Solid collection of trading quotes and wisdom by @gfc4

“Above all else...the stock market is people. People trying to read the future...The main obstacle lies in disentangling ourselves from our own emotions.” - Bernard Baruch

traderprinciples.com

“Above all else...the stock market is people. People trying to read the future...The main obstacle lies in disentangling ourselves from our own emotions.” - Bernard Baruch

traderprinciples.com

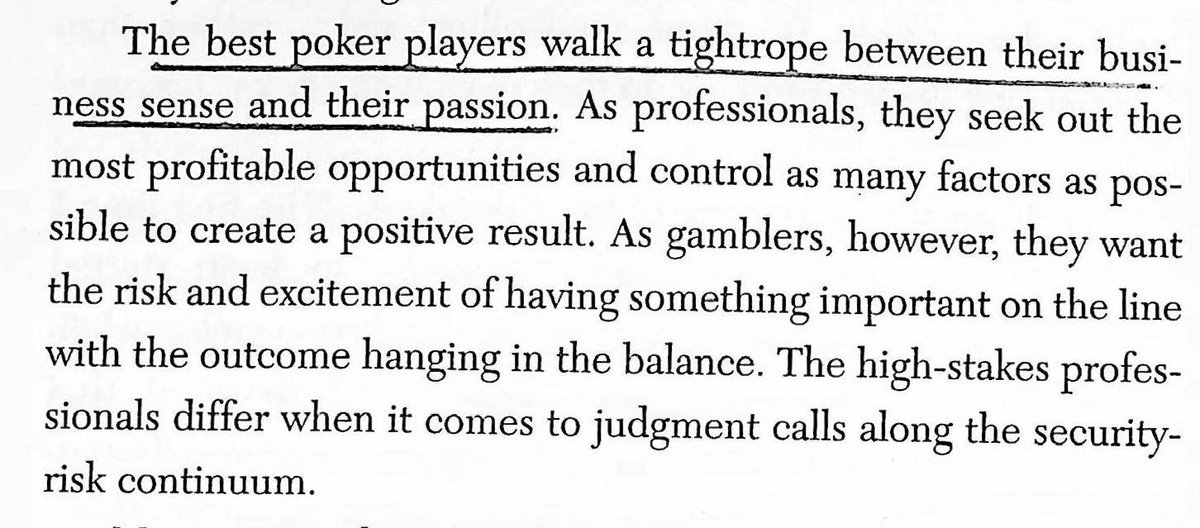

“Pride of opinion accounts for as many losses in the market as any other human factor. Traders, due to losses from previous trades in a stock, feel that the stock ‘owes them something’. They take gambling risks in order to ‘get even,’ in order to satisfy their pride or vanity.”

Druckenmiller: “around March 2000 I could feel it coming. I just- I had to play. I couldn’t help myself. I pick up the phone finally. I think I missed the top by an hour. I bought $6 billion worth of tech stocks, and in six weeks I had left Soros and I had lost $3 billion.”

“If the bias and trend survive the testing, both emerge stronger than ever...” George Soros

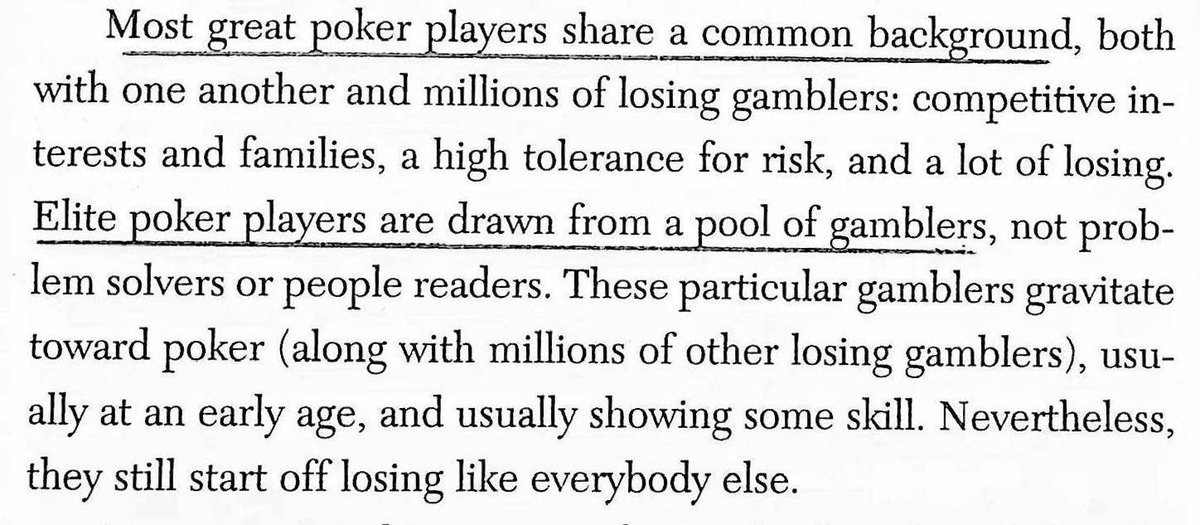

"You put positions on and then when the thesis starts to evolve and you see the momentum start to change in your favor, then you really go for it. You pile into the trade.” Druckenmiller

"You put positions on and then when the thesis starts to evolve and you see the momentum start to change in your favor, then you really go for it. You pile into the trade.” Druckenmiller

• • •

Missing some Tweet in this thread? You can try to

force a refresh