It's Monday, so it's time for the weekly US real estate data from @AltosResearch

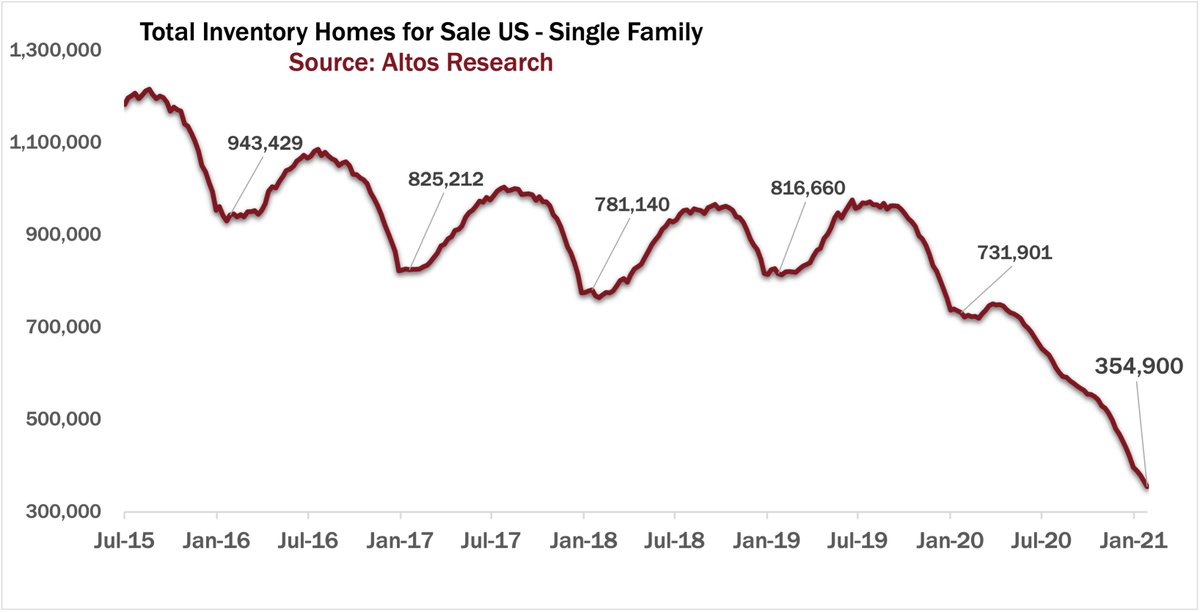

We'll start with the latest view of the Inventory Crisis we're in.

thread 1/6

We'll start with the latest view of the Inventory Crisis we're in.

thread 1/6

Total active inventory plummets yet again. Down to 355,000 single family homes on the market. Properties are moving so fast there are another roughly 10,000 that bypassed the active market altogether, going straight into contract, spending essentially zero days on market.

2/6

2/6

Unsurprisingly, prices are climbing. Up to $344,900, we're well on our way to another 10% price appreciation year. Massive equity gains for all homeowners.

3/6

3/6

We're in Sellers' Market Conditions unlike any we've ever seen.

The Altos Market Action Index is skyrocketing. You can see the bright red last year during the initial lockdown period. Contrast that with today where demand is off the charts on tiny supply.

4/6

The Altos Market Action Index is skyrocketing. You can see the bright red last year during the initial lockdown period. Contrast that with today where demand is off the charts on tiny supply.

4/6

And finally this week, if you're a professional in the real estate market, you should join us on our webinar Wednesday. We'll spend an hour looking at this data, local markets, talking policy and the implications for the rest of the year. Don't miss!

6/6

bit.ly/feb21-altos-we…

6/6

bit.ly/feb21-altos-we…

• • •

Missing some Tweet in this thread? You can try to

force a refresh