🔟Investing Philosophies I greatly admire. Learning from the best Investing Teams out there (that match your Philosophy/Strategy) and improving your own process is one of the best investing hacks. What are some others that you admire?

🔟of my principles at the end.

⬇️⬇️

🔟of my principles at the end.

⬇️⬇️

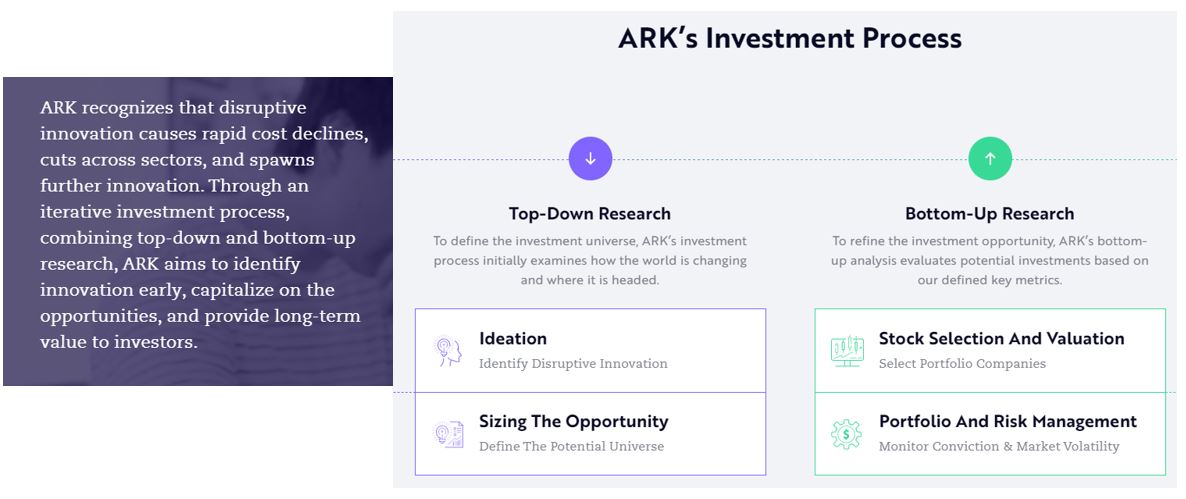

Bonus : @ARKInvest

The core principles of investing aren't too many, and doesn't change too often.

Below are my quick useful🔟principles.

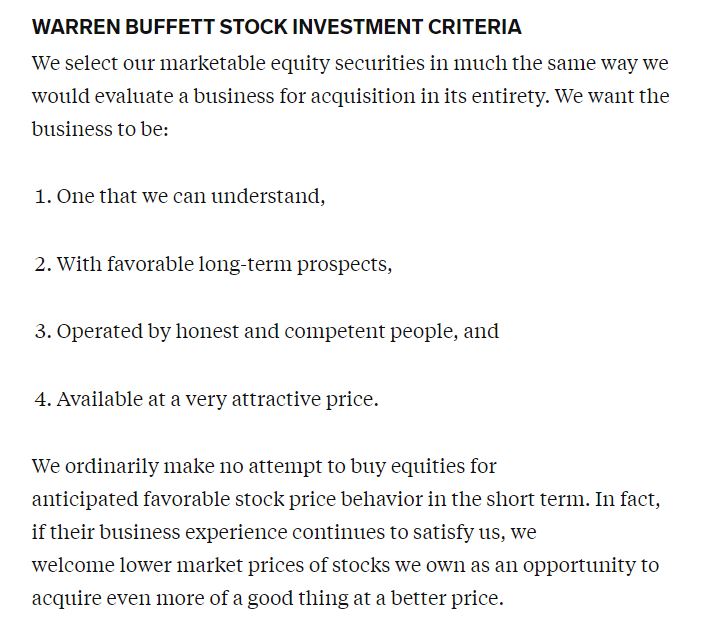

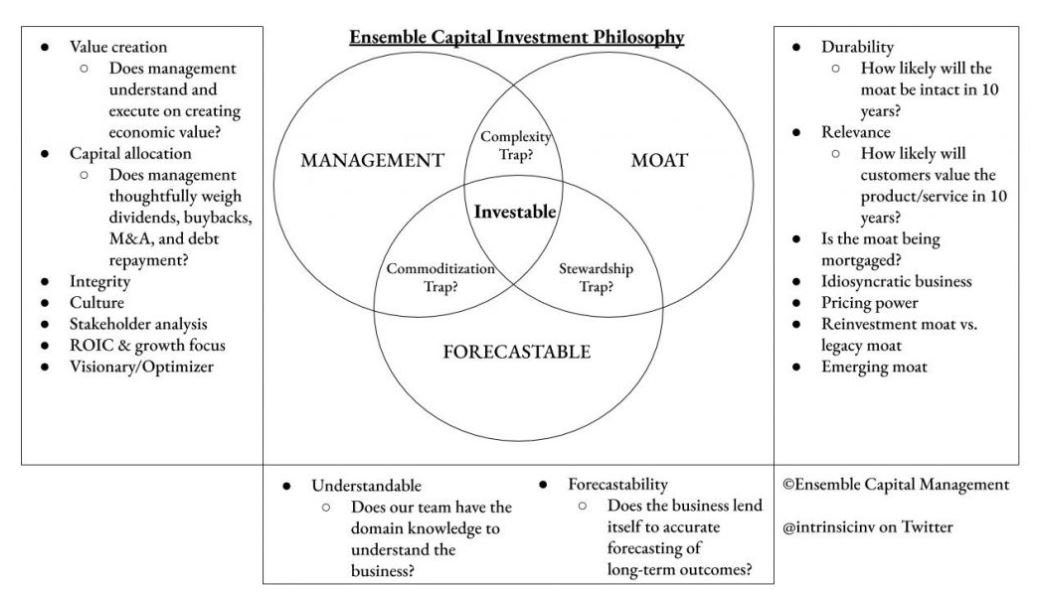

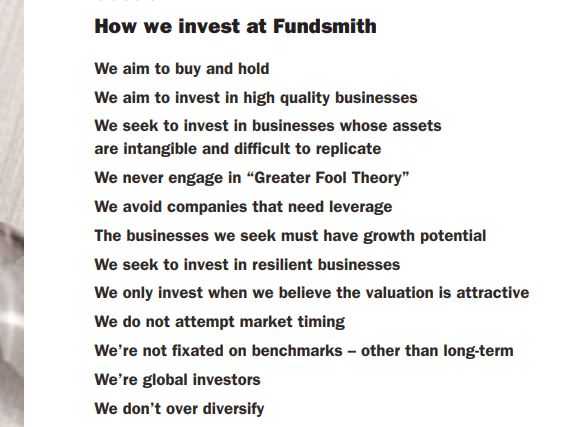

1⃣ Focus on Understandability (& circle of competence), Quality, Durability, Growth & Competitive advantages/Moats.

Below are my quick useful🔟principles.

1⃣ Focus on Understandability (& circle of competence), Quality, Durability, Growth & Competitive advantages/Moats.

2⃣ Focus on Financial strength, cash generation capability along with long runway and high re-investment opportunity.

3⃣ Focus on Management - Integrity, Capability, Vision, Incentives alignment and long-term orientation.

3⃣ Focus on Management - Integrity, Capability, Vision, Incentives alignment and long-term orientation.

4⃣ Learn how to interpret the Financial Statements of a Company, given it's growth stage/life cycle, Industry and what it's actual goals currently are.

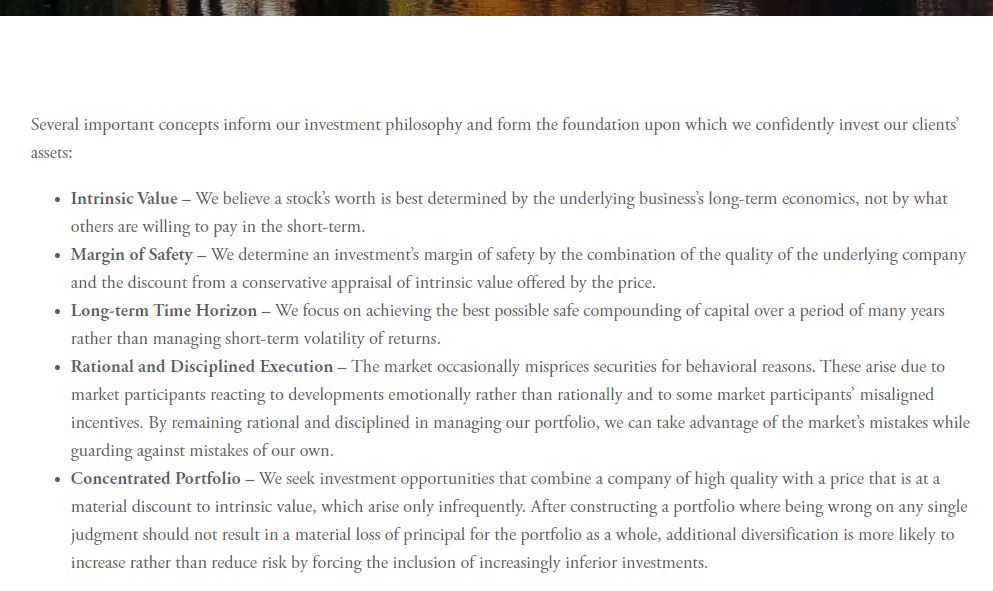

5⃣ Respect Valuation (but that doesn't always have to mean purely statistical/backward looking metrics).

5⃣ Respect Valuation (but that doesn't always have to mean purely statistical/backward looking metrics).

6⃣ Keep an eye on innovation, disruption and major trends helping/hurting your holdings and prospective Co's.

7⃣ Portfolio Concentration towards the best ideas based on conviction & return potential.

7⃣ Portfolio Concentration towards the best ideas based on conviction & return potential.

8⃣ Think & act long-term. Rational & disciplined execution. Time & patience given to great businesses will generally be rewarded with great returns.

9⃣ Keep an open mind. Respect well researched contrary opinions.

Learn from various good resources, but always make your own decisions.

Learn from your mistakes & move on. Do not try to justify your past mistakes if the facts are no longer aligned with them.

Learn from various good resources, but always make your own decisions.

Learn from your mistakes & move on. Do not try to justify your past mistakes if the facts are no longer aligned with them.

🔟Accept Volatility as part of the journey and even take advantage of it.

Moderating your fear (during bad times) and greed (during good times) will ensure survival and long-term success.

Hope this was helpful.

/END.

Moderating your fear (during bad times) and greed (during good times) will ensure survival and long-term success.

Hope this was helpful.

/END.

• • •

Missing some Tweet in this thread? You can try to

force a refresh