While we are in the first great consolidation of the 2021 bull market, here's a bunch of charts to get the feel of where we are in this bull cycle.

👇

👇

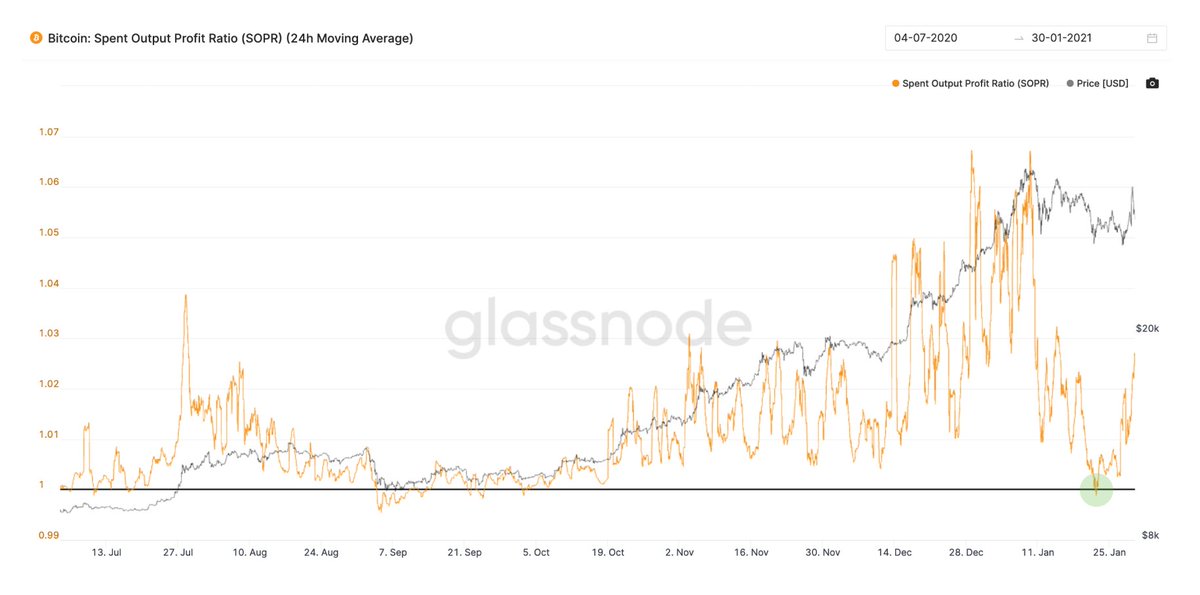

SOPR tracks profit-taken when coins being sold. It hit the 1.0 line which means we completely reset. To go lower we'd need to have investors sell at a loss. This would need a bear phase (that's is NOT on the cards with the current setup)

Here's how it looks in the longer time frame (1 week SOPR). Pretty close to a full reset, Elon kind of screwed with it, bounced us early.

On-chain RSI is in the lower band for this phase of the bull market. Pretty close to a full reset. The price is no longer overheated.

An indication of the sheer numbers of new Bitcoin users arriving here. Even during this consolidation, new users arriving per day is higher than any other time in this bull market.

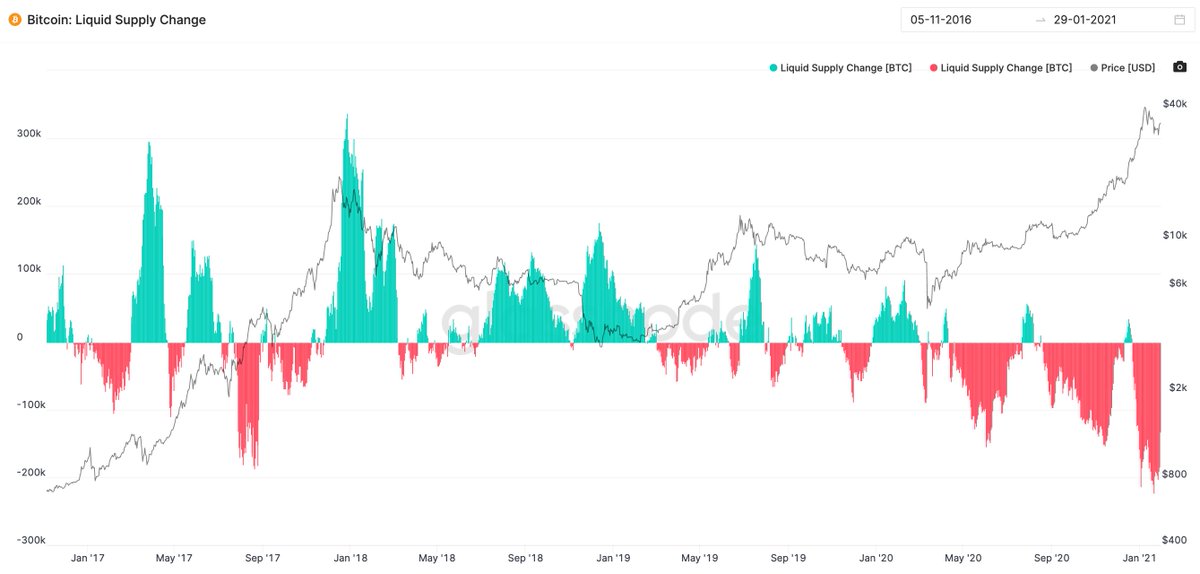

Coin buyers right now are extremely strong HOLDers. Coins moving to RED means HODLers who seldom sell.

With the current flows of capital coming in, the consolidation floor is expected to be $29k on daily closes (short of a black swan event), upper bound would be $56k (but rising quickly each day).

Charts via @glassnode

Charts via @glassnode

• • •

Missing some Tweet in this thread? You can try to

force a refresh