1/ If you've felt like stock market has been disconnected from reality for the past few days, you're not alone

this is the story of the magic bubble created by amatuer traders that broke a multibillion dollar hedge fund

this is the story of the magic bubble created by amatuer traders that broke a multibillion dollar hedge fund

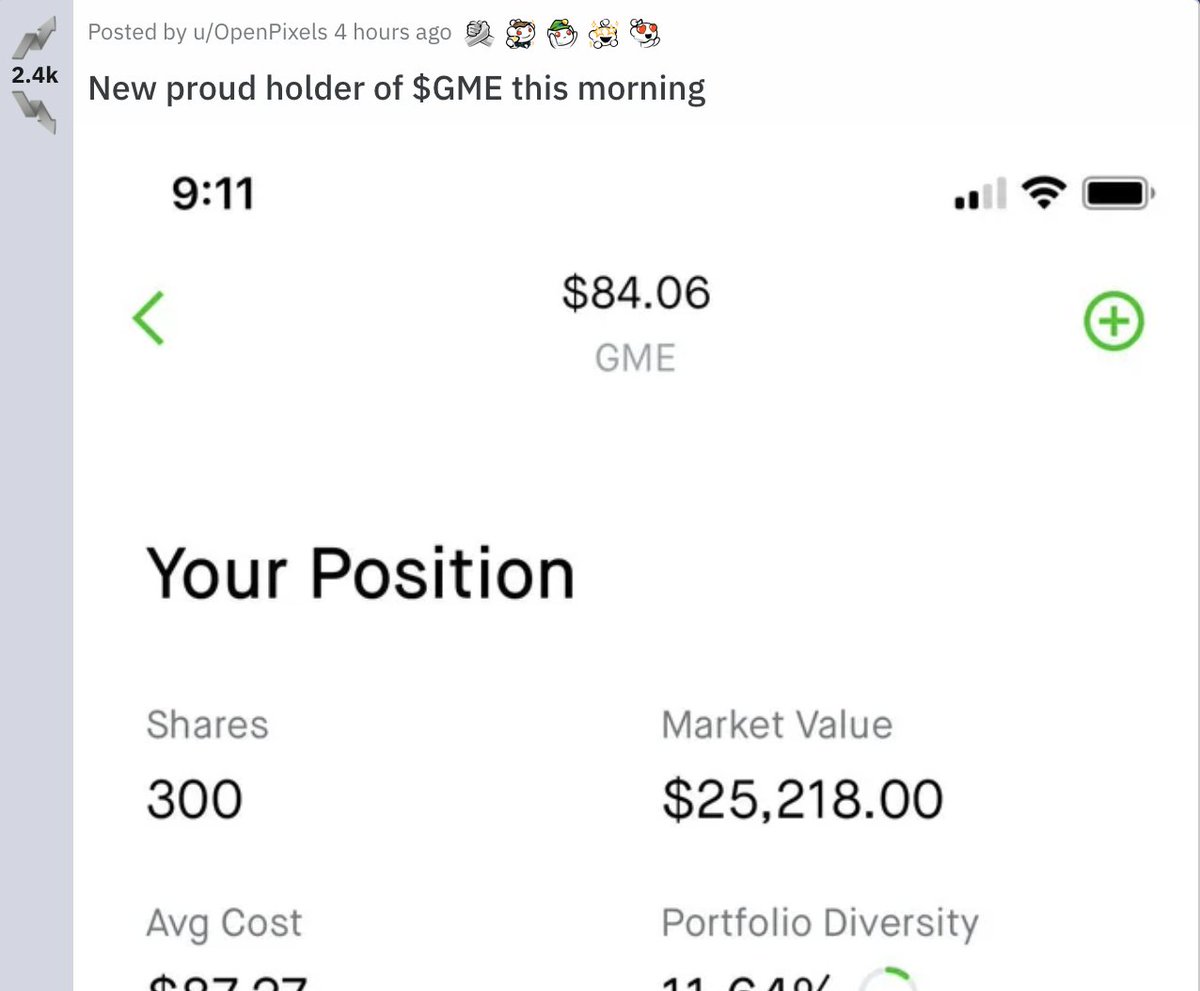

2/ To understand the market right now is to understand r/WallStreetBets

it's a 2.3 million person subreddit dedicated to memes and YOLO Tesla calls that relishes in the massive swings that come with risky trades

aka heaven for the hyperactive amateur trader

it's a 2.3 million person subreddit dedicated to memes and YOLO Tesla calls that relishes in the massive swings that come with risky trades

aka heaven for the hyperactive amateur trader

3/ The other main character in this saga is GameStop

it's a mall-based retailer that is saddled with debt ($450 million as of Q4 2020) and falling sales (down 40% in last 2 years)

essentially, it's the Blockbuster of video games waiting to be eaten by a Netflix

it's a mall-based retailer that is saddled with debt ($450 million as of Q4 2020) and falling sales (down 40% in last 2 years)

essentially, it's the Blockbuster of video games waiting to be eaten by a Netflix

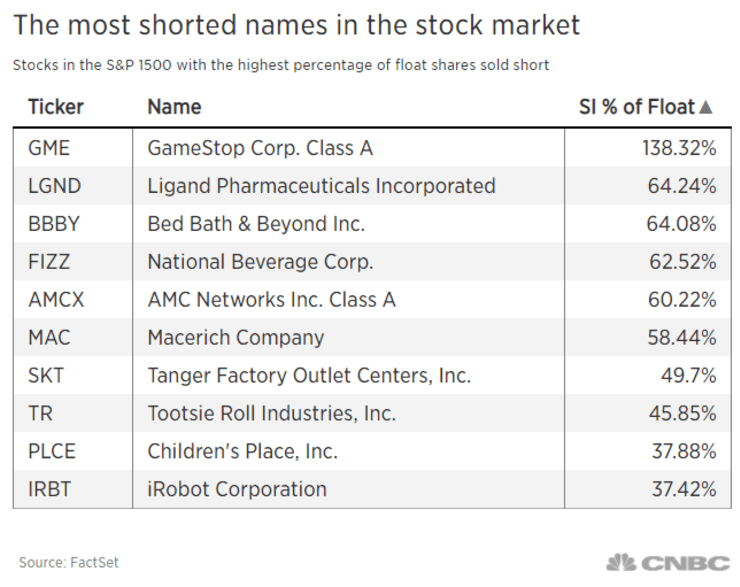

4/ So hedge funds have been shorting it

the pros on Wall Street saw a failing business and took positions where they would profit if the stock falls

in fact, it's the single most shorted stock in the entire Stock and S&P 500

the pros on Wall Street saw a failing business and took positions where they would profit if the stock falls

in fact, it's the single most shorted stock in the entire Stock and S&P 500

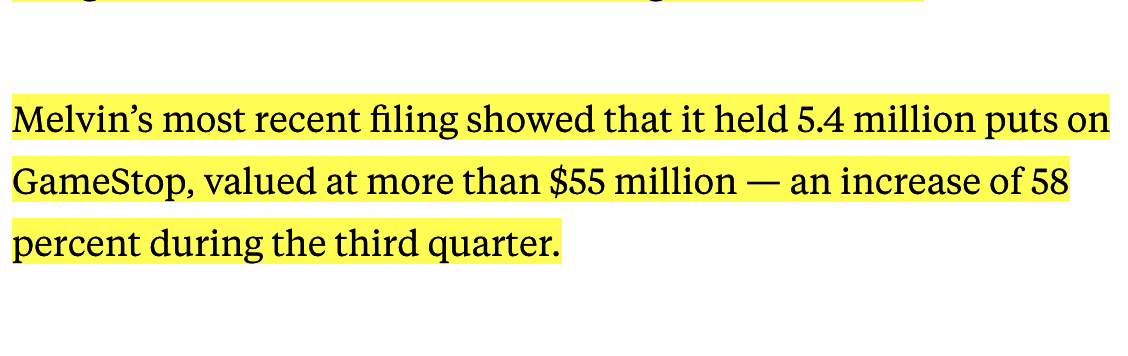

5/ One hedge fund in particular called Melvin Capital held a $55 million short position against GameStop

Melvin also held large short positions against National Beverage, iRobot, and Bed Bath & Beyond

big mistake

Melvin also held large short positions against National Beverage, iRobot, and Bed Bath & Beyond

big mistake

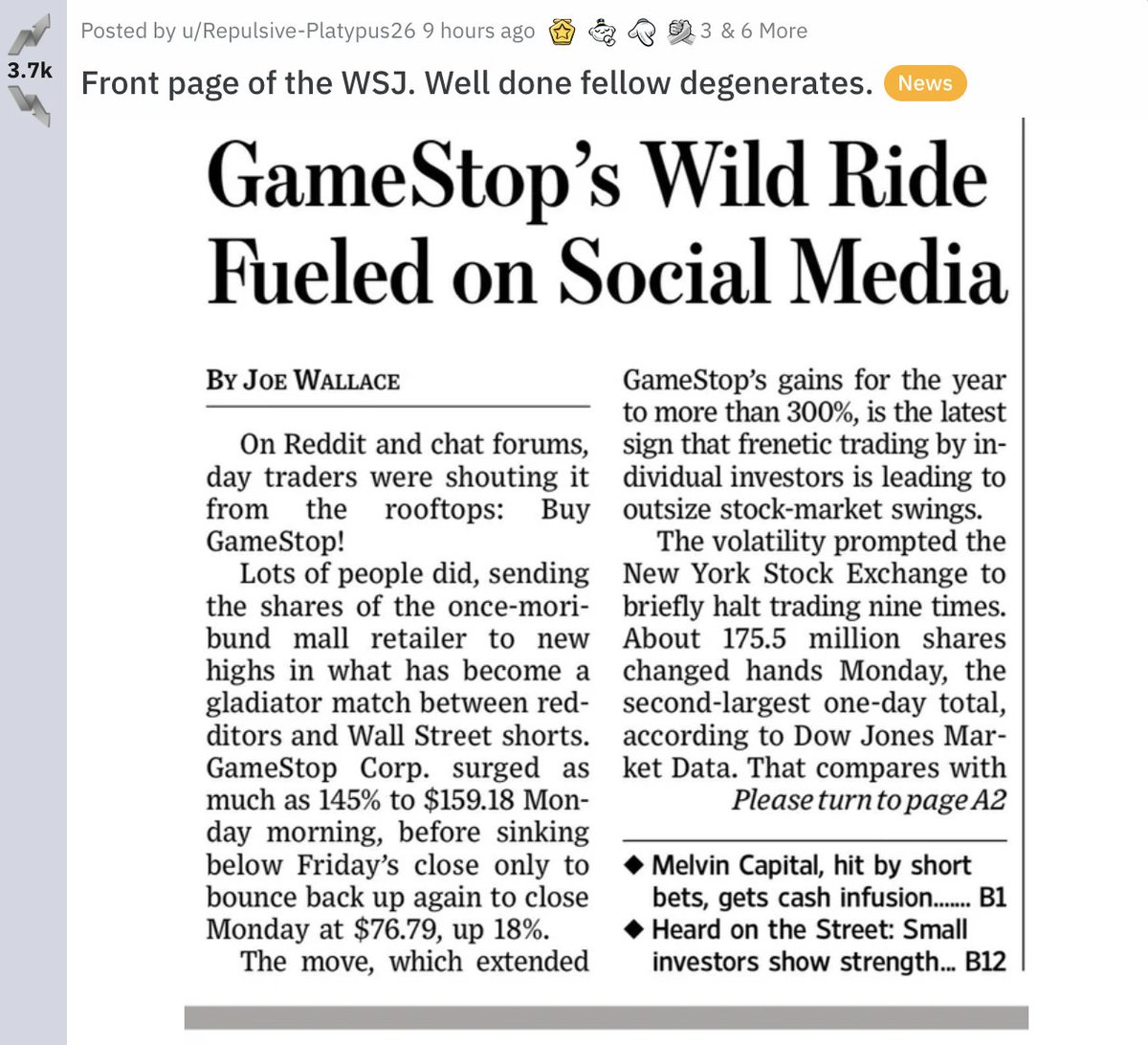

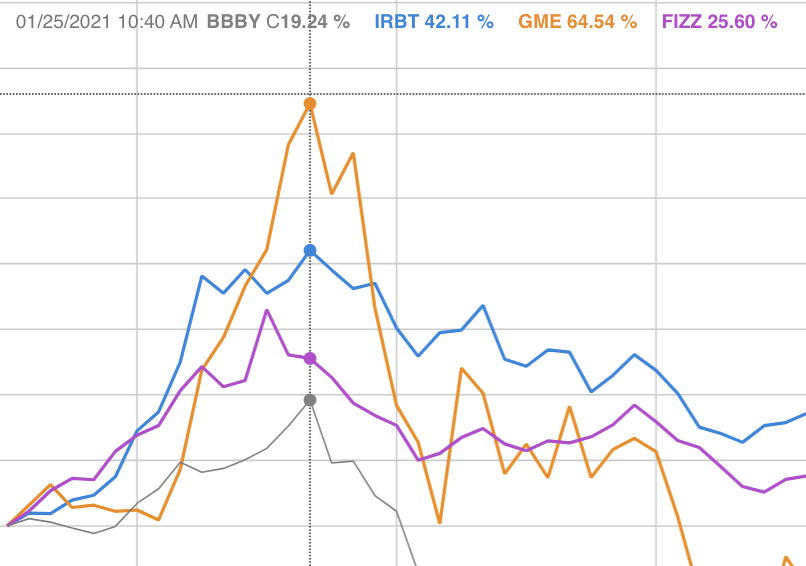

6/ Soon after the market opened yesterday, look what happened

GameStop: +64%

iRobot: +42%

Nat. Beverage: +26%

Bed, Bath & Beyond: +19%

Melvin got absolutely obliterated

GameStop: +64%

iRobot: +42%

Nat. Beverage: +26%

Bed, Bath & Beyond: +19%

Melvin got absolutely obliterated

7/ Who's behind these ridiculous swings?

r/WallStreetBets

they had seen Melvin's shorts and mobilized en masse to blow them up

and yes, it's possible for the little guy to take on a multi-billion dollar hedge fund right now

r/WallStreetBets

they had seen Melvin's shorts and mobilized en masse to blow them up

and yes, it's possible for the little guy to take on a multi-billion dollar hedge fund right now

8/ Melvin got caught in a short squeeze

as traders piled into GameStop, Melvin was forced to buy shares to cut some of its losses...which only drove the price higher

and remember, GameStop is a failing business

this was just r/WallStreetBets flexing on "the establishment"

as traders piled into GameStop, Melvin was forced to buy shares to cut some of its losses...which only drove the price higher

and remember, GameStop is a failing business

this was just r/WallStreetBets flexing on "the establishment"

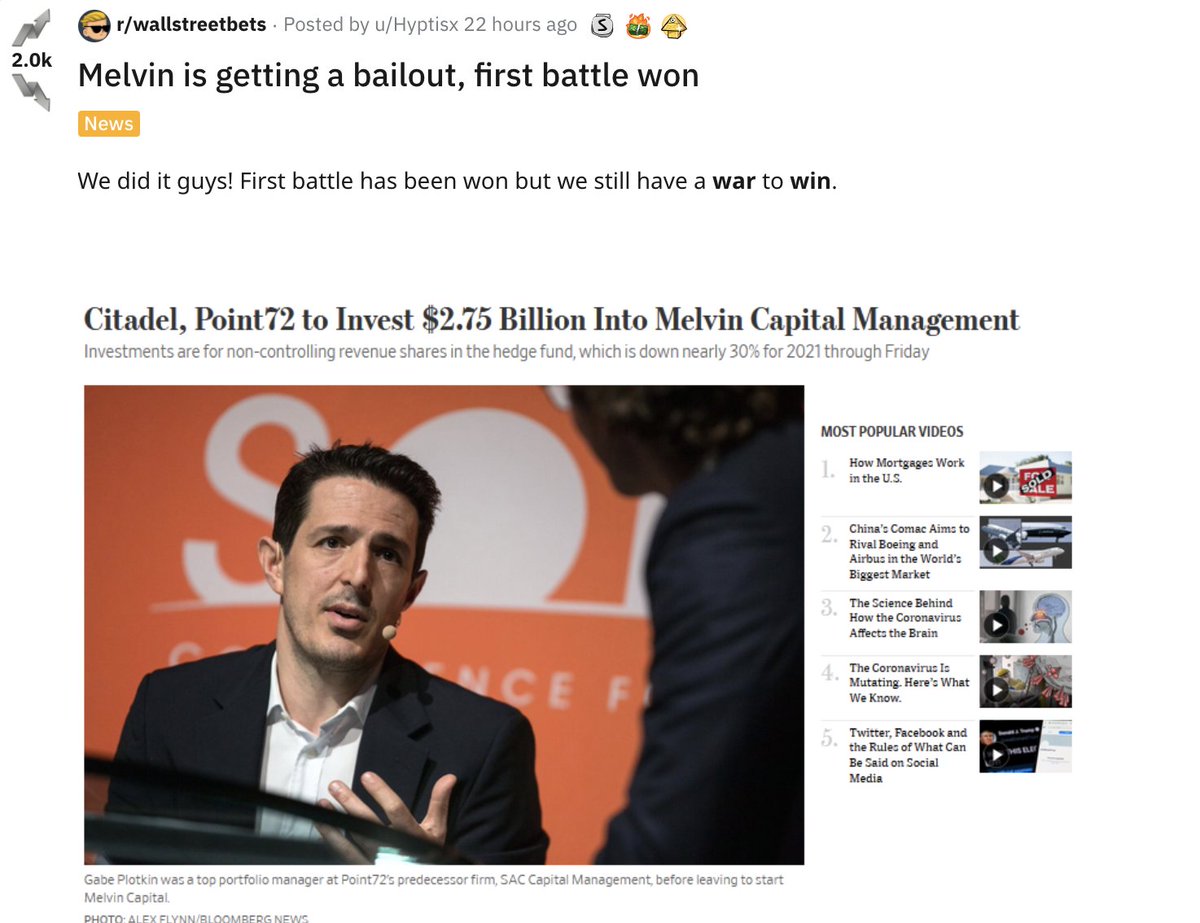

9/ And poor Melvin?

after averaging a 30% yearly return since it was founded in 2014, its DOWN 30% to start the year

it had to take in $2.75 billion in outside funding to stay afloat

after averaging a 30% yearly return since it was founded in 2014, its DOWN 30% to start the year

it had to take in $2.75 billion in outside funding to stay afloat

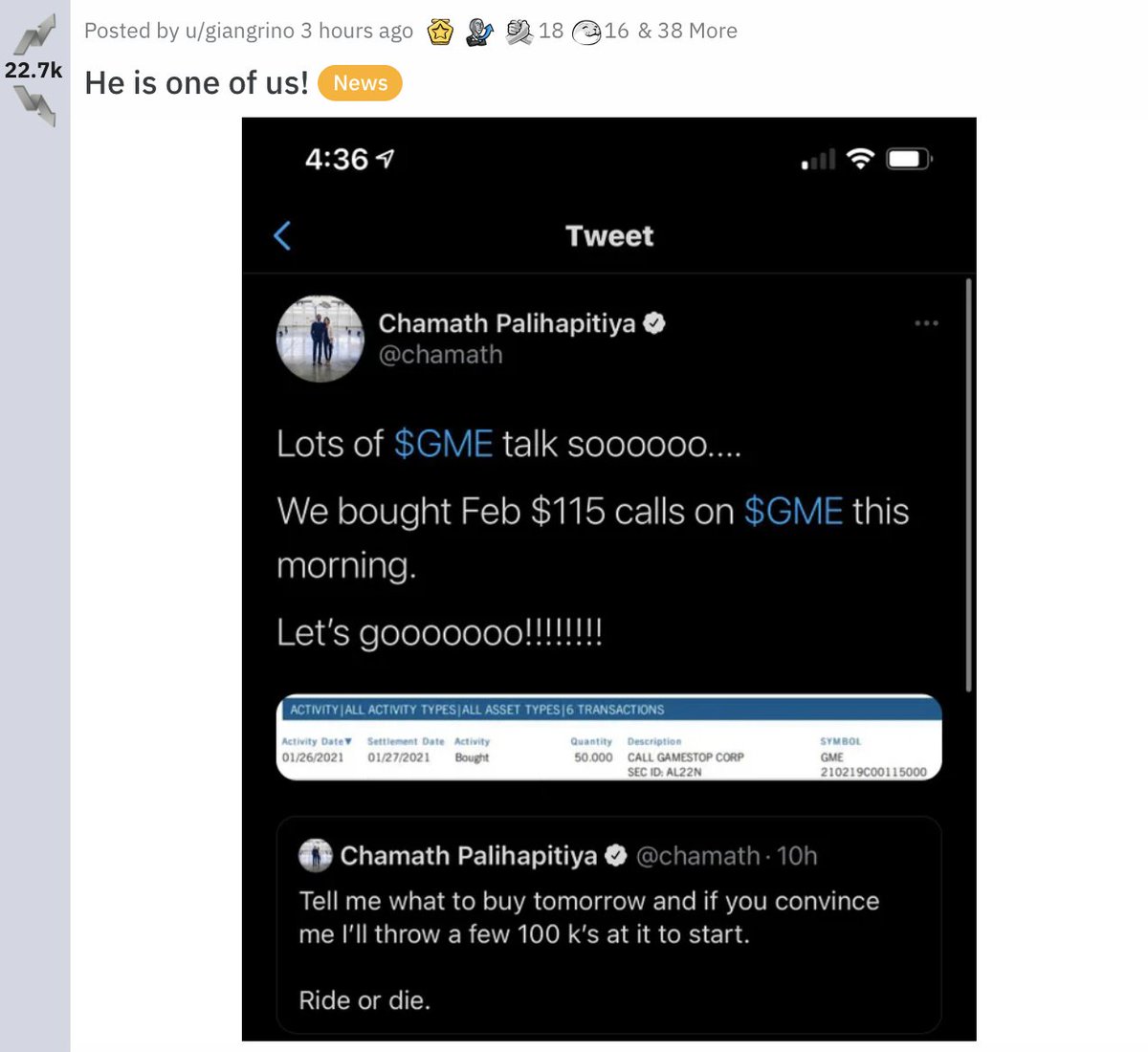

10/ GameStop's crippled one hedge fund, but ain't done yet

earlier today, billionaire investor @chamath bought $115 call options meaning he thinks the stock will keep on rising

despite his slightly tongue and cheek bullishness, the stock is skyrocketing once more today

earlier today, billionaire investor @chamath bought $115 call options meaning he thinks the stock will keep on rising

despite his slightly tongue and cheek bullishness, the stock is skyrocketing once more today

11/ It's been a wild few days, completely detached from reality

but if GameStop teaches us one thing

it's that technology has leveled the playing field

the little guy can now mobilize online and go to-to-toe—and win—against the heaviest hitters on Wall Street

but if GameStop teaches us one thing

it's that technology has leveled the playing field

the little guy can now mobilize online and go to-to-toe—and win—against the heaviest hitters on Wall Street

• • •

Missing some Tweet in this thread? You can try to

force a refresh