A thread on my understanding of #IEX Indian Energy Exchange

https://twitter.com/Keshav_Sood101/status/1350188010583703552

IEX - The Power Exchange Platform

Debt Free, Monopolistic Business, High ROE, High ROCE business with Asset Light business model available at a Mcap of 7000Cr.

Debt Free, Monopolistic Business, High ROE, High ROCE business with Asset Light business model available at a Mcap of 7000Cr.

IEX is India’s leading power exchange – Nation wide, Automated and Transparent platform for physical delivery of electricity

Commenced operations in 2008

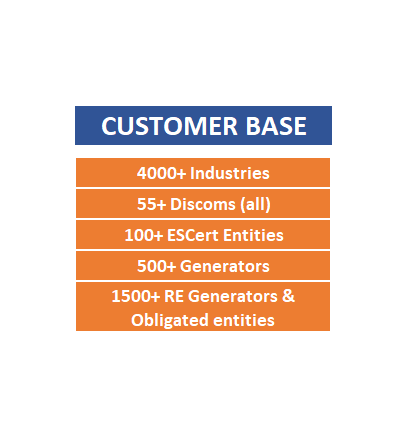

Market Share: 95% (DAM & RTM >99%)

Record day volume : 187000 MW

Commenced operations in 2008

Market Share: 95% (DAM & RTM >99%)

Record day volume : 187000 MW

Market Segments in which IEX operates are DAM, TAM, REC, ESCerts, RTM and Green TAM.

Lets understand these frequently used terminologies-

Lets understand these frequently used terminologies-

IEX is catering to only 4% (Exchange) of the total Power Sector Structure, commanding a market share of >90% in DAM and RTM.

Network Effect

IEX is Increasing Market Share and Creating Network Effect- more buyers come to the platform where more sellers are present and more sellers come to the platform where more buyers are present.

IEX is Increasing Market Share and Creating Network Effect- more buyers come to the platform where more sellers are present and more sellers come to the platform where more buyers are present.

DSM Demand-Side Management

DSM programs consist of the planning, implementing, and monitoring

activities of electric utilities which are designed to encourage consumers

to modify their level and pattern of electricity usage.

DSM programs consist of the planning, implementing, and monitoring

activities of electric utilities which are designed to encourage consumers

to modify their level and pattern of electricity usage.

Open Access

Open access is one of the key measures to bring about competition in electricity, whereby large consumers have access to the transmission and distribution (T&D) network to obtain electricity from suppliers other than the local distribution company (discom)

Open access is one of the key measures to bring about competition in electricity, whereby large consumers have access to the transmission and distribution (T&D) network to obtain electricity from suppliers other than the local distribution company (discom)

Who will use Open Access and who will not.

What are the advantages of utilizing Open Access Platform

What are the advantages of utilizing Open Access Platform

Indian Gas Exchanges (IGX), a wholly owned subsidiary of IEX secures authorization from the PNGRB to operate as a Gas exchange for a period of 25 years. The authorization from the board makes IGX India’s first regulated gas exchange.

IGX currently offers trade in five contracts namely: Daily Weekly, Weekday, Fortnightly and Monthly at 3 physical hubs at Hazira and Dahej in Gujarat and KG Basin in Andhra. Since its launch on 15 June 2020, the platform has cumulatively traded 74,600 MMBTU.

Acc to regulations, members of IGX can have max 5% stake. Adani Gas and Torrent Gas have each acquired 5% stake in IGX. IGX is not divesting, its only looking for strategic partners for smooth operations. IEX will have to bring down its stake in IGX to 25% in the next 5 yrs.

Risks-

Technological Risk

Regulatory Risk

Loss of Market Share due to Competition

Technological Risk

Regulatory Risk

Loss of Market Share due to Competition

Opportunity-

According to IEA, the contribution of renewable energy has grown to 26% of the energy basket. With governments adopting more sustainable sources of energy supply, the share of renewable energy source is expected to reach 30% by 2024.

According to IEA, the contribution of renewable energy has grown to 26% of the energy basket. With governments adopting more sustainable sources of energy supply, the share of renewable energy source is expected to reach 30% by 2024.

Power traded on exchanges in India is only ~5% against developed economies contributing 30-80% of power volumes to exchanges.

Launch of Longer Duration, Cross Border and Green Day Ahead Market Products & IGX will further drive growth

Launch of Longer Duration, Cross Border and Green Day Ahead Market Products & IGX will further drive growth

• Phasing of old power plants - result in shift in volumes to exchanges

• Discoms not signing new PPAs - volumes being shifted to short term category

• Per capita consumption in India is 1/3rd of global average - expected to double in next 5-6 yrs

• Discoms not signing new PPAs - volumes being shifted to short term category

• Per capita consumption in India is 1/3rd of global average - expected to double in next 5-6 yrs

Quarterly Update Q3FY21

IEX has seen the highest ever qtr volumes of 20,167MU. Since the launch, RTM and Green TAM has traded 5,703MU and 549MU.

In Dec’20, IEX also launched 2 new contracts – Green Daily and Weekly Contracts in the Green TAM segment

IEX has seen the highest ever qtr volumes of 20,167MU. Since the launch, RTM and Green TAM has traded 5,703MU and 549MU.

In Dec’20, IEX also launched 2 new contracts – Green Daily and Weekly Contracts in the Green TAM segment

@amey_candor @safiranand @MashraniVivek @VallumConnect @AvinashGoraksha @nid_rockz

@equialpha @VRtrendfollower @vetris_stocks @Rishikesh_ADX @Investor_Mohit

@equialpha @VRtrendfollower @vetris_stocks @Rishikesh_ADX @Investor_Mohit

• • •

Missing some Tweet in this thread? You can try to

force a refresh