🚨 Why $RTP/Reinvent Tech Partners is my largest pre-target SPAC holding!

- Led by Reid Hoffman & Mark Pincus

- Prolific VCs & serial entrepreneurs

- $690 million raised

- Targeting tech sector (AI, autonomous driving, gaming focus)

*Current Price: $11.90

Time for a thread! ⬇️

- Led by Reid Hoffman & Mark Pincus

- Prolific VCs & serial entrepreneurs

- $690 million raised

- Targeting tech sector (AI, autonomous driving, gaming focus)

*Current Price: $11.90

Time for a thread! ⬇️

$RTP S1:

"Invention is when a company builds a new product in an adjacent market, such as Amazon developing AWS. Reinvention is when a company has to adapt its core products to continue growing in an existing market, as Netflix did moving from DVDs to streaming."

"Invention is when a company builds a new product in an adjacent market, such as Amazon developing AWS. Reinvention is when a company has to adapt its core products to continue growing in an existing market, as Netflix did moving from DVDs to streaming."

Who is Reid Hoffman?

- One of Silicon Valley’s most prolific angel investors

- Co-founder of LinkedIn & PayPal

- Microsoft board member

- Early top exec of PayPal

- Early investor in Facebook, Airbnb, Discord, Dropbox, Coinbase, Instagram

$RTP

- One of Silicon Valley’s most prolific angel investors

- Co-founder of LinkedIn & PayPal

- Microsoft board member

- Early top exec of PayPal

- Early investor in Facebook, Airbnb, Discord, Dropbox, Coinbase, Instagram

$RTP

$RTP S1:

"Hoffman is an expert in social networks, online marketplaces, emerging technologies, like artificial intelligence and autonomous driving, and reinventing industries."

"Hoffman is an expert in social networks, online marketplaces, emerging technologies, like artificial intelligence and autonomous driving, and reinventing industries."

Who is Mark Pincus?

- Founder of Zynga, the pioneer in social gaming

- Founding investor in Napster, Facebook, Friendster, Snapchat, Xiaomi and Twitter

- Early investor in JD, Brightmail, & Buddy Media

- 2009 "CEO of the Year" at The Crunchies technology award

$RTP

- Founder of Zynga, the pioneer in social gaming

- Founding investor in Napster, Facebook, Friendster, Snapchat, Xiaomi and Twitter

- Early investor in JD, Brightmail, & Buddy Media

- 2009 "CEO of the Year" at The Crunchies technology award

$RTP

Hoffman has partnered as an early investor and board member with companies such as Airbnb, Aurora, Convoy, OpenAI, and Zynga as they have grown from small start-ups to scaled technology companies. $RTP

Hoffman & Pincus have pursued their shared intellectual interest in the games industry through an investment in Epic Games. Pincus also has invested in gaming software giant Niantic. $RTP

In 2019, Pincus & Hoffman raised up to $700 million for a new investment fund that will focus on publicly traded tech companies in need of strategic restructuring: Reinvent Capital $RTP

➡️ reinventcapital.com

➡️ reinventcapital.com

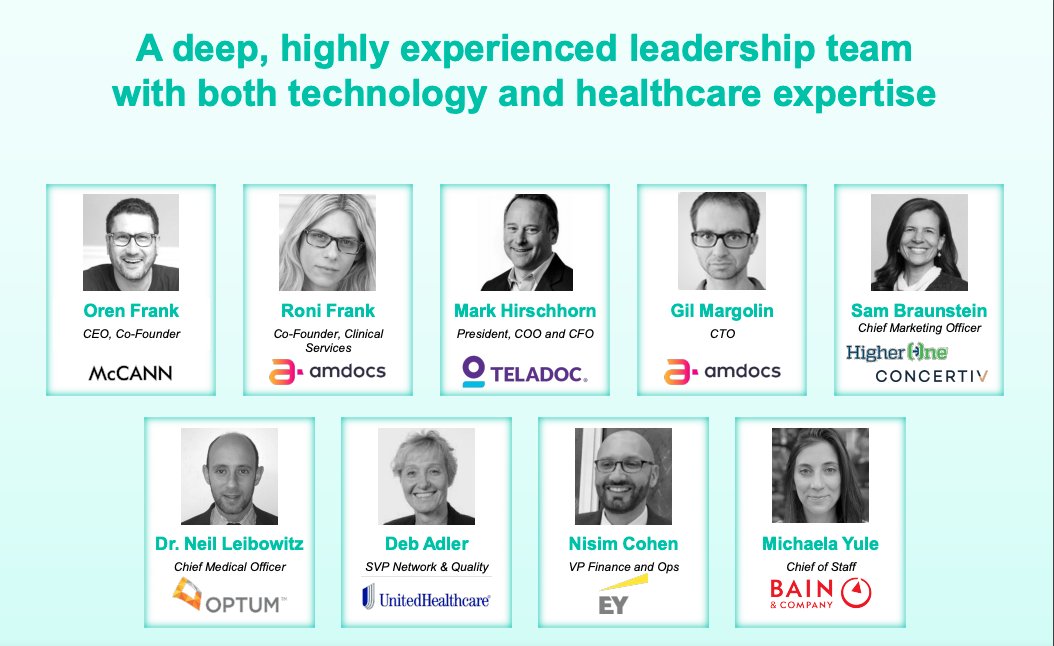

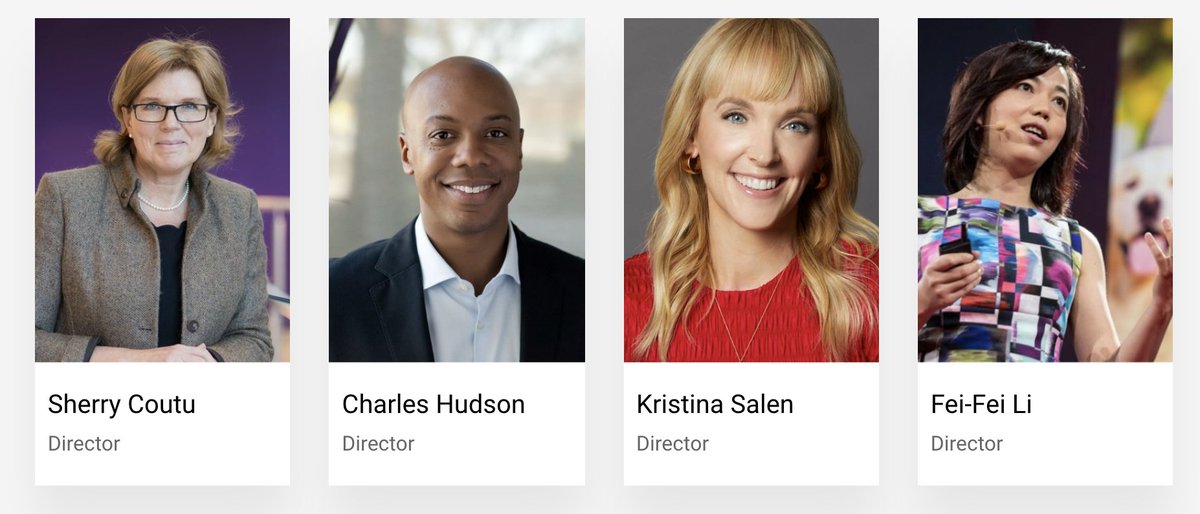

$RTP independent directors:

1) Sherry Coutu: More than 60 angel investments & three IPO's

2) Charls Hudson: Founder of Precursor ventures, ex-partner at SoftTech VC

3) Kristina Salen: ex-CFO of WWE and Etsy

4) Fei-Fei Li: Co-Director of Stanford's Human-Centered AI Institute

1) Sherry Coutu: More than 60 angel investments & three IPO's

2) Charls Hudson: Founder of Precursor ventures, ex-partner at SoftTech VC

3) Kristina Salen: ex-CFO of WWE and Etsy

4) Fei-Fei Li: Co-Director of Stanford's Human-Centered AI Institute

My speculation? $RTP's specific target is either in the autonomous vehicles, artificial intelligence, or gaming industries.

My first and foremost bet is on autonomous vehicles and artificial intelligence.

Why? Let's check below ⬇️

My first and foremost bet is on autonomous vehicles and artificial intelligence.

Why? Let's check below ⬇️

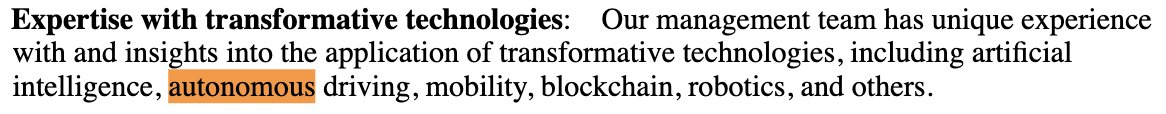

In $RTP's S1, "autonomous driving" is mentioned 10x.

It's listed under their business criteria and highlighted multiple times around Hoffman's interest and experience.

Full S1 ➡️ sec.gov/Archives/edgar…

It's listed under their business criteria and highlighted multiple times around Hoffman's interest and experience.

Full S1 ➡️ sec.gov/Archives/edgar…

In March 2016, Hoffman invested $16m in on-demand trucking startup Convoy and joins board.

In Feb 2019, Hoffman (through Greylock Partners) invested $90m in self-driving car startup Aurora and joins board.

Convoy 2019 valuation: $2.75bn

Aurora 2020 valuation: $10bn

$RTP

In Feb 2019, Hoffman (through Greylock Partners) invested $90m in self-driving car startup Aurora and joins board.

Convoy 2019 valuation: $2.75bn

Aurora 2020 valuation: $10bn

$RTP

In March 2018, Hoffman speaks on Startup Grind on the future of autonomous vehicles & the technology and mechanics of how it works. $RTP

Just a month after $RTP IPOed (Sep 2020), Hoffman spoke to Bloomberg technology on why AI and autonomous driving will be as transformative as electricity.

In October 2020, Hoffman spoke to CNBC about $RTP.

On his target, he starts with: "It could be artificial intelligence, which I've been doing through Open AI & Stanford's Human Center of AI, and other areas such as investing in autonomous vehicles."

On his target, he starts with: "It could be artificial intelligence, which I've been doing through Open AI & Stanford's Human Center of AI, and other areas such as investing in autonomous vehicles."

Hint Hint:

Fei-Fei Li, on $RTP board:

- Co-Director of Stanford Institute for Human-Centered AI, - Co-Director of Stanford Vision and Learning Lab.

- Co-Founder of AI4ALL

Expert in AI, machine learning, deep learning, computer vision and cognitive neuroscience.

Fei-Fei Li, on $RTP board:

- Co-Director of Stanford Institute for Human-Centered AI, - Co-Director of Stanford Vision and Learning Lab.

- Co-Founder of AI4ALL

Expert in AI, machine learning, deep learning, computer vision and cognitive neuroscience.

My target speculation #1 $RTP

Aurora: Leader in autonomous vehicles and self-driving tech

- Founded by self-driving pioneers from Google, Uber and Tesla

- Dec 2020: Acquired Uber's self driving division for $4bn

- Valued at $10bn and ripe to go public

news.greylock.com/our-investment…

Aurora: Leader in autonomous vehicles and self-driving tech

- Founded by self-driving pioneers from Google, Uber and Tesla

- Dec 2020: Acquired Uber's self driving division for $4bn

- Valued at $10bn and ripe to go public

news.greylock.com/our-investment…

My target speculation #2 $RTP

Convoy: Leader in automation & machine learning on-demand trucking/freight.

- Investors include Salesforce's Marc Benioff, Dropbox's Drew Houston, Instagram's Kevin Systrom, & Amazon's Jeff Bezos

- Valued at $2.75bn in 2019

convoy.com/blog/tackling-…

Convoy: Leader in automation & machine learning on-demand trucking/freight.

- Investors include Salesforce's Marc Benioff, Dropbox's Drew Houston, Instagram's Kevin Systrom, & Amazon's Jeff Bezos

- Valued at $2.75bn in 2019

convoy.com/blog/tackling-…

My target speculation #3 and #4 $RTP

If the target is in the gaming world, the two lead candidates are Epic Games and Niantic.

- Epic Games valued at $17.3bn

- Niantic valued at $4bn

Both are ripe public market candidates after Unity + potential Roblox IPO.

If the target is in the gaming world, the two lead candidates are Epic Games and Niantic.

- Epic Games valued at $17.3bn

- Niantic valued at $4bn

Both are ripe public market candidates after Unity + potential Roblox IPO.

Hope you enjoyed!

🚨 Disclaimer: Nothing contained in this thread should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific profit.

🚨 Disclaimer: Nothing contained in this thread should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific profit.

Cc @reidhoffman & @markpinc

• • •

Missing some Tweet in this thread? You can try to

force a refresh