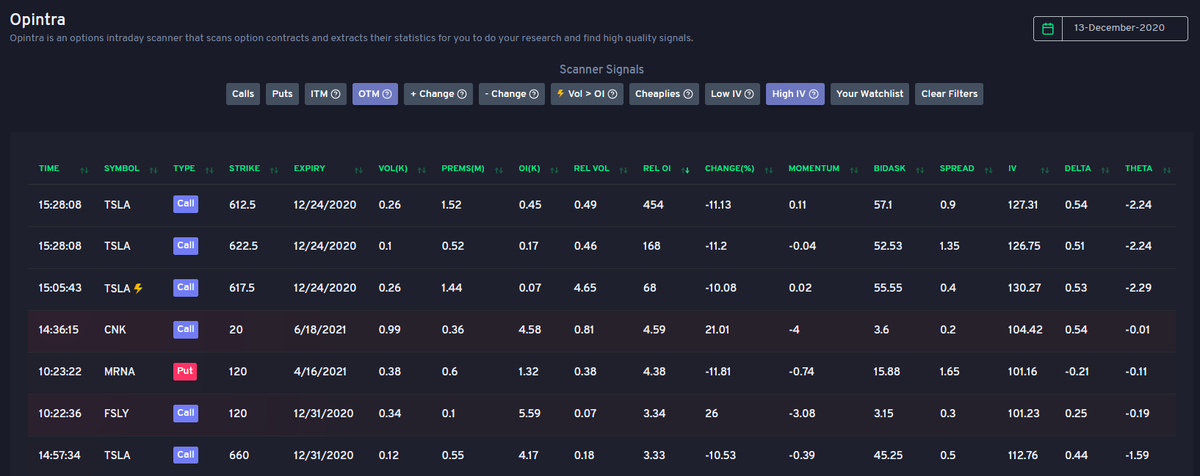

Feature update - just added another widget for our premium users in the options market dashboard on far out of the money contracts with very high volume. This should help us pick some unusual activity. Some observations in comments. 🏆🥳🔥

$GME $NOK $VXX $CCIV

$GME $NOK $VXX $CCIV

Although meme stocks are losing steam, I am still seeing a bunch of very far OTM strikes with calls, especially for $NOK. Keep an eye on it please.

Other meme stocks have both far OTM puts and calls so don't know where they're gonna go.

Other meme stocks have both far OTM puts and calls so don't know where they're gonna go.

Very interesting to see so far OTM calls on $VXX here. These can easily be just hedges but still very interesting. Let's see if this indicates a dump or are just a few hedges.

Despite the dump today, $SLV keeps appearing everywhere. Based on the flow, it might go up a lot more from the current price. Just keep an eye.

I am seeing plenty of $CCIV far OTM puts here. Careful if you're long.

Last, I am also seeing a few $GSX very far OTM puts. It has already fell hard after the rally but be careful if you're long here.

Please always look at the flow before getting in on a position. It can help you get a better timing on your entry exits. Stay safe and have a great rest of the week. We will keep trying to be the best platform for all of you 🙏🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh