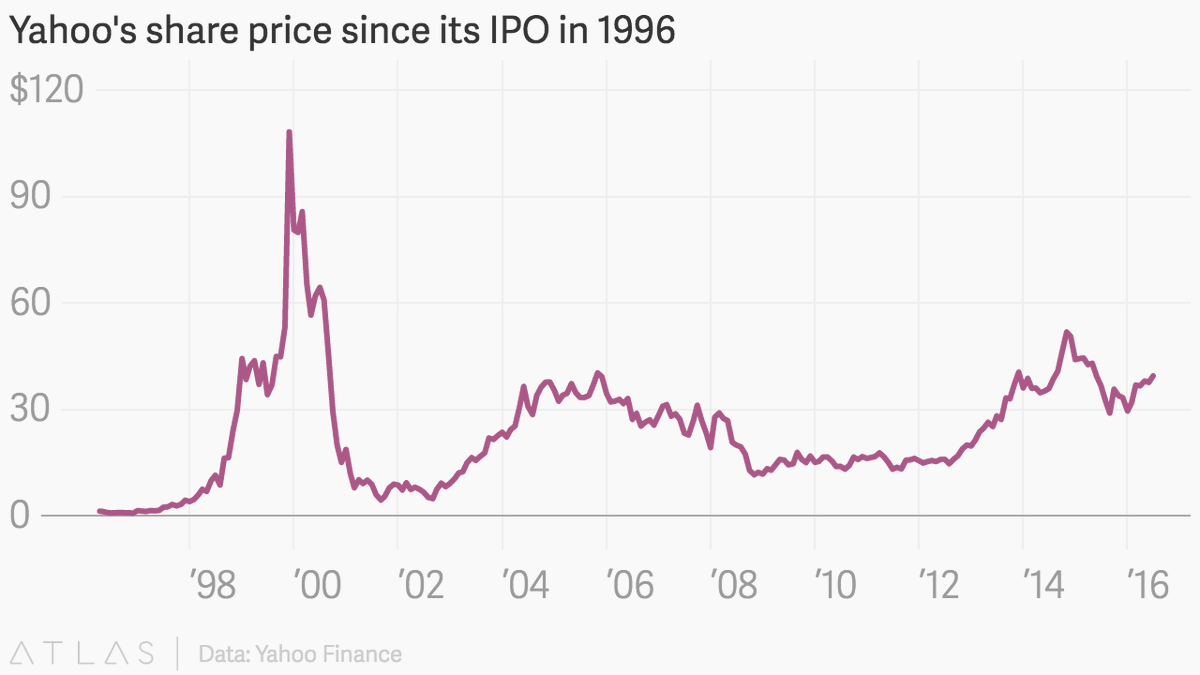

Is this right? Energy & materials with some of the highest average growth? Or is this projected NTM growth that just fails to materialize?

Energy only dividend yield above 20 year average.

Energy only dividend yield above 20 year average.

• • •

Missing some Tweet in this thread? You can try to

force a refresh