1) Portfolio summary - Jan-end

$ACTC $ADYEY $AFTPY $BAINF $BIB $CRWD $CURI $DKNG $DOCU $FUBO $IPOE $MELI $OPEN $OZON $PINS $ROKU $SE $SHOP $SKLZ $SNOW $SQ $STNE $TWLO $VRM

Return since 1 Sep'16 -

A/c +608.25%

$ACWI +56.82%

$SPX +71.10%

Cont..

$ACTC $ADYEY $AFTPY $BAINF $BIB $CRWD $CURI $DKNG $DOCU $FUBO $IPOE $MELI $OPEN $OZON $PINS $ROKU $SE $SHOP $SKLZ $SNOW $SQ $STNE $TWLO $VRM

Return since 1 Sep'16 -

A/c +608.25%

$ACWI +56.82%

$SPX +71.10%

Cont..

2) CAGR since inception (1 Sep 2016) -

Portfolio +55.73%

$ACWI +10.72%

$SPX +12.92%

YTD return -

Portfolio +12.56%

$ACWI (-)0.31%

$SPX (-)1.11%

Contd...

Portfolio +55.73%

$ACWI +10.72%

$SPX +12.92%

YTD return -

Portfolio +12.56%

$ACWI (-)0.31%

$SPX (-)1.11%

Contd...

3) Biggest positions -

1) $BIB 2) $SE 3) $MELI 4) $IPOE 5) $AFTPY

Commentary -

During the month, I made a few changes --> sold a few over-extended/richly valued payments/software stocks and bought into some new high-growth, more reasonably valued listings....

1) $BIB 2) $SE 3) $MELI 4) $IPOE 5) $AFTPY

Commentary -

During the month, I made a few changes --> sold a few over-extended/richly valued payments/software stocks and bought into some new high-growth, more reasonably valued listings....

4) Over the past few months, a number of my stocks tripled or quadrupled and their recent valuations made up uncomfortable, which is why I booked my gains and re-allocated capital to more fairly valued businesses (which due to their lower multiples have the potential to triple...

5) or quadruple over the following months/years.

Most recently, after a run up from $10 to $40+ within 2-2.5 months, I also sold my entire stake in $PLTR which is now trading ~65 times TTM revenue! $PLTR is a great business but its 'only' forecast to grow ~30%CAGR...

Most recently, after a run up from $10 to $40+ within 2-2.5 months, I also sold my entire stake in $PLTR which is now trading ~65 times TTM revenue! $PLTR is a great business but its 'only' forecast to grow ~30%CAGR...

6) over the next 4-5 years and this implies that the recent quadrupling of its share price has already pulled forward most its gains.

Elsewhere, after conducting more DD, I didn't feel comfortable with $TRIT and early in the month, I sold off my entire position...

Elsewhere, after conducting more DD, I didn't feel comfortable with $TRIT and early in the month, I sold off my entire position...

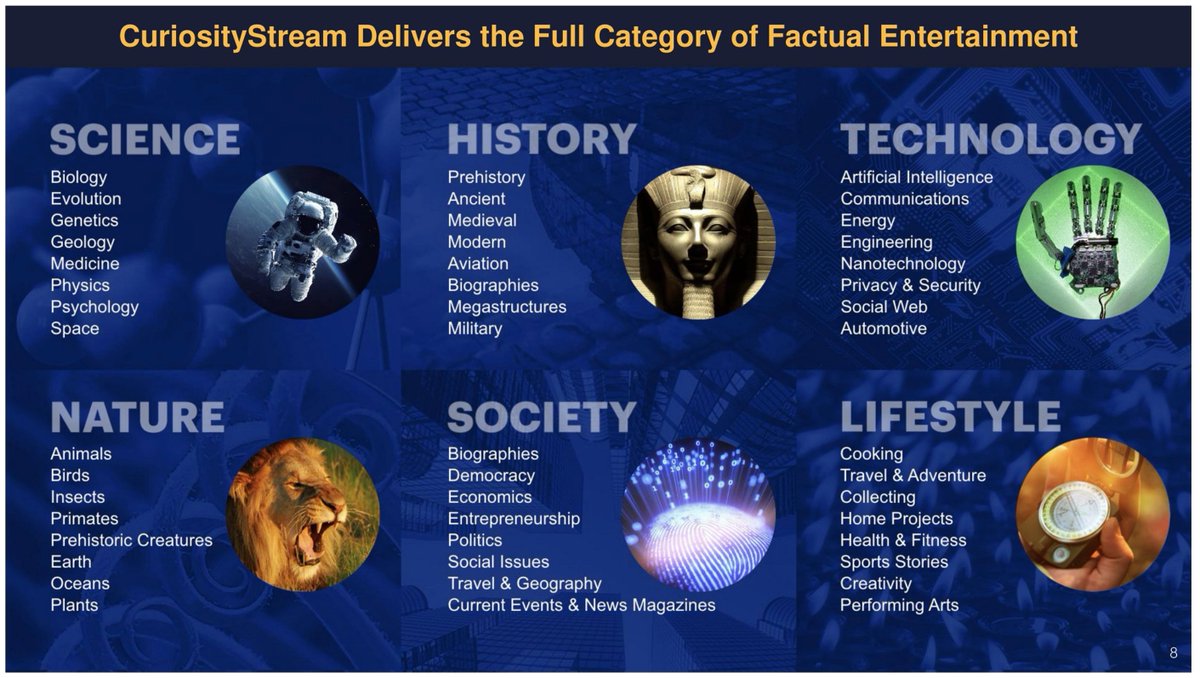

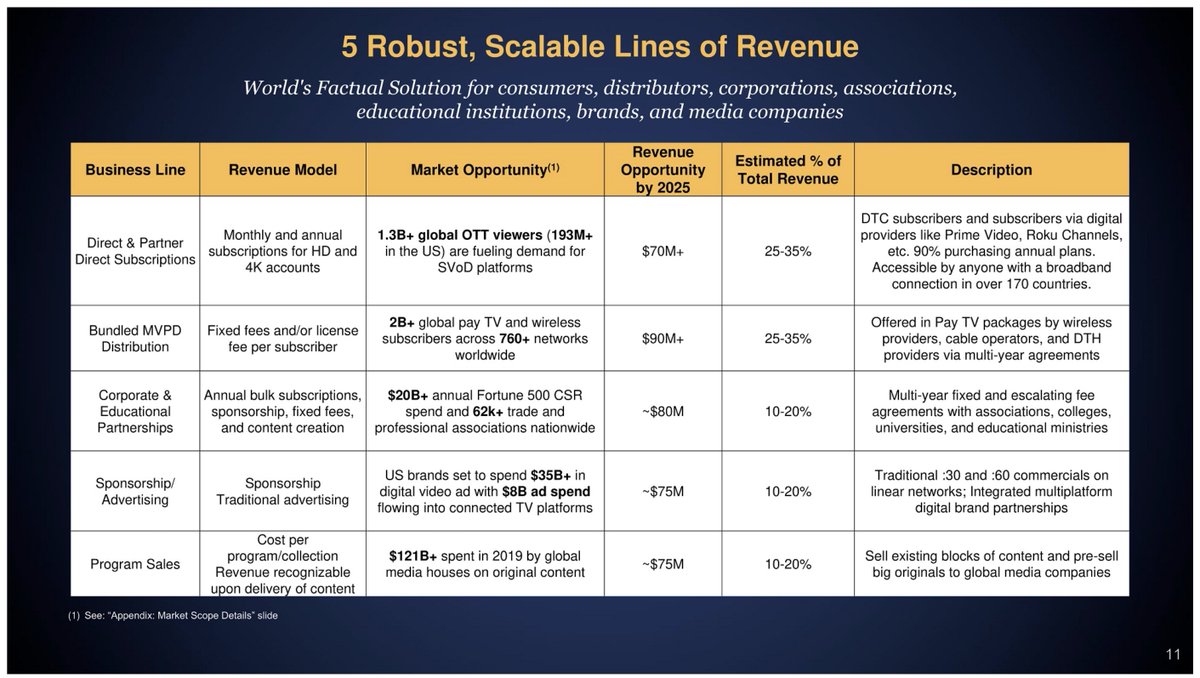

7) In terms of new positions, I bought into $CURI and also three of Chamath's new deals - $ACTC $OPEN $IPOE - which appeared promising and reasonably valued and just a few days ago, after the 35% decline in $SNOW, I re-invested in the company.

On the surface, $SNOW appears...

On the surface, $SNOW appears...

8) absurdly valued but this is a compounding machine and is forecast to generate ~$4.5-5b revenue in 4-5 years. Astonishingly, analysts are expecting that this business will be growing ~50-60%YOY at that ARR! Finally, IMHO this business probably has the best management team...

9) in enterprise software and this is why I've bought back shares despite the super high multiple.

My overall portfolio has gotten off to a good start in '21 - mid-month it was +20%YTD and it has ended the month with a 12.56% gain which is very satisfactory given the flat...

My overall portfolio has gotten off to a good start in '21 - mid-month it was +20%YTD and it has ended the month with a 12.56% gain which is very satisfactory given the flat...

10) YTD returns from both the $ACWI and $SPX.

Since inception (1 September 2016), when I started running this high-growth personal portfolio post retirement, my portfolio has septupled (7 bagger in 4 years/5 months) which equates to a CAGR of 55.73%.

Goes without...

Since inception (1 September 2016), when I started running this high-growth personal portfolio post retirement, my portfolio has septupled (7 bagger in 4 years/5 months) which equates to a CAGR of 55.73%.

Goes without...

11) saying that I'm delighted with the returns which have far exceeded my expectations!

These returns have been achieved by investing in exciting, high growth companies, use of a little bit of leverage and a systematic hedging strategy which has reduced my drawdowns...

These returns have been achieved by investing in exciting, high growth companies, use of a little bit of leverage and a systematic hedging strategy which has reduced my drawdowns...

12) In other words, these returns have come from good ol' investing or ownership of world-class high growth businesses. FYI - I haven't dabbled in options so these returns haven't been artificially juiced.

What can I say except that the teachings of Phil Fisher, Peter Lynch...

What can I say except that the teachings of Phil Fisher, Peter Lynch...

13) Warren Buffett and Charlie Munger are still valid and Tom Basso's brilliant hedging strategy which I adopted several years ago still works. I am forever grateful to these brilliant minds who've helped me greatly in devising my own investment strategy...

14) Turning to the broad market, we have recently seen a lot of volatility and this is largely due to the de-grossing (forced liquidation) by those hedge funds which were caught in the various short squeezes. Hopefully, this will calm down in the near future...

15) The Fed has already made it clear that it'll keep buying assets for the foreseeable future and the new administration has just announced a big fiscal stimulus.

Given this backdrop, I believe the bull market is still intact, which is why I'm 120% long (no hedges).

The end.

Given this backdrop, I believe the bull market is still intact, which is why I'm 120% long (no hedges).

The end.

• • •

Missing some Tweet in this thread? You can try to

force a refresh