Now available on @TheTerminal . Passively managed assets in U.S. ETFs and Mutual Funds sit right around 43% market share and passive is increasing at over 2 percentage points per year. Means we're likely to see majority passive by 2026. Likely earlier if there's a bear market...

If you're thinking, "I thought passive was already a majority?" that's probably from domestic equity funds. Which sit around 53.8% passive.

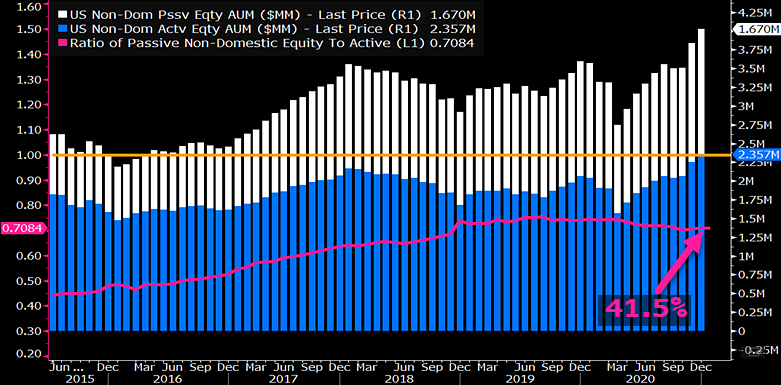

What i'm calling "Non-Domestic" sits around 41.5%. and puts the aggregate equity fund market at about 50.3% passive. But if international equities start offering relative positive performance to domestic, I expect that % to increase as well.

For more detail/color you can read about this here: blinks.bloomberg.com/news/stories/Q…

Have a terminal and would like to analyze the raw data? That's available on our dashboard now and breaks out mutual funds vs ETFs as well:

{BI ETFSG 1099 |1099-2-S-Units|M12||USD<GO>}

Have a terminal and would like to analyze the raw data? That's available on our dashboard now and breaks out mutual funds vs ETFs as well:

{BI ETFSG 1099 |1099-2-S-Units|M12||USD<GO>}

• • •

Missing some Tweet in this thread? You can try to

force a refresh