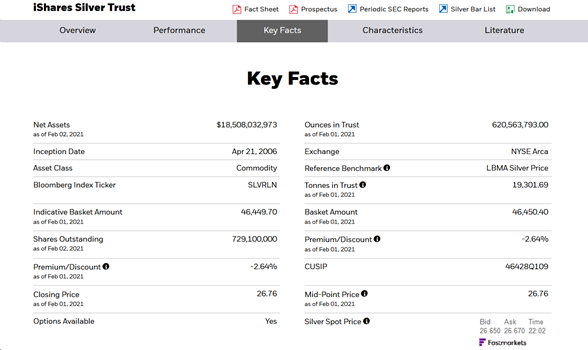

From January 28 to February 2, 118,450,000 shares were created. This coincided with a $4 move higher. Over the next 2 days, SLV’s shares outstanding fell 19,450,000. This represented a 16% retracement, yet the price of silver fell all the way back to 26 or a near 100% retracement

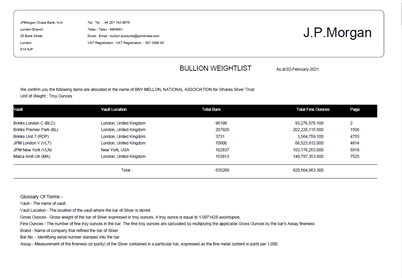

There is a great deal of discussion that is questioning the drop in price and whether SLV has silver in the vaults. SLV reports everyday a Bullion Weight List report that itemizes every bar by Brand, Bar number, fineness, weight, and vault location. ishares.com/us/products/23…

SLV is certainly reporting metal in the Custodian and Sub Custodian vaults. To say there is no metal would be saying this 10,843 page report is completely fictitious. I do not believe that is the case since that could be considered outright fraud.

So where did all this metal come from to meet the enormous demand? I found an interesting addition in today’s report vs the prior day’s report. This is yesterday’s report, page 1

If you noticed the addition of a new depository, you are correct. Loomis International was added, along with 30,607,451 ounces. So, I did some digging. It turns out many of the bar numbers at Loomis included the year in the bar number.

Many bars were made in prior years. What this tells me is, either there were large sellers of existing silver bars to meet this demand, bars were acquired by Approved Participants of the SLV via swaps/forwards or leasing activities, or a combination of all the above.

What does this mean? There is no question that metal exists in SLV, the real question everyone should be asking is how did the approved participants acquire the metal to deliver into the fund.

Knowing how the industry operates, when an approved participant takes a physical or a long position, many times they will hedge that position with Comex futures contracts to neutralize price risk.This is one reason why the commercial interest is normally short the Comex contracts

When they sell the underlying long position, they will buyback their short position as well. This eliminates their overall exposure.

So how did the SLV get the metal and what was the correlation to price? If the approved participants were delivering existing hedged physical bars to SLV during the run up, they could have been simultaneously closing out short Comex contracts.

This may have influenced the price on the contract to the upside. These numbers are reported each Friday via the Commitment of Traders report. cftc.gov/dea/futures/de…

An alternative would be the approved participants went out to the market and possibly leased metal from other bar owners. In this instance, the approved participant may take advantage of a rising price to lease metal through a financial transaction with the promise of returning

silver bars to the owner. This provides artificial supply into the market since leasing is a leveraged activity. The risk is that the lessor may incur an opportunity cost of giving up higher prices in lieu of current income or additional ounces.

On the other hand, the lessee is obligated to return the metal and pay a premium for the use of the metals.

Here is an interesting concept. If one had a strategy where one could lease silver while having enough capital to influence short term price action, why couldn’t one lease the bars and deliver them to SLV at a higher price, then use their capital to short the market, knowing that

many holders in the SLV are short term traders motivated by price action. If one can shake these weak hands from SLV causing redemptions in the trust, one can redeem the shares at a lower price, take delivery of the metal, and return it to the lessor for a quick profit.

One would call this an old fashioned rug pull. Could these strategies been used recently or in the past as part of the court cases surrounding silver manipulation?

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh