🚨 $AJAX: The tech-savvy, star-studded SPAC!

- $750m raised

- Led by Daniel Och (Willoughby Capital) & Fuhrman (GS)

- Board: Kevin Systrom (Instagram), Anne Wojcicki (23andMe), Jim McKelvey (Square), & Steve Ellis (Chipotle)

- Targeting internet/software/fintech

Thread ⬇️🧵

- $750m raised

- Led by Daniel Och (Willoughby Capital) & Fuhrman (GS)

- Board: Kevin Systrom (Instagram), Anne Wojcicki (23andMe), Jim McKelvey (Square), & Steve Ellis (Chipotle)

- Targeting internet/software/fintech

Thread ⬇️🧵

$AJAX CEO: Dan Och

- Founder of Willoughby Capital

- Multibillion $$ portfolio focused on growth companies in the internet, software, fintech sectors

- Investments include Brex, Capsule, Coinbase, Coupang, Github, Instacart, Robinhood, Strike, Talkdesk, Transferwise, Wish & more

- Founder of Willoughby Capital

- Multibillion $$ portfolio focused on growth companies in the internet, software, fintech sectors

- Investments include Brex, Capsule, Coinbase, Coupang, Github, Instacart, Robinhood, Strike, Talkdesk, Transferwise, Wish & more

$AJAX President/Director: Glenn Fuhrman

- Ex-Goldman MD and ex co-founder of MSD Capital, the private investment firm of Michael Dell (Dell Tech)

- Oversaw increase in assets from $400m to $2bn

- Investments included PVH Corp and Dine Brands Global

- Ex-Goldman MD and ex co-founder of MSD Capital, the private investment firm of Michael Dell (Dell Tech)

- Oversaw increase in assets from $400m to $2bn

- Investments included PVH Corp and Dine Brands Global

$AJAX Strategic Advisor: Steve Ells

- Founder and ex-CEO of Chipotle Mexican Grill

- Visionary entrepreneur who revolutionized casual dining concept

- Led Chipotle to almost $30bn marketcap prior to his departure

- Founder and ex-CEO of Chipotle Mexican Grill

- Visionary entrepreneur who revolutionized casual dining concept

- Led Chipotle to almost $30bn marketcap prior to his departure

$AJAX Strategic Advisor: Jim McKelvey

- Serial entrepreneur and businessman

- Co-founder of payments firm Square along with Jack Dorsey, the company that revolutionized the financial industry

- Independent Director of the Federal Reserve Bank of St. Louis

- Serial entrepreneur and businessman

- Co-founder of payments firm Square along with Jack Dorsey, the company that revolutionized the financial industry

- Independent Director of the Federal Reserve Bank of St. Louis

$AJAX Strategic Advisor: Kevin Systrom

- Former CEO and Co-Founder of Instagram, one of the most revolutionary internet product sin history

- Sold to Facebook for $1bn

- Previously worked at Google, Odeo (now Twitter) and Burbn

- Former CEO and Co-Founder of Instagram, one of the most revolutionary internet product sin history

- Sold to Facebook for $1bn

- Previously worked at Google, Odeo (now Twitter) and Burbn

$AJAX Strategic Advisor: Anne Wojcicki

- Serial entrepeneur and co-founder of personal genomics company 23andMe

- Forbes World's 100 Most Powerful Women in the World

- Fast Company's 2013 "Most Daring CEO"

- Sister of Susan Wojcicki, CEO of YouTube

- Serial entrepeneur and co-founder of personal genomics company 23andMe

- Forbes World's 100 Most Powerful Women in the World

- Fast Company's 2013 "Most Daring CEO"

- Sister of Susan Wojcicki, CEO of YouTube

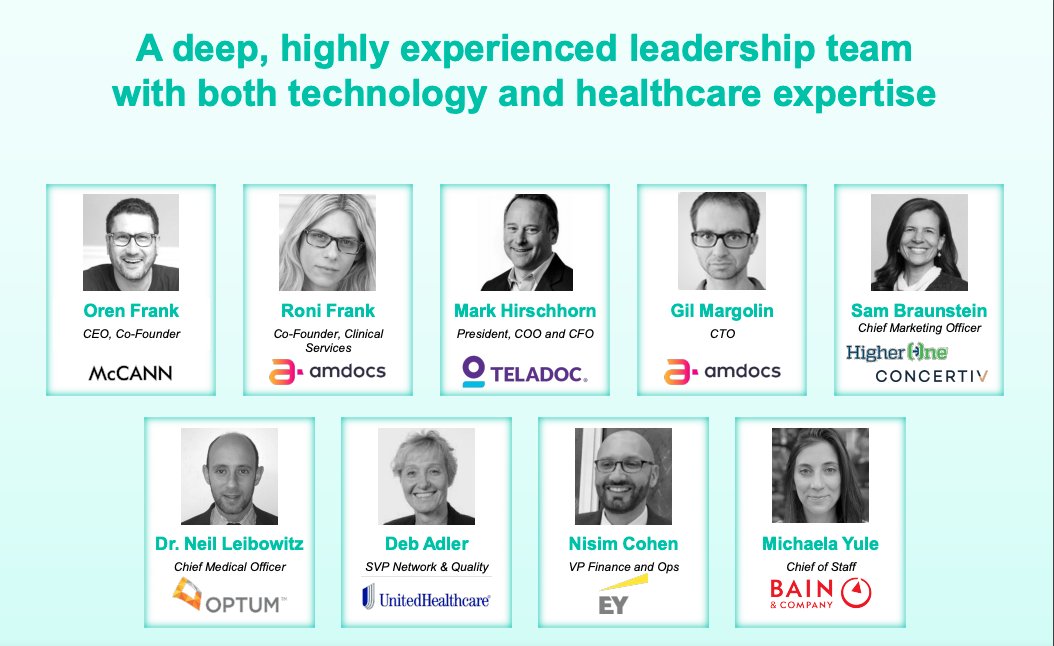

$AJAX Value Proposition:

- Extensive leadership experience in public & private companies

- Vast public equity capital markets knowledge

- Founder-Driven Growth Initiatives

- Fundamental Investment Expertise

- Track Record of Value Creation

- Access to Proprietary Deal Flow

- Extensive leadership experience in public & private companies

- Vast public equity capital markets knowledge

- Founder-Driven Growth Initiatives

- Fundamental Investment Expertise

- Track Record of Value Creation

- Access to Proprietary Deal Flow

$AJAX Acquisition Criteria:

- Scaled, Multibillion-Dollar Asset

- Deep, Competitive Moat

- Large Addressable Market and Attractive Unit Economics

- Minimal Cyclical Risk

- Superior Leadership Team and Vision

ajaxcap.com

- Scaled, Multibillion-Dollar Asset

- Deep, Competitive Moat

- Large Addressable Market and Attractive Unit Economics

- Minimal Cyclical Risk

- Superior Leadership Team and Vision

ajaxcap.com

$AJAX Competitive Edge:

- AJAX has reduced their sponsor promote fee to 10% versus the traditional 20%, making it more investor-aligned and friendly

- AJAX expects their founders and board members to invest from their own capital into the target company upon business completion

- AJAX has reduced their sponsor promote fee to 10% versus the traditional 20%, making it more investor-aligned and friendly

- AJAX expects their founders and board members to invest from their own capital into the target company upon business completion

🚨 Disclaimer: Nothing contained in this thread should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific profit $AJAX

• • •

Missing some Tweet in this thread? You can try to

force a refresh