On the importance of leverage for the crypto ecosystem.

A long time ago, BNP Paribas bought a retail forex exchange, because they thought they'd get an insight into forex trading flows and positions. What they quickly discovered, is that the website was a muppet slaughterhouse.

A long time ago, BNP Paribas bought a retail forex exchange, because they thought they'd get an insight into forex trading flows and positions. What they quickly discovered, is that the website was a muppet slaughterhouse.

People would get stopped out ALL THE TIME because they used too much leverage. Over 90% of them lost money in a consistent way. Those are worse than even casino odds.

That's why around 2005, you had so many forex trading websites popping up. They would offer up to 500x leverage.

That's why around 2005, you had so many forex trading websites popping up. They would offer up to 500x leverage.

The higher the leverage, the better (for the website).

This became such a huge trend that regulators stepped in, and introduced maximum leverage rules. Something like x30 for forex, if I remember correctly. All of a sudden, all the ads and Premier League sponsorships vanished.

This became such a huge trend that regulators stepped in, and introduced maximum leverage rules. Something like x30 for forex, if I remember correctly. All of a sudden, all the ads and Premier League sponsorships vanished.

Forex gambling is still around, but not nearly as profitable, because it takes time for people to lose their money with a pitiful x30 leverage. Currencies usually don't move by 3% in a day. It can take weeks for an amateur trader to lose it all. Plus the adrenaline rush is gone.

Enter crypto.

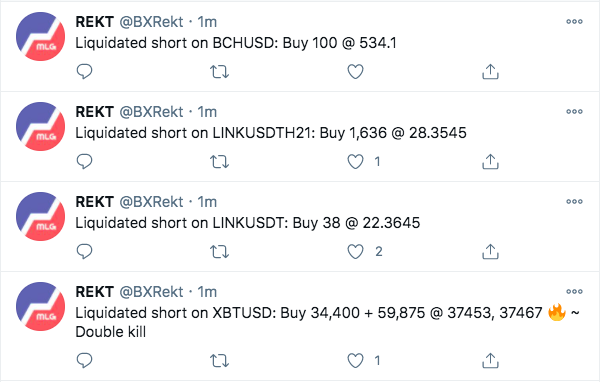

It's hard to explain how one-sided leveraged crypto trading is. Traders don't stand a chance. With currencies, you could expect to extract SOME money from real world flows. In crypto, there are no real world flows. It's just traders against traders against insiders.

It's hard to explain how one-sided leveraged crypto trading is. Traders don't stand a chance. With currencies, you could expect to extract SOME money from real world flows. In crypto, there are no real world flows. It's just traders against traders against insiders.

Of course leveraged trading is very fun and addictive. So the flows are substantial. Regulated exchanges don't offer leverage, because it's a pain in the ass legally - just look at Coinbase dropping it recently. Because cryptos aren't currencies, you have to deal with all this

crap about ownership and being able to deliver the goods that's just not worth it. Plus the CFTC thinks cryptos are commodities, while the SEC thinks they're securities, and you have to deal with regulations for both.

That's why offshore, unregulated exchanges sprung up so fast.

That's why offshore, unregulated exchanges sprung up so fast.

Those exchanges are a huge threat to the crypto industry, because they're serving US citizens, which is illegal, and regulated exchanges knowingly serve as on-ramp platforms and enable US citizens to fund their gambling accounts there. It all hangs on a very thin thread.

But those unregulated exchanges are also an absolute bonanza, because they create huge demand for crypto as for on-ramp purposes, and - crucial point - this crypto is then lost by gamblers back to the crypto industry. This creates a one-way flow of real cash into the system.

This cash can then be used to pay for mining, for infrastructure, PR, you name it. People buying Bitcoins and holding isn't nearly as interesting a business as people buying Bitcoins and losing them by getting rekt on Binance. A HODLer is a risk because he can sell his Bitcoins.

A rekt gambler will simply buy more.

Unregulated offshore exchanges are feeding the rest of the crypto industry. They're also feeding regulated exchanges. Regulators are looking into it. The difference with forex, is that laws already exist that should prevent what's happening.

Unregulated offshore exchanges are feeding the rest of the crypto industry. They're also feeding regulated exchanges. Regulators are looking into it. The difference with forex, is that laws already exist that should prevent what's happening.

Regulated exchanges just pretend like they don't know. But they do. When the hammer drops, it will be Armageddon.

• • •

Missing some Tweet in this thread? You can try to

force a refresh