o the vaccine). Indonesia too got urgency

This is an Asian star of vaccine so it may turn around its bad performance of 2020 (already doing much better w/o the vaccine). Indonesia too got urgency

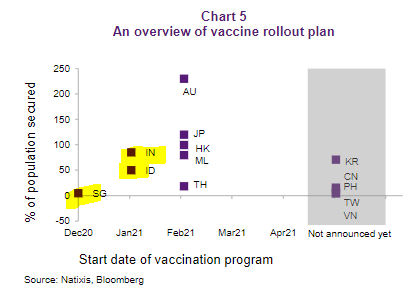

In Asia, for the economies disclosed their strategy, most starting in Q1 2021. But let's not forget the other side of the puzzle, do u have enough vaccines to finish by end 2021?

The answer is no for Thailand yet as it still needs to buy more & not getting most til Q2.

And...

The answer is no for Thailand yet as it still needs to buy more & not getting most til Q2.

And...

For Taiwan & Vietnam, they haven't acquired enough. China we don't have updated data to say but since it got its own vaccine it doesn't have the acquisition problem other countries have. South Korea & the Philippines haven't disclosed details either. Meaning, a lot of uncertainty

Bottom line:

Some EM Asian economies are starting 2020 better even before the vaccine, notably India & also some ASEAN economies. But some worse, such as Thailand & Malaysia in term of Covid cases etc.

Looking at vaccine plans, Thailand looks underwhelming while India rocks!

Some EM Asian economies are starting 2020 better even before the vaccine, notably India & also some ASEAN economies. But some worse, such as Thailand & Malaysia in term of Covid cases etc.

Looking at vaccine plans, Thailand looks underwhelming while India rocks!

For more information on who bought which vaccine, when they start (specific date), when they aim to finish by which date & the urgency of it, read our @natixis @NatixisResearch report!!!

Enjoy & have a great day & weekend! Be safe🤗!

Sincerely,

@Trinhnomics

Enjoy & have a great day & weekend! Be safe🤗!

Sincerely,

@Trinhnomics

• • •

Missing some Tweet in this thread? You can try to

force a refresh