1/ Right after a massive Friday Deribit month-end option expiry, Elon Musk released a cryptic (somewhat bullish) tweet, causing a huge squeeze higher in BTC price. This closed out a strange week in markets marked by social media-engineered squeezes in tickers like GME & DOGE.

On this 'Elon rally' BTC rose by $120bn in mkt cap on the tweet alone, roughly 2/3 of Elon's net worth before coming off highs but closing higher on the day - market seems to have priced in possibility that Microstrat's rocket scientist has won Musk over to the Bitcoin camp.

3/ For us Elon Musk's twitter has always been his crazy alter-ego and the tweet might be cheekiness more than anything. We treat it as near-term volatility spike similar to observations the last 2-3 weeks. We don't believe that it changes any medium-to-long term market dynamics

4/ Not until we see Elon Musk back this up with indications that he personally, or one of his companies has bought or plans to buy significant amounts. In the meantime, internal market dynamics will still govern medium-term price action.

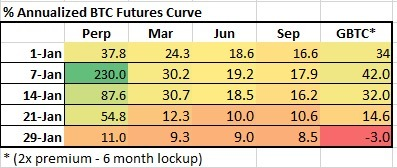

5/ On that front, we have been seeing a significant deleveraging process in the market continue since BTC priced topped out in the first week of Jan. The BTC futures curve has continued to flatten, a sign the euphoria in the market is exhausted.

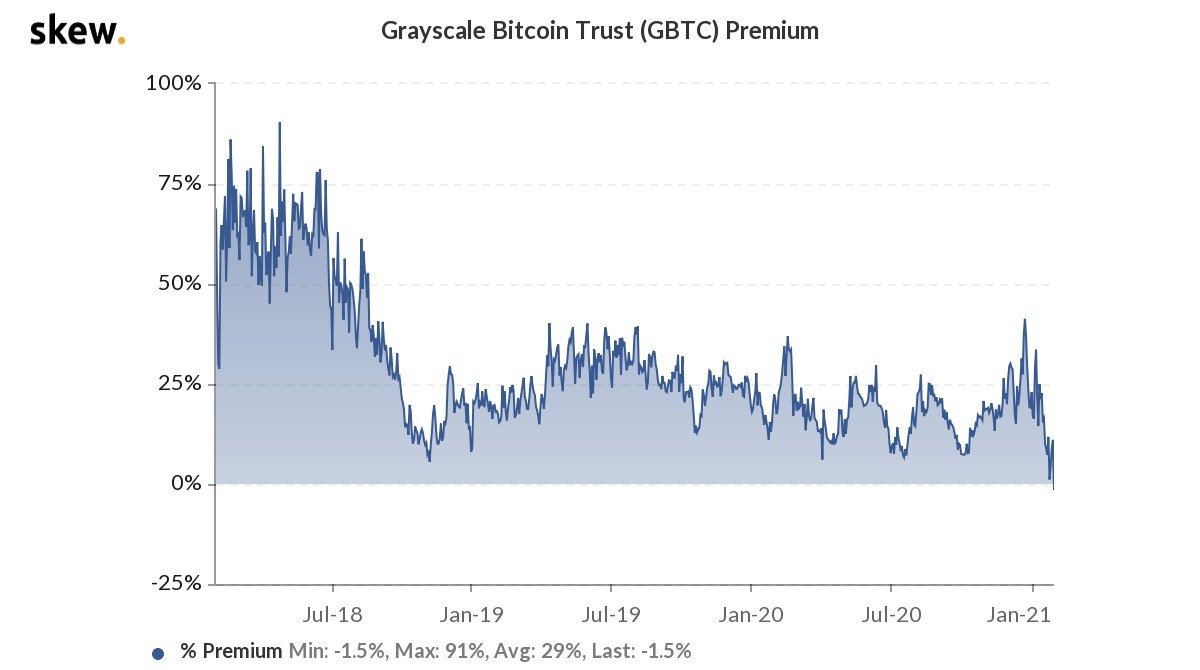

6/ What stands out most to us is GBTC - which is most sensitive to market sentiment. On the back of Musk’s tweet, we expected GBTC to be most likely candidate to squeeze higher. Instead GBTC premium on Friday turned negative for the first time since it launched in 2017.

7/ Even during the massive liquidation event in Mar 2020 the GBTC premium never went negative. While there may be other idiosyncrasies at play the massive GBTC position makes the premium an important indicator - we're watching how GBTC begins the month tmr & if it was just a blip

8/ A persistent negative GBTC premium will certainly be a drag on the futures curve and more importantly have implications on the market's truly massive cash & carry position.

9/ The next point of failure we're watching is on the CME front-month contract - which thus far continues to have its parabolic support well defended, but also its upside well capped

10/ In the spot market the Musk tweet low at 32k is the near-term bull/bear level we're watching ahead of the key 30k close. We still remain more concerned about the downside to 20k versus upside above 40k for now.

11/ Anyone who needs a reminder of how all these pump schemes often end up would just need to look at GME & DOGE now. Nonetheless our thesis remains that BTC has matured to a point beyond these one-off manipulations.

12/ We continue to like our discretionary short strangle trade while treating these sudden vol spikes as tactical opportunities to add to the position.

13/ Bigger picture perspective - the issue of our times is a growing binge culture which has spawned what we know here as Binge investing - last week proving this in an extreme way. Druckenmiller spoke on Wed for the first time since he disclosed his BTC position 3 months ago.

14/ The one thing that struck us was how bullish he was on active management, a complete U-turn from what he said in 2010 - that it was a bearish time for active investing & that he would underperform for 10 years.

15/ Previously a key aim of central banks was to suppress market volatility. However now their crazy stimulus' have & will continue to drive massive Boom&Bust cycles - on a global-economic scale & within individual instruments. Logically, trading these moves will generate alpha.

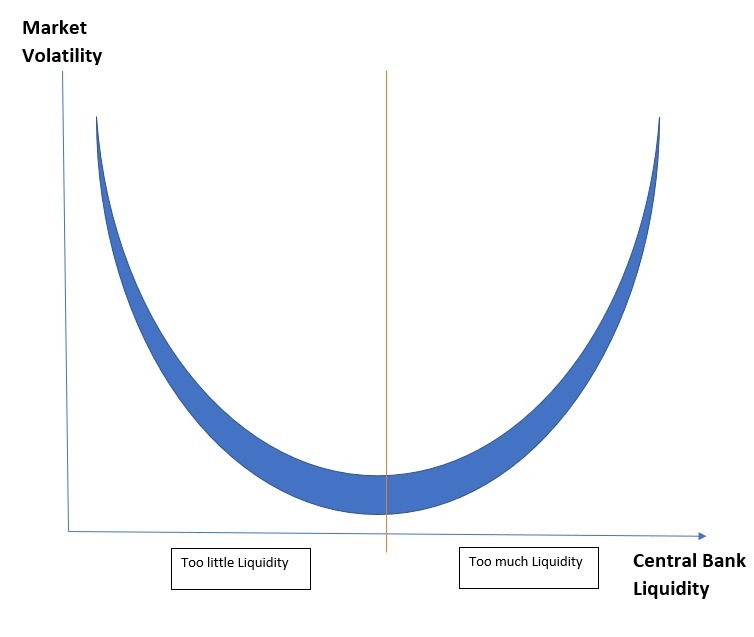

16/ We agree with this completely. There is a volatility smile curve related to liquidity - and central banks have now stepped well past the optimal equilibrium point

17/ The reason for this is the broken QE transmission mechanism - where the flood of M2 generated just goes straight back into financial markets, and was solely the cause of the massive Equity, Gold and BTC rally last year - which was the sharpest and fastest in history

18/ For BTC going forward the crucial question is how long this transmission lag actually is - and whether we've already seen all the new liquidity make its way into the crypto market at ~$1trn market cap. Based on our past studies with SPX this tends to be between 250 - 300 days

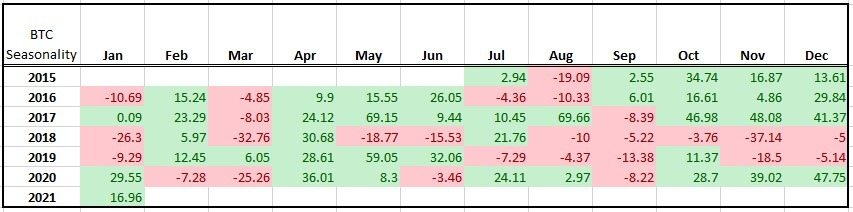

19/ This would gel with our Wave count and seasonality into Mar-end, and consistent with the deleveraging we're seeing now. Nonetheless, even during this deleveraging process spot BTC has held up extremely well

20/ ... and thus we believe that any downside will still be limited from here and we continue to like selling longer-term puts at our key 24k, 20k and 16k support levels. Full Update here. qcpcapital.medium.com/monthly-update…

• • •

Missing some Tweet in this thread? You can try to

force a refresh