Short selling in the 80's sounds so much less exciting compared to today.

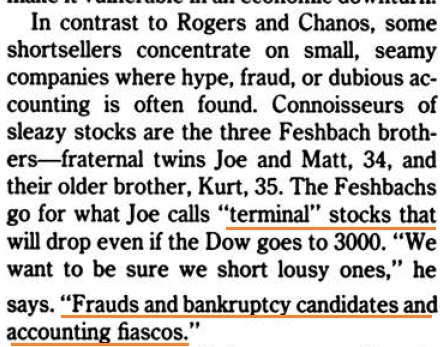

Go for terminal stocks (“frauds, bankruptcy candidates, accounting fiascos”) and complain they don't answer your calls, “it’s as if you were calling up the CEO to ask if someone in his family has AIDS”

Go for terminal stocks (“frauds, bankruptcy candidates, accounting fiascos”) and complain they don't answer your calls, “it’s as if you were calling up the CEO to ask if someone in his family has AIDS”

Daily game of basketball for @WallStCynic

"asset values are contingent, debt is forever"

“stupendously leveraged, no operating earnings, a stock price dependent on asset values that were not sustainable”

"asset values are contingent, debt is forever"

“stupendously leveraged, no operating earnings, a stock price dependent on asset values that were not sustainable”

“why don’t you just be happy and buy stocks?”

Because it's more satisfying..

"see the optimists in disarray when the preposterous claims and cockeyed accounting explode in their faces"

Because it's more satisfying..

"see the optimists in disarray when the preposterous claims and cockeyed accounting explode in their faces"

"see themselves as outsiders"

"when the hostility and and envy cascade upon them, they see it as proof that they are getting the kind of attention they deserve"

Shorting “it’s not sympathetic to the American philosophy, which is positive” aka 'it's un-American'

"when the hostility and and envy cascade upon them, they see it as proof that they are getting the kind of attention they deserve"

Shorting “it’s not sympathetic to the American philosophy, which is positive” aka 'it's un-American'

“Go to Harry’s Bar and see the gigantic amount of pumping that goes on for stocks people own. Lies being told. Exaggeration and hyperbole.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh