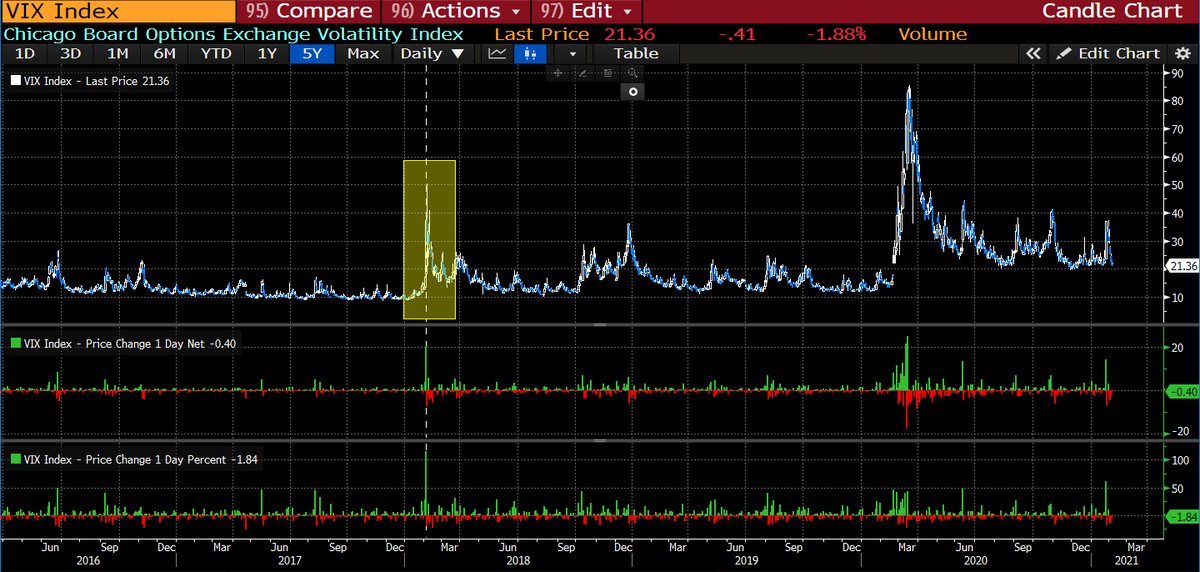

1/x) Today is the 3 year anniversary of Volmageddon. (Aside from being my greatest single PnL day lol), it was a critical event that not only changed the volatility trading landscape, but also triggered a volatility regime change in markets that's still in motion today.

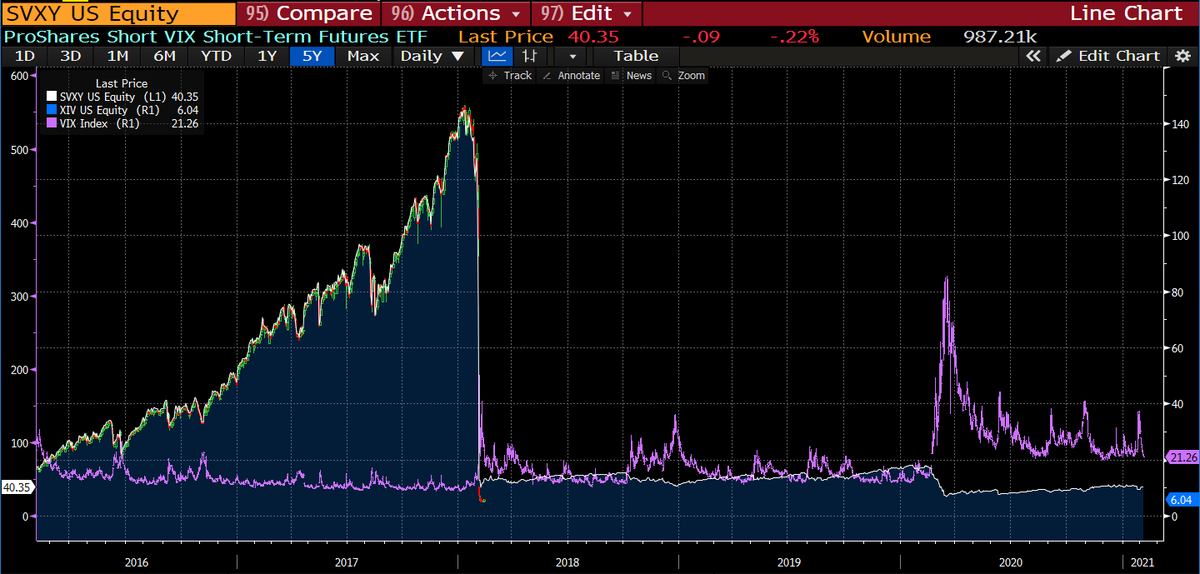

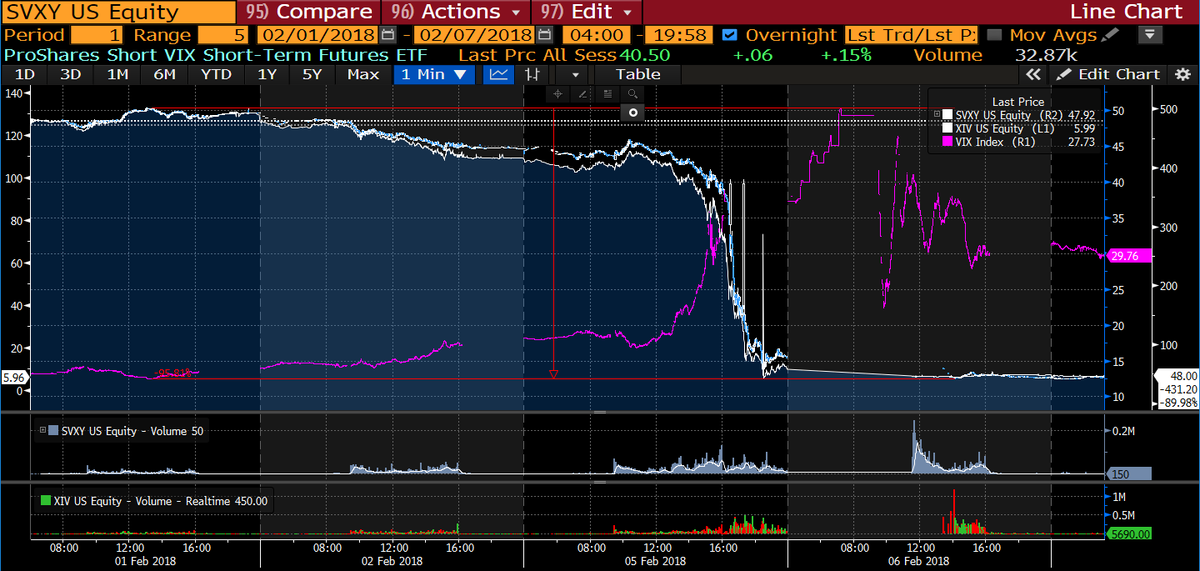

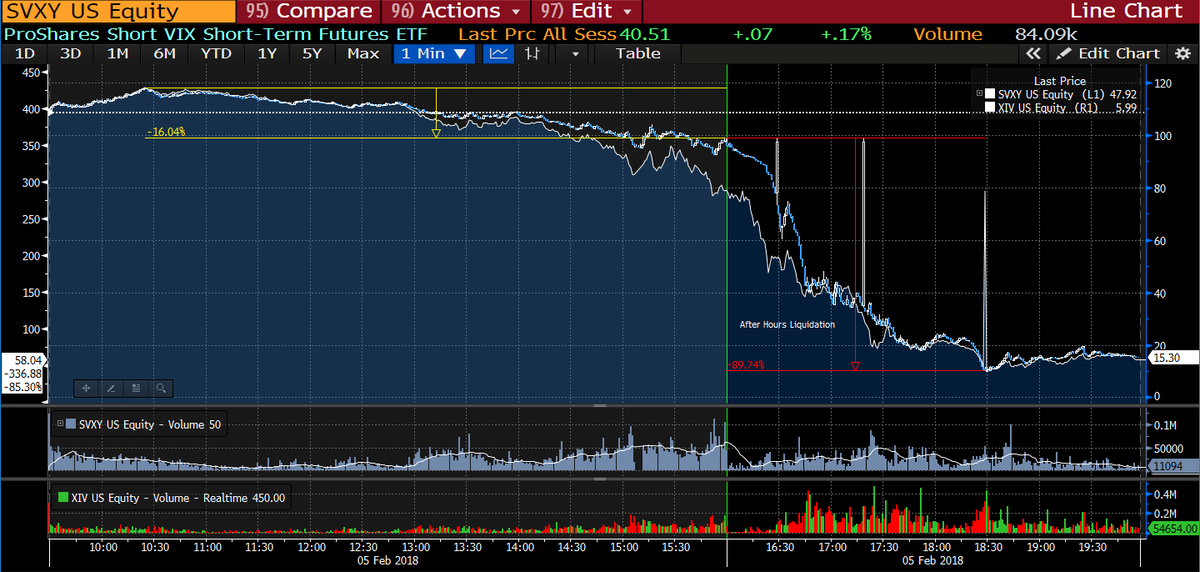

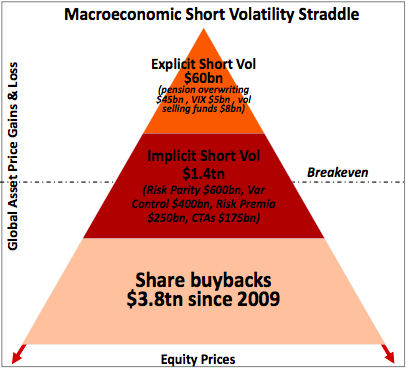

2/xThe most well-known aspect of Volmageddon was the blowup of short vol, best highlighted through the destruction of inverse $VIX ETPs: $SVXY $XIV, which lost most of their value overnight. However, these retail products were only a tiny fraction of the broader short-vol complex

3/x) I won't get into the mechanics of the products related to the event (requires an entire thread of its own), but due to poor financial engineering & understanding, the blowup sent shockwaves across short vol & started the decline in vol selling (as I've discussed previously).

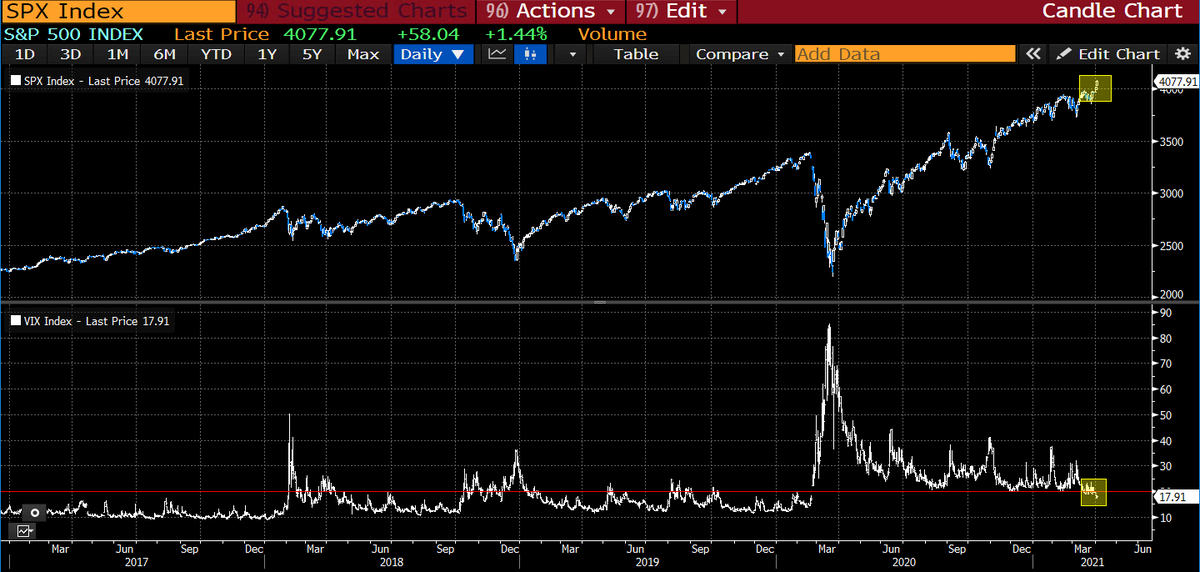

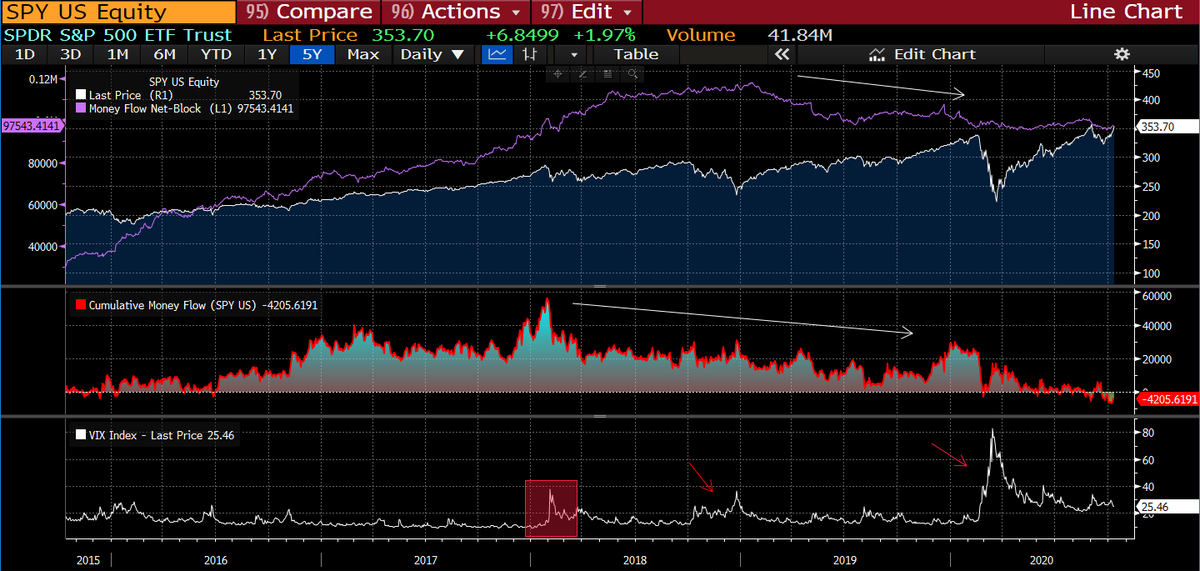

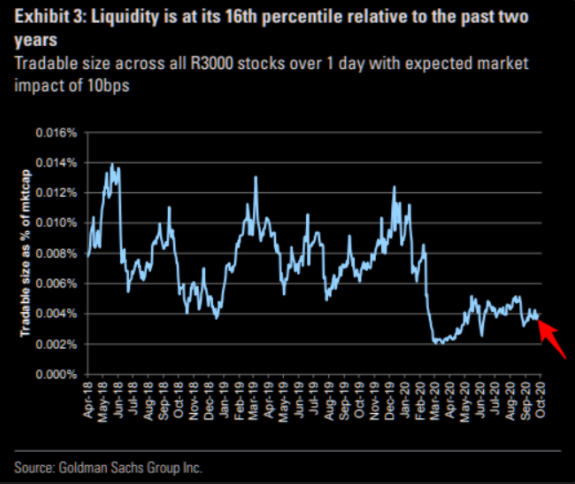

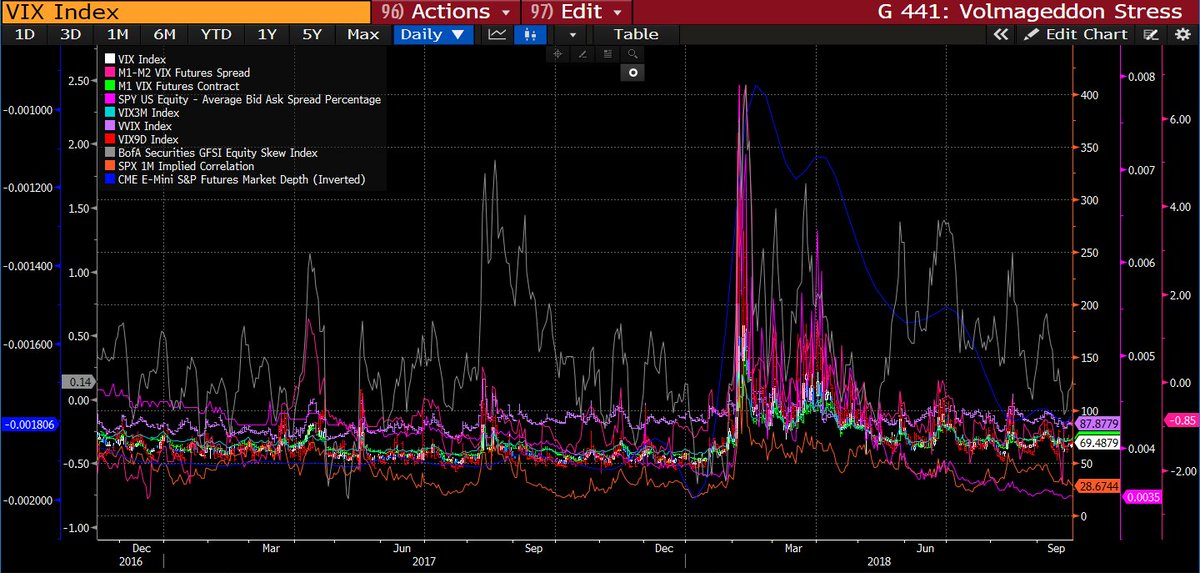

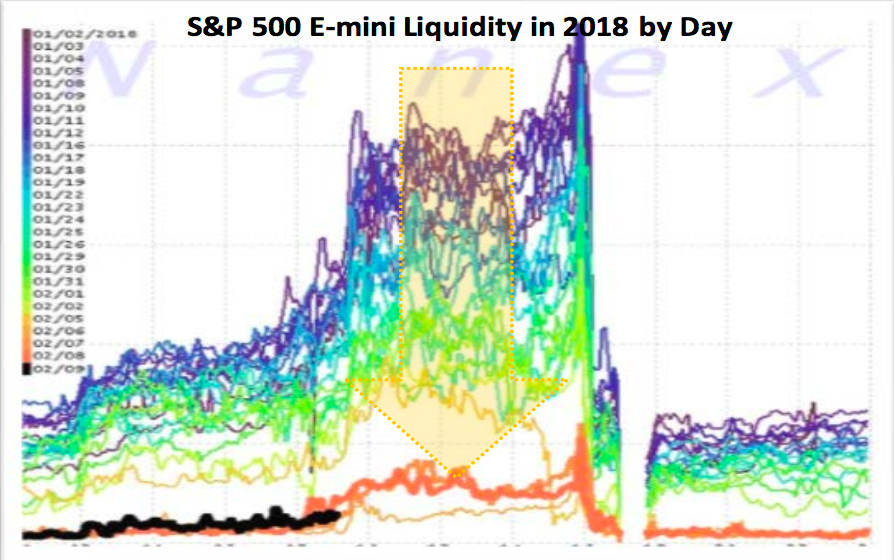

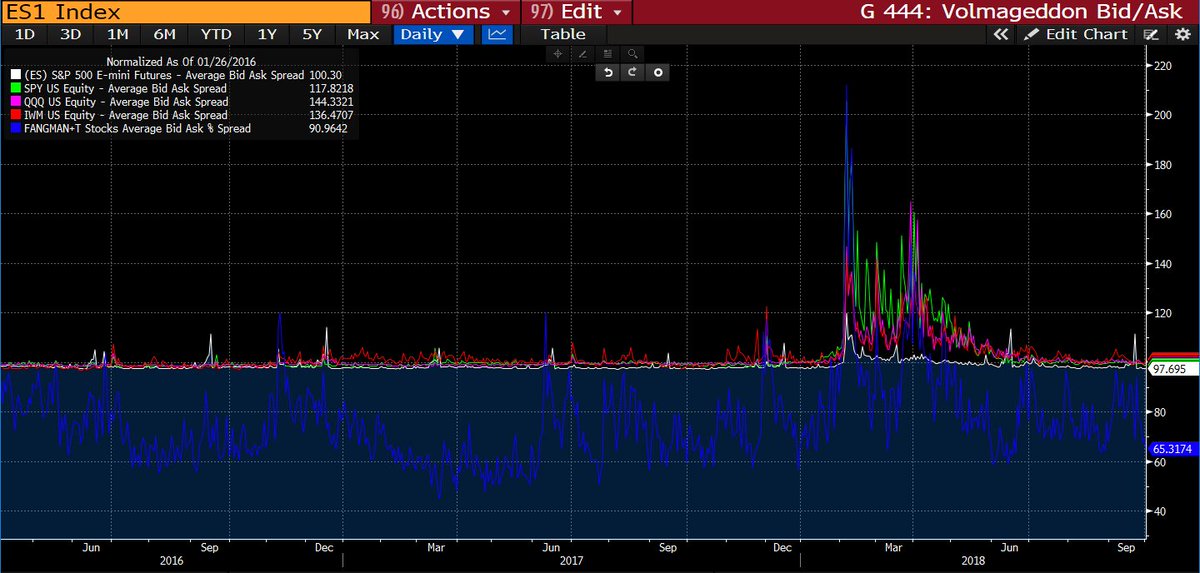

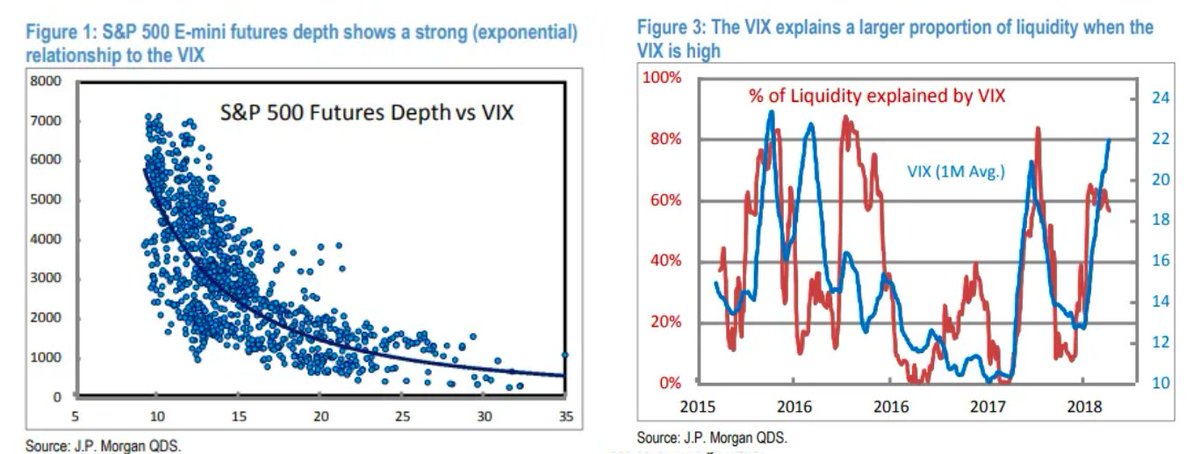

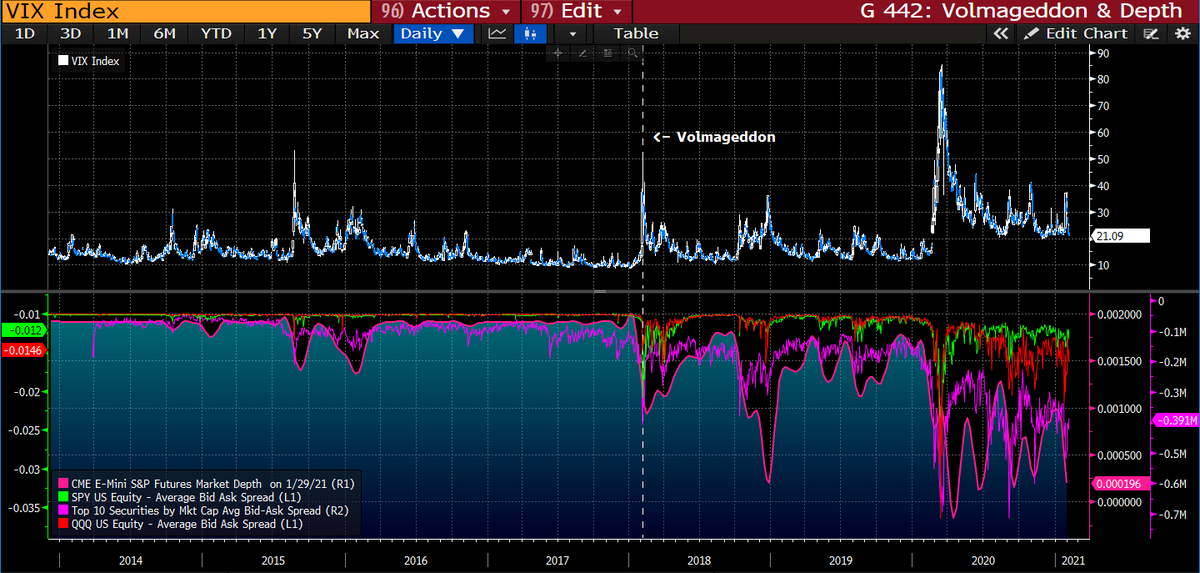

4/x The Mkt stress that occurred on that day was REAL. There was a panicked bid under Vol & Liquidity absolutely disappeared, as Volatility & Liquidity are not only negatively correlated, but reflexively intertwined. Mkt fragility was exposed. (H/T @vol_christopher for Nx chart).

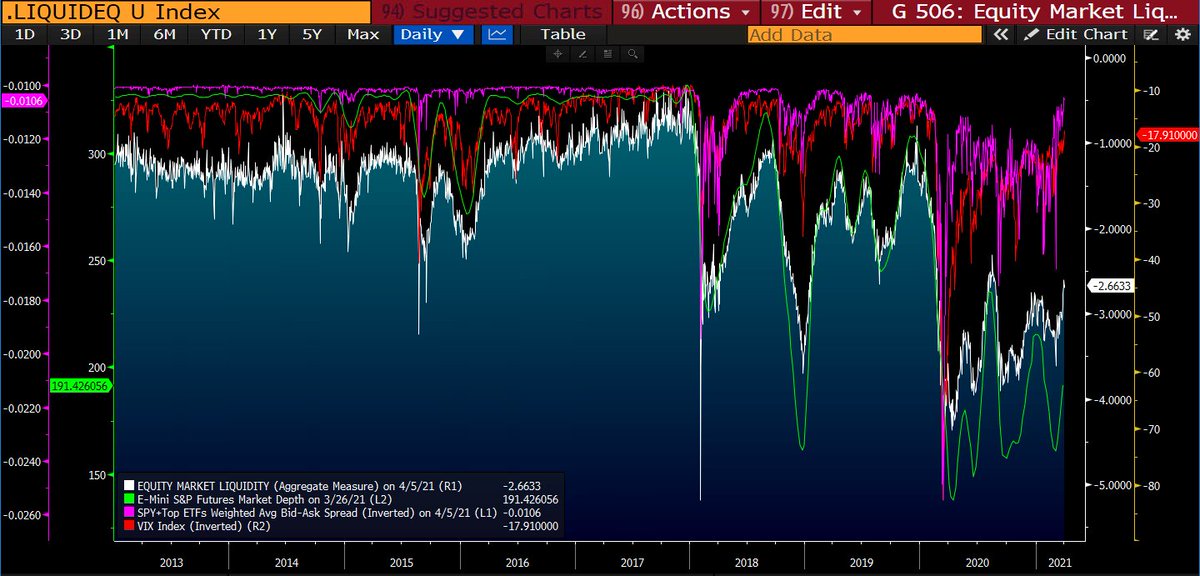

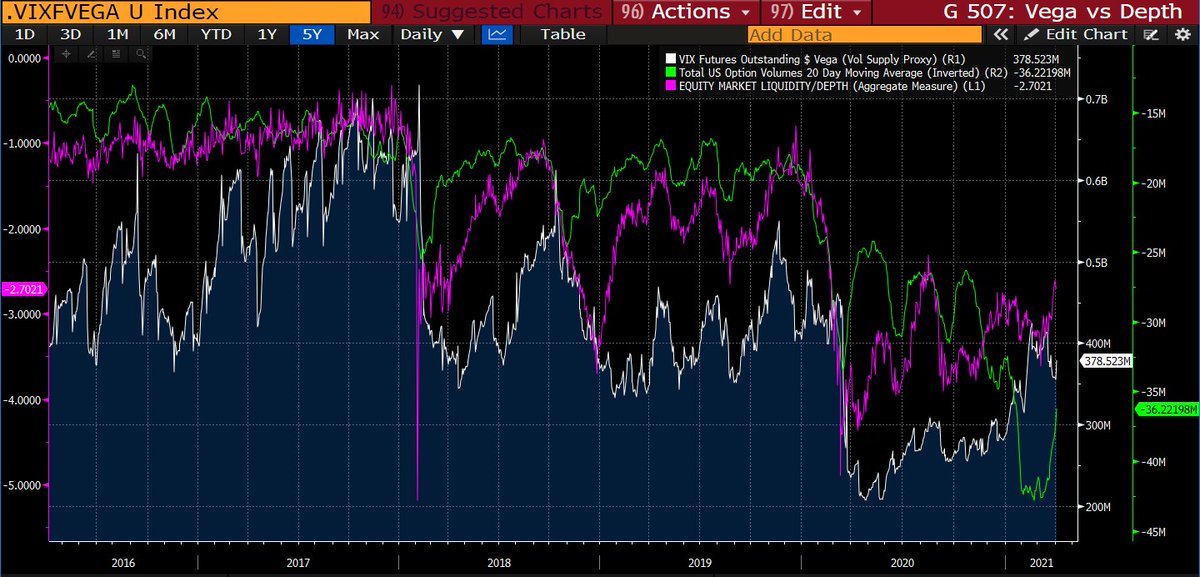

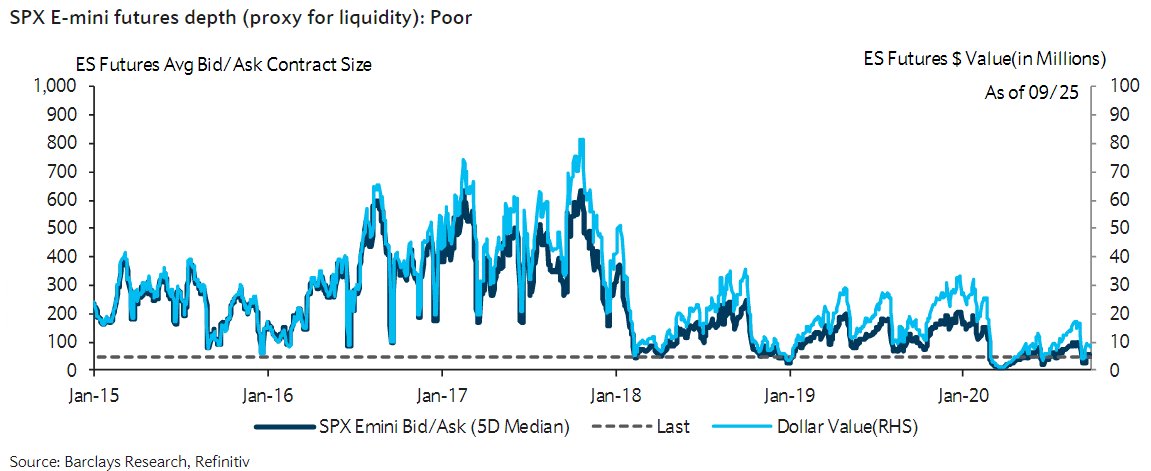

5/x But Volmageddon didn't just create liquidity stress that day... It triggered the beginning of diminishing liquidity in markets. I've argued extensively how it caused a regime change in Vol; declining liquidity is a symptom of this–posing an ominous threat to our Mkt structure

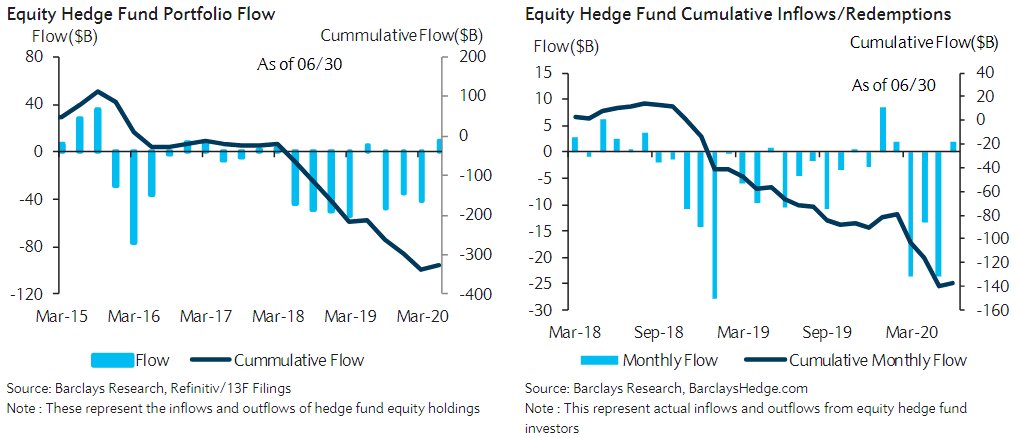

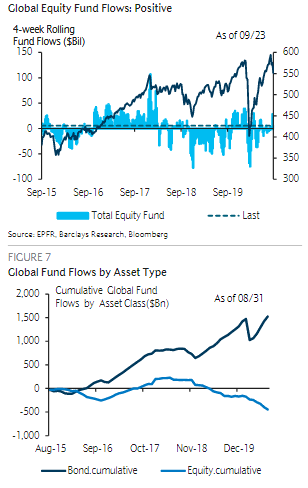

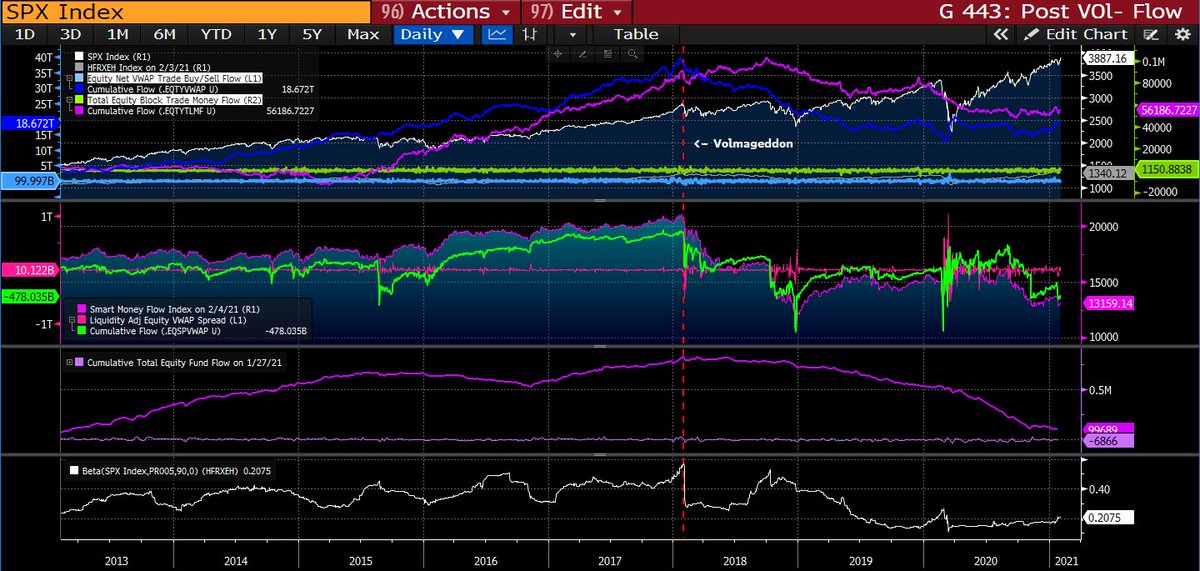

6/xThere are countless divergences across markets formed following Volmageddon (might make a separate thread on that), but the divergent shift in positioning & flows is a significant one that goes unnoticed underneath the surface. All of these portray a fragment of the same story

7/7) Ultimately, Volmageddon was a historic event in the volatility landscape & broader markets, but it's the regime shifts it triggered that exposed true vulnerabilities in markets and has higher-order implications for our economic paradigm...

https://twitter.com/FadingRallies/status/1334519442697555974?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh