Cross the spread and you'll get crossed up

Volatility.

8 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/FadingRallies/status/1379517673185361925

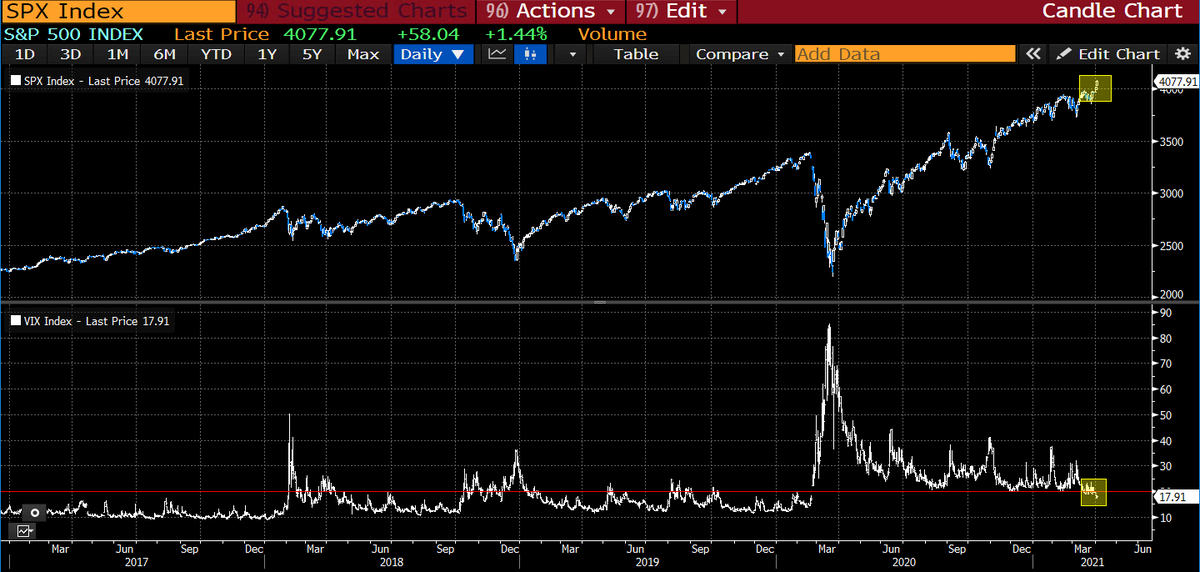

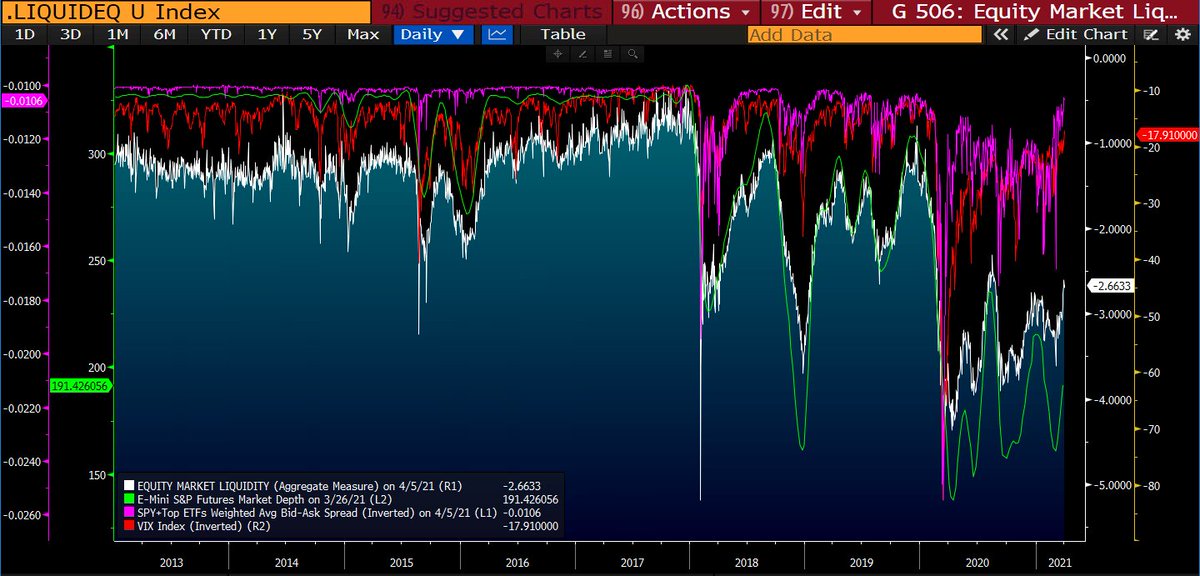

2/x) The implications of this are pretty obvious, but it's not that straightforward. Bc of latent orderbooks etc, it's not that bad moving isolated size during calm waters. But liquidity is inherently short volatility & embeds convexity within the orderbook on heavy onesided flow

2/x) The implications of this are pretty obvious, but it's not that straightforward. Bc of latent orderbooks etc, it's not that bad moving isolated size during calm waters. But liquidity is inherently short volatility & embeds convexity within the orderbook on heavy onesided flow

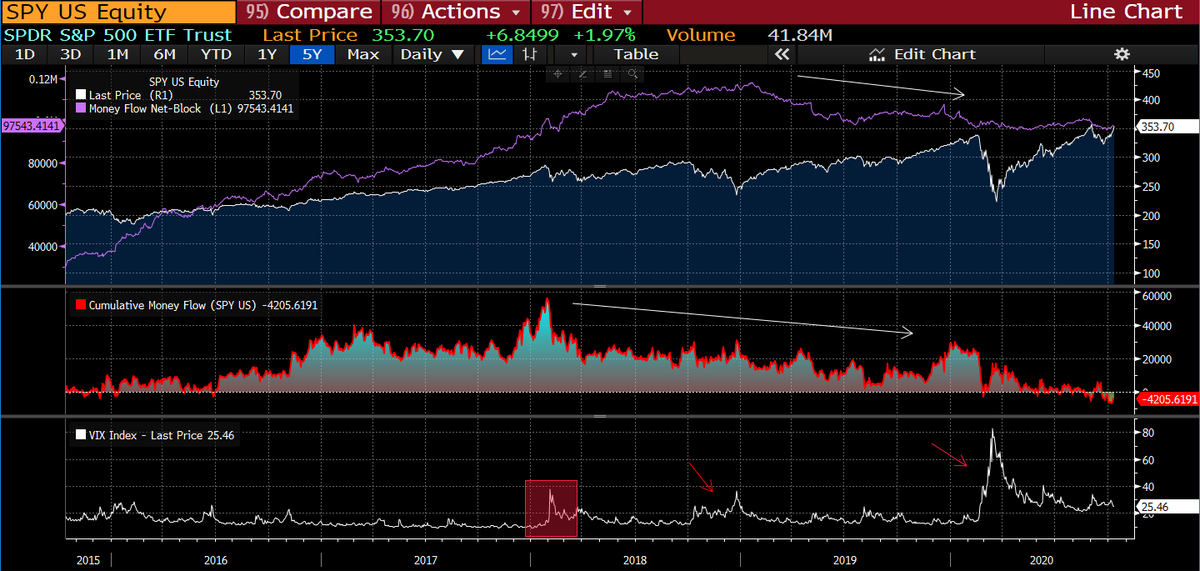

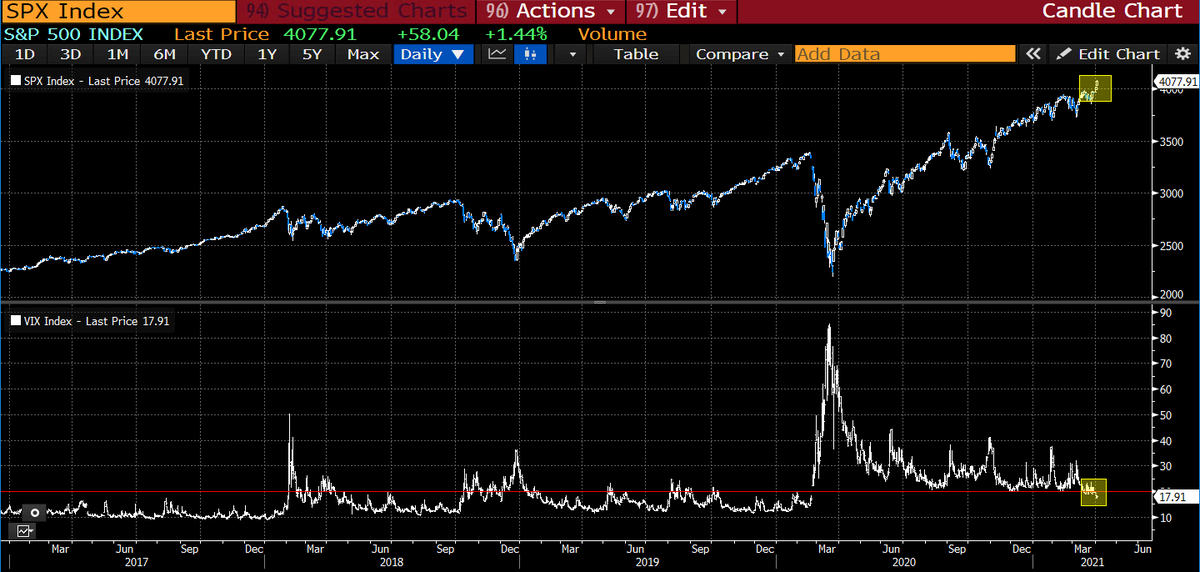

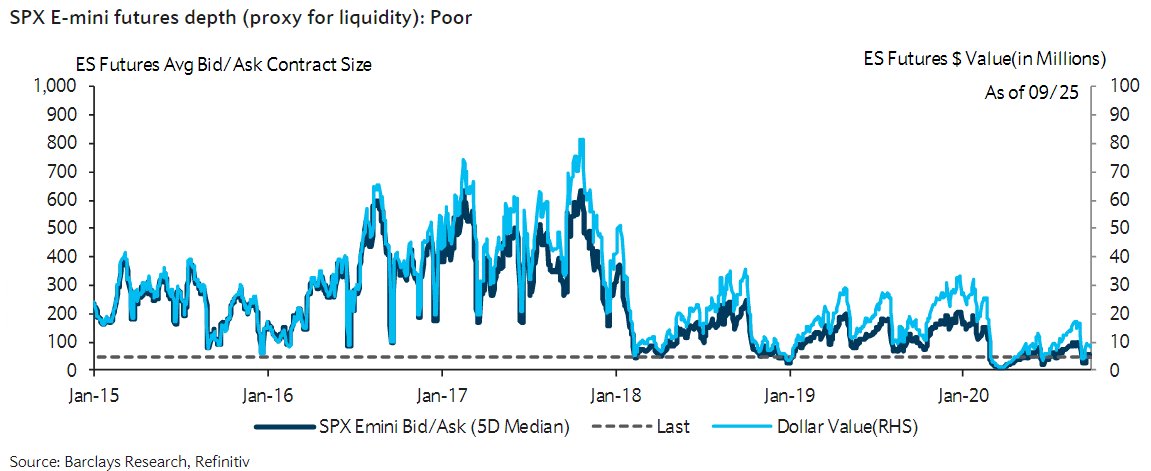

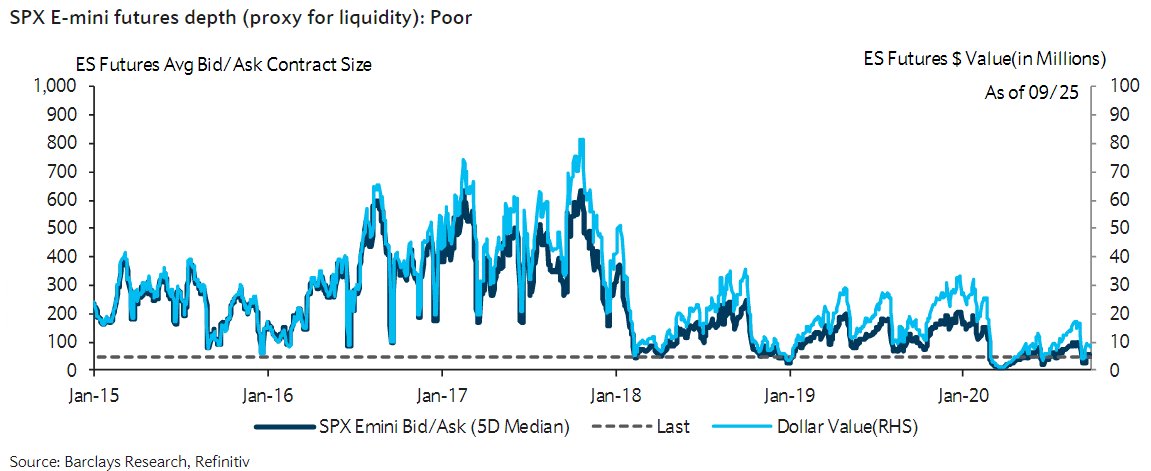

2/x) I've already discussed deteriorating equity market liquidity extensively, but in our overleveraged market the significance and implications of this sinister vulnerability can't be understated. Liquidity –– most importantly market depth, has been vanishing since Volmageddon.

2/x) I've already discussed deteriorating equity market liquidity extensively, but in our overleveraged market the significance and implications of this sinister vulnerability can't be understated. Liquidity –– most importantly market depth, has been vanishing since Volmageddon.

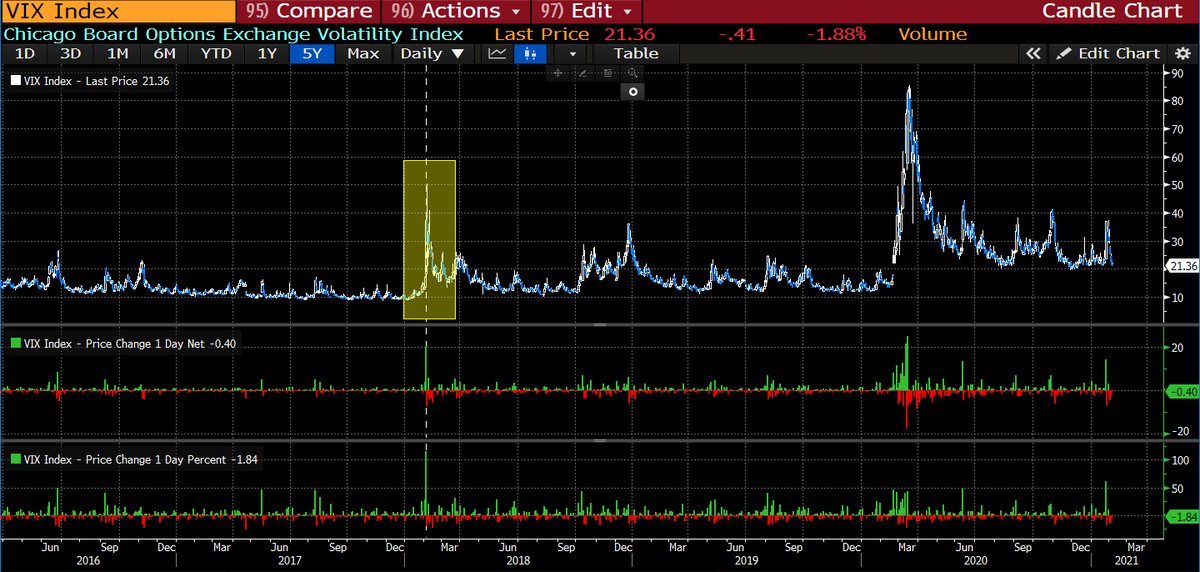

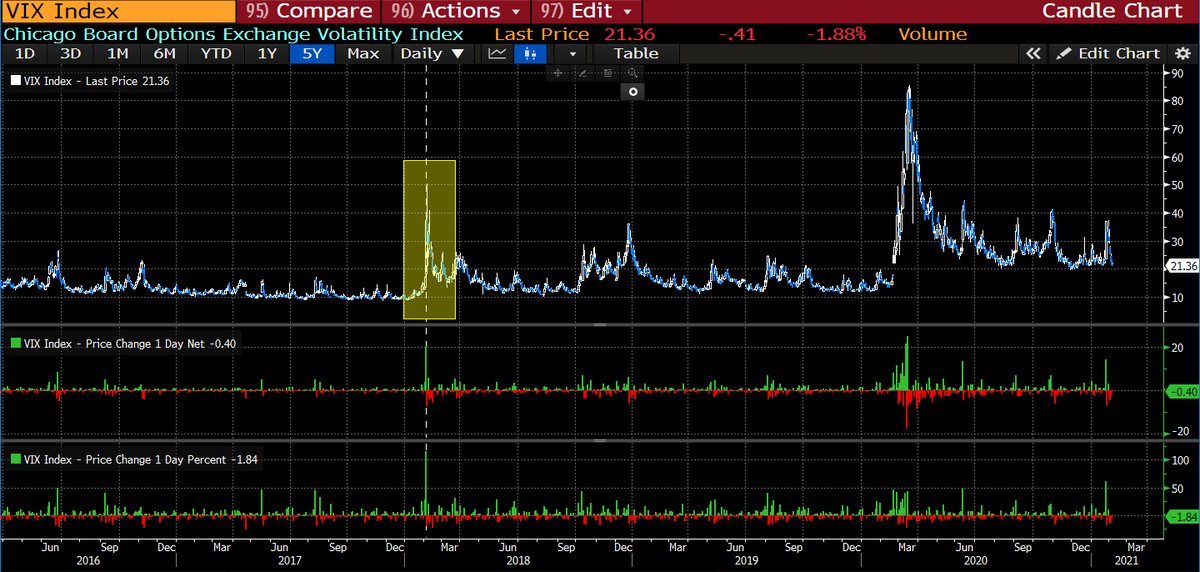

2/x) To counter Kolanovic, I've already argued extensively how elevated vols are more due to a lack of vol supply over hedging demand (vega supply shocks, risk mngmt constraints, etc) Moreover, note the $VIX- $SPX 30D ATM IV spread; OTM is dragging VIX up

2/x) To counter Kolanovic, I've already argued extensively how elevated vols are more due to a lack of vol supply over hedging demand (vega supply shocks, risk mngmt constraints, etc) Moreover, note the $VIX- $SPX 30D ATM IV spread; OTM is dragging VIX up https://twitter.com/FadingRallies/status/1354242862079221762?s=20

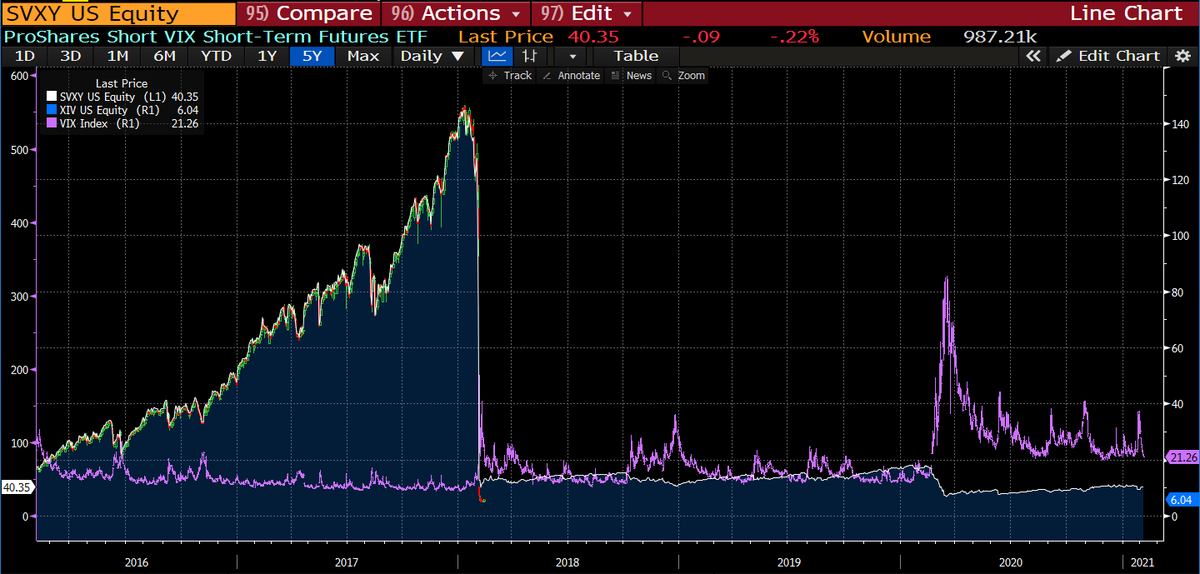

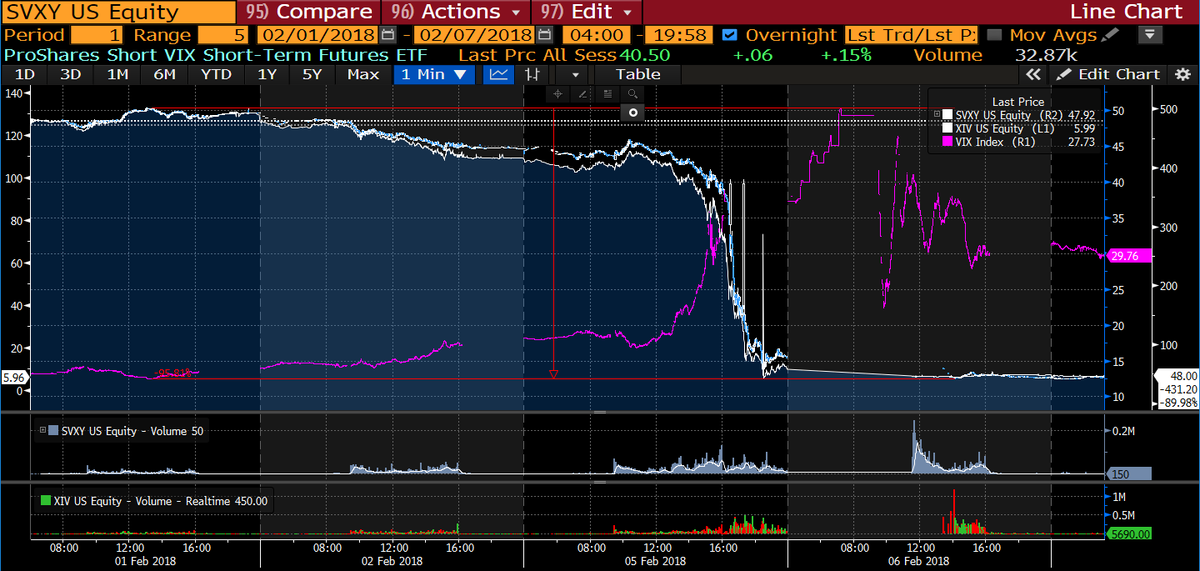

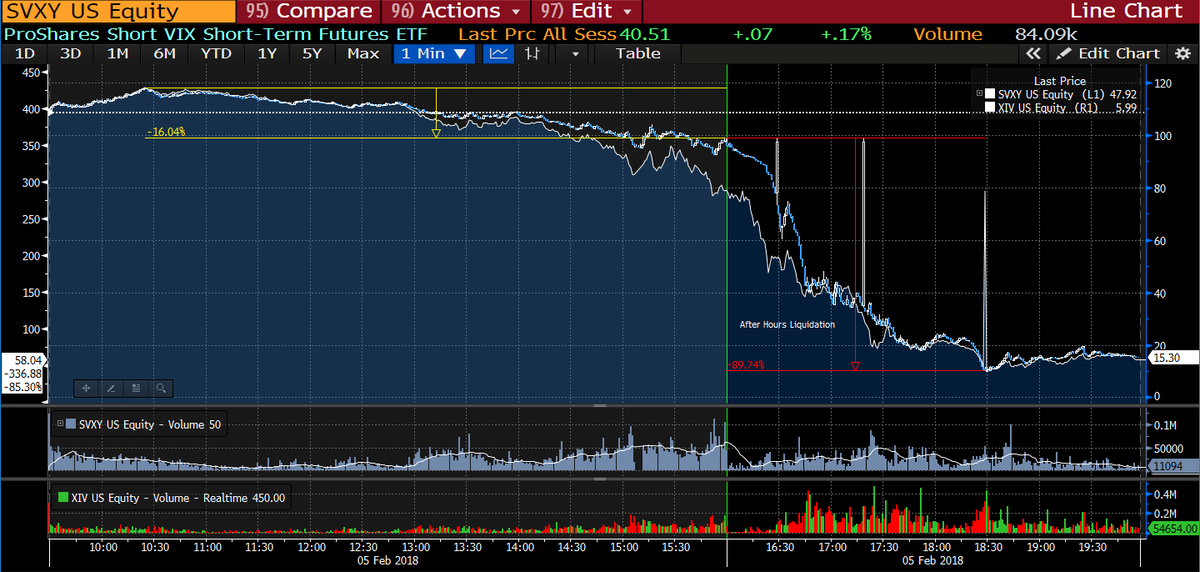

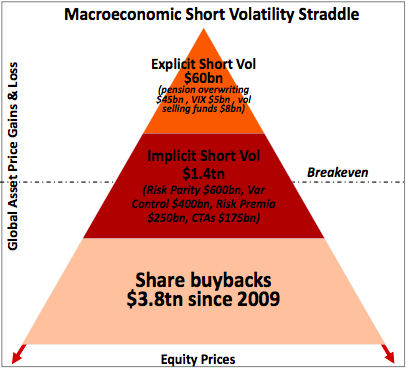

2/xThe most well-known aspect of Volmageddon was the blowup of short vol, best highlighted through the destruction of inverse $VIX ETPs: $SVXY $XIV, which lost most of their value overnight. However, these retail products were only a tiny fraction of the broader short-vol complex

2/xThe most well-known aspect of Volmageddon was the blowup of short vol, best highlighted through the destruction of inverse $VIX ETPs: $SVXY $XIV, which lost most of their value overnight. However, these retail products were only a tiny fraction of the broader short-vol complex

2/x The constant Vol supply from systematic Vol sellers, inverse $VIX ETPs, implicit short Vol, etc. was first significantly wiped on Volmageddon as short Vol blew up, and again during March 2020. The decline in VIX Futures outstanding Vega highlights the diminished Vol supply.

2/x The constant Vol supply from systematic Vol sellers, inverse $VIX ETPs, implicit short Vol, etc. was first significantly wiped on Volmageddon as short Vol blew up, and again during March 2020. The decline in VIX Futures outstanding Vega highlights the diminished Vol supply.

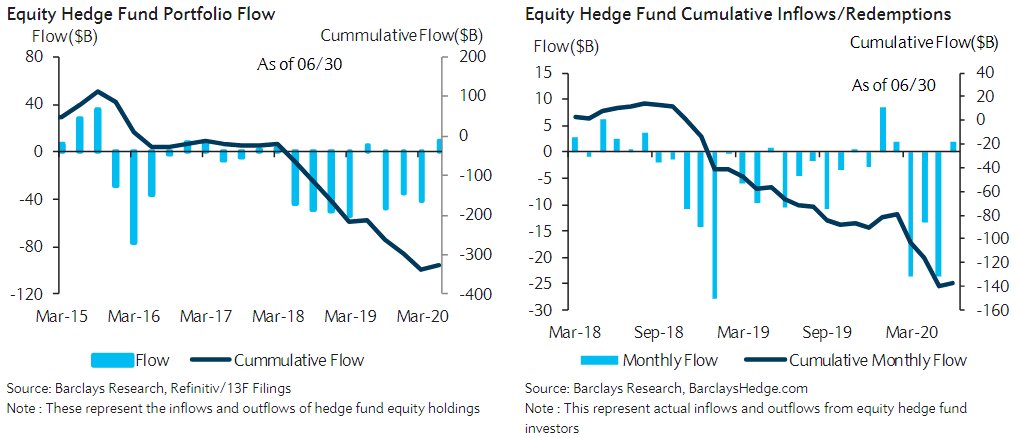

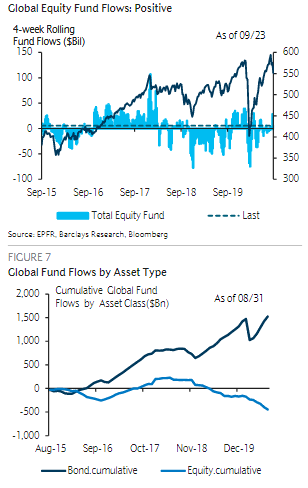

It's no coincidence that the $VIX spike in Feb 2018, Volmageddon, coincided with this shift in declining liquidity and triggered money flowing out of equities. Volmageddon marked a regime change in volatility, and hence declining liquidity that creates more fragile equity markets

It's no coincidence that the $VIX spike in Feb 2018, Volmageddon, coincided with this shift in declining liquidity and triggered money flowing out of equities. Volmageddon marked a regime change in volatility, and hence declining liquidity that creates more fragile equity markets