THREAD - Info on new positions -

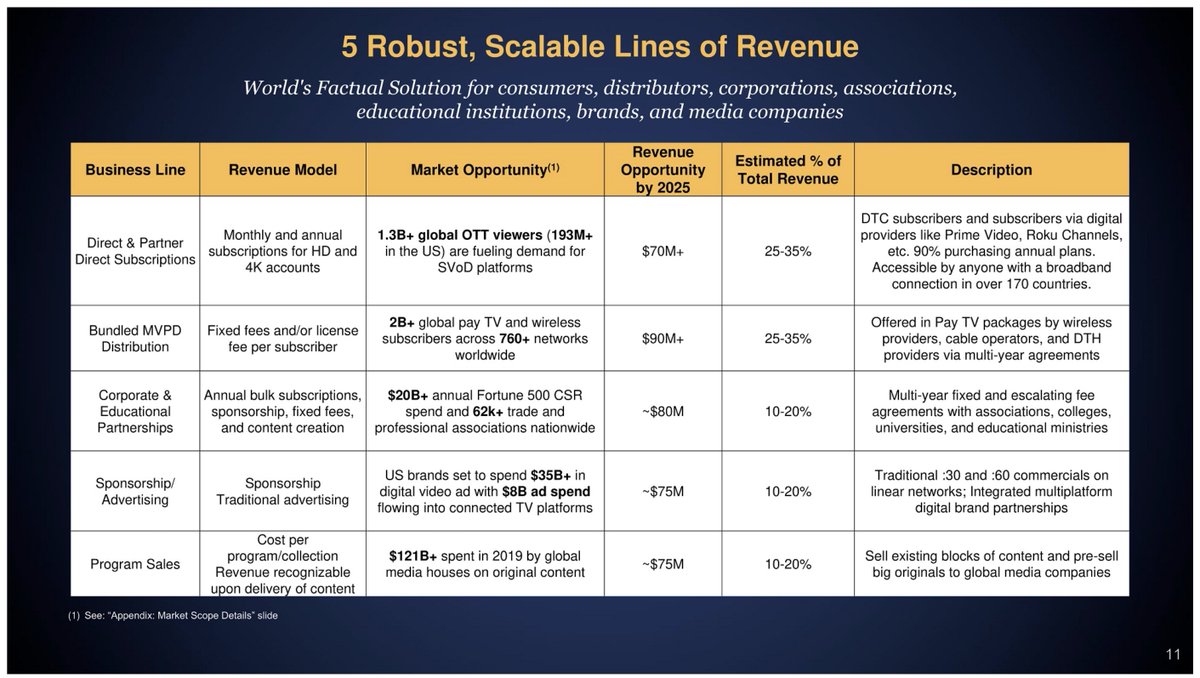

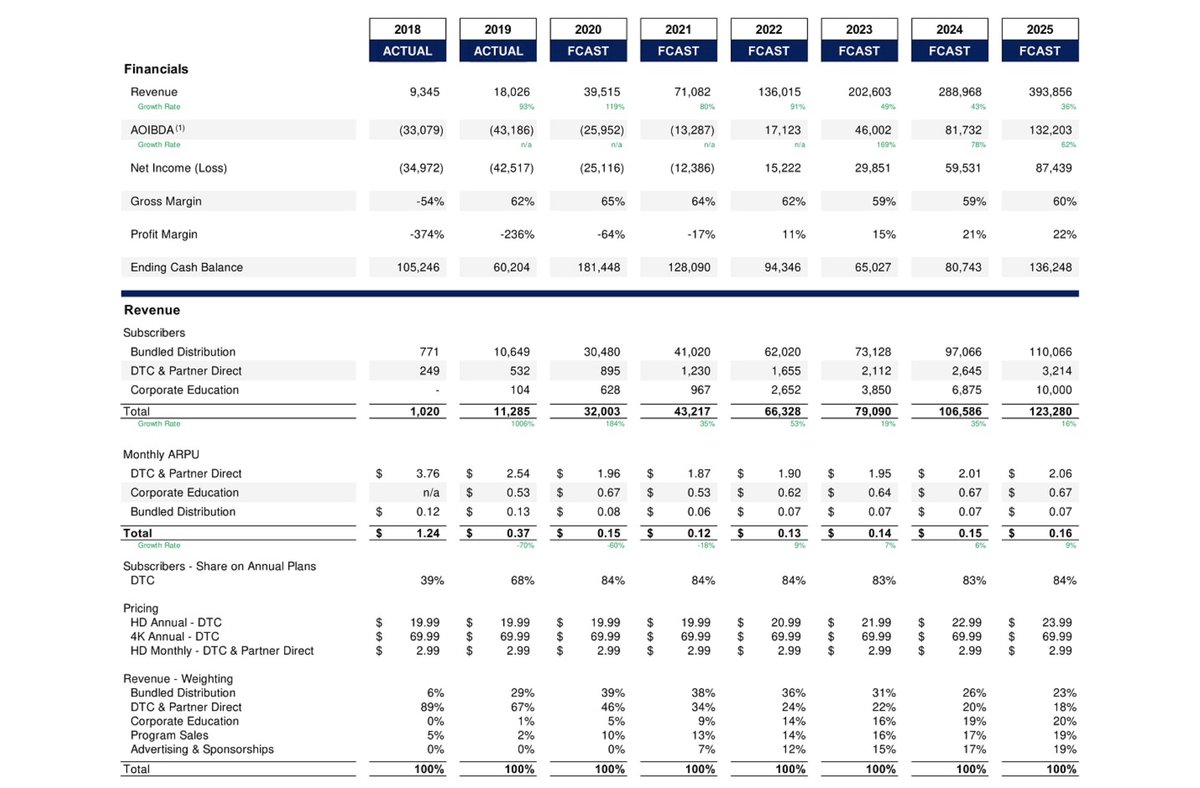

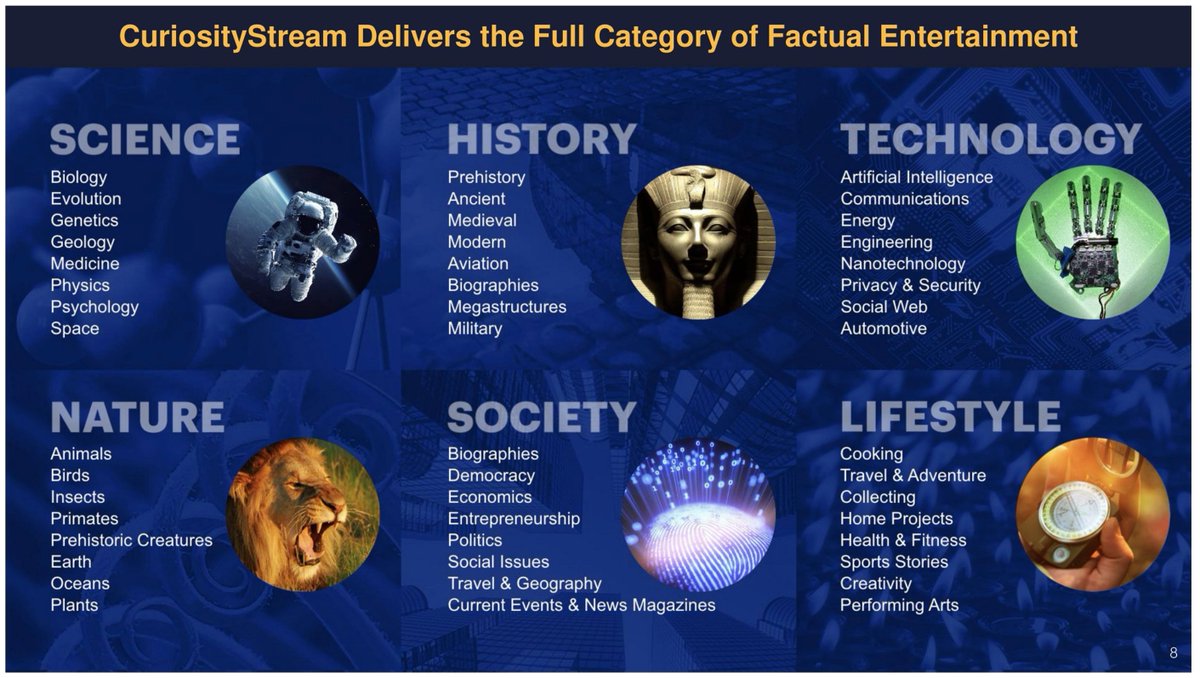

1) $CURI - Factual content streaming service

H/T @OphirGottlieb for the idea

1) $CURI - Factual content streaming service

H/T @OphirGottlieb for the idea

$IPOE (SoFi) - Long-term model and margin profile -

H/T to @chamath for arranging these deals

Disclosure - I own shares of all these businesses, am biased and this is not investment advice/recommendation. Do your own DD, its your money (profits/losses are also yours).

H/T to @chamath for arranging these deals

Disclosure - I own shares of all these businesses, am biased and this is not investment advice/recommendation. Do your own DD, its your money (profits/losses are also yours).

• • •

Missing some Tweet in this thread? You can try to

force a refresh