OK so: what is a gamma squeeze?

Suppose gamestop GME is trading at $20. You buy a bunch of call options with strike $30 from your market maker (MM)

You have a long call position on GME, so you profit if GME goes up

MM has a short call position, so MM loses money if GME goes up

Suppose gamestop GME is trading at $20. You buy a bunch of call options with strike $30 from your market maker (MM)

You have a long call position on GME, so you profit if GME goes up

MM has a short call position, so MM loses money if GME goes up

MM, however, doesn't actually want to take bets on GME. MM's trick is that MM takes a position in the underlying stock which hedges the call option. MM thus buys a bunch of GME stock. If GME goes up, MM loses money on her option position, but gains on her stock position

Any security based on GME is, in a very short span of time, simply a bet on whether GME will go up or down. Hence, you can hedge any security just by taking a position in GME. This is called "delta hedging"

(there is some subtlety here which I'll gloss over for now)

(there is some subtlety here which I'll gloss over for now)

The interesting thing about MM's position, however, is that its sensitivity to GME depends on the price of GME.

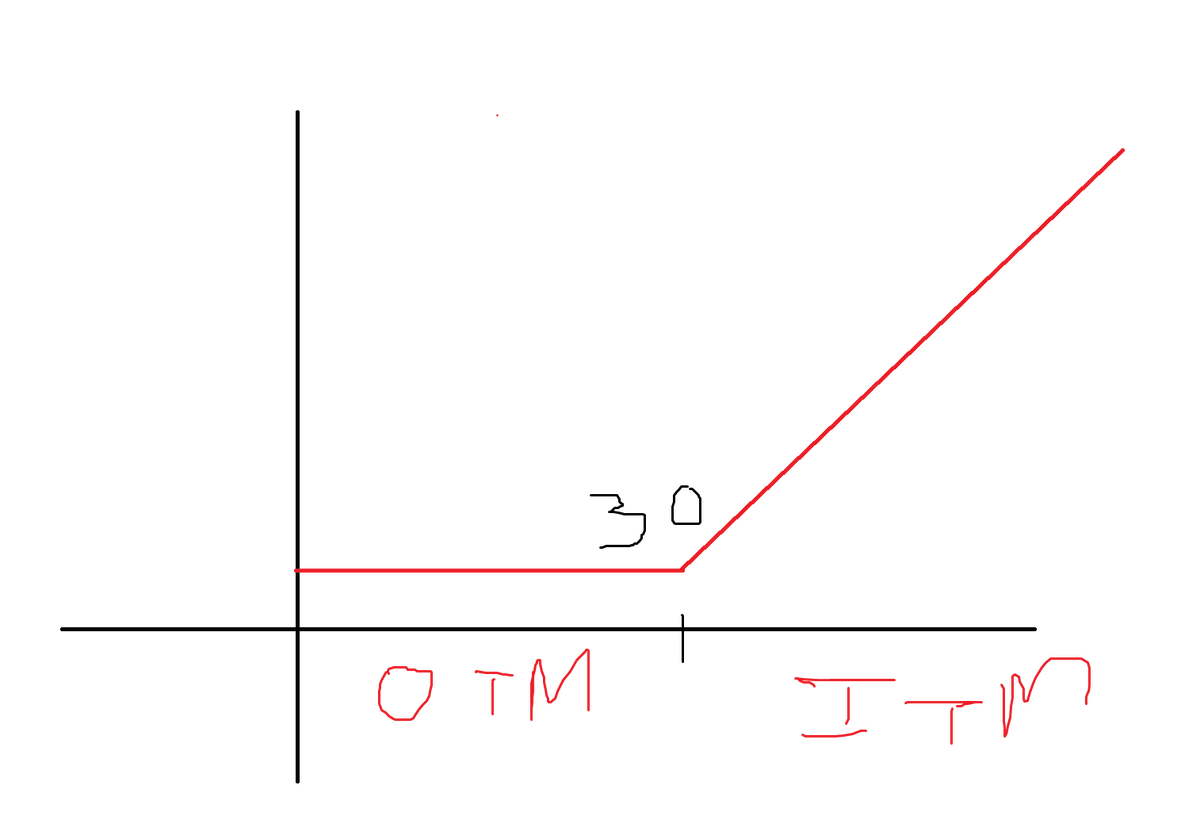

If GME is at $10, the option is probably worthless. It is worth 0 regardless of whether GME goes to $11 or $9. So MM doesn't need to hold much GME.

If GME is at $10, the option is probably worthless. It is worth 0 regardless of whether GME goes to $11 or $9. So MM doesn't need to hold much GME.

If GME is at $40 (call strike is $30), option is basically worth $40 - $30 = $10. If GME goes to $41, MM loses a dollar, $39, MM makes a dollar. So MM's option position is very sensitive to GME, and MM has to buy a whole share of stock to hedge

Option positions have nonlinear - convex - exposure to underlying. MM is more exposed when GME price is higher. To hedge, MM has to buy more GME stock if the price goes up to $40

The result, however, is that the MM has to buy more stock when GME price starts going up. Trades move markets! If MM is buying GME stock when it's moving up, it drives GME further upwards, and so on

Another more abstract way to understand this is the idea of "dynamic replication". Any option is essentially equivalent to trading the underlying stock in a certain way: an option can be thought of as a static position which replicates a dynamic trading strategy

The market maker can (in an ideal frictionless world) be thought of as a machine who translates your static option position into the dynamic trading strat in the underlying stock

A call option is expressing a dynamic strat which basically says "I will buy more exposure if the stock price goes up". The MM takes your static option and literally translates this into the dynamic trading strat in the GME stock

If there are a bunch of ppl who decide they want to buy when prices go up, this could will tend to push prices further up (and symmetrically for downswings), exacerbating "momentum"

Meaning upswings tend to be followed by upswings, and so on. So there's a hypothesis floating around that long option positions increase momentum, I retweeted a paper about this a while back

I've skipped over a bunch of stuff about vol, "model risk", etc. mostly since it's complicated and not super important for the current story imo, but the story is a bit more complicated than this

tl;dr: when there's lots of call option buying, this forces market makers to buy when prices go up and sell when prices go down, which can tend to create momentum (though the size of this effect overall, to my understanding, is still a subject of debate in the academic lit)

• • •

Missing some Tweet in this thread? You can try to

force a refresh